CHAPTER 7

Inventories

Solutions

- C is correct. Transportation costs incurred to ship inventory to customers are an expense and may not be capitalized in inventory. (Transportation costs incurred to bring inventory to the business location can be capitalized in inventory.) Storage costs required as part of production, as well as costs incurred as a result of normal waste of materials, can be capitalized in inventory. (Costs incurred as a result of abnormal waste must be expensed.)

- B is correct. Inventory expense includes costs of purchase, costs of conversion, and other costs incurred in bringing the inventories to their present location and condition. It does not include storage costs not required as part of production.

- A is correct. IFRS allow the inventories of producers and dealers of agricultural and forest products, agricultural produce after harvest, and minerals and mineral products to be carried at net realizable value even if above historical cost. (US GAAP treatment is similar.)

- A is correct. A perpetual inventory system updates inventory values and quantities and cost of goods sold continuously to reflect purchases and sales. The ending inventory of 800 units consists of 300 units at $20 and 500 units at $17.

(300 × $20) + (500 × $17) = $14,500

- A is correct. In an environment with falling inventory costs and declining inventory levels, periodic LIFO will result in a higher ending inventory value and lower cost of goods sold versus perpetual LIFO and perpetual FIFO methods. This results in a lower inventory turnover ratio, which is calculated as follows:

Inventory turnover ratio = Cost of goods sold/Ending inventory

The inventory turnover ratio using periodic LIFO is $39,000/$16,000 = 244% or 2.44 times.

The inventory turnover ratio using perpetual LIFO is 279% or 2.79 times, which is provided in Table 2 (= 40,500/14,500 from previous question).

The inventory turnover for perpetual FIFO is $41,400/$13,600 = 304% or 3.04 times.

- B is correct. During a period of rising inventory costs, a company using the FIFO method will allocate a lower amount to cost of goods sold and a higher amount to ending inventory as compared with the LIFO method. The inventory turnover ratio is the ratio of cost of sales to ending inventory. A company using the FIFO method will produce a lower inventory turnover ratio as compared with the LIFO method. The current ratio (current assets/current liabilities) and the gross profit margin [gross profit/sales = (sales less cost of goods sold)/sales] will be higher under the FIFO method than under the LIFO method in periods of rising inventory unit costs.

- A is correct. LIFO reserve is the FIFO inventory value less the LIFO inventory value. In periods of rising inventory unit costs, the carrying amount of inventory under FIFO will always exceed the carrying amount of inventory under LIFO. The LIFO reserve may increase over time as a result of the increasing difference between the older costs used to value inventory under LIFO and the more recent costs used to value inventory under FIFO. When inventory unit levels are decreasing, the company will experience a LIFO liquidation, reducing the LIFO reserve.

- A is correct. When the number of units sold exceeds the number of units purchased, a company using LIFO will experience a LIFO liquidation. If inventory unit costs have been rising from period-to-period and a LIFO liquidation occurs, it will produce an increase in gross profit as a result of the lower inventory carrying amounts of the liquidated units (lower cost per unit of the liquidated units).

- B is correct. The adjusted COGS under the FIFO method is equal to COGS under the LIFO method less the increase in LIFO reserve:

COGS (FIFO) = COGS (LIFO) − Increase in LIFO reserve

COGS (FIFO) = £50,800 − (£4,320 − £2,600)

COGS (FIFO) = £49,080

- B is correct. Under IFRS, the reversal of write-downs is required if net realizable value increases. The inventory will be reported on the balance sheet at £1,000,000. The inventory is reported at the lower of cost or net realizable value. Under US GAAP, inventory is carried at the lower of cost or market value. After a write-down, a new cost basis is determined, and additional revisions may only reduce the value further. The reversal of write-downs is not permitted.

- A is correct. IFRS require the reversal of inventory write-downs if net realizable values increase; US GAAP do not permit the reversal of write-downs.

- C is correct. Activity ratios (for example, inventory turnover and total asset turnover) will be positively affected by a write-down to net realizable value because the asset base (denominator) is reduced. On the balance sheet, the inventory carrying amount is written down to its net realizable value and the loss in value (expense) is generally reflected on the income statement in cost of goods sold, thus reducing gross profit, operating profit, and net income.

- B is correct. Cinnamon uses the weighted average cost method, so in 2018, 5,000 units of inventory were 2017 units at €10 each, and 50,000 were 2008 purchases at €11. The weighted average cost of inventory during 2008 was thus (5,000 × 10) + (50,000 × 11) = 50,000 + 550,000 = €600,000, and the weighted average cost was approximately €10.91 = €600,000/55,000. Cost of sales was €10.91 × 45,000, which is approximately €490,950.

- C is correct. Zimt uses the FIFO method, and thus the first 5,000 units sold in 2018 depleted the 2017 inventory. Of the inventory purchased in 2018, 40,000 units were sold, and 10,000 remain, valued at €11 each, for a total of €110,000.

- A is correct. Zimt uses the FIFO method, so its cost of sales represents units purchased at a (no longer available) lower price. Nutmeg uses the LIFO method, so its cost of sales is approximately equal to the current replacement cost of inventory.

- B is correct. Nutmeg uses the LIFO method, and thus some of the inventory on the balance sheet was purchased at a (no longer available) lower price. Zimt uses the FIFO method, so the carrying value on the balance sheet represents the most recently purchased units and thus approximates the current replacement cost.

- B is correct. In a declining price environment, the newest inventory is the lowest-cost inventory. In such circumstances, using the LIFO method (selling the newer, cheaper inventory first) will result in lower cost of sales and higher profit.

- B is correct. In a rising price environment, inventory balances will be higher for the company using the FIFO method. Accounts payable are based on amounts due to suppliers, not the amounts accrued based on inventory accounting.

- C is correct. The write-down reduced the value of inventory and increased cost of sales in 2017. The higher numerator and lower denominator mean that the inventory turnover ratio as reported was too high. Gross margin and the current ratio were both too low.

- A is correct. The reversal of the write-down shifted cost of sales from 2018 to 2017. The 2017 cost of sales was higher because of the write-down, and the 2018 cost of sales was lower because of the reversal of the write-down. As a result, the reported 2018 profits were overstated. Inventory balance in 2018 is the same because the write-down and reversal cancel each other out. Cash flow from operations is not affected by the non-cash write-down, but the higher profits in 2018 likely resulted in higher taxes and thus lower cash flow from operations.

- B is correct. LIFO will result in lower inventory and higher cost of sales. Gross margin (a profitability ratio) will be lower, the current ratio (a liquidity ratio) will be lower, and inventory turnover (an efficiency ratio) will be higher.

- A is correct. LIFO will result in lower inventory and higher cost of sales in periods of rising costs compared to FIFO. Consequently, LIFO results in a lower gross profit margin than FIFO.

- B is correct. The LIFO method increases cost of sales, thus reducing profits and the taxes thereon.

- A is correct. US GAAP do not permit inventory write-downs to be reversed.

- B is correct. Both US GAAP and IFRS require disclosure of the amount of inventories recognized as an expense during the period. Only US GAAP allows the LIFO method and requires disclosure of any material amount of income resulting from the liquidation of LIFO inventory. US GAAP does not permit the reversal of prior-year inventory write-downs.

- B is correct. A significant increase (attributable to increases in unit volume rather than increases in unit cost) in raw materials and/or work-in-progress inventories may signal that the company expects an increase in demand for its products. If the growth of finished goods inventories is greater than the growth of sales, it could indicate a decrease in demand and a decrease in future earnings. A substantial increase in finished goods inventories while raw materials and work-in-progress inventories are declining may signal a decrease in demand for the company’s products.

- B is correct. During a period of rising inventory prices, a company using the LIFO method will have higher cost of cost of goods sold and lower inventory compared with a company using the FIFO method. The inventory turnover ratio will be higher for the company using the LIFO method, thus making it appear more efficient. Current assets and gross profit margin will be lower for the company using the LIFO method, thus making it appear less liquid and less profitable.

- B is correct. In an environment of declining inventory unit costs and constant or increasing inventory quantities, FIFO (in comparison with weighted average cost or LIFO) will have higher cost of goods sold (and net income) and lower inventory. Because both inventory and net income are lower, total equity is lower, resulting in a higher debt-to-equity ratio.

- C is correct. The storage costs for inventory awaiting shipment to customers are not costs of purchase, costs of conversion, or other costs incurred in bringing the inventories to their present location and condition, and are not included in inventory. The storage costs for the chocolate liquor occur during the production process and are thus part of the conversion costs. Excise taxes are part of the purchase cost.

- C is correct. The carrying amount of inventories under FIFO will more closely reflect current replacement values because inventories are assumed to consist of the most recently purchased items. FIFO is an acceptable, but not preferred, method under IFRS. Weighted average cost, not FIFO, is the cost formula that allocates the same per unit cost to both cost of sales and inventory.

- B is correct. Inventory turnover = Cost of sales/Average inventory = 41,043/7,569.5 = 5.42. Average inventory is (8,100 + 7,039)/2 = 7,569.5.

- B is correct. For comparative purposes, the choice of a competitor that reports under IFRS is requested because LIFO is permitted under US GAAP.

- A is correct. The carrying amount of the ending inventory may differ because the perpetual system will apply LIFO continuously throughout the year, liquidating layers as sales are made. Under the periodic system, the sales will start from the last layer in the year. Under FIFO, the sales will occur from the same layers regardless of whether a perpetual or periodic system is used. Specific identification identifies the actual products sold and remaining in inventory, and there will be no difference under a perpetual or periodic system.

- B is correct. The cost of sales is closest to CHF 4,550. Under FIFO, the inventory acquired first is sold first. Using Exhibit 4, a total of 310 cartons were available for sale (100 + 40 + 70 + 100) and 185 cartons were sold (50 + 100 + 35), leaving 125 in ending inventory. The FIFO cost would be as follows:

100 (beginning inventory) × 22 = 2,200

40 (February 4, 2009) × 25 = 1,000

45 (July 23, 2009) × 30 = 1,350

Cost of sales = 2,200 + 1,000 + 1,350 = CHF 4,550

- A is correct. Gross profit will most likely increase by CHF 7,775. The net realizable value has increased and now exceeds the cost. The write-down from 2017 can be reversed. The write-down in 2017 was 9,256 [92,560 × (4.05 − 3.95)]. IFRS require the reversal of any write-downs for a subsequent increase in value of inventory previously written down. The reversal is limited to the lower of the subsequent increase or the original write-down. Only 77,750 kilograms remain in inventory; the reversal is 77,750 × (4.05 − 3.95) = 7,775. The amount of any reversal of a write-down is recognized as a reduction in cost of sales. This reduction results in an increase in gross profit.

- C is correct. Using the FIFO method to value inventories when prices are rising will allocate more of the cost of goods available for sale to ending inventories (the most recent purchases, which are at higher costs, are assumed to remain in inventory) and less to cost of sales (the oldest purchases, which are at lower costs, are assumed to be sold first).

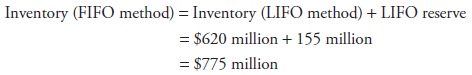

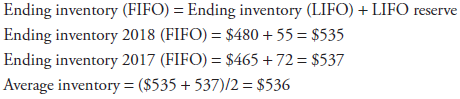

- C is correct. Karp’s inventory under FIFO equals Karp’s inventory under LIFO plus the LIFO reserve. Therefore, as of December 31, 2018, Karp’s inventory under FIFO equals:

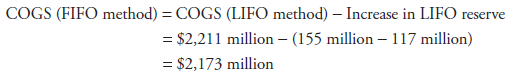

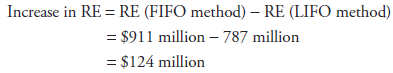

- B is correct. Karp’s cost of goods sold (COGS) under FIFO equals Karp’s cost of goods sold under LIFO minus the increase in the LIFO reserve. Therefore, for the year ended December 31, 2018, Karp’s cost of goods sold under FIFO equals:

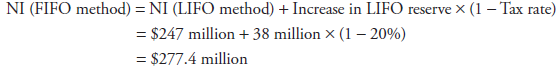

- A is correct. Karp’s net income (NI) under FIFO equals Karp’s net income under LIFO plus the after-tax increase in the LIFO reserve. For the year ended December 31, 2018, Karp’s net income under FIFO equals:

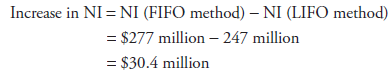

Therefore, the increase in net income is:

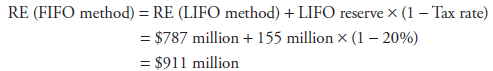

- B is correct. Karp’s retained earnings (RE) under FIFO equals Karp’s retained earnings under LIFO plus the after-tax LIFO reserve. Therefore, for the year ended December 31, 2018, Karp’s retained earnings under FIFO equals:

Therefore, the increase in retained earnings is:

- A is correct. The cash ratio (cash and cash equivalents ÷ current liabilities) would be lower because cash would have been less under FIFO. Karp’s income before taxes would have been higher under FIFO, and consequently taxes paid by Karp would have also been higher, and cash would have been lower. There is no impact on current liabilities. Both Karp’s current ratio and gross profit margin would have been higher if FIFO had been used. The current ratio would have been higher because inventory under FIFO increases by a larger amount than the cash decreases for taxes paid. Because the cost of goods sold under FIFO is lower than under LIFO, the gross profit margin would have been higher.

- B is correct. If Karp had used FIFO instead of LIFO, the debt-to-equity ratio would have decreased. No change in debt would have occurred, but shareholders’ equity would have increased as a result of higher retained earnings.

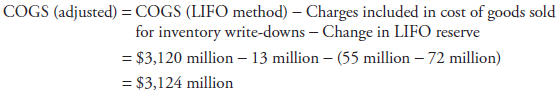

- B is correct. Crux’s adjusted inventory turnover ratio must be computed using cost of goods sold (COGS) under FIFO and excluding charges for increases in valuation allowances.

Note: Minus the change in LIFO reserve is equivalent to plus the decrease in LIFO reserve. The adjusted inventory turnover ratio is computed using average inventory under FIFO.

Therefore, adjusted inventory turnover ratio equals:

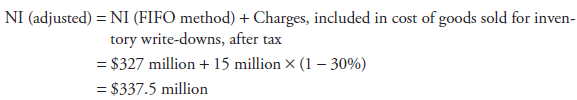

Inventory turnover ratio = COGS/Average inventory = $3,124/$536 = 5.83 - B is correct. Rolby’s adjusted net profit margin must be computed using net income (NI) under FIFO and excluding charges for increases in valuation allowances.

Therefore, adjusted net profit margin equals:

Net profit margin = NI/Revenues = $337.5/$5,442 = 6.20% - A is correct. Mikko’s adjusted debt-to-equity ratio is lower because the debt (numerator) is unchanged and the adjusted shareholders’ equity (denominator) is higher. The adjusted shareholders’ equity corresponds to shareholders’ equity under FIFO, excluding charges for increases in valuation allowances. Therefore, adjusted shareholders’ equity is higher than reported (unadjusted) shareholders’ equity.

- C is correct. Mikko’s and Crux’s gross margin ratios would better reflect the current gross margin of the industry than Rolby because both use LIFO. LIFO recognizes as cost of goods sold the cost of the most recently purchased units; therefore, it better reflects replacement cost. However, Mikko’s gross margin ratio best reflects the current gross margin of the industry because Crux’s LIFO reserve is decreasing. This could reflect a LIFO liquidation by Crux, which would distort gross profit margin.

- B is correct. The FIFO method shows a higher gross profit margin than the LIFO method in an inflationary scenario, because FIFO allocates to cost of goods sold the cost of the oldest units available for sale. In an inflationary environment, these units are the ones with the lowest cost.

- A is correct. An inventory write-down increases cost of sales and reduces profit and reduces the carrying value of inventory and assets. This has a negative effect on profitability and solvency ratios. However, activity ratios appear positively affected by a write-down because the asset base, whether total assets or inventory (denominator), is reduced. The numerator, sales, in total asset turnover is unchanged, and the numerator, cost of sales, in inventory turnover is increased. Thus, turnover ratios are higher and appear more favorable as the result of the write-down.

- B is correct. Finished goods least accurately reflect current prices because some of the finished goods are valued under the “last-in, first-out” (“LIFO”) basis. The costs of the newest units available for sale are allocated to cost of goods sold, leaving the oldest units (at lower costs) in inventory. ZP values raw materials and work in process using the weighted average cost method. While not fully reflecting current prices, some inflationary effect will be included in the inventory values.

- C is correct. FIFO inventory = Reported inventory + LIFO reserve =

608,572 + 10,120 =

608,572 + 10,120 =  618,692. The LIFO reserve is disclosed in Note 2 of the notes to consolidated financial statements.

618,692. The LIFO reserve is disclosed in Note 2 of the notes to consolidated financial statements. - A is correct. The inventory turnover ratio would be lower. The average inventory would be higher under FIFO, and cost of products sold would be lower by the increase in LIFO reserve. LIFO is not permitted under IFRS.

Inventory turnover ratio = Cost of products sold ÷ Average inventory

2018 inventory turnover ratio as reported = 10.63 =

5,822,805/[(608,572 + 486,465)/2].

5,822,805/[(608,572 + 486,465)/2].2018 inventory turnover ratio adjusted to FIFO as necessary = 10.34 = [

5,822,805 − (19,660 − 10,120)]/[(608,572 + 10,120 + 486,465 + 19,660)/2].

5,822,805 − (19,660 − 10,120)]/[(608,572 + 10,120 + 486,465 + 19,660)/2]. - A is correct. No LIFO liquidation occurred during 2018; the LIFO reserve increased from

10,120 million in 2008 to

10,120 million in 2008 to  19,660 million in 2018. Management stated in the MD&A that the decrease in inventories reflected the impacts of decreased sales volumes and fluctuations in foreign currency translation rates.

19,660 million in 2018. Management stated in the MD&A that the decrease in inventories reflected the impacts of decreased sales volumes and fluctuations in foreign currency translation rates. - C is correct. Finished goods and raw materials inventories are lower in 2018 when compared to 2017. Reduced levels of inventory typically indicate an anticipated business contraction.

- B is correct. The decrease in LIFO inventory in 2018 would typically indicate that more inventory units were sold than produced or purchased. Accordingly, one would expect a liquidation of some of the older LIFO layers and the LIFO reserve to decrease. In actuality, the LIFO reserve increased from

10,120 million in 2017 to

10,120 million in 2017 to  19,660 million in 2009. This is not to be expected and is likely caused by the increase in prices of raw materials, other production materials, and parts of foreign currencies as noted in the MD&A. An analyst should seek to confirm this explanation.

19,660 million in 2009. This is not to be expected and is likely caused by the increase in prices of raw materials, other production materials, and parts of foreign currencies as noted in the MD&A. An analyst should seek to confirm this explanation. - B is correct. If prices have been decreasing, write-downs under FIFO are least likely to have a significant effect because the inventory is valued at closer to the new, lower prices. Typically, inventories valued using LIFO are less likely to incur inventory write-downs than inventories valued using weighted average cost or FIFO. Under LIFO, the oldest costs are reflected in the inventory carrying value on the balance sheet. Given increasing inventory costs, the inventory carrying values under the LIFO method are already conservatively presented at the oldest and lowest costs. Thus, it is far less likely that inventory write-downs will occur under LIFO; and if a write-down does occur, it is likely to be of a lesser magnitude.