CHAPTER 17

Evaluating Quality of Financial Reports

Learning Outcomes

After completing this chapter, you will be able to do the following:

- demonstrate the use of a conceptual framework for assessing the quality of a company’s financial reports;

- explain potential problems that affect the quality of financial reports;

- describe how to evaluate the quality of a company’s financial reports;

- evaluate the quality of a company’s financial reports;

- describe the concept of sustainable (persistent) earnings;

- describe indicators of earnings quality;

- explain mean reversion in earnings and how the accruals component of earnings affects the speed of mean reversion;

- evaluate the earnings quality of a company;

- describe indicators of cash flow quality;

- evaluate the cash flow quality of a company;

- describe indicators of balance sheet quality;

- evaluate the balance sheet quality of a company;

- describe sources of information about risk.

Summary Overview

Assessing the quality of financial reports—both reporting quality and results quality—is an important analytical skill.

- The quality of financial reporting can be thought of as spanning a continuum from the highest quality to the lowest.

- Potential problems that affect the quality of financial reporting broadly include revenue and expense recognition on the income statement; classification on the statement of cash flows; and the recognition, classification, and measurement of assets and liabilities on the balance sheet.

- Typical steps involved in evaluating financial reporting quality include an understanding of the company’s business and industry in which the company is operating; comparison of the financial statements in the current period and the previous period to identify any significant differences in line items; an evaluation of the company’s accounting policies, especially any unusual revenue and expense recognition compared with those of other companies in the same industry; financial ratio analysis; examination of the statement of cash flows with particular focus on differences between net income and operating cash flows; perusal of risk disclosures; and review of management compensation and insider transactions.

- High-quality earnings increase the value of the company more than low-quality earnings, and the term “high-quality earnings” assumes that reporting quality is high.

- Low-quality earnings are insufficient to cover the company’s cost of capital and/or are derived from non-recurring, one-off activities. In addition, the term “low-quality earnings” can be used when the reported information does not provide a useful indication of the company’s performance.

- Various alternatives have been used as indicators of earnings quality: recurring earnings, earnings persistence and related measures of accruals, beating benchmarks, and after-the-fact confirmations of poor-quality earnings, such as enforcement actions and restatements.

- Earnings that have a significant accrual component are less persistent and thus may revert to the mean more quickly.

- A company that consistently reports earnings that exactly meet or only narrowly beat benchmarks can raise questions about its earnings quality.

- Cases of accounting malfeasance have commonly involved issues with revenue recognition, such as premature recognition of revenues or the recognition of fraudulent revenues.

- Cases of accounting malfeasance have involved misrepresentation of expenditures as assets rather than as expenses or misrepresentation of the timing or amount of expenses.

- Bankruptcy prediction models, used in assessing financial results quality, quantify the likelihood that a company will default on its debt and/or declare bankruptcy.

- Similar to the term “earnings quality,” when reported cash flows are described as being high quality, it means that the company’s underlying economic performance was satisfactory in terms of increasing the value of the firm, and it also implies that the company had high reporting quality (i.e., that the information calculated and disclosed by the company was a good reflection of economic reality). Cash flow can be described as “low quality” either because the reported information properly represents genuinely bad economic performance or because the reported information misrepresents economic reality.

- For the balance sheet, high financial reporting quality is indicated by completeness, unbiased measurement, and clear presentation.

- A balance sheet with significant amounts of off-balance-sheet debt would lack the completeness aspect of financial reporting quality.

- Unbiased measurement is a particularly important aspect of financial reporting quality for assets and liabilities for which valuation is subjective.

- A company’s financial statements can provide useful indicators of financial or operating risk.

- The management commentary (also referred to as the management discussion and analysis, or MD&A) can give users of the financial statements information that is helpful in assessing the company’s risk exposures and approaches to managing risk.

- Required disclosures regarding, for example, changes in senior management or inability to make a timely filing of required financial reports can be a warning sign of problems with financial reporting quality.

- The financial press can be a useful source of information about risk when, for example, a financial reporter uncovers financial reporting issues that had not previously been recognized. An analyst should undertake additional investigation of any issue identified.

Problems

The following information relates to Questions 1–4

Mike Martinez is an equity analyst who has been asked to analyze Stellar, Inc. by his supervisor, Dominic Anderson. Stellar exhibited strong earnings growth last year; however, Anderson is skeptical about the sustainability of the company’s earnings. He wants Martinez to focus on Stellar’s financial reporting quality and earnings quality.

After conducting a thorough review of the company’s financial statements, Martinez concludes the following:

Conclusion 1: Although Stellar’s financial statements adhere to generally accepted accounting principles (GAAP), Stellar understates earnings in periods when the company is performing well and overstates earnings in periods when the company is struggling.

Conclusion 2: Stellar most likely understated the value of amortizable intangibles when recording the acquisition of Solar, Inc. last year. No goodwill impairment charges have been taken since the acquisition.

Conclusion 3: Over time, the accruals component of Stellar’s earnings is large relative to the cash component.

Conclusion 4: Stellar reported an unusually sharp decline in accounts receivable in the current year, and an increase in long-term trade receivables.

- Based on Martinez’s conclusions, Stellar’s financial statements are best categorized as:

- non-GAAP compliant.

- GAAP compliant, but with earnings management.

- GAAP compliant and decision useful, with sustainable and adequate returns.

- Based on Conclusion 2, after the acquisition of Solar, Stellar’s earnings are most likely:

- understated.

- fairly stated.

- overstated.

- In his follow-up analysis relating to Conclusion 3, Martinez should focus on Stellar’s:

- total accruals.

- discretionary accruals.

- non-discretionary accruals.

- What will be the impact on Stellar in the current year if Martinez’s belief in Conclusion 4 is correct? Compared with the previous year, Stellar’s:

- current ratio will increase.

- days sales outstanding (DSO) will decrease.

- accounts receivable turnover will decrease.

The following information relates to Questions 5–12

Ioana Matei is a senior portfolio manager for an international wealth management firm. She directs research analyst Teresa Pereira to investigate the earnings quality of Miland Communications and Globales, Inc.

Pereira first reviews industry data and the financial reports of Miland Communications for the past few years. Pereira then makes the following three statements about Miland:

Statement 1: Miland shortened the depreciable lives for capital assets.

Statement 2: Revenue growth has been higher than that of industry peers.

Statement 3: Discounts to customers and returns from customers have decreased.

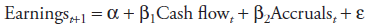

Pereira also observes that Miland has experienced increasing inventory turnover, increasing receivables turnover, and net income greater than cash flow from operations. She estimates the following regression model to assess Miland’s earnings persistence:

Pereira and Matei discuss quantitative models such as the Beneish model, used to assess the likelihood of misreporting. Pereira makes the following two statements to Matei:

Statement 4: An advantage of using quantitative models is that they can determine cause and effect between model variables.

Statement 5: A disadvantage of using quantitative models is that their predictive power declines over time because many managers have learned to test the detectability of manipulation tactics by using the model.

Pereira collects the information in Exhibit 1 to use the Beneish model to assess Miland’s likelihood of misreporting.

Exhibit 1 Selected Beneish Model Data for Miland Communications

| Last Year | Current Year | |||

| Days’ sales receivable index (DSR) | 0.90 |

1.20 |

||

| Leverage index (LEVI) | 0.75 |

0.95 |

||

| Sales, general, and administrative expenses index (SGAI) | 0.60 |

0.75 |

Pereira concludes her investigation of Miland by examining the company’s reported pre-tax income of $5.4 billion last year. This amount includes $1.2 billion of acquisition and divestiture-related expenses, $0.5 billion of restructuring expenses, and $1.1 billion of other non-operating expenses. Pereira determines that the acquisition and divestiture-related expenses as well as restructuring expenses are non-recurring expenses, but other expenses are recurring expenses.

Matei then asks Pereira to review last year’s financial statements for Globales, Inc. and assess the effect of two possible misstatements. Upon doing so, Pereira judges that Globales improperly recognized EUR50 million of revenue and improperly capitalized EUR100 million of its cost of revenue. She then estimates the effect of these two misstatements on net income, assuming a tax rate of 25%.

Pereira compares Globales, Inc.’s financial statements with those of an industry competitor. Both firms have similar, above-average returns on equity (ROE), although Globales has a higher cash flow component of earnings. Pereira applies the mean reversion principle in her forecasts of the two firms’ future ROE.

- Which of Pereira’s statements describes an accounting warning sign of potential overstatement or non-sustainability of operating and/or net income?

- Statement 1

- Statement 2

- Statement 3

- Which of Pereira’s statements about Miland Communications is most likely a warning sign of potential earnings manipulation?

- The trend in inventory turnover

- The trend in receivables turnover

- The amount of net income relative to cash flow from operations

- Based on the regression model used by Pereira, earnings persistence for Miland would be highest if:

- β1 is less than 0.

- β1 is greater than β2.

- β2 is greater than β1.

- Which of Pereira’s statements regarding the use of quantitative models to assess the likelihood of misreporting is correct?

- Only Statement 4

- Only Statement 5

- Both Statement 4 and Statement 5

- Based on Exhibit 1, which variable in the Beneish model has a year-over-year change that would increase Miland’s likelihood of manipulation?

- DSR

- LEVI

- SGAI

- Based on Pereira’s determination of recurring and non-recurring expenses for Miland, the company’s recurring or core pre-tax earnings last year is closest to:

- $4.3 billion.

- $4.8 billion.

- $7.1 billion.

- After adjusting the Globales, Inc. income statement for the two possible misstatements, the decline in net income is closest to:

- EUR37.5 million.

- EUR112.5 million.

- EUR150.0 million.

- Pereira should forecast that the ROE for Globales is likely to decline:

- more slowly than that of the industry competitor.

- at the same rate as the industry competitor.

- more rapidly than that of the industry competitor.

The following information relates to Questions 13–19

Emmitt Dodd is a portfolio manager for Upsilon Advisers. Dodd meets with Sonya Webster, the firm’s analyst responsible for the machinery industry, to discuss three established companies: BIG Industrial, Construction Supply, and Dynamic Production. Webster provides Dodd with research notes for each company that reflect trends during the last three years:

BIG Industrial:

Note 1: Operating income has been much lower than operating cash flow (OCF).

Note 2: Accounts payable has increased, while accounts receivable and inventory have substantially decreased.

Note 3: Although OCF was positive, it was just sufficient to cover capital expenditures, dividends, and debt repayments.

Construction Supply:

Note 4: Operating margins have been relatively constant.

Note 5: The growth rate in revenue has exceeded the growth rate in receivables.

Note 6: OCF was stable and positive, close to its reported net income, and just sufficient to cover capital expenditures, dividends, and debt repayments.

Dynamic Production:

Note 7: OCF has been more volatile than that of other industry participants.

Note 8: OCF has fallen short of covering capital expenditures, dividends, and debt repayments.

Dodd asks Webster about the use of quantitative tools to assess the likelihood of misreporting. Webster tells Dodd she uses the Beneish model, and she presents the estimated M-scores for each company in Exhibit 1.

Exhibit 1 Beneish Model M-scores

| Company | 2017 |

2016 |

Change in M-score |

|||

| BIG Industrial | −1.54 |

−1.82 |

0.2800000 |

|||

| Construction Supply | −2.60 |

−2.51 |

−0.0900000 |

|||

| Dynamic Production | −1.86 |

−1.12 |

−0.7400000 |

Webster tells Dodd that Dynamic Production was required to restate its 2016 financial statements as a result of its attempt to inflate sales revenue. Customers of Dynamic Production were encouraged to take excess product in 2016, and they were then allowed to return purchases in the subsequent period, without penalty.

Webster’s industry analysis leads her to believe that innovations have caused some of the BIG Industrial’s inventory to become obsolete. Webster expresses concern to Dodd that although the notes to the financial statements for BIG Industrial are informative about its inventory cost methods, its inventory is overstated.

The BIG Industrial income statement reflects a profitable 49% unconsolidated equity investment. Webster calculates the return on sales of BIG Industrial based on the reported income statement. Dodd notes that industry peers consolidate similar investments. Dodd asks Webster to use a comparable method of calculating the return on sales for BIG Industrial.

- Which of Webster’s notes about BIG Industrial provides an accounting warning sign of a potential reporting problem?

- Only Note 1

- Only Note 2

- Both Note 1 and Note 2

- Do either of Webster’s Notes 4 or 5 about Construction Supply describe an accounting warning sign of potential overstatement or non-sustainability of operating income?

- No

- Yes, Note 4 provides a warning sign

- Yes, Note 5 provides a warning sign

- Based on Webster’s research notes, which company would most likely be described as having high-quality cash flow?

- BIG Industrial

- Construction Supply

- Dynamic Production

- Based on the Beneish model results for 2017 in Exhibit 1, which company has the highest probability of being an earnings manipulator?

- BIG Industrial

- Construction Supply

- Dynamic Production

- Based on the information related to its restatement, Dynamic Production reported poor operating cash flow quality in 2016 by understating:

- inventories.

- net income.

- trade receivables.

- Webster’s concern about BIG Industrial’s inventory suggests poor reporting quality, most likely resulting from a lack of:

- completeness.

- clear presentation.

- unbiased measurement.

- In response to Dodd’s request, Webster’s recalculated return on sales will most likely:

- decrease.

- remain the same.

- increase.