Given that we want to describe how banking services could be disrupted in the future, it will be best to start by distinguishing between the two main types of banking, commercial and investment banking.

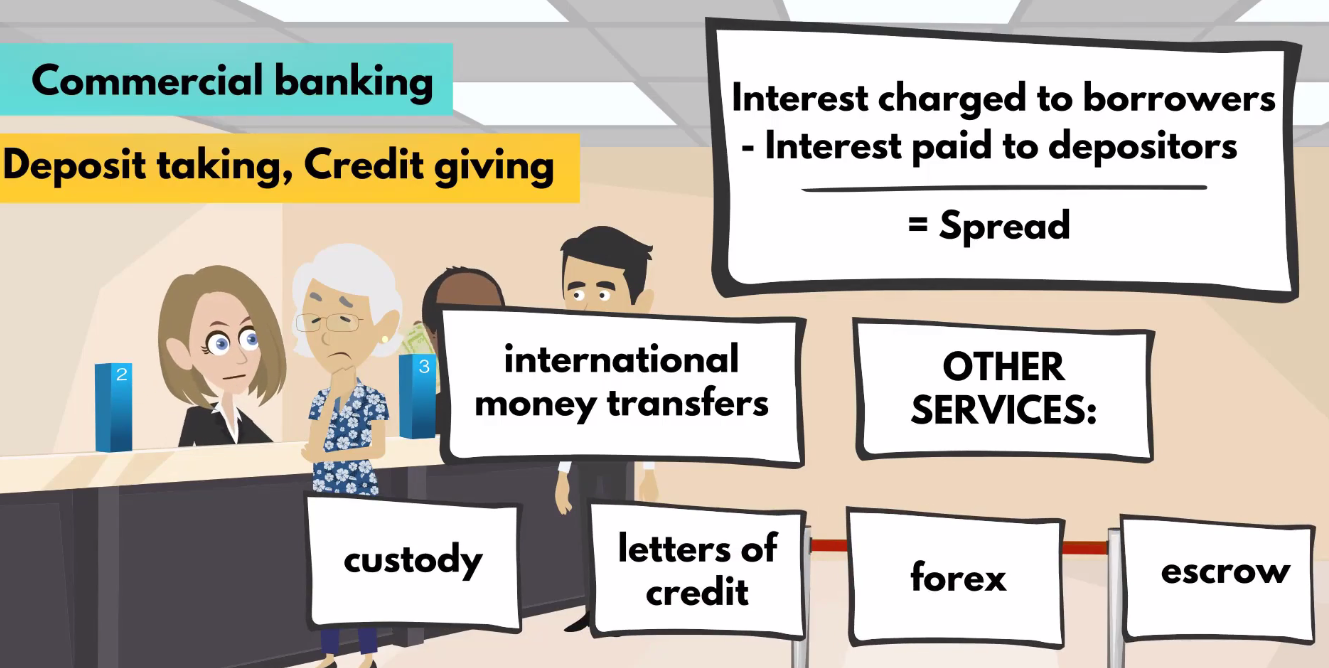

Commercial banks are the regular banks we see around us, providing loans to the population and storing its savings. These are the so-called traditional banks that are mainly involved with deposit taking and credit giving activities. These banks collect deposits from people and companies who have savings and then lend the money to borrowers. The difference between the interest they pay to depositors and the interest they charge borrowers is called spread and represents commercial banks' main source of revenue. In addition, over the years, commercial banks started offering some other services, such as international money transfers, custody, letters of credit, forex dealing, and escrow accounts:

Investment banks, on the other hand, deal with more sophisticated operations. They assist businesses in major corporate events such as when they are about to make an initial public offering and list their shares on a stock exchange, or when they are involved in mergers and acquisitions.

Since these two business models are quite different, it makes sense to analyze them separately.

Let's focus on commercial banks, since they impact the everyday lives of most people.

The commercial banking business model would need to be updated in a major way with the advent of blockchain technology.

In his 2015 letter to shareholders, Jamie Dimon (the CEO and Chairman of JP Morgan Chase, one of the largest banks in the world) said that there are hundreds of startups with lots of brains and money who are hard at work on alternatives to traditional banking.

After the boom of 2017, and the huge amounts of capital, research, and development pouring into blockchain technology, it wouldn't be an exaggeration to say that Silicon Valley and tech startups are not simply coming. They are advancing at full speed to disrupt the world and banking is the first sector to be impacted.