CHAPTER 15

Multinational Operations

Solutions

- B is correct. IAS 21 requires that the financial statements of the foreign entity first be restated for local inflation using the procedures outlined in IAS 29, “Financial Reporting in Hyperinflationary Economies.” Then, the inflation-restated foreign currency financial statements are translated into the parent’s presentation currency using the current exchange rate. Under US GAAP, the temporal method would be used with no restatement.

- B is correct. Ruiz expects the EUR to appreciate against the UAH and expects some inflation in the Ukraine. In an inflationary environment, FIFO will generate a higher gross profit than weighted-average cost. For either inventory choice, the current rate method will give higher gross profit to the parent company if the subsidiary’s currency is depreciating. Thus, using FIFO and translating using the current rate method will generate a higher gross profit for the parent company, Eurexim SA, than any other combination of choices.

- B is correct. If the parent’s currency is chosen as the functional currency, the temporal method must be used. Under the temporal method, fixed assets are translated using the rate in effect at the time the assets were acquired.

- C is correct. Monetary assets and liabilities such as accounts receivable are translated at current (end-of-period) rates regardless of whether the temporal or current rate method is used.

- B is correct. When the foreign currency is chosen as the functional currency, the current rate method is used. All assets and liabilities are translated at the current (end-of-period) rate.

- C is correct. When the foreign currency is chosen as the functional currency, the current rate method must be used, and all gains or losses from translation are reported as a cumulative translation adjustment to shareholder equity. When the foreign currency decreases in value (weakens), the current rate method results in a negative translation adjustment in stockholders’ equity.

- B is correct. When the parent company’s currency is used as the functional currency, the temporal method must be used to translate the subsidiary’s accounts. Under the temporal method, monetary assets and liabilities (e.g., debt) are translated at the current (year-end) rate, non-monetary assets and liabilities measured at historical cost (e.g., inventory) are translated at historical exchange rates, and non-monetary assets and liabilities measured at current value are translated at the exchange rate at the date when the current value was determined. Because beginning inventory was sold first and sales and purchases were evenly acquired, the average rate is most appropriate for translating inventory, and C$77 million × 0.92 = $71 million. Long-term debt is translated at the year-end rate of 0.95. C$175 million × 0.95 = $166 million.

- B is correct. Translating the 20X2 balance sheet using the temporal method, as is required in this instance, results in assets of US$369 million. The translated liabilities and common stock are equal to US$325 million, meaning that the value for 20X2 retained earnings is US$369 million − US$325 million = US$44 million.

Temporal Method (20X2) Account C$ Rate US$ Cash 135 0.95 128 Accounts receivable 98 0.95 93 Inventory 77 0.92 71 Fixed assets 100 0.86 86 Accumulated depreciation (10) 0.86 (9) Total assets 400 369 Accounts payable 77 0.95 73 Long-term debt 175 0.95 166 Common stock 100 0.86 86 Retained earnings 48 to balance 44 Total liabilities and shareholders’ equity 400 369 - C is correct. The Canadian dollar would be the appropriate reporting currency when substantially all operating, financing, and investing decisions are based on the local currency. The parent country’s inflation rate is never relevant. Earnings manipulation is not justified, and at any rate changing the functional currency would take the gains off of the income statement.

- C is correct. If the functional currency were changed from the parent currency (US dollar) to the local currency (Canadian dollar), the current rate method would replace the temporal method. The temporal method ignores unrealized gains and losses on non-monetary assets and liabilities, but the current rate method does not.

- B is correct. If the Canadian dollar is chosen as the functional currency, the current rate method will be used, and the current exchange rate will be the rate used to translate all assets and liabilities. Currently, only monetary assets and liabilities are translated at the current rate. Sales are translated at the average rate during the year under either method. Fixed assets are translated using the historical rate under the temporal method but would switch to current rates under the current rate method. Therefore, there will most likely be an effect on sales/fixed assets. Because the cash ratio involves only monetary assets and liabilities, it is unaffected by the translation method. Receivables turnover pairs a monetary asset with sales and is thus also unaffected.

- B is correct. If the functional currency were changed, then Consol-Can would use the current rate method, and the balance sheet exposure would be equal to net assets (total assets − total liabilities). In this case, 400 − 77 − 175 = 148.

- B is correct. Julius is using the current rate method, which is most appropriate when it is operating with a high degree of autonomy.

- A is correct. If the current rate method is being used (as it is for Julius), the local currency (euro) is the functional currency. When the temporal method is being used (as it is for Augustus), the parent company’s currency (US dollar) is the functional currency.

- C is correct. When the current rate method is being used, all currency gains and losses are recorded as a cumulative translation adjustment to shareholder equity.

- C is correct. Under the current rate method, all assets are translated using the year-end 20X2 (current) rate of $1.61/€1.00. €2,300 × 1.61 = $3,703.

- A is correct. Under the current rate method, both sales and cost of goods sold would be translated at the 20X2 average exchange rate. The ratio would be the same as reported under the euro. €2,300 − €1,400 = €900, €900/€2,300 = 39.1%. Or, $3,542 − $2,156 = $1,386, $1,386/$3,542 = 39.1%.

- C is correct. Augustus is using the temporal method in conjunction with FIFO inventory accounting. If FIFO is used, ending inventory is assumed to be composed of the most recently acquired items, and thus inventory will be translated at relatively recent exchange rates. To the extent that the average weight used to translate sales differs from the historical rate used to translate inventories, the gross margin will be distorted when translated into US dollars.

- C is correct. If the US dollar is the functional currency, the temporal method must be used. Revenues and receivables (monetary asset) would be the same under either accounting method. Inventory and fixed assets were purchased when the US dollar was stronger, so at historical rates (temporal method), translated they would be lower. Identical revenues/lower fixed assets would result in higher fixed-asset turnover.

- A is correct. If the US dollar is the functional currency, the temporal method must be used, and the balance sheet exposure will be the net monetary assets of 125 + 230 − 185 − 200 = −30, or a net monetary liability of SGD30 million. This net monetary liability would be eliminated if fixed assets (non-monetary) were sold to increase cash. Issuing debt, either short-term or long-term, would increase the net monetary liability.

- A is correct. Because the US dollar has been consistently weakening against the Singapore dollar, cost of sales will be lower and gross profit higher when an earlier exchange rate is used to translate inventory, compared with using current exchange rates. If the Singapore dollar is the functional currency, current rates would be used. Therefore, the combination of the US dollar (temporal method) and FIFO will result in the highest gross profit margin.

- A is correct. Under the current rate method, revenue is translated at the average rate for the year, SGD4,800 × 0.662 = USD3,178 million. Debt should be translated at the current rate, SGD200 × 0.671 = USD134 million. Under the current rate method, Acceletron would have a net asset balance sheet exposure. Because the Singapore dollar has been strengthening against the US dollar, the translation adjustment would be positive rather than negative.

- B is correct. Under the temporal method, inventory and fixed assets would be translated using historical rates. Accounts receivable is a monetary asset and would be translated at year-end (current) rates. Fixed assets are found as (1,000 × 0.568) + (640 × 0.606) = USD 956 million.

- B is correct. USD0.671/SGD is the current exchange rate. That rate would be used regardless of whether Acceletron uses the current rate or temporal method. USD0.654 was the weighted-average rate when inventory was acquired. That rate would be used if the company translated its statements under the temporal method but not the current rate method. USD0.588/SGD was the exchange rate in effect when long-term debt was issued. As a monetary liability, long-term debt is always translated using current exchange rates. Consequently, that rate is not applicable regardless of how Acceletron translates its financial statements.

- C is correct. In Transaction 3, the payment for the inventory is due in Bindiar francs, a different currency from the Norvoltian krone, which is Ambleu’s presentation currency. Because the import purchase (account payable) is under 45-day credit terms, Ambleu has foreign currency transaction exposure. The payment is subject to fluctuations in the

B/NVK exchange rate during the 45-day period between the sale and payment dates. Thus, Ambleu is exposed to potential foreign currency gains if the Bindiar franc weakens against the Norvoltian krone or foreign currency losses if the Bindiar franc strengthens against the Norvoltian krone.

B/NVK exchange rate during the 45-day period between the sale and payment dates. Thus, Ambleu is exposed to potential foreign currency gains if the Bindiar franc weakens against the Norvoltian krone or foreign currency losses if the Bindiar franc strengthens against the Norvoltian krone. - C is correct. The currency of Ngcorp as the borrowing foreign subsidiary, relative to that of Ambleu, determines Ambleu’s choice of translation method for Transaction 2. Because Ngcorp’s functional currency is the Bindiar franc and Ambleu’s presentation currency is the Norvoltian krone, the current rate method rather than the temporal method should be used. Regardless of the currency in which the loan is denominated, the loan is first recorded in Ngcorp’s financial statements. Then, Ngcorp’s financial statements, which include the bank loan, are translated into Ambleu’s consolidated financial statements.

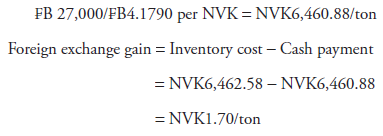

- A is correct. On Ambleu’s balance sheet, the cost included in the inventory account is the translation of

B27,000/ton into Norvoltian krone on the purchase date. Ambleu could have paid this amount on the purchase date but chose to wait 45 days to settle the account. The inventory cost is determined using the

B27,000/ton into Norvoltian krone on the purchase date. Ambleu could have paid this amount on the purchase date but chose to wait 45 days to settle the account. The inventory cost is determined using the  B/NVK exchange rate of 4.1779 on the purchase date of June 1, 2016.

B/NVK exchange rate of 4.1779 on the purchase date of June 1, 2016.  B27,000/

B27,000/ B4.1779/NVK = NVK6,462.58/ton.

B4.1779/NVK = NVK6,462.58/ton.

The cash outflow is the amount exchanged from the Norvoltian krone to the Bindiar franc to pay the

B27,000/ton owed for the inventory 45 days after the transaction date. This payment uses the

B27,000/ton owed for the inventory 45 days after the transaction date. This payment uses the  B/NVK exchange rate of 4.1790 on the settlement date of 15 July 2016.

B/NVK exchange rate of 4.1790 on the settlement date of 15 July 2016.

Thus, Ambleu’s cash outflow is less than the cost included in the inventory account, and NVK1.70/ton is the realized foreign exchange gain relating to this transaction. By deferring payment for 45 days, and because the Bindiar franc decreased in value during this period, Ambleu pays NVK1.70/ton less than the inventory cost on the purchase date of 1 June 2016. Thus, Ambleu will report a foreign exchange gain in its 2016 net income.

- A is correct. Net sales growth equals organic sales growth plus or minus the effects of acquisitions, divestitures, and foreign exchange. A foreign currency translation loss would reduce net sales growth. Thus the answer to Question 1 is yes.

- C is correct. IFRS requires that Ambleu disclose “the amount of exchange differences recognized in profit or loss” when determining net income for the period. Because companies may present foreign currency transaction gains and losses in various places on the income statement, it is useful for companies to disclose both the amount of transaction gain or loss that is included in income as well as the presentation alternative used.

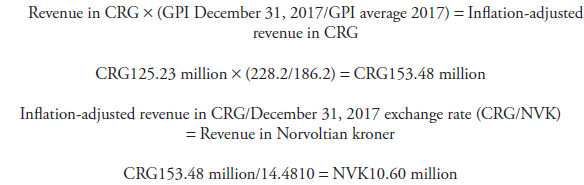

- A is correct. Crenland experienced hyperinflation from December 31, 2015 to December 31, 2017, as shown by the General Price Index, with cumulative inflation of 128.2% during this period. According to IFRS, Cendaró’s financial statements must be restated for local inflation, then translated into Norvoltian kroner using the current exchange rate. The 2017 revenue from Cendaró that should be included in Ambleu’s income statement is calculated as follows:

- B is correct. The consolidated income tax rate is calculated as income tax expense divided by profit before tax. Note 2 shows that Ambleu’s consolidated income tax rate decreases by 2.29%, from 34.94% (=94/269) in 2016 to 32.65% (=96/294) in 2017. The largest component of the decrease stems from the 1.42% change in the effect of tax rates in non-domestic jurisdictions, which lowers Ambleu’s consolidated income tax rate in 2016 by 3.34% (=9/269) and in 2017 by 4.76% (=14/294). The decrease in 2017 could indicate that Ambleu’s business mix shifted to countries with lower marginal tax rates, resulting in a lower consolidated income tax rate and more profit. (The change could also indicate that the marginal tax rates decreased in the countries in which Ambleu earns profits.)

- B is correct. IAS 29 indicates that a cumulative inflation rate approaching or exceeding 100% over three years would be an indicator of hyperinflation. Because the cumulative inflation rate for 2016 and 2017 in Crenland was 128.2%, Cendaró’s accounts must first be restated for local inflation. Then, the inflation-restated Crenland guinea financial statements can be translated into Ambleu’s presentation currency, the Norvoltian krone, using the current exchange rate.

Using this approach, the cumulative translation loss on December 31, 2017 for the CRG85.17 million patent purchase is −NVK1.58 million, as shown in the following table.

Date Inflation

Rate (%)Restated

Carrying

Value (CRG/

MM)Current

Exchange Rate

(CRG/NVK)Translated

Amount

(NVK MM)Annual

Translation

Gain/Loss

(NVK MM)Cumulative

Translation

Gain/Loss

(NVK MM)Jan 1, 2016 — 85.17 5.6780 15.00 N/A N/A Dec 31, 2016 40.6 119.75 8.6702 13.81 −1.19 −1.19 Dec 31, 2017 62.3 194.35 14.4810 13.42 −0.39 −1.58 - B is correct. Because Ngcorp has a functional currency that is different from Ambleu’s presentation currency, the intangible assets are translated into Norvoltian kroner using the current rate method. The current

B/NVK exchange rate is 4.2374 as of December 31, 2016. Thus, the intangible assets on Ngcorp’s 2016 balance sheet are NVK3 million ×

B/NVK exchange rate is 4.2374 as of December 31, 2016. Thus, the intangible assets on Ngcorp’s 2016 balance sheet are NVK3 million ×  B4.2374/NVK =

B4.2374/NVK =  B12.71 million.

B12.71 million. - B is correct. Using the temporal method, monetary assets (i.e., cash) are translated using the current exchange rate (as of December 31, 2016) of BRD1.20/NER (or NER0.8333/BRD), and non-monetary assets are translated using the historical exchange rate when acquired. Inventory is translated at its 2016 weighted-average rate of BRD1.19/NER (or NER0.8403/BRD). Therefore, the total assets for Triofind-B translated into Norvolt euros (Triofind’s presentation currency) as of December 31, 2016 are calculated as follows:

Assets December 31,

2016 (BRD)Applicable

Exchange Rate

(NER/BRD)Rate Used NER Cash 900,000 0.8333 Current 750,000 Inventory 750,000 0.8403 Average 630,252 Total 1,650,000 1,380,252 - A is correct. The monetary balance sheet items for Triofind-B are translated at the current exchange rate, which reflects that the Borliand dollar weakened during the period relative to the Norvolt euro. The rate as of June 30, 2016 was BRD1.15/NER (or NER0.8696/BRD) and as of December 31, 2016 was BRD1.20/NER (or NER0.8333/BRD). Therefore, notes payable translates to NER416,667 (BRD500,000 × NER/BRD0.8333) as of December 31, 2016, compared with NER434,783 (BRD500,000 × NER/BRD0.8696) as of June 30, 2016. Thus, the translation adjustment for liabilities is negative.

- A is correct. Triofind uses the temporal method to translate the financial statements of Triofind-B. The temporal method uses the current exchange rate for translating monetary assets and liabilities and the historical exchange rate (based on the date when the assets were acquired) for non-monetary assets and liabilities. Monetary assets and liabilities are translated using the current exchange rate (as of June 30, 2017) of NER1 = BRD1.17 (or NER0.8547/BRD), and non-monetary assets and liabilities are translated using the historical exchange rate (as of June 30, 2016) of NER1 = BRD1.15 (or NER0.8696/BRD). Inventory is translated at the 2017 weighted average rate of NER1 = BRD1.18 (or NER0.8475/BRD). The difference required to maintain equality between (a) total assets and (b) total liabilities and shareholder’s equity is then recorded as retained earnings. The retained earnings for Triofind-B translated into Norvolt euros (Triofind’s presentation currency) as of June 30, 2017 is calculated as follows:

Assets June 30, 2017

(BRD)Exchange

Rate (NER/

BRD)Rate Used June 30, 2017

(NER)Liabilities and

Stockholders’

EquityJune 30, 2017

(BRD)Exchange Rate

(NER/BRD)Rate Used June 30, 2017

(NER)Cash 1,350,000 0.8547 C 1,153,846 Notes Payable 500,000 0.8547 C 427,350 Inventory 500,000 0.8475 H 423,729 Common Stock 1,150,000 0.8696 H 1,000,000 Retained Earnings 200,000 150,225 1,850,000 1,577,575 Total 1,850,000 1,577,575 - C is correct. The functional currency is the currency of the primary economic environment in which an entity operates. Abuelio is Triofind-A’s primary economic environment, and its currency is the Abuelio peso (ABP). Another important factor used to determine the functional currency is the currency that mainly influences sales prices for goods and services. The fact that Triofind-A prices its goods in Abuelio pesos supports the case for the ABP to be the functional currency.

- B is correct. Triofind complies with IFRS, and Abuelio can be considered a highly inflationary economy because its cumulative inflation rate exceeded 100% from 2015 to 2017. Thus, Triofind-A’s financials must be restated to include local inflation rates and then translated using the current exchange rate into Norvolt euros, which is Triofind’s presentation currency. This approach reflects both the likely change in the local currency value of the warehouse as well as the actual change in the exchange rate. The original purchase price is ABP1,008,065 (NER50,000/ABP0.0496). The value of the new warehouse in Abuelio as of July 31, 2017 is NER47,964, calculated as follows:

Date Abuelio

Monthly

Inflation Rate

(%)Restated Warehouse

Value (ABP)NER/ABP Warehouse Value

(NER)May 31, 2017 1,008,065 0.0496 50,000 June 30, 2017 25 1,260,081 0.0388 48,891 July 31, 2017 22 1,537,298 0.0312 47,964 - A is correct. Norvolt exempts the non-domestic income of multinationals from taxation. Because Norvolt has a corporate tax rate of 34%, the 0% tax rate in Borliand and the fact that 25% of Triofind’s net income comes from Borliand should result in a lower effective tax rate on Triofind’s consolidated financial statements compared with Triofind’s domestic tax rate. Abuelio’s tax rate of 35% is very close to that of Norvolt, and it constitutes only 15% of Triofind’s net income, so its effect is unlikely to be significant.

- B is correct. Although Borliand shows the highest growth in Norvolt euro terms, this result is partially because of currency fluctuations, which cannot be controlled. Abuelio had the highest change in sales resulting from price and volume at 13% (excluding foreign currency exchange). This growth is more sustainable than net sales growth, which includes currency fluctuations, because Triofind’s management has more control over growth in sales resulting from greater volume or higher prices.