CHAPTER 10

Non-Current (Long-Term) Liabilities

Solutions

- B is correct. The company receives €1 million in cash from investors at the time the bonds are issued, which is recorded as a financing activity.

- B is correct. The effective interest rate is greater than the coupon rate, and the bonds will be issued at a discount.

- A is correct. Under US GAAP, expenses incurred when issuing bonds are generally recorded as an asset and amortized to the related expense (legal, etc.) over the life of the bonds. Under IFRS, they are included in the measurement of the liability. The related cash flows are financing activities.

- C is correct. The bonds will be issued at a premium because the coupon rate is higher than the market interest rate. The future cash outflows, the present value of the cash outflows, and the total present value are as follows:

Date Interest

Payment ($)Present Value

at Market

Rate 5% ($)Present Value

at Market

Rate 5% ($)Total Present

Value ($)December 31, 2015 60,000.00 57,142.86 December 31, 2016 60,000.00 54,421.77 December 31, 2017 60,000.00 51,830.26 December 31, 2018 60,000.00 49,362.15 December 31, 2019 60,000.00 47,011.57 December 31, 2020 60,000.00 44,772.92 December 31, 2021 60,000.00 42,640.88 December 31, 2022 60,000.00 40,610.36 December 31, 2023 60,000.00 38,676.53 December 31, 2024 60,000.00 36,834.80 1,000,000.00 613,913.25 463,304.10 613,913.25 1,077,217.35 Sales Proceeds The following illustrates the keystrokes for many financial calculators to calculate sales proceeds of $1,077,217.35:

Calculator Notation Numerical Value for This Problem N 10 % i or I/Y 5 FV $1,000,000.00 PMT $60,000.00 PV compute X Thus, the sales proceeds are reported on the balance sheet as an increase in long-term liability, bonds payable of $1,077,217.

- A is correct. The bonds payable reported at issue is equal to the sales proceeds. The interest payments and future value of the bond must be discounted at the market interest rate of 3% to determine the sales proceeds.

Date Interest

PaymentPresent Value

at Market

Rate (3%)Face Value

PaymentPresent Value

at Market Rate

(3%)Total Present

ValueDecember 31, 2015 $125,000.00 $121,359.22 December 31, 2016 $125,000.00 $117,824.49 December 31, 2017 $125,000.00 $114,392.71 $5,000,000.00 $4,575,708.30 Total $353,576.42 $4,575,708.30 $4,929,284.72 The following illustrates the keystrokes for many financial calculators to calculate sales proceeds of $4,929,284.72:

Calculator Notation Numerical Value for This Problem N 3 % i or I/Y 3.0 FV $5,000,000.00 PMT $125,000.00 PV compute X - B is correct. The market interest rate at the time of issuance is the effective interest rate that the company incurs on the debt. The effective interest rate is the discount rate that equates the present value of the coupon payments and face value to their selling price. Consequently, the effective interest rate is 5.50%.

- B is correct. The bonds will be issued at a discount because the market interest rate is higher than the stated rate. Discounting the future payments to their present value indicates that at the time of issue, the company will record £978,938 as both a liability and a cash inflow from financing activities. Interest expense in 2010 is £58,736 (£978,938 times 6.0 percent). During the year, the company will pay cash of £55,000 related to the interest payment, but interest expense on the income statement will also reflect £3,736 related to amortization of the initial discount (£58,736 interest expense less the £55,000 interest payment). Thus, the value of the liability at December 31, 2010 will reflect the initial value (£978,938) plus the amortized discount (£3,736), for a total of £982,674. The cash outflow of £55,000 may be presented as either an operating or financing activity under IFRS.

- A is correct. The coupon rate on the bonds is higher than the market rate, which indicates that the bonds will be issued at a premium. Taking the present value of each payment indicates an issue date value of €10,210,618. The interest expense is determined by multiplying the carrying amount at the beginning of the period (€10,210,618) by the market interest rate at the time of issue (6.0 percent) for an interest expense of €612,637. The value after one year will equal the beginning value less the amount of the premium amortized to date, which is the difference between the amount paid (€650,000) and the expense accrued (€612,637) or €37,363. €10,210,618 − €37,363 = €10,173,255 or €10.17 million.

- A is correct. The future cash outflows, the present value of the cash outflows, and the total present value are as follows:

Date Interest

Payment (€)Present Value

at Market

Rate 6% (€)Present Value

at Market

Rate 6% (€)Total Present

Value (€)December 31, 2015 700,000.00 660,377.36 December 31, 2016 700,000.00 622,997.51 December 31, 2017 700,000.00 587,733.50 December 31, 2018 700,000.00 554,465.56 December 31, 2019 700,000.00 523,080.72 December 31, 2020 700,000.00 493,472.38 December 31, 2021 700,000.00 465,539.98 December 31, 2022 700,000.00 439,188.66 December 31, 2023 700,000.00 414,328.92 December 31, 2024 700,000.00 390,876.34 10,000,000.00 5,583,947.77 5,152,060.94 5,583,947.77 10,736,008.71 Sales Proceeds The following illustrates the keystrokes for many financial calculators to calculate sales proceeds of €10,736,008.71:

Calculator Notation Numerical Value for This Problem N 10 % i or I/Y 6 FV $10,000,000.00 PMT $700,000.00 PV compute X The interest expense is calculated by multiplying the carrying amount at the beginning of the year by the effective interest rate at issuance. As a result, the interest expense at December 31, 2015 is €644,161 (€10,736,008.71 × 6%).

- C is correct. The future cash outflows, the present value of the cash outflows, and the total present value are as follows:

Date Interest

Payment ($)Present Value

at Market Rate

5% ($)Present Value

at Market Rate

5% ($)Total Present

Value ($)December 31, 2015 1,200,000 1,142,857.14 December 31, 2016 1,200,000 1,088,435.37 December 31, 2017 1,200,000 1,036,605.12 December 31, 2018 1,200,000 987,242.97 December 31, 2019 1,200,000 940,231.40 30,000,000 23,505,785.00 5,195,372.00 23,505,785.00 28,701,157.00 Sales Proceeds The following illustrates the keystrokes for many financial calculators to calculate sales proceeds of $28,701,157.00:

Calculator Notation Numerical Value for This Problem N 5 % i or I/Y 5 FV $30,000,000.00 PMT $1,200,000.00 PV compute X The following table illustrates interest expense, premium amortization, and carrying amount (amortized cost) for 2015.

Year Carrying

Amount

(beginning of

year)Interest

Expense (at

effective interest

rate of 5%)Interest Payment

(at coupon rate

of 4%)Amortization

of DiscountCarrying

Amount

(end of year)2015 $28,701,157.00 $1,435,057.85 $1,200,000.00 $235,057.85 $28,936,214.85 The carrying amount at the end of the year is found by adding the amortization of the discount to the carrying amount at the beginning of the year. As a result, the carrying amount on December 31, 2015 is $28,936,215.

Alternatively, the following illustrates the keystrokes for many financial calculators to calculate the carrying value at the end of first year of $28,936, 215:

Calculator Notation Numerical Value for This Problem N 4 % i or I/Y 5 FV $30,000,000.00 PMT $1,200,000.00 PV compute X - B is correct. The interest expense for a given year is equal to the carrying amount at the beginning of the year times the effective interest of 4%. Under the effective interest rate method, the difference between the interest expense and the interest payment (based on the coupon rate and face value) is the discount amortized in the period, which increases the carrying amount annually. For 2017, the interest expense is the beginning carrying amount ($1,944,499) times the effective interest of 4%.

Year Carrying

Amount

(beginning)Interest

Expense

(at effective

interest of

4%)Interest

Payment

(at coupon

rate of 3%)Amortization

of DiscountCarrying

Amount

(end of year)2015 $1,910,964 $76,439 $60,000.00 $16,439 $1,927,403 2016 $1,927,403 $77,096 $60,000.00 $17,096 $1,944,499 2017 $1,944,499 $77,780 $60,000.00 $17,780 $1,962,279 - B is correct. The amortization of the premium equals the interest payment minus the interest expense. The interest payment is constant, and the interest expense decreases as the carrying amount decreases. As a result, the amortization of the premium increases each year.

- B is correct. Under the straight-line method, the bond premium is amortized equally over the life of the bond. The annual interest payment is $165,000 ($3,000,000 × 5.5%), and annual amortization of the premium under the straight-line method is $13,616 [($3,040,849 − $3,000,000)/3)]. The interest expense is the interest payment less the amortization of the premium ($165,000 − $13,616 = $151,384).

- C is correct. A gain of €3.3 million (carrying amount less amount paid) will be reported on the income statement.

- B is correct. If a company decides to redeem a bond before maturity, bonds payable is reduced by the carrying amount of the debt. The difference between the cash required to redeem the bonds and the carrying amount of the bonds is a gain or loss on the extinguishment of debt. Because the call price is 104 and the face value is $1,000,000, the redemption cost is 104% of $1,000,000 or $1,040,000. The company’s loss on redemption would be $50,000 ($990,000 carrying amount of debt minus $1,040,000 cash paid to redeem the callable bonds).

- A is correct. The value of the liability for zero-coupon bonds increases as the discount is amortized over time. Furthermore, the amortized interest will reduce earnings at an increasing rate over time as the value of the liability increases. Higher relative debt and lower relative equity (through retained earnings) will cause the debt-to-equity ratio to increase as the zero-coupon bonds approach maturity.

- A is correct. When interest rates rise, bonds decline in value. Thus, the carrying amount of the bonds being carried on the balance sheet is higher than the market value. The company could repurchase the bonds for less than the carrying amount, so the economic liabilities are overestimated. Because the bonds are issued at a fixed rate, there is no effect on interest coverage.

- C is correct. Affirmative covenants require certain actions of the borrower. Requiring the company to perform regular maintenance on equipment pledged as collateral is an example of an affirmative covenant because it requires the company to do something. Negative covenants require that the borrower not take certain actions. Prohibiting the borrower from entering into mergers and preventing the borrower from issuing excessive additional debt are examples of negative covenants.

- C is correct. Covenants protect debtholders from excessive risk taking, typically by limiting the issuer’s ability to use cash or by limiting the overall levels of debt relative to income and equity. Issuing additional equity would increase the company’s ability to meet its obligations, so debtholders would not restrict that ability.

- C is correct. The non-current liabilities section of the balance sheet usually includes a single line item of the total amount of a company’s long-term debt due after 1 year, and the current liabilities section shows the portion of a company’s long-term debt due in the next 12 months. Notes to the financial statements generally present the stated and effective interest rates and maturity dates for a company’s debt obligations

- B is correct. An operating lease is not recorded on the balance sheet (debt is lower), and lease payments are entirely categorized as rent (interest expense is lower.) Because the rent expense is an operating outflow but principal repayments are financing cash flows, the operating lease will result in lower cash flow from operating activity.

- B is correct. The lessee will disclose the future obligation by maturity of its operating leases. The future obligations by maturity, leased assets, and lease liabilities will all be shown for finance leases.

- B is correct. When a lease is classified as an operating lease, the underlying asset remains on the lessor’s balance sheet. The lessor will record a depreciation expense that reduces the asset’s value over time.

- A is correct. A sales-type lease treats the lease as a sale of the asset, and revenue is recorded at the time of sale equal to the present value of future lease payments. Under a direct financing lease, only interest income is reported as earned. Under an operating lease, revenue from rent is reported when collected.

- A is correct. A portion of the payments for capital leases, either direct financing or sales-type, is reported as interest income. With an operating lease, all revenue is recorded as rental revenue.

- A is correct. An operating lease is an agreement that allows the lessee to use an asset for a period of time. Thus, an operating lease is similar to renting an asset, whereas a finance lease is equivalent to the purchase of an asset by the lessee that is directly financed by the lessor.

- C is correct. If the present value of the lease payments is greater than 90% of the fair value of the asset, the lease is considered a capital lease. A lease with a term that is 75% or more of the useful life of the asset is deemed to be a capital lease. The option to purchase the asset must be deemed to be cheap (bargain purchase option), not just to include the option to purchase the asset.

- A is correct. A finance lease is similar to borrowing money and buying an asset; a company that enters into a finance lease as the lessee reports an asset (leased asset) and related debt (lease payable) on its balance sheet. A company that enters into a finance lease as the lessee will report interest expense and depreciation expense on its income statement. A company that enters into an operating lease will report the lease payment on its income statement. For a finance lease, only the portion of the lease payment relating to interest expense reduces operating cash flow; the portion of the lease payment that reduces the lease liability appears as a cash outflow in the financing section. A company that enters into an operating lease as the lessee will report the full lease payment as an operating cash outflow.

- A is correct. A company that enters into a finance lease reports the value of both the leased asset and lease payable as the lower of the present value of future lease payments and the fair value of the leased asset. The present value of the future lease payments, €47,250,188, is lower than the fair market value of the leased asset, €49,000,000. The company will record a lease payable on the balance sheet of €47,250,188.

- B is correct. An operating lease is economically similar to renting an asset. A company that enters into an operating lease as a lessee reports a lease expense on its income statement during the period it uses the asset and reports no asset or liability on its balance sheet. The operating lease is disclosed in notes to the financial statements.

- C is correct. The current debt-to-total-capital ratio is $840/($840 + $520) = 0.62. To adjust for the lease commitments, an analyst should add $100 to both the numerator and denominator: $940/($940 + $520) = 0.64.

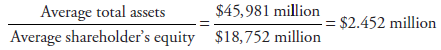

- C is correct. The financial leverage ratio is calculated as follows:

- B is correct. Company B has the lowest debt-to-equity ratio, indicating the lowest financial leverage, and the highest interest coverage ratio, indicating the greatest number of times that EBIT covers interest payments.

- A is correct because the debt-to-assets (total debt)/(total assets) ratio is (1,258 + 321)/(8,750) = 1,579/8,750 = 0.18

- B is correct. The company will report a net pension obligation of €1 million equal to the pension obligation (€10 million) less the plan assets (€9 million).

- A is correct. A company that offers a defined benefit plan makes payments into a pension fund, and the retirees are paid from the fund. The payments that a company makes into the fund are invested until they are needed to pay retirees. If the fair value of the fund’s assets is higher than the present value of the estimated pension obligation, the plan has a surplus, and the company’s balance sheet will reflect a net pension asset. Because the fair value of the fund’s assets are $1,500,000,000 and the present value of estimated pension obligations is $1,200,000,000, the company will present a net pension asset of $300,000,000 on its balance sheet.