CHAPTER 9

RECEIVABLES

9.1 ACCOUNTS RECEIVABLE

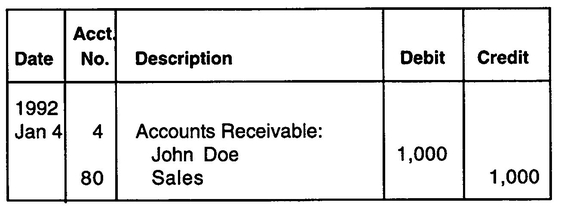

Accounts receivable arise when a business makes sales on credit. In such cases, the sales agreement calls for payment within a certain time period and may offer a discount for payment before the due date. Whether a general journal or a specialized journal such as the sales journal is used, the journal entries for a credit sale and subsequent collection would be as shown in Example 9.1.1.

EXAMPLE 9.1.1

The Sample Company

General Journal

To record the sale of merchandise on account to John Doe.

To record the collection of accounts receivable from John Doe.

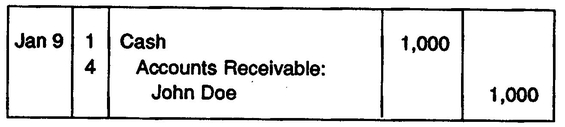

If a discount of 2% for payment within 10 days had been offered to John Doe, the entry of January 9 would be as shown in Example 9.1.2.

EXAMPLE 9.1.2

The Sample Company

General Journal

To record collection of $1,000 sale made to John Doe on January 4th less 2% discount.

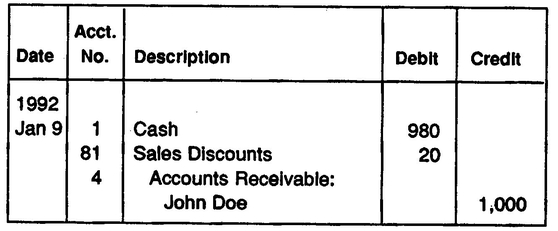

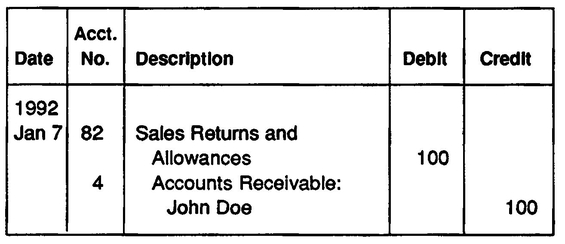

A business may allow the return of merchandise by the customer for credit against their account. This is accomplished through the use of the sales returns and allowances account. For example, if the customer in the previous example, John Doe, returned merchandise for $100 credit prior to payment, accounts receivable would be adjusted through the entry shown in Example 9.1.3.

EXAMPLE 9.1.3

The Sample Company

General Journal

9.2 UNCOLLECTIBLE ACCOUNTS RECEIVABLE

Uncollectible accounts receivable are the accounts receivable that a company cannot collect. When the conclusion is reached that a receivable is not collectible, that amount is written off, or removed from the company’s books. Since that sale was originally recorded as revenue, this action has the effect of reducing income.

9.2.1 ALLOWANCE METHOD OF ACCOUNTING FOR UNCOLLECTIBLE ACCOUNTS

This method is also known as the reserve method because it provides in advance for uncollectible receivables. This provision for uncollectibility is made through an adjusting entry performed at the end of a fiscal period and serves two purposes. It reduces the value of receivables to the amount of cash expected to be received and allocates the expected expense associated with this reduction to the current fiscal period.

The amount of provision to be established can be calculated several different ways. One method involves the careful examination of each customer’s account to determine the probability of collection. Those deemed questionable as to collectibility are then totaled and that amount will be used as the provision amount. A simpler method involves a percentage estimate of uncollectible accounts based on outstanding receivables. Many businesses have found that the percentage of uncollectible accounts varies little from year to year and therefore feel comfortable making provisions based on this historical figure.

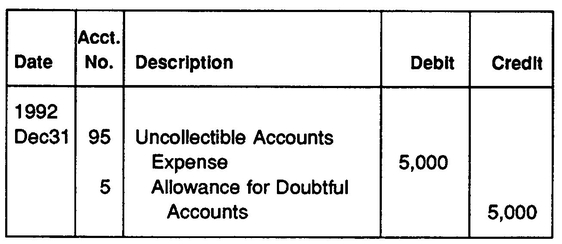

Once the provision amount is established, that figure will be debited to uncollectible accounts expense (or bad debts expense) and credited to allowance for doubtful accounts. For example, assume that The Sample Company has outstanding accounts receivable totaling $100,000 as of December 31. After examination of the individual accounts, management believes all but $5,000 is likely to be collected. The adjusting entry to reflect the provision for uncollectible accounts is shown in Example 9.2.1.

EXAMPLE 9.2.1

The Sample Company

General Journal

The debit balance of $100,000 in outstanding accounts receivable represents total claims against customers. The net realizable value of those receivables (the amount expected to be collected) is $95,000. The amount of accounts receivable reported on the financial statement is generally the net realizable value, accompanied by a notation as to the amount of allowance for uncollectible accounts.

9.2.2 WRITE-OFFS TO THE ALLOWANCE ACCOUNT

When an account is determined to be uncollectible, that amount is charged against the allowance for uncollectible accounts. As an example, the account of Mary Smith, which has a balance of $200, is deemed to be uncollectible on May 13th. The entry to reflect this action is shown in Example 9.2.2.

EXAMPLE 9.2.2

The Sample Company

General Journal

To record write off of uncollectible account.

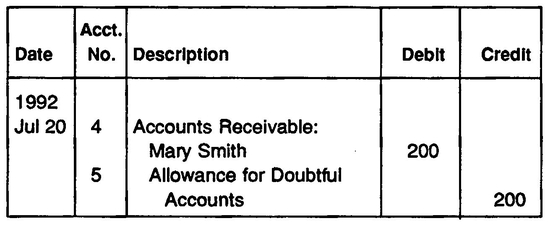

An account which has been written off may later be collected. In such an instance, the account should be reinstated through an entry just the reverse of that used to write off the account. To illustrate, should the account written off in Example 9.2.2 be subsequently collected, an entry to reinstate that account is shown in Example 9.2.3.

EXAMPLE 9.2.3

The Sample Company

General Journal

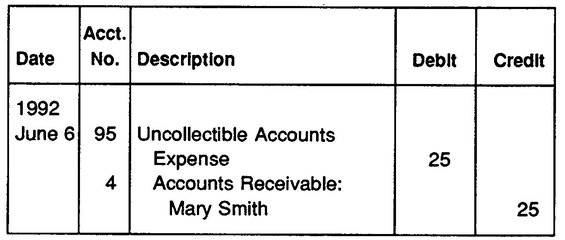

9.3 DIRECT WRITE-OFF METHOD OF ACCOUNTING FOR UNCOLLECTIBLE ACCOUNTS

The allowance method of accounting for uncollectible accounts is preferred, since it allows the matching of uncollectible accounts expense with the associated revenues. There may be situations, however, where the direct write-off method may be used. There may be situations where it is not feasible to estimate the amount of uncollectible accounts or the amount may not be material. In such cases, a business may choose to adopt the direct write-off method. Under this method, an allowance account or an adjusting entry at the end of the fiscal period are not needed. When an account is deemed to be uncollectible, an entry to reflect that decision is made as shown in Example 9.3.1.

EXAMPLE 9.3.1

The Sample Company

General Journal

To write off uncollectible account.

Subsequent recovery of an account that has been written-off would require an entry to reinstate that account. The entry would be performed in reverse manner from the entry shown in Example 9.3.1.

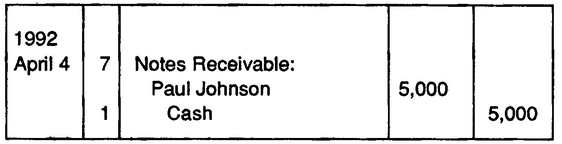

9.4 NOTES RECEIVABLE

Notes receivable arise when customers or others obligate themselves to a business through a formal contract to repay the face amount of a loan at a specific date with interest calculated at a specific rate. For example, assume that Paul Johnson borrows $5,000 from The Sample Company on April 4. The terms of the note require repayment within 60 days. Interest is to be calculated at 12%. The entry to reflect this transaction and subsequent payment of the loan is shown in Example 9.4.1.

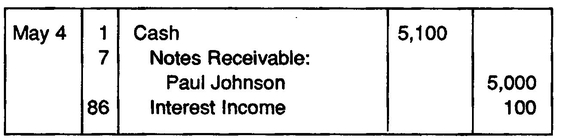

EXAMPLE 9.4.1

The Sample Company

General Journal

To reflect loan to Paul Johnson of $5,000 for 60 days at 12%.

To record payment of note receivable.

9.5 DISCOUNTING NOTES RECEIVABLE

A business may not wish to wait until a note receivable matures before receiving cash. In such a case, it may discount, or sell a note receivable to a bank. The bank obviously will not pay the full maturity value of the note and will calculate a discount based on an agreed percentage. Using the note receivable shown in Example 9.4.1, assume that The Sample Company needs the cash immediately and discounts the note to its bank on April 6. The bank charges a discount rate of 14%. The discount value of the note is calculated in Example 9.5.1.

EXAMPLE 9.5.1

| Face value of the note | $5,000 |

| Interest on note — 30 days @ 12% | 100 |

| Maturity value | 5,100 |

| Discount period April 6 to June 3: 58 days | |

| Discount on maturity value: 58 days @ 14% | 115 |

| Proceeds | $4,985 |

|

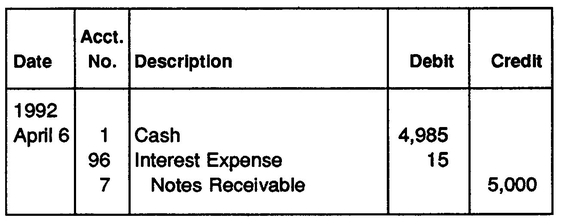

The journal entry to record this transaction is shown in Example 9.5.2.

EXAMPLE 9.5.2

The Sample Company

General Journal

In this case, the proceeds received from discounting were less than the face value of the note. Had the proceeds exceeded the face value of the note receivable, the difference would have been interest income, instead of interest expense.

9.6 DISHONORED NOTES RECEIVABLE

When a customer fails to pay a note receivable on the due date, the note is dishonored and is no longer considered a valid asset of the company. In such cases, the face amount of the note receivable may be charged against an allowance account similar to that used for uncollectible accounts receivable. Any interest income that has been accrued and recorded as interest receivable would then be written off. As an alternative, the face amount of the note plus accrued interest may be converted to an account receivable and handled according to established procedures for that type of account.