CHAPTER 6

ACCOUNTING FOR A MERCHANDISING OPERATION

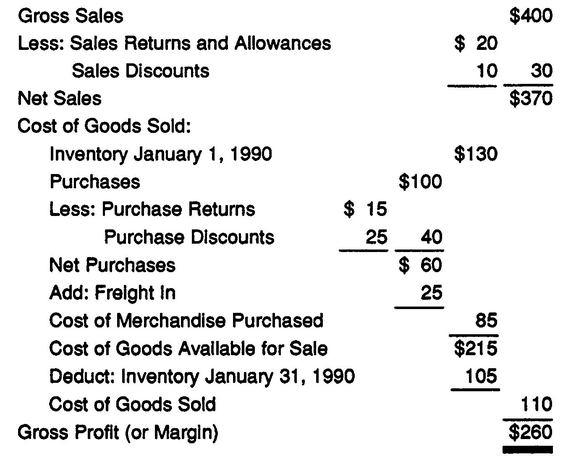

6.1 GROSS PROFIT/MARGIN

Gross profit and gross margin are terms used interchangeably to denote the difference between the amount of sales and the cost of goods sold. The general format for the top part of the income statement is usually as shown in Example 6.1.1.

EXAMPLE 6.1.1

| Sales | $300 |

| Less Cost of Goods Sold | 200 |

| Gross Profit/Gross Margin | $100 |

|

6.2 PERPETUAL AND PERIODIC ACCOUNTING SYSTEMS

There are two basic ways to set up inventory systems to process the flow of information about purchases and sales. These are known as perpetual and periodic accounting systems.

6.2.1 ENTRIES UNDER PERPETUAL ACCOUNTING SYSTEMS

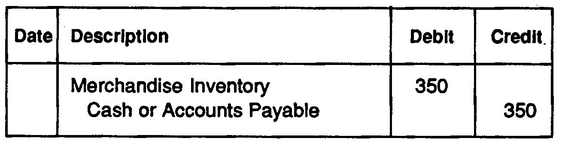

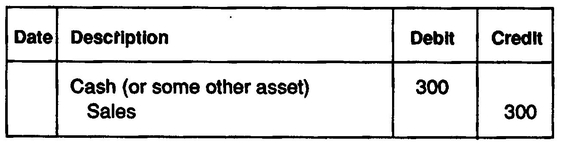

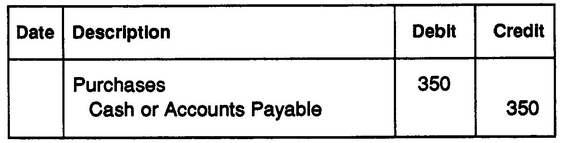

When utilizing perpetual, each purchase and sale transaction has a two-step entry. Sales entries directly affect the cost of goods sold account. Assuming that merchandise costing $350 was purchased, and one-half of that merchandise was sold for $300, the necessary entries are shown in Example 6.2.1.

EXAMPLE 6.2.1

To record purchase of merchandise

To record sales of merchandise

If the merchandise is sold for cash, then cash would be debited. If instead, a promise to pay later was made, accounts or notes receivable would be debited.

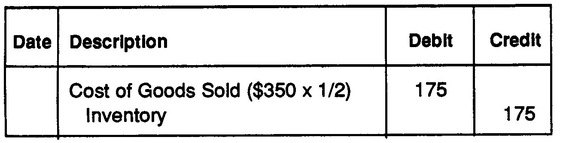

Additionally, there an entry is needed to adjust both inventory and cost of goods sold as shown in Example 6.2.2.

EXAMPLE 6.2.2

Under this method, inventory should always be determinable by looking in the records. Even when using this method, a physical inventory should be taken at least once each accounting cycle to assure the accuracy of the records.

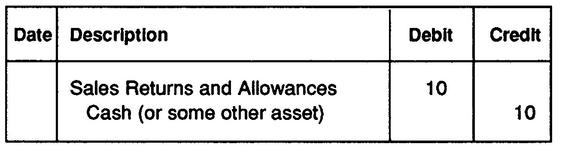

6.2.2 ENTRIES UNDER PERIODIC ACCOUNTING SYSTEMS

Using the transaction from the previous section, the entries under a periodic accounting system are shown in Example 6.2.3.

EXAMPLE 6.2.3

To record purchase of merchandise.

To record sale of merchandise.

Using this method, no entries are made to adjust the inventory and cost of goods sold upon sale. These adjustments are made at the end of the accounting period. Inventory will be debited for the ending inventory amount and credited with the amount of beginning inventory. This will leave as a balance the amount of the ending physical inventory.

The calculation to determine cost of goods sold is shown in Example 6.2.4.

EXAMPLE 6.2.4

| Merchandise Inventory — Beginning of Year | $150 |

| Add Purchases During the Year | 350 |

| Total Goods Available for Sale | $500 |

| Deduct Merchandise Inventory — End of Year | 325 |

| Cost of Goods Sold | $175 |

|

6.3 TRANSPORTATION CHARGES

Transportation charges are of two types. Charges for transporting merchandise to the company are freight In. This will be an additional cost of acquiring the goods. Outward bound charges to transport goods the firm sold are freight out. These are shown as shipping expense (a form of selling expense).

F.O.B. destination means that shipping charges are free at the destination. The charges are borne by the seller.

F.O.B. shipping point means that the seller delivers the merchandise to the carrier. However, the purchaser bears the cost of the transportation charges.

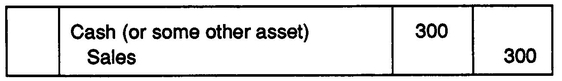

6.4 MERCHANDISE RETURNS

Nearly every business has some merchandise that is returned. This may be due to quality, color or some other factor. The seller will call these sales returns, while the buyer calls them purchase returns. The journal entry to record a retum on the seller’s books is shown in Example 6.4.1.

EXAMPLE 6.4.1

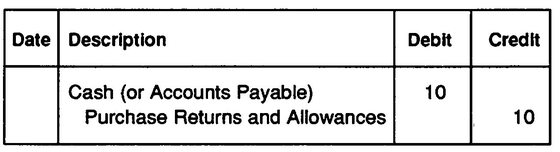

Example 6.4.2 reflects the entry on the books of the buyer.

EXAMPLE 6.4.2

6.5 MERCHANDISE ALLOWANCES

Subsequent to a sale, some merchandise can become subject to a reduced price. To the seller, this would be a sales allowance and to the buyer this would be a purchase allowance.

Entries to record merchandise allowances are identical to those for returns. Usually returns and allowances are grouped into the same account. It is important to keep them separate from sales so analysis can be done on the level of returns and allowances in relation to total sales and purchases.

6.6 TRADE DISCOUNTS

Trade discounts are price concessions made to certain buyers where the actual price charged is less than the list price. No entries are required since sales are recorded at actual price, not the list price.

6.7 SALES DISCOUNTS

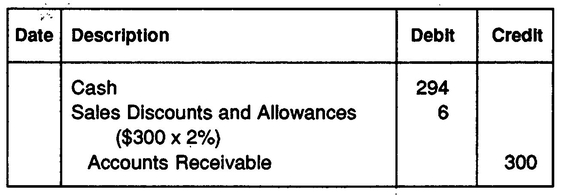

Cash discounts are deductions allowed to customers to encourage them to pay their bills in a timely manner. These discounts are usually stated as: 2/10; n/30. This means a discount of 2% is available if paid within 10 days, but after that time, the customers must pay the full amount. Assume a sales discount was given for the $300 sale described above. If the customer paid within the ten days, the entry to record the receipt of the cash is shown in Example 6.7.1.

EXAMPLE 6.7.1