Now, we'll have a look at a specific initiative by IBM and several global banks, which goes on to highlight what we discussed in the previous sections. Innovation in traditional finance is already underway.

The specific initiative we will examine is called Batavia, and it involves a partnership between IBM and UBS, joined by several other major banks such as Bank of Montreal, CaixaBank, Commerzbank, and Erste Group. Its main goal is to tackle the inefficient processes in the field of trade finance.

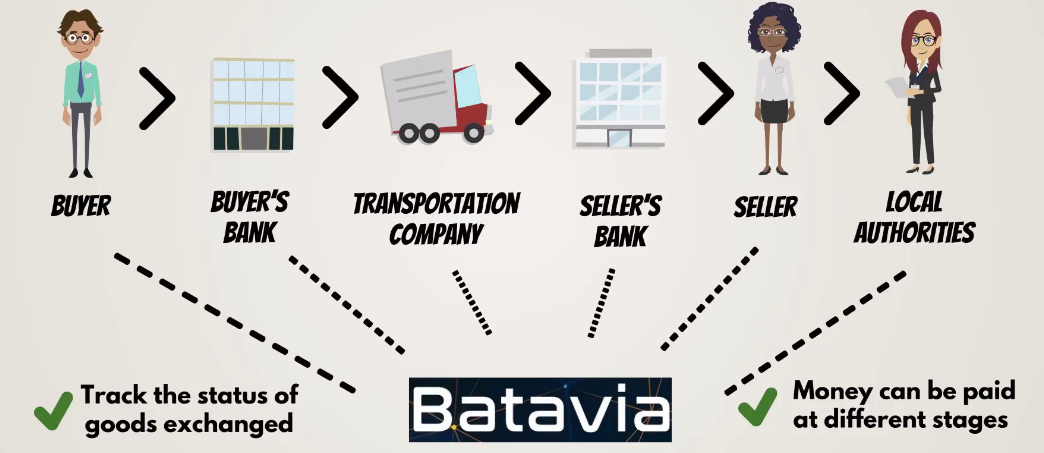

Trade finance is a slow process burdened by bureaucracy, as it stands now: a lengthy process involving multiple verifications carried out by different participants. In most cases, a single deal involves a buyer, a seller, a buyer's bank, a seller's bank, a transportation company, and local authorities. The entire process requires plenty of paperwork and isn't automated because all participants have their own separate IT systems, which require human intervention for reconciliation and verification:

The process is lengthy (taking weeks in some cases) and expensive for companies (given that they have to pay man-hours and can't use the proceeds of the deal in the meantime).

Therefore, a trade finance platform like Batavia definitely makes sense and feels like a breath of fresh air. Companies will be able to use the platform to enter into agreements with each other using standard forms. What is even more important is that the degree of transparency and trust in the system will increase due to its secure and immutable distributed ledger.

The platform is designed in a very innovative way. All parties involved will be able to track the status and whereabouts of the goods exchanged. Another key feature is that money can be paid to different participants in the trade at different stages, as goods move along the supply chain:

For example, a company will be able to pay its supplier once goods are in the hands of the logistics firm. Then the logistics firm will be paid once the shipment arrives at its destination.

Batavia is an open platform encouraging companies, banks, and authorities to join forces together and collaborate towards a more efficient outcome for all. Such initiatives promote trade and make it more efficient, thereby creating value and stimulating economic growth.

This is a great example of a platform that has been constructed using blockchain technology and can potentially disrupt the existing status quo in trade finance by increasing efficiency and effectiveness for all parties involved.