CHAPTER 15

Multinational Operations

Learning Outcomes

After completing this chapter, you will be able to do the following:

- distinguish among presentation (reporting) currency, functional currency, and local currency;

- describe foreign currency transaction exposure, including accounting for and disclosures about foreign currency transaction gains and losses;

- analyze how changes in exchange rates affect the translated sales of the subsidiary and parent company;

- compare the current rate method and the temporal method, evaluate how each affects the parent company’s balance sheet and income statement, and determine which method is appropriate in various scenarios;

- calculate the translation effects and evaluate the translation of a subsidiary’s balance sheet and income statement into the parent company’s presentation currency;

- analyze how the current rate method and the temporal method affect financial statements and ratios;

- analyze how alternative translation methods for subsidiaries operating in hyperinflationary economies affect financial statements and ratios;

- describe how multinational operations affect a company’s effective tax rate;

- explain how changes in the components of sales affect the sustainability of sales growth;

- analyze how currency fluctuations potentially affect financial results, given a company’s countries of operation.

Summary Overview

The translation of foreign currency amounts is an important accounting issue for companies with multinational operations. Foreign exchange rate fluctuations cause the functional currency values of foreign currency assets and liabilities resulting from foreign currency transactions as well as from foreign subsidiaries to change over time. These changes in value give rise to foreign exchange differences that companies’ financial statements must reflect. Determining how to measure these foreign exchange differences and whether to include them in the calculation of net income are the major issues in accounting for multinational operations.

- The local currency is the national currency of the country where an entity is located. The functional currency is the currency of the primary economic environment in which an entity operates. Normally, the local currency is an entity’s functional currency. For accounting purposes, any currency other than an entity’s functional currency is a foreign currency for that entity. The currency in which financial statement amounts are presented is known as the presentation currency. In most cases, the presentation currency will be the same as the local currency.

- When an export sale (import purchase) on an account is denominated in a foreign currency, the sales revenue (inventory) and foreign currency account receivable (account payable) are translated into the seller’s (buyer’s) functional currency using the exchange rate on the transaction date. Any change in the functional currency value of the foreign currency account receivable (account payable) that occurs between the transaction date and the settlement date is recognized as a foreign currency transaction gain or loss in net income.

- If a balance sheet date falls between the transaction date and the settlement date, the foreign currency account receivable (account payable) is translated at the exchange rate at the balance sheet date. The change in the functional currency value of the foreign currency account receivable (account payable) is recognized as a foreign currency transaction gain or loss in income. Analysts should understand that these gains and losses are unrealized at the time they are recognized and might or might not be realized when the transactions are settled.

- A foreign currency transaction gain arises when an entity has a foreign currency receivable and the foreign currency strengthens or it has a foreign currency payable and the foreign currency weakens. A foreign currency transaction loss arises when an entity has a foreign currency receivable and the foreign currency weakens or it has a foreign currency payable and the foreign currency strengthens.

- Companies must disclose the net foreign currency gain or loss included in income. They may choose to report foreign currency transaction gains and losses as a component of operating income or as a component of non-operating income. If two companies choose to report foreign currency transaction gains and losses differently, operating profit and operating profit margin might not be directly comparable between the two companies.

- To prepare consolidated financial statements, foreign currency financial statements of foreign operations must be translated into the parent company’s presentation currency. The major conceptual issues related to this translation process are, What is the appropriate exchange rate for translating each financial statement item, and how should the resulting translation adjustment be reflected in the consolidated financial statements? Two different translation methods are used worldwide.

- Under the current rate method, assets and liabilities are translated at the current exchange rate, equity items are translated at historical exchange rates, and revenues and expenses are translated at the exchange rate that existed when the underlying transaction occurred. For practical reasons, an average exchange rate is often used to translate income items.

- Under the temporal method, monetary assets (and non-monetary assets measured at current value) and monetary liabilities (and non-monetary liabilities measured at current value) are translated at the current exchange rate. Non-monetary assets and liabilities not measured at current value and equity items are translated at historical exchange rates. Revenues and expenses, other than those expenses related to non-monetary assets, are translated at the exchange rate that existed when the underlying transaction occurred. Expenses related to non-monetary assets are translated at the exchange rates used for the related assets.

- Under both IFRS and US GAAP, the functional currency of a foreign operation determines the method to be used in translating its foreign currency financial statements into the parent’s presentation currency and whether the resulting translation adjustment is recognized in income or as a separate component of equity.

- The foreign currency financial statements of a foreign operation that has a foreign currency as its functional currency are translated using the current rate method, and the translation adjustment is accumulated as a separate component of equity. The cumulative translation adjustment related to a specific foreign entity is transferred to net income when that entity is sold or otherwise disposed of. The balance sheet risk exposure associated with the current rate method is equal to the foreign subsidiary’s net asset position.

- The foreign currency financial statements of a foreign operation that has the parent’s presentation currency as its functional currency are translated using the temporal method, and the translation adjustment is included as a gain or loss in income. US GAAP refer to this process as remeasurement. The balance sheet exposure associated with the temporal method is equal to the foreign subsidiary’s net monetary asset/liability position (adjusted for non-monetary items measured at current value).

- IFRS and US GAAP differ with respect to the translation of foreign currency financial statements of foreign operations located in a highly inflationary country. Under IFRS, the foreign currency statements are first restated for local inflation and then translated using the current exchange rate. Under US GAAP, the foreign currency financial statements are translated using the temporal method, with no restatement for inflation.

- Applying different translation methods for a given foreign operation can result in very different amounts reported in the parent’s consolidated financial statements.

- Companies must disclose the total amount of translation gain or loss reported in income and the amount of translation adjustment included in a separate component of stockholders’ equity. Companies are not required to separately disclose the component of translation gain or loss arising from foreign currency transactions and the component arising from application of the temporal method.

- Disclosures related to translation adjustments reported in equity can be used to include these as gains and losses in determining an adjusted amount of income following a clean-surplus approach to income measurement.

- Foreign currency translation rules are well established in both IFRS and US GAAP. Fortunately, except for the treatment of foreign operations located in highly inflationary countries, the two sets of standards have no major differences in this area. The ability to understand the impact of foreign currency translation on the financial results of a company using IFRS should apply equally well in the analysis of financial statements prepared in accordance with US GAAP.

- An analyst can obtain information about the tax impact of multinational operations from companies’ disclosure on effective tax rates.

- For a multinational company, sales growth is driven not only by changes in volume and price but also by changes in the exchange rates between the reporting currency and the currency in which sales are made. Arguably, growth in sales that comes from changes in volume or price is more sustainable than growth in sales that comes from changes in exchange rates.

Problems

The following information relates to Questions 1–6

Pedro Ruiz is an analyst for a credit rating agency. One of the companies he follows, Eurexim SA, is based in France and complies with International Financial Reporting Standards (IFRS). Ruiz has learned that Eurexim used EUR220 million of its own cash and borrowed an equal amount to open a subsidiary in Ukraine. The funds were converted into hryvnia (UAH) on December 31, 20X1 at an exchange rate of EUR1.00 = UAH6.70 and used to purchase UAH1,500 million in fixed assets and UAH300 million of inventories.

Ruiz is concerned about the effect that the subsidiary’s results might have on Eurexim’s consolidated financial statements. He calls Eurexim’s Chief Financial Officer, but learns little. Eurexim is not willing to share sales forecasts and has not even made a determination as to the subsidiary’s functional currency.

Absent more useful information, Ruiz decides to explore various scenarios to determine the potential impact on Eurexim’s consolidated financial statements. Ukraine is not currently in a hyperinflationary environment, but Ruiz is concerned that this situation could change. Ruiz also believes the euro will appreciate against the hryvnia for the foreseeable future.

- If Ukraine’s economy becomes highly inflationary, Eurexim will most likely translate inventory by:

- restating for inflation and using the temporal method.

- restating for inflation and using the current exchange rate.

- using the temporal method with no restatement for inflation.

- Given Ruiz’s belief about the direction of exchange rates, Eurexim’s gross profit margin would be highest if it accounts for the Ukraine subsidiary’s inventory using:

- FIFO and the temporal method.

- FIFO and the current rate method.

- weighted-average cost and the temporal method.

- If the euro is chosen as the Ukraine subsidiary’s functional currency, Eurexim will translate its fixed assets using the:

- average rate for the reporting period.

- rate in effect when the assets were purchased.

- rate in effect at the end of the reporting period.

- If the euro is chosen as the Ukraine subsidiary’s functional currency, Eurexim will translate its accounts receivable using the:

- rate in effect at the transaction date.

- average rate for the reporting period.

- rate in effect at the end of the reporting period.

- If the hryvnia is chosen as the Ukraine subsidiary’s functional currency, Eurexim will translate its inventory using the:

- average rate for the reporting period.

- rate in effect at the end of the reporting period.

- rate in effect at the time the inventory was purchased.

- Based on the information available and Ruiz’s expectations regarding exchange rates, if the hryvnia is chosen as the Ukraine subsidiary’s functional currency, Eurexim will most likely report:

- an addition to the cumulative translation adjustment.

- a translation gain or loss as a component of net income.

- a subtraction from the cumulative translation adjustment.

The following information relates to Questions 7–12

Consolidated Motors is a US-based corporation that sells mechanical engines and components used by electric utilities. Its Canadian subsidiary, Consol-Can, operates solely in Canada. It was created on December 31, 20X1, and Consolidated Motors determined at that time that it should use the US dollar as its functional currency.

Chief Financial Officer Monica Templeton was asked to explain to the board of directors how exchange rates affect the financial statements of both Consol-Can and the consolidated financial statements of Consolidated Motors. For the presentation, Templeton collects Consol-Can’s balance sheets for the years ended 20X1 and 20X2 (Exhibit 1), as well as relevant exchange rate information (Exhibit 2).

Exhibit 1 Consol-Can Condensed Balance Sheet for Fiscal Years Ending December 31 (C$ millions)

| Account | 20X2 |

20X1 |

|||||

| Cash | 135 |

167 |

|||||

Accounts receivable |

98 |

— |

|||||

Inventory |

77 |

30 |

|||||

Fixed assets |

100 |

100 |

|||||

Accumulated depreciation |

0(10) |

0— |

|||||

| Total assets | 400 |

297 |

|||||

Accounts payable |

77 |

22 |

|||||

Long-term debt |

175 |

175 |

|||||

Common stock |

100 |

100 |

|||||

Retained earnings |

48 |

— |

|||||

| Total liabilities and shareholders’ equity | 400 |

297 |

|||||

Exhibit 2 Exchange Rate Information

US$/C$ |

||

Rate on December 31, 20X1 |

0.86 |

|

Average rate in 20X2 |

0.92 |

|

Weighted-average rate for inventory purchases |

0.92 |

|

| Rate on December 31, 20X2 | 0.95 |

Templeton explains that Consol-Can uses the FIFO inventory accounting method and that purchases of C$300 million and the sell-through of that inventory occurred evenly throughout 20X2. Her presentation includes reporting the translated amounts in US dollars for each item, as well as associated translation-related gains and losses. The board responds with several questions.

- Would there be a reason to change the functional currency to the Canadian dollar?

- Would there be any translation effects for Consolidated Motors if the functional currency for Consol-Can were changed to the Canadian dollar?

- Would a change in the functional currency have any impact on financial statement ratios for the parent company?

- What would be the balance sheet exposure to translation effects if the functional currency were changed?

- After translating Consol-Can’s inventory and long-term debt into the parent company’s currency (US$), the amounts reported on Consolidated Motor’s financial statements on December 31, 20X2 would be closest to (in millions):

- $71 for inventory and $161 for long-term debt.

- $71 for inventory and $166 for long-term debt.

- $73 for inventory and $166 for long-term debt.

- After translating Consol-Can’s December 31, 20X2 balance sheet into the parent company’s currency (US$), the translated value of retained earnings will be closest to:

- $41 million.

- $44 million.

- $46 million.

- In response to the board’s first question, Templeton would most likely reply that such a change would be justified if:

- the inflation rate in the United States became hyperinflationary.

- management wanted to flow more of the gains through net income.

- Consol-Can were making autonomous decisions about operations, investing, and financing.

- In response to the board’s second question, Templeton should reply that if the change is made, the consolidated financial statements for Consolidated Motors would begin to recognize:

- realized gains and losses on monetary assets and liabilities.

- realized gains and losses on non-monetary assets and liabilities.

- unrealized gains and losses on non-monetary assets and liabilities.

- In response to the board’s third question, Templeton should note that the change will most likely affect:

- the cash ratio.

- fixed asset turnover.

- receivables turnover.

- In response to the board’s fourth question, the balance sheet exposure (in C$ millions) would be closest to:

- –19.

- 148.

- 400.

The following information relates to Questions 13–18

Romulus Corp. is a US-based company that prepares its financial statements in accordance with US GAAP. Romulus Corp. has two European subsidiaries: Julius and Augustus. Anthony Marks, CFA, is an analyst trying to forecast Romulus’s 20X2 results. Marks has prepared separate forecasts for both Julius and Augustus, as well as for Romulus’s other operations (prior to consolidating the results.) He is now considering the impact of currency translation on the results of both the subsidiaries and the parent company’s consolidated financials. His research has provided the following insights:

- The results for Julius will be translated into US dollars using the current rate method.

- The results for Augustus will be translated into US dollars using the temporal method.

- Both Julius and Augustus use the FIFO method to account for inventory.

- Julius had year-end 20X1 inventory of €340 million. Marks believes Julius will report €2,300 in sales and €1,400 in cost of sales in 20X2.

Marks also forecasts the 20X2 year-end balance sheet for Julius (Exhibit 1). Data and forecasts related to euro/dollar exchange rates are presented in Exhibit 2.

Exhibit 1 Forecasted Balance Sheet Data for Julius, December 31, 20X2 (€ millions)

| Cash | 50 |

Accounts receivable |

100 |

Inventory |

700 |

Fixed assets |

1,450 |

Total assets |

2,300 |

| Liabilities | 700 |

Common stock |

1,500 |

Retained earnings |

100 |

| Total liabilities and shareholder equity | 2,300 |

Exhibit 2 Exchange Rates ($/€)

| December 31, 20X1 | 1.47 |

December 31, 20X2 |

1.61 |

20X2 average |

1.54 |

Rate when fixed assets were acquired |

1.25 |

Rate when 20X1 inventory was acquired |

1.39 |

| Rate when 20X2 inventory was acquired | 1.49 |

- Based on the translation method being used for Julius, the subsidiary is most likely:

- a sales outlet for Romulus’s products.

- a self-contained, independent operating entity.

- using the US dollar as its functional currency.

- To account for its foreign operations, Romulus has most likely designated the euro as the functional currency for:

- Julius only.

- Augustus only.

- both Julius and Augustus.

- When Romulus consolidates the results of Julius, any unrealized exchange rate holding gains on monetary assets should be:

- reported as part of operating income.

- reported as a non-operating item on the income statement.

- reported directly to equity as part of the cumulative translation adjustment.

- When Marks translates his forecasted balance sheet for Julius into US dollars, total assets as of December 31, 20X2 (dollars in millions) will be closest to:

- $1,429.

- $2,392.

- $3,703.

- When Marks converts his forecasted income statement data for Julius into US dollars, the 20X2 gross profit margin will be closest to:

- 39.1%.

- 40.9%.

- 44.6%.

- Relative to the gross margins the subsidiaries report in local currency, Romulus’s consolidated gross margin most likely:

- will not be distorted by currency translations.

- would be distorted if Augustus were using the same translation method as Julius.

- will be distorted because of the translation and inventory accounting methods Augustus is using.

The following information relates to Questions 19–24

Redline Products, Inc. is a US-based multinational with subsidiaries around the world. One such subsidiary, Acceletron, operates in Singapore, which has seen mild but not excessive rates of inflation. Acceletron was acquired in 2000 and has never paid a dividend. It records inventory using the FIFO method.

Chief Financial Officer Margot Villiers was asked by Redline’s board of directors to explain how the functional currency selection and other accounting choices affect Redline’s consolidated financial statements. Villiers gathers Acceletron’s financial statements denominated in Singapore dollars (SGD) in Exhibit 1 and the US dollar/Singapore dollar exchange rates in Exhibit 2. She does not intend to identify the functional currency actually in use but rather to use Acceletron as an example of how the choice of functional currency affects the consolidated statements.

Exhibit 1 Selected Financial Data for Acceletron, December 31, 2007 (SGD millions)

| Cash | SGD125) |

Accounts receivable |

230) |

Inventory |

500) |

Fixed assets |

1,640) |

Accumulated depreciation |

0000(205) |

Total assets |

SGD2,290) |

| Accounts payable | 185) |

Long-term debt |

200) |

Common stock |

620) |

Retained earnings |

1,285) |

Total liabilities and equity |

2,290) |

| Total revenues | SGD4,800) |

| Net income | SGD450) |

Exhibit 2 Exchange Rates Applicable to Acceletron

Exchange Rate in Effect at Specific Times |

USD per SGD |

Rate when first SGD1 billion of fixed assets were acquired |

0.568 |

Rate when remaining SGD640 million of fixed assets were acquired |

0.606 |

Rate when long-term debt was issued |

0.588 |

December 31, 2006 |

0.649 |

Weighted-average rate when inventory was acquired |

0.654 |

Average rate in 2007 |

0.662 |

| December 31, 2007 | 0.671 |

- Compared with using the Singapore dollar as Acceletron’s functional currency for 2007, if the US dollar were the functional currency, it is most likely that Redline’s consolidated:

- inventories will be higher.

- receivable turnover will be lower.

- fixed asset turnover will be higher.

- If the US dollar were chosen as the functional currency for Acceletron in 2007, Redline could reduce its balance sheet exposure to exchange rates by:

- selling SGD30 million of fixed assets for cash.

- issuing SGD30 million of long-term debt to buy fixed assets.

- issuing SGD30 million in short-term debt to purchase marketable securities.

- Redline’s consolidated gross profit margin for 2007 would be highest if Acceletron accounted for inventory using:

- FIFO, and its functional currency were the US dollar.

- LIFO, and its functional currency were the US dollar.

- FIFO, and its functional currency were the Singapore dollar.

- If the current rate method is used to translate Acceletron’s financial statements into US dollars, Redline’s consolidated financial statements will most likely include Acceletron’s:

- USD3,178 million in revenues.

- USD118 million in long-term debt.

- negative translation adjustment to shareholder equity.

- If Acceletron’s financial statements are translated into US dollars using the temporal method, Redline’s consolidated financial statements will most likely include Acceletron’s:

- USD336 million in inventory.

- USD956 million in fixed assets.

- USD152 million in accounts receivable.

- When translating Acceletron’s financial statements into US dollars, Redline is least likely to use an exchange rate of USD per SGD:

- 0.671.

- 0.588.

- 0.654.

The following information relates to Questions 25–33

Adrienne Yu is an analyst with an international bank. She analyzes Ambleu S.A. (“Ambleu”), a multinational corporation, for a client presentation. Ambleu complies with IFRS, and its presentation currency is the Norvoltian krone (NVK). Ambleu’s two subsidiaries, Ngcorp and Cendaró, have different functional currencies: Ngcorp uses the Bindiar franc ( B) and Cendaró uses the Crenland guinea (CRG).

B) and Cendaró uses the Crenland guinea (CRG).

Yu first analyzes the following three transactions to assess foreign currency transaction exposure:

| Transaction 1: | Cendaró sells goods to a non-domestic customer that pays in dollars on the purchase date. | |

Transaction 2: |

Ngcorp obtains a loan in Bindiar francs on June 1, 2016 from a European bank with the Norvoltian krone as its presentation currency. |

|

| Transaction 3: | Ambleu imports inventory from Bindiar under 45-day credit terms, and the payment is to be denominated in Bindiar francs. |

Yu then reviews Transactions 2 and 3. She determines the method that Ambleu would use to translate Transaction 2 into its December 31, 2016 consolidated financial statements. While analyzing Transaction 3, Yu notes that Ambleu purchased inventory on June 1, 2016 for  B27,000/ton. Ambleu pays for the inventory on July 15, 2016. Exhibit 1 presents selected economic data for Bindiar and Crenland.

B27,000/ton. Ambleu pays for the inventory on July 15, 2016. Exhibit 1 presents selected economic data for Bindiar and Crenland.

Exhibit 1 Selected Economic Data for Bindiar and Crenland

Date |

Spot FB/NVK Exchange Rate |

Bindiar Inflation Rate (%) |

Spot CRG/ NVK Exchange Rate |

Crenland Inflation Rate (%) |

Crenland GPI |

|||||

Dec 31, 2015 |

— |

— |

5.6780 |

— |

100.0 |

|||||

Jun 1, 2016 |

4.1779 |

— |

— |

— |

— |

|||||

Jul 15, 2016 |

4.1790 |

— |

— |

— |

— |

|||||

Dec 31, 2016 |

4.2374 |

3.1 |

8.6702 |

40.6 |

140.6 |

|||||

Average 2016 |

4.3450 |

— |

— |

— |

— |

|||||

Dec 31, 2017 |

4.3729 |

2.1 |

14.4810 |

62.3 |

228.2 |

|||||

| Average 2017 | 4.3618 |

— |

11.5823 |

— |

186.2 |

Prior to reviewing the 2016 and 2017 consolidated financial statements of Ambleu, Yu meets with her supervisor, who asks Yu the following two questions:

Question 1: Would a foreign currency translation loss reduce Ambleu’s net sales growth?

Question 2: According to IFRS, what disclosures should be included relating to Ambleu’s treatment of foreign currency translation for Ngcorp?

To complete her assignment, Yu analyzes selected information and notes from Ambleu’s 2016 and 2017 consolidated financial statements, presented in Exhibit 2.

Exhibit 2 Selected Information and Notes from Consolidated Financial Statements of Ambleu S.A. (in NVK millions)

Income Statement |

2017 |

2016 |

Balance Sheet |

2017 |

2016 |

|||||

| Revenue (1) | 1,069 |

1,034 |

Cash(3) | 467 |

425 |

|||||

Profit before tax |

294 |

269 |

Intangibles (4) |

575 |

570 |

|||||

Income tax expense (2) |

–96 |

–94 |

— |

— |

— |

|||||

| Net profit | 198 |

175 |

— | — |

— |

Note 1: Cendaro’s revenue for 2017 is CRG125.23 million.

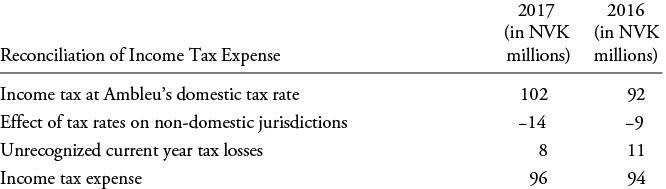

Note 2:

Note 3: The parent company transferred NVK15 million to Cendaró on January 1, 2016 to purchase a patent from a competitor for CRG85.17 million.

Note 4: The 2016 consolidated balance sheet includes Ngcorp’s total intangible assets of NVK3 million, which were added to Ngcorp’s balance sheet on July 15, 2016.

- Which transaction would generate foreign currency transaction exposure for Ambleu?

- Transaction 1

- Transaction 2

- Transaction 3

- Yu’s determination regarding Transaction 2 should be based on the currency of the:

- loan.

- bank.

- borrower.

- Based on Exhibit 1, what is the foreign exchange gain resulting from Transaction 3 on the December 31, 2016 financial statements?

- NVK1.70 per ton

- NVK90.75 per ton

- NVK248.54 per ton

- What is the best response to Question 1?

- Yes

- No, because it would reduce organic sales growth

- No, because it would reduce net price realization and mix

- Based on Exhibit 1, the best response to Question 2 is that Ambleu should disclose:

- a restatement for local inflation.

- that assets carried at historical cost are translated at historical rates.

- the amount of foreign exchange differences included in net income.

- Based on Exhibit 1 and Note 1 in Exhibit 2, the amount that Ambleu should include in its December 31, 2017 revenue from Cendaró is closest to:

- NVK10.60 million.

- NVK13.25 million.

- NVK19.73 million.

- Based on Exhibit 2 and Note 2, the change in Ambleu’s consolidated income tax rate from 2016 to 2017 most likely resulted from a:

- decrease in Ambleu’s domestic tax rate.

- more profitable business mix in its subsidiaries.

- stronger Norvoltian krone relative to the currencies of its subsidiaries.

- Based on Exhibit 1 and Note 3 in Exhibit 2, the cumulative translation loss recognized by Ambleu related to the patent purchase on the December 31, 2017 financial statements is closest to:

- NVK0.39 million.

- NVK1.58 million

- NVK9.12 million.

- Based on Exhibit 1 and Note 4 in Exhibit 2, the total intangible assets on Ngcorp’s balance sheet as of December 31, 2016 are closest to:

B12.54 million.

B12.54 million. B12.71 million.

B12.71 million. B13.04 million.

B13.04 million.

The following information relates to Questions 34–40

Triofind, Inc. (Triofind), based in the country of Norvolt, provides wireless services to various countries, including Norvolt, Borliand, Abuelio, and Certait. The company’s presentation currency is the Norvolt euro (NER), and Triofind complies with IFRS. Triofind has two wholly owned subsidiaries, located in Borliand and Abuelio. The Borliand subsidiary (Triofind-B) was established on June 30, 2016, by Triofind both investing NER1,000,000, which was converted into Borliand dollars (BRD), and borrowing an additional BRD500,000.

Marie Janssen, a financial analyst in Triofind’s Norvolt headquarters office, translates Triofind-B’s financial statements using the temporal method. Non-monetary assets are measured at cost under the lower of cost or market rule. Spot BRD/NER exchange rates are presented in Exhibit 1, and the balance sheet for Triofind-B is presented in Exhibit 2.

Exhibit 1 Spot BRD/NER Exchange Rates

Date |

BRD per NER |

|

June 30, 2016 |

1.15 |

|

Weighted-average rate when inventory was acquired (2016) |

1.19 |

|

December 31, 2016 |

1.20 |

|

Weighted-average rate when inventory was acquired (2017) |

1.18 |

|

| June 30, 2017 | 1.17 |

Exhibit 2 Triofind-B Balance Sheet for 2016 and 2017 (BRD)

| Assets | December 31, 2016 |

June 30, 2017 |

Liabilities and Stockholders’ Equity |

December 31, 2016 |

June 30, 2017 |

|||||||||

Cash |

900,000 |

1,350,000 |

Notes payable |

500,000 |

500,000 |

|||||||||

Inventory |

750,000 |

500,000 |

Common stock |

1,150,000 |

1,150,000 |

|||||||||

Retained earnings |

200,000 |

|||||||||||||

| Total | 1,650,000 |

1,850,000 |

Total | 1,650,000 |

1,850,000 |

Janssen next analyzes Triofind’s Abuelio subsidiary (Triofind-A), which uses the current rate method to translate its results into Norvolt euros. Triofind-A, which prices its goods in Abuelio pesos (ABP), sells mobile phones to a customer in Certait on May 31, 2017 and receives payment of 1 million Certait rand (CRD) on July 31, 2017.

On May 31, 2017, Triofind-A also received NER50,000 from Triofind and used the funds to purchase a new warehouse in Abuelio. Janssen translates the financial statements of Triofind-A as of July 31, 2017 and must determine the appropriate value for the warehouse in Triofind’s presentation currency. She observes that the cumulative Abuelio inflation rate exceeded 100% from 2015 to 2017. Spot exchange rates and inflation data are presented in Exhibit 3.

Exhibit 3 Spot Exchange Rates and Inflation Data for Triofind-A

| Date | NER per CRD |

NER per ABP |

Abuelio Monthly Inflation Rate (%) |

|||

May 31, 2017 |

0.2667 |

0.0496 |

— |

|||

June 30, 2017 |

0.2703 |

0.0388 |

25 |

|||

| July 31, 2017 | 0.2632 |

0.0312 |

22 |

Janssen gathers corporate tax rate data and company disclosure information to include in Triofind’s annual report. She determines that the corporate tax rates for Abuelio, Norvolt, and Borliand are 35%, 34%, and 0%, respectively, and that Norvolt exempts the non-domestic income of multinationals from taxation. Triofind-B constitutes 25% of Triofind’s net income, and Triofind-A constitutes 15%. Janssen also gathers data on components of net sales growth in different countries, presented in Exhibit 4.

Exhibit 4 Components of Net Sales Growth (%) Fiscal Year 2017

Country |

Contribution from Volume Growth |

Contribution from Price Growth |

Foreign Currency Exchange |

Net Sales Growth |

||||

Abuelio |

7 |

6 |

–2 |

11 |

||||

Borliand |

4 |

5 |

4 |

13 |

||||

| Norvolt | 7 |

3 |

— |

10 |

- Based on Exhibits 1 and 2 and Janssen’s translation method, total assets for Triofind-B translated into Triofind’s presentation currency as of December 31, 2016 are closest to:

- NER1,375,000.

- NER1,380,252.

- NER1,434,783.

- Based on Exhibits 1 and 2, the translation adjustment for Triofind-B’s liabilities into Triofind’s presentation currency for the six months ended December 31, 2016 is:

- negative.

- zero.

- positive.

- Based on Exhibits 1 and 2 and Janssen’s translation method, retained earnings for Triofind-B translated into Triofind’s presentation currency as of June 30, 2017 are closest to:

- NER150,225.

- NER170,940.

- NER172,414.

- The functional currency for Triofind-A’s sale of mobile phones to a customer in Certait is the:

- Certait real.

- Norvolt euro.

- Abuelio peso.

- Based on Exhibit 3, the value of the new warehouse in Abuelio on Triofind’s balance sheet as of July 31, 2017 is closest to:

- NER31,452.

- NER47,964.

- NER50,000.

- Relative to its domestic tax rate, Triofind’s effective tax rate is most likely:

- lower.

- the same.

- higher.

- Based on Exhibit 4, the country with the highest sustainable sales growth is:

- Norvolt.

- Abuelio.

- Borliand.