CHAPTER 8

Long-Lived Assets

Solutions

- B is correct. Only costs necessary for the machine to be ready to use can be capitalized. Therefore, Total capitalized costs = 12,980 + 1,200 + 700 + 100 = $14,980.

- C is correct. When property and equipment are purchased, the assets are recorded on the balance sheet at cost. Costs for the assets include all expenditures required to prepare the assets for their intended use. Any other costs are expensed. Costs to train staff for using the machine are not required to prepare the property and equipment for their intended use, and these costs are expensed.

- B is correct. When a company constructs an asset, borrowing costs incurred directly related to the construction are generally capitalized. If the asset is constructed for sale, the borrowing costs are classified as inventory.

- A is correct. Borrowing costs can be capitalized under IFRS until the tangible asset is ready for use. Also, under IFRS, income earned on temporarily investing the borrowed monies decreases the amount of borrowing costs eligible for capitalization. Therefore, Total capitalized interest = (500 million × 14% × 2 years) − 10 million = 130 million.

- B is correct. A product patent with a defined expiration date is an intangible asset with a finite useful life. A copyright with no expiration date is an intangible asset with an indefinite useful life. Goodwill is no longer considered an intangible asset under IFRS and is considered to have an indefinite useful life.

- C is correct. An intangible asset with a finite useful life is amortized, whereas an intangible asset with an indefinite useful life is not.

- A is correct. The costs to internally develop intangible assets are generally expensed when incurred.

- C is correct. Under both International Financial Reporting Standards (IFRS) and US GAAP, if an item is acquired in a business combination and cannot be recognized as a tangible asset or identifiable intangible asset, it is recognized as goodwill. Under US GAAP, assets arising from contractual or legal rights and assets that can be separated from the acquired company are recognized separately from goodwill.

- A is correct. In the fiscal year when long-lived equipment is purchased, the assets on the balance sheet increase, and depreciation expense on the income statement increases because of the new long-lived asset.

- B is correct. Company Z’s return on equity based on year-end equity value will be 6.1%. Company Z will have an additional £200,000 of expenses compared with Company X. Company Z expensed the printer for £300,000 rather than capitalizing the printer and having a depreciation expense of £100,000 like Company X. Company Z’s net income and shareholders’ equity will be £150,000 lower (= £200,000 × 0.75) than that of Company X.

- A is correct. If the company uses the straight-line method, the depreciation expense will be one-fifth (20 percent) of the depreciable cost in Year 1. If it uses the units-of-production method, the depreciation expense will be 19 percent (2,000/10,500) of the depreciable cost in Year 1. Therefore, if the company uses the straight-line method, its depreciation expense will be higher, and its net income will be lower.

- C is correct. The operating income or earnings before interest and taxes will be lowest for the method that results in the highest depreciation expense. The double-declining balance method results in the highest depreciation expense in the first year of use.

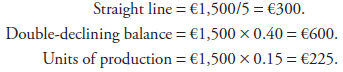

Depreciation expense:

- C is correct. If Martinez wants to minimize tax payments in the first year of the machine’s life, he should use an accelerated method, such as the double-declining balance method.

- A is correct. Using the straight-line method, depreciation expense amounts to

Depreciation expense = (1,200,000 − 200,000)/8 years = 125,000.

- B is correct. Using the units-of-production method, depreciation expense amounts to

Depreciation expense = (1,200,000 − 200,000) × (135,000/800,000) = 168,750.

- A is correct. The straight-line method is the method that evenly distributes the cost of an asset over its useful life because amortization is the same amount every year.

- A is correct. A higher residual value results in a lower total depreciable cost and, therefore, a lower amount of amortization in the first year after acquisition (and every year after that).

- C is correct. Shifting at the end of Year 2 from double-declining balance to straight-line depreciation methodology results in depreciation expense being the same in each of Years 3, 4, and 5. Shifting to the straight-line methodology at the beginning of Year 3 results in a greater depreciation expense in Year 4 than would have been calculated using the double-declining balance method.

Depreciation expense Year 4 (Using double-declining balance method all five years)

= 2 × Annual depreciation % using straight-line method × Carrying amount at end of Year 3

= 40% × $43,200

Depreciation expense Year 4 with switch to straight-line method in Year 3

= 1/3 × Remaining depreciable cost at start of Year 3

= 1/3 × $72,000

= $24,000

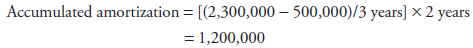

- B is correct. Using the straight-line method, accumulated amortization amounts to

- B is correct. Using the units-of-production method, depreciation expense amounts to

Depreciation expense = 5,800,000 × (20,000/175,000) = 662,857

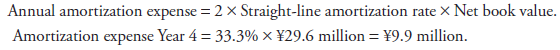

- B is correct. As shown in the following calculations, under the double-declining balance method, the annual amortization expense in Year 4 is closest to

9.9 million.

9.9 million.

- A is correct. As shown in the following calculations, at the end of Year 4, the difference between the net book values calculated using straight-line versus double-declining balance is closest to €81,400.

Net book value end of Year 4 using straight-line method = €600,000 − [4 × (€600,000/6)] = €200,000.

Net book value end of Year 4 using double-declining balance method = €600,000 (1 − 33.33%)4 ≍ €118,600.

- B is correct. In this case, the value increase brought about by the revaluation should be recorded directly in equity. The reason is that under IFRS, an increase in value brought about by a revaluation can only be recognized as a profit to the extent that it reverses a revaluation decrease of the same asset previously recognized in the income statement.

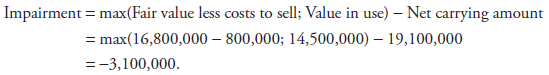

- B is correct. The impairment loss equals £3,100,000.

- B is correct. Under IFRS, an impairment loss is measured as the excess of the carrying amount over the asset’s recoverable amount. The recoverable amount is the higher of the asset’s fair value less costs to sell and its value in use. Value in use is a discounted measure of expected future cash flows. Under US GAAP, assessing recoverability is separate from measuring the impairment loss. If the asset’s carrying amount exceeds its undiscounted expected future cash flows, the asset’s carrying amount is considered unrecoverable, and the impairment loss is measured as the excess of the carrying amount over the asset’s fair value.

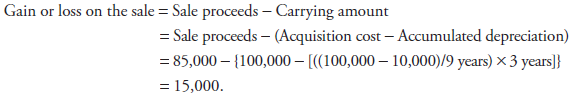

- B is correct. The result on the sale of the vehicle equals

- A is correct. Gain or loss on the sale = Sale proceeds − Carrying amount. Rearranging this equation, Sale proceeds = Carrying amount + Gain or loss on sale. Thus, Sale price = (12 million − 2 million) + (−3.2 million) = 6.8 million.

- C is correct. The carrying amount of the asset on the balance sheet is reduced by the amount of the impairment loss, and the impairment loss is reported on the income statement.

- A is correct. The gain or loss on the sale of long-lived assets is computed as the sales proceeds minus the carrying amount of the asset at the time of sale. This is true under the cost and revaluation models of reporting long-lived assets. In the absence of impairment losses, under the cost model, the carrying amount will equal historical cost net of accumulated depreciation.

- B is correct. IFRS do not require acquisition dates to be disclosed.

- A is correct. IFRS do not require fair value of intangible assets to be disclosed.

- C is correct. Under US GAAP, companies are required to disclose the estimated amortization expense for the next five fiscal years. Under US GAAP, there is no reversal of impairment losses. Disclosure of the useful lives—finite or indefinite and additional related details—is required under IFRS.

- B is correct. Investment property earns rent. Investment property and property, plant, and equipment are tangible and long-lived.

- C is correct. When a company uses the fair value model to value investment property, changes in the fair value of the property are reported in the income statement—not in other comprehensive income.

- A is correct. Investment property earns rent. Inventory is held for resale, and property, plant, and equipment are used in the production of goods and services.

- C is correct. A company will change from the fair value model to either the cost model or revaluation model when the company transfers investment property to property, plant, and equipment.

- A is correct. Under both the revaluation model for property, plant, and equipment and the fair model for investment property, the asset’s fair value must be able to be measured reliably. Under the fair value model, net income is affected by all changes in the asset’s fair value. Under the revaluation model, any increase in an asset’s value to the extent that it reverses a previous revaluation decrease will be recognized on the income statement and increase net income.

- A is correct. Under IFRS, when using the cost model for its investment properties, a company must disclose useful lives. The method for determining fair value, as well as reconciliation between beginning and ending carrying amounts of investment property, is a required disclosure when the fair value model is used.

- C is correct. Expensing rather than capitalizing an investment in long-term assets will result in higher expenses and lower net income and net profit margin in the current year. Future years’ incomes will not include depreciation expense related to these expenditures. Consequently, year-to-year growth in profitability will be higher. If the expenses had been capitalized, the carrying amount of the assets would have been higher, and the 2009 total asset turnover would have been lower.

- C is correct. In 2010, switching to an accelerated depreciation method would increase depreciation expense and decrease income before taxes, taxes payable, and net income. Cash flow from operating activities would increase because of the resulting tax savings.

- B is correct. 2009 net income and net profit margin are lower because of the impairment loss. Consequently, net profit margins in subsequent years are likely to be higher. An impairment loss suggests that insufficient depreciation expense was recognized in prior years, and net income was overstated in prior years. The impairment loss is a non-cash item and will not affect operating cash flows.

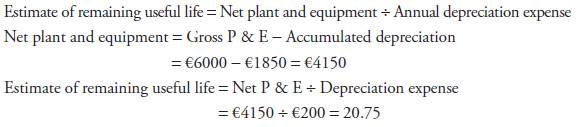

- A is correct. The estimated average remaining useful life is 20.75 years.

- C is correct. The decision to capitalize the costs of the new computer system results in higher cash flow from operating activities; the expenditure is reported as an outflow of investing activities. The company allocates the capitalized amount over the asset’s useful life as depreciation or amortisation expense rather than expensing it in the year of expenditure. Net income and total assets are higher in the current fiscal year.

- B is correct. Alpha’s fixed asset turnover will be lower because the capitalized interest will appear on the balance sheet as part of the asset being constructed. Therefore, fixed assets will be higher, and the fixed asset turnover ratio (total revenue/average net fixed assets) will be lower than if it had expensed these costs. Capitalized interest appears on the balance sheet as part of the asset being constructed instead of being reported as interest expense in the period incurred. However, the interest coverage ratio should be based on interest payments, not interest expense (earnings before interest and taxes/interest payments), and should be unchanged. To provide a true picture of a company’s interest coverage, the entire amount of interest expenditure, both the capitalized portion and the expensed portion, should be used in calculating interest coverage ratios.

- A is correct. Accelerated depreciation will result in an improving, not declining, net profit margin over time, because the amount of depreciation expense declines each year. Under straight-line depreciation, the amount of depreciation expense will remain the same each year. Under the units-of-production method, the amount of depreciation expense reported each year varies with the number of units produced.

- B is correct. The estimated average total useful life of a company’s assets is calculated by adding the estimates of the average remaining useful life and the average age of the assets. The average age of the assets is estimated by dividing accumulated depreciation by depreciation expense. The average remaining useful life of the asset base is estimated by dividing net property, plant, and equipment by annual depreciation expense.

- C is correct. The impairment loss is a non-cash charge and will not affect cash flow from operating activities. The debt to total assets and fixed asset turnover ratios will increase, because the impairment loss will reduce the carrying amount of fixed assets and therefore total assets.

- A is correct. In an asset revaluation, the carrying amount of the assets increases. The increase in the asset’s carrying amount bypasses the income statement and is reported as other comprehensive income and appears in equity under the heading of revaluation surplus. Therefore, shareholders’ equity will increase, but net income will not be affected, so return on equity will decline. Return on assets and debt to capital ratios will also decrease.