CHAPTER THREE

The Giant as Adolescent

HEZEKIEL NILES, THE PROPRIETOR OF

NILES WEEKLY REGISTER, AMERICA’S first national newspaper, reported in October 1825:

Wednesday last [October 26, 1825] was a great day in New York, the Erie Canal being completed. . . . The first gun, to announce the complete opening of the New York canal, was to be fired at Buffalo, on Wednesday last, at 10 o’clock precisely. . . . It was repeated, by heavy cannon stationed long the whole canal and river . . . and the gladsome sound reached the city of New York at 20 minutes past 11—when a grand salute was fired at fort Lafayette, and was reiterated back up to Buffalo. . . . The cannon . . . were some of those Perry had before used on Lake Erie, on the memorable 11th of September 1814.

The serious partying got under way when a flotilla of dignitaries actually arrived in the city ten days after embarking upon the canal at Buffalo. They were received “with thunders of artillery, and the acclamations of rejoicing scores of thousands.” Niles guessed that there were “some 30 to 50,000 strangers in New York” to watch deWitt Clinton pour a barrel of Lake Erie water into the Hudson.

The whole population of the city exerted itself to give brilliancy to the occasion. The various banners of different bodies, highly ornamented states, &c. presented a whole the like of which never has before been witnessed in America. In the evening, some of the public buildings were illuminated, and there were balls and private parties, not to be counted.... The whole appears to have passed off without disturbance, except at Castle Garden, in which 4 or 5,000 people were assembled to witness the second ascension by Mad. Johnson, in a balloon—but it would not rise with her; the people outside became very clamorous; and those within, at last, got impatient, and proceeded to tear the balloon into pieces and destroy the furniture within the walls, by way of satisfaction.

1The high spirits were fully justified, for it was hard to overestimate the importance of the Erie Canal. It welded the whole Northeast into a single economic unit, vaulting it, even in its still-primitive state, into the ranks of the world’s largest economies.

Britons paid little attention to such developments. Rev. Sidney Smith, a canon of St. Paul and well-known man of letters, was speaking for the elite when he commented on an 1820 statistical review of the United States:

We are friends and admirers of Jonathan [“Brother Jonathan” was British slang for their bumptious transatlantic cousin]; But he must not grow vain and ambitious; or allow himself to grow dazzled . . . [by claims] that they are the greatest, the most refined, the most enlightened, and the most moral people upon earth.... The Americans are a brave, industrious, and acute people; but they have hitherto given no indication of genius, and have made no approach to the heroic.... Where are their Foxes, their Burkes, their Sheridans? . . .—Where their Arkwrights, their Watts, their Davys. . . . Who drinks from American glasses? Or eats from their plates?

2Through a European lens, in fact, America looked very backward, if only because of its overwhelmingly rural demography. In the 1820s, more than 90 percent of Americans still lived in the countryside, a pattern that had changed very little by mid-century.

3 In nineteenth-century Europe, rural areas were mostly peasant-ridden backwaters, but America’s agrarian patina concealed a beehive of commercial and industrial activity. By the end of the War of 1812, Gordon Wood suggests, the northern states were possibly “the most thoroughly commercialized society in the world.” A Rhode Island industrialist made the same point in 1829: “The manufacturing activities of the United States are carried on in little hamlets . . . around the water fall which serves to turn the mill wheel.”

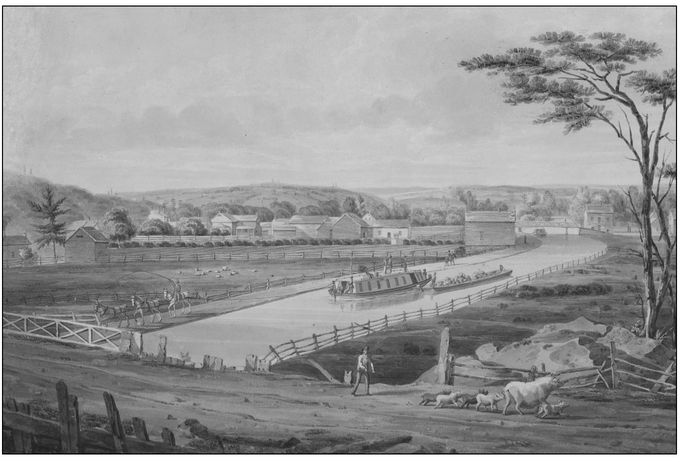

4

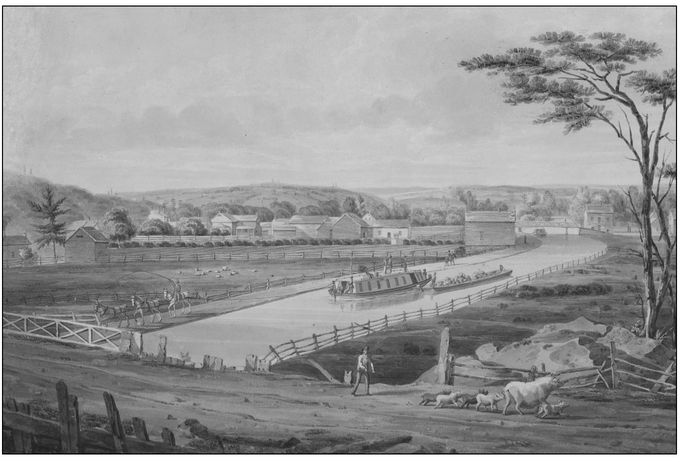

Erie Canal, 1830. This bucolic scene would have been typical of virtually the entire route when the canal first opened. By connecting the port of New York City with the New York interior and all the territories bordering on the Great Lakes, it jump-started the commercialization of the entire region. Note the horse-drawn motive power.

American historians have suffered their own bafflements. It is only in recent decades that a consensus of sorts has emerged on the nation’s early growth spurt. Winifred Rothenberg did much of the groundbreaking work—twenty-five years of patient excavation of the account books, diaries, estates, mortgages, and other records of Massachusetts farmers.

5 What she finds is an organic, bottom-up form of modernization, originating in the increasing prosperity of ordinary farmers. The British experience was starkly different. The underbelly of Victorian society mapped by Charles Dickens was a rural proletariat brutally expelled from the countryside and herded into urban factories.

Many of Rothenberg’s farmers were among their local elites, but outside of the South, American rural elites were decidedly middle-class, with modestly sized farms. During the immediate post-Revolutionary years, New England and Middle Atlantic farmers became strikingly more entrepreneurial. Farmers started making more frequent, and longer, marketing trips, evidencing a search for best-price markets. Those trips ceased abruptly in the 1820s, as thickening networks of local merchants made them unnecessary. Price disparities for crops or tools virtually disappeared over wide regions. That same market-driven behavior can be seen in farmers’ own operations. Wage labor became a favored form of farm employment, with consistent skill-based wage rates. Farm surpluses were often invested in mercantile and industrial undertakings instead of land, and farmer’s estates showed a clear trend toward financial instruments: mortgages, canal and bridge bonds, even company stock.

As the Erie Canal exposed Rothenberg’s farmers to new competitive threats from larger-scale New York grain farms, they quickly shifted into labor-intensive, high-productivity lines like dairying and hay production. The timing of hog slaughtering suggests that farmers made sophisticated profit calculations: stretching out fattening periods when feed was cheap and meat was dear, and vice versa. All in all, it was a sharp departure from pre-Revolutionary behavior, when the forebears of these same farmers were far less experimental than the English in adopting new farming methods or searching for higher-return crops.

6Local merchants often provided the impetus toward new enterprises. The Holleys of Salisbury, in the northwest corner of Connecticut, are a good example. The family was old farming stock who had been in western Connecticut for generations. Holley males were mostly farmers and ministers until Luther Holley opened a store and trading operation in the mid-eighteenth century. Salisbury also had good-quality iron deposits, and Luther traded iron from local smelters from the start.

A group that included Ethan Allen of Revolutionary War fame opened a blast furnace in 1762. Although the Allen group failed, subsequent owners prospered during the war, even casting cannons for the American forces.

7 After the war, as the iron business went into decline, Luther started buying ironworking properties to lock up supply for his iron trading and by 1799 had the largest local holdings. He took in his son John as a partner, and when Luther retired in 1810, John formed a new partnership with another merchant and iron trader, John Coffing.

8Neither Coffing nor John Holley considered themselves “iron men.” They were merchants who happened to trade their own iron and iron kettles, along with grains, liquors, cloth, and whatever else they could readily sell. But they had a good eye for talent and knew the top local artisans. During the War of 1812, they cast cannon and anchors for the navy, and they began making sales and lobbying forays to Washington. After the war, they become an important source of gun iron to the Springfield Armory and to contractors like Eli Whitney.

John’s son, Alexander Hamilton Holley, succeeded to the business but was also active in politics, served a term as governor, and was a founding member of the local bank. It was Alexander who finally made the decisive break of “closing the store” to concentrate on the ironworks. He and a local partner, George Merwin, started a knife-making shop in 1844, which was incorporated as Holley Manufacturing in 1854. It was a major area employer until it closed in 1946.

Over time, the Holleys had become the leading family of the town. They certainly lived well, with a gracious house but not a mansion. The children all went to good schools, and they had carriages and some servants. (But American servants in this period had become “help” and tended to think and act like contracted employees.

9) With all of that, the Holleys were never rich: almost all of them worked hard, and their cash mostly went into their businesses. When Luther died in 1826, he left an estate valued at $34,000, to be divided among six children. Much of it was personal inventory like furniture and silver, and some of the children had already borrowed against their shares. (Several had overborrowed, so their brothers and sisters had to take their notes when the estate settled.) Alexander’s correspondence and diary fragments frequently mention money pressures, and the same pressures are also reflected in the letters his oldest son, Alexander Lyman Holley, wrote home from college. (We’ll meet Alexander Lyman again, because he became a great figure in the nineteenth-century steel industry.)

Rothenberg’s farmers and proto-industrialists like the Holleys dissolve an old interpretive conflict. Historians long divided over whether or the degree to which America’s nineteenth-century agrarians were apple-cheeked prelapsarian Jeffersonians, ripe for exploitation by commercially minded interlopers. The reality seems to be that both the sons of the soil and merchant-industrialists were intensely commercial, profit-seeking animals, and both were deeply rooted in their communities. The behavior of both the entrepreneurial merchant and the farmer was constrained within local webs of obligation: mortgages and mercantile credits were extended, old farm hands kept on, seasonal patterns of work and leisure respected, local celebrations and rituals honored.

The iron districts of Pennsylvania and New Jersey display the same intricate interlacing of farming and industry from early days. The district’s iron industries employed an estimated 4,000 workers by the late 1770s, a far denser concentration than any in New England; by 1810 the region accounted for 61 percent of national iron furnace output.

10 Iron was quintessentially a rural industry. With seemingly inexhaustible wood supplies, Americans smelted iron with charcoal, which is far freer of impurities than coal, so blast furnaces were typically located in deep woods.

The Martha Furnace opened in 1808 in the pine woods of southern New Jersey, financed by Philadelphia merchants and iron traders, and has been documented in great detail by the historian Thomas Doerflinger. The furnace proprietors owned timber and bog iron

s rights to a section of the pine woods bigger than Manhattan, and its development had the character of a modest-sized town. Based on a lake with a busy dock, it was centered around a thirty-foot blast furnace and a collection of industrial buildings: a bellows house, charcoal storage sheds, and a sand-molding works for casting iron into blocks of pig or end-products like pots and stoves. There were also a grist mill, a saw mill, and a stamping mill, stables, a carpentry shop, and a smithy, plus housing for about seventy workers on a year-round basis, a store, and food warehouse facilities.

The core staff were the skilled artisans who kept the furnace running and executed the crucial annual shutdown, hearth rebuild, and restart. Other skilled men built the cast-iron sand molds, ran the mills, and built and maintained the waterworks and a small fleet of ore boats. The work force was filled out with teamsters, wood cutters, and ore raisers, the nastiest job of all, entailing long, wet days of dredging mud with a clam shovel. All together, there were between seventy and eighty full-timers, all of them resident on-site.

Except for the skilled iron men, the work force was mostly recruited from the local villages. The skilled men tended to be recent immigrants, mostly Irish and Germans, although with a scattering of skilled African Americans. Labor was treated as a scarce resource: the works don’t exhibit any of the rigid disciplines of, say, a Carnegie factory later in the century, and bouts of absenteeism and drunkenness were usually overlooked. Camaraderie among the skilled iron men and the management was high—with “days at the beach” and group partying at the local taverns.

Work in general trades like carpentry and wood chopping was scheduled to mesh with the agricultural cycle, so chopping and charcoal making peaked in the winter, much of it with part-time workers from the local farms. Bulk pork and corn supplies were shipped in by Philadelphia-area merchants, but all dairy products, most vegetables, bread, and other meats were sold at the ironworks by the locals. Most of the bigger farmers also had side businesses—tavern keeping, wagon building, and the like—and Martha Furnace was their most important customer. In other words, it was the same industrial-agricultural symbiosis that Rothenberg uncovered in Massachusetts. In early nineteenth-century America, “rural” wasn’t synonymous with “agricultural.”

As a formula for national growth, it clearly worked. For 135 years, from 1778 to the eve of the First World War, America achieved an average 3.9 percent annual economic growth, in constant dollars. No other country has yet come close to achieving such sustained rapid growth for so long a period of time. The economic historian David Landes attributed Great Britain’s sudden rise to commercial and industrial dominance to its culture: its empiricism, its relative social mobility compared to the rest of Europe, its commercialism, its respect for numbers and contracts. By comparison with eighteenth-century Britons, Americans were strivers on steroids.

The sharpest contrast between British and American industry was the intense focus of American companies on large-scale production and distribution of ordinary goods. Historians have from time to time focused on one industry or the other, like gun making, as the quintessentially American industry. But the dominating American characteristic across nearly all major industries was the push for scale—adapting the production methods, the use of machinery, and the distribution to suit the product. This chapter will look at five different early American industries: clocks and textiles in some depth, along with shorter takes on shoes, stoves, and steam engines.

Affordable Clocks

Mechanical clocks had been around for nearly five hundred years in 1800, but it took only a generation for American clockmakers, led by Eli Terry, to show the world how to make decent clocks easily and cheaply and to make them by the million.

The mechanical clock was invented sometime in the late thirteenth century and very quickly reached a remarkably stable basic design. A clock needs a power source, like a falling weight or a coiled spring. It needs a pulsing mechanism, like a pendulum or an oscillating balance wheel. It needs an escapement device that breaks the clock’s motion into precisely timed segments. And finally it needs a gear train to transmit the timed pulses to the display mechanism.

The heart of a mechanical clock is the escapement mechanism, a pulsing device that breaks up the gear actions into precisely timed segments. In the illustration, the pulse is provided by the pendulum, which tilts the anchor from side to side to interrupt the turning of the escapement wheel at top. Note the very precise shape and fit of the anchor tips and escapement wheel teeth.

The evolution of clocks marched to the accelerating tempo of commerce. The workdays of farmers and peasants extended from dawn to dusk, but the quitting whistles at Massachusetts’s new textile factories were governed by the clock, and owners tracked output by the minute. Before Terry, American clockmakers worked to order, making expensive products for commercial men, who actually needed them, or for the wealthy, who merely enjoyed them as display and conversation pieces. The standard American clock was a pendulum-driven “tall-clock” design.

Almost all clockmaking was machine-assisted, for few craftsmen could cut out a seventy-eight-tooth gear by eye. Since the machinery was mostly executed in wood, however, only remnants have survived. Turn-of-the-century clockmakers usually powered their tools with hand cranks and foot treadles, although water-powered machines were coming into wider use. Small mechanical saws cut gear teeth. (Jigs were used to clamp several gears together so the saw could cut a number of gears at a time, ensuring that they were uniform.) Indexing devices moved the tool the precise distance to the next tooth. Simple dies were used to draw hot metal into proper-diameter wire. All were supported by a great variety of special-purpose measuring tools and gauges.

Despite Eli Terry’s importance in the history of clockmaking, he left a frustratingly sparse record.

11 He was born in Connecticut in 1772 and served as an apprentice to two well-known clockmakers, one of whom, Benjamin Cheney, specialized in wooden clock movements. Hardwood gears, usually of lignum vitae, were quite durable and much cheaper than brass.

t In 1793, Terry went into business on his own, making both brass and wooden clocks. In his early years in business, he would make three or four clocks at a time and then take to horse as a peddler, with the clocks strapped around his body on the saddle. He was also an experimenter. In 1797, he was awarded a patent on an “Equation Clock,” showing both solar and solar mean time, an impressive achievement,

u but too expensive for his market.

It was Terry’s disappointment with the Equation Clock that sparked his interest in the trade-off between volume and price. In 1802, Terry found sufficient sales outlets to drop his peddling and built a small water-powered factory that employed several apprentices and workmen. When he announced his intention to build clocks by the thousand, a local wag mockingly guaranteed to purchase the thousandth—and was soon forced to make good his bargain.

Then in 1807, Terry made a historic contract with two merchant-brothers, Levi and Edward Porter, to supply them 4,000 clocks over three years. Terry spent the whole first year creating and organizing a larger water-powered factory in a converted grist mill. He produced 1,000 clocks in the second year, and the remaining 3,000 in the third. (Terry produced only the movements, or innards of the clocks, which was normal practice; the Porters contracted with others for the decorative cases.)

And then Terry retired, selling his business and licensing his patents to two joiners who had worked at his plant, Seth Thomas and Silas Hoadly. The Thomas-Hoadly partnership did well, but the two soon went their separate ways. Hoadly became a locally successful clockmaker, while Seth Thomas clocks became a national icon. All of Thomas’s early clocks were Terry designs.

But Terry had retired only to rethink his clock designs, and he resurfaced in 1814 in a new factory dedicated to his Connecticut shelf clock, one of the two or three greatest manufacturing successes of the first half of the century. No previous clock had come close to achieving such durability and accuracy in such a portable form at such a low price point. The pendulum and weight hangings were much shorter and cleverly rearranged so they could fit inside a shelf-sized case.

But it was Terry’s final iteration of the shelf clock that embodied the truly critical insight. Volume manufacturing requires rethinking product design along with manufacturing processes.

v The larger the number of interacting moving parts, the greater the likelihood that small errors will propagate into large outcome variances. The hard way to solve that is to eliminate all the small errors. It’s often better and easier to reduce the number of parts or, perhaps easiest of all, if the variances are not too gross, to build in a final adjustment at the last stage of manufacturing. That was the strategy Terry followed in his 1822 five-arbor shelf clock.

The tolerances required for gear trains to move clock hands or strike bells were tight by traditional standards but readily achievable with the current clockmaking technology. The quality of small gear-cutting machines and jigs and gauges had reached the point at which clockmakers could farm out gear making to home craftsmen. Scholars have remeasured stocks of contracted wooden gear teeth from early-nineteenth-century clockmaking shops, and they are indeed interchangeable: not exactly the same, but with variances well within the margins for acceptable performance.

The escapement tolerance, however—the accuracy with which the anchor

w impinged on the gear teeth of the escapement wheel—was much more demanding. As the motion of the pendulum jogs the anchor back and forth, its two tips slide in and out of the escapement wheel’s gear teeth. Even small misalignments disrupt the movement. The most time-consuming task in clockmaking was (and still is in craft-centered watchmaking and clockmaking) the depthing. A depthing tool is a complicated vise that allows the craftsman to hold gears in proper alignment to drill their shaft placements on the clock plate. Placing the entire train so the anchor and escapement wheel emerged in near-perfect alignment required a master craftsman and took time.

Terry’s breakthrough was breathtakingly simple. He placed the escapement wheel and anchor outside the movement container, so it was accessible just by removing the case. And he placed the anchor on a moveable brass fixture. After the craftsman placed the gear train and closed up the movement, he simply moved the anchor fixture to a good alignment, then locked it in place with two small nails. Problem solved—not by increasing manufacturing precision but by increasing the allowable margin of error for producing an excellent clock. A bonus was that if an escapement became misaligned or clogged over the years, it could easily be removed for cleaning and readjustment. It was win-win all around. Costs were cut, and prices fell, but nobody could challenge Terry’s advertising slogan that his “Clock will run as long without repairs, and be as durable and accurate for keeping time, as any kind of Clock whatever,” because it was true enough.

12

The central challenge of craft clock-making is to align all the gears so the escapement device works properly. Even in Terry’s first mass-produced clocks, it was a time-consuming task for a skilled clockmaker. His most ingenious breakthrough was a simple adjustment mechanism that greatly increased the allowable margin of error in gear placement.

Terry duly patented his five-arbor clock, but any clockmaker could see what he had done. Some major manufacturers, like Seth Thomas, paid him license fees, but the design was widely pirated. The five-arbor shelf clock design became the standard for almost all Connecticut clocks, although with many variations, and production shifted decisively to large-factory modes.

As Terry, Thomas, and other Connecticut clockmakers proliferated inexpensive clocks, peddler networks quickly grew up to handle the distribution. New England tinware makers, who provided all manner of kitchen goods, had extended their peddler networks throughout the country after the turn of the century. Merchants like Levi and Porter seeded new peddler networks for clocks, an ideal peddling product because of its high value to weight. Well-established peddlers paid wholesale prices—often on credit—for their goods, kept the markups, and hired other peddlers on a salary and commission basis. New men often had to post security for their wares.

As markets expanded, leading merchants or manufacturers set up regional operations to supply their peddlers; tinware makers often created satellite factories. Water-powered clockmaking was not feasible in most of the country, but clockmakers, or merchant houses with a strong clock trade, frequently used local merchants as storage points for peddler networks and arranged regional clock-case construction with local cabinet makers.

The Yankee peddler became an iconic figure in the Southern press: readers were regaled with tales of sharpster peddlers hawking goods at a ten-times markup to dim plantation masters. “Peddling” has a derogatory connotation now, but in the national market revolution that took place in the years after the War of 1812, peddling was a reputable, and often a lucrative, first step into a career in merchandising.

13The sharp depression of 1837 winnowed the weaker clock manufacturers. Chauncey Jerome, a former Terry apprentice, took advantage of falling brass prices to lead the transition to brass. By the 1850s, his annual production was up to 280,000 movements a year. Jerome was also the first American clockmaker to enter the English market. At first London shops mostly scorned his product, but one dealer took a few on consignment. When they sold immediately—even with duty, they were a lot cheaper than British clocks—the dealer took more that sold just as fast. Jerome therefore sent a large shipment invoiced at $1.50 apiece, which was seized by customs as an obvious case of “dumping” below cost. Customs seizure rules, however, required that they pay the vendor the invoiced amount. Jerome was perfectly happy with that, so he sent another shipment, which was similarly seized and paid for. Delighted, he promptly sent yet another, whereupon customs decided they had their fill of brass movements and let them through.

14 By the 1860s, it was taken for granted that clocks in the average British home had American-made movements.

Terry’s brother and three of his sons also went into the clock business; Terryville, Connecticut, is named after Eli Terry Jr., the most successful of Eli’s relatives. Terry himself retired from business in 1833 at the age of sixty-one and died in 1852. At retirement, he was rich enough to give away $100,000 and leave sufficient principal to draw an income of $3,000 a year—more than enough to live comfortably, which was the extent of his aspirations. His retirement years were spent working on clocks, mostly new designs for very large church clocks, apparently just for the fun of it.

Samuel Slater Rips Off the British

American entrepreneurs approached textiles much as Terry approached clocks. The focus from the start was on inexpensive, highly uniform, broadly distributed products of “good enough” quality for the average consumer. In the first half of the century, no other new industry could match textiles in financial returns, employment impact, and technology spin-offs.

15The United States never disguised its avarice for British textile technology. It refused to recognize British patents, and American entrepreneurs openly advertised for British power-spinning experts, who were forbidden by law from emigrating. Tench Coxe, Alexander Hamilton’s deputy at the Treasury, even sent an agent to England to procure machine drawings, but he was arrested. Great Britain’s cotton districts were crawling with surreptitious American agents offering dreams of wealth and preferment for skilled artisans willing to risk prison for flouting the technology embargo.

In fact, few mule-spinning foremen, or even plant managers, were actually able to build working machines, although many would take American money to try. Samuel Slater, only twenty-one, turned out to be the rare individual with the ambition, the intelligence, and the thorough understanding of both spinning and spinning technology to create a working plant from scratch.

16Slater was a farm boy who had been put to work in an early Arkwright-style water-powered cotton mill and eventually caught the eye of the mill owner and manager Jedidiah Strutt, who had helped finance Arkwright’s first mills and subsequently gone into business replicating them. Strutt opened a new mill when Slater was fourteen and took Slater to the new site as an apprentice, giving him direct experience of the mill construction and start-up process. As he finished the apprenticeship, Slater worried that there was little room for advancement in the British textile industry. So he decided to take his chances in America, embarking in 1789 under an assumed name to evade watchful British emigration officers.

After Slater landed in New York, he worked briefly in a yarn factory, confirming the backwardness of American technology. Hearing that Moses Brown, a Providence merchant and a cofounder of Brown University, was seeking an experienced spinning mechanic, Slater contacted him and traveled to Providence. Brown had been burnt by useless yarn machinery, and an agreement was reached on a partnership to construct an Arkwright-style cotton mill, financed by Brown’s advance of $10,000. The partners were Brown’s son-in-law, William Almy; Smith Brown, a cousin; and Slater, who had a half share in both the profits and the debt from the advances.

17Slater was the genuine article and, within a year, had an operating yarn factory, with water-powered carding (combing the raw cotton), roving (creating rough tubes of fibers), and spinning machinery. While he worked on the factory, he boarded with the family of Oziel Wilkinson, the local machinist who actually built the equipment. He married Wilkinson’s daughter, Hannah, who later won a patent on an improved cotton thread, and he frequently partnered with her brother, David, also a machinist, who earned a place in machining history for building a high-precision screw-thread/slide-rest lathe several years before Henry Maudslay.

18The first small mill was operated with children, but Slater discovered that he would have to develop a different staffing model. American farmers didn’t give up their children as easily as the British, and they kept vigilant eyes on their working hours. Slater’s solution was to hire whole families. The father, who often kept working as a farmer on leased, mill-owned land, managed a contract for family production at the mill.

Americans had long-established merchant and peddler distribution systems for British yarns and cloth that Slater could tap into. It took a while for sales to catch on, since American-made yarns had a terrible reputation, but yarn merchants understood value, and word soon spread that Slater was producing basic yarns of British quality at excellent prices.

By 1799, the group had three mills up and running: the original one, another taken over by Almy and Brown and converted by Slater, and a third owned by Slater and Wilkinson—each one bigger than the last. Slater had no patent rights in any of his machines, but it was some years before he faced serious competition. Although the artisans he trained dispersed throughout the northeast, merely understanding the machinery wasn’t enough. Cotton varies widely in its fiber lengths and tensile strength, and mill practices, process flows, and thread tensions all needed constant vigilance by experienced supervisors to maintain high-volume production.

Providence soon became the center of a new yarn-making district. Mills often sold both yarns and cloth, although the cloth making was contracted to home weavers using mill yarns. Slater-type spinning mills spread rapidly eastward into Connecticut and Massachusetts—a number of them with Slater capital and technology—and then to New York, where Utica became a major yarn center.

But Lowell Invents a New Kind of Company

Samuel Slater was a fine technologist, but Francis Cabot Lowell was a visionary who, within just a few years in a sadly short career, created a uniquely American textile industry.

19 Born into one of Boston’s elite merchant and shipping families, Lowell did a stint on one of the family merchantmen, concentrated on mathematics at Harvard, went into one of the family countinghouses, and eventually prospered in his own trading business. His health seems to have been delicate, and in 1810, at age thirty-five, wealthy but worn down by the constant stresses of his business,

x he took his family on an extended trip abroad. Wartime conditions curtailed plans for a continental tour, so the family spent most of their two-year sojourn in Scotland and England.

Whether Lowell intended to pirate British technology from the start isn’t clear, but he made no doubt of his intentions when he met Nathan Appleton, his fellow Bostonian and merchant, in Scotland early in his trip. “Cotton Manufacture” was Lowell’s primary focus, Appleton later recalled, for he thought it the kind of business that, if properly set up, could produce a reliable stream of steady, stress-free profits.

Lowell’s mercantile friends gained him access to the mills; one can imagine him strolling through the plants, feigning languorous inattention while picking up countless trade secrets—the process flows, the details of gearing, and much else. Before he embarked for America, he also managed to secure copies of machine drawings that he slipped by customs. If that story is true, it seems vaguely dishonorable, and his friends may have been embarrassed when it was revealed what he had been up to.

When Lowell returned to Boston, he set about organizing his Boston Manufacturing Company. Everything about it was bold. The War of 1812 was just underway, and Massachusetts mercantile houses were staring at economic disaster. (Lowell’s return ship, in fact, was taken by a British frigate, and he was briefly held in Nova Scotia.) It was created as a joint-stock company, an unusual form for the time, which preferred partnerships. The initial financing goal was enormous: $400,000, forty times more than the start-up investment in the first Brown-Almy-Slater spinning mill. But Lowell wanted to be absolutely sure of enough capital to carry the business through any reasonable early setbacks. His circular letter proposed an offering of one hundred shares, at $4,000 apiece, $1,000 of which would be paid at closing, with the remainder drawn from time to time as the company required.

The initial investors were an extremely tight group. Lowell’s brother-in-law, Patrick Tracy Jackson, with whom he was quite close, took twenty shares, and Lowell himself took fifteen. Jackson was appointed agent, effectively the CEO of the new company.

The remaining shares were very much a “friends and family” offering. Jackson’s two brothers took fifteen; two of Jackson’s in-laws, John Gore and James Lloyd, took fifteen; while two of Lowell’s relatives, Benjamin Gorham and Warren Dutton, took five between them. The roster was rounded out from among their merchant friends. The senior and junior Israel Thorndikes took twenty, and Uriah Cutting took five. The remaining five went to Nathan Appleton, who hesitated considerably before investing. He was probably the wealthiest of Lowell’s close friends, and his reluctance evidences the skittishness of the investment climate.

Lowell’s mother’s family, the Cabots, declined to invest at all. They and other Bostonians, after all, had built fortunes importing British goods. Many of them had been burned two decades previously by the Beverly Cotton Manufactory, an ill-starred, pre-Slater spinning venture that required an embarrassing bailout from the state legislature.

The first critical hire outside the group was Paul Moody, a brilliant young machinist. Lowell had approached Jacob Perkins, a machinist, nail manufacturer, and prolific inventor, to join the enterprise. Perkins recommended Moody, who was an inspired choice, for he had first trained as a weaver—under Scotsmen, who were known for their high-craft weaving tradition—and only then as a machinist under Perkins.

Lowell’s strategic vision was as bold as his financing approach. Yarn making and weaving had always been viewed as a separate industries, like flour manufacturing and baking. The two trades had also mechanized at different rates. The Cartwright power loom was patented in 1785, twenty years after the Arkwright spinning frame, and was still an immature technology. British weaving was mostly on the “putting-out” cottage industry basis, and few plants had both power-spinning and power-weaving operations.

But Lowell wanted an integrated production line from the start. He and Jackson bought a vacant paper mill on the Charles River at Waltham and designed a three-story factory in which raw cotton would be cleaned and processed on the ground floor, spun into yarn on the second floor, and woven into cloth on the third. It is an interesting decision, for yarn production multiplied his technology challenges, and good yarns were readily available from established companies quite near his new plant. But Lowell, in true American spirit, was driving for economies of scale and had apparently decided he could not risk not controlling the entire production process.

It took nearly a year for Lowell and Moody to get their first loom working. The challenge wasn’t conceptual, but as with the English, it was a matter of capturing the micro-motions of weaving without unacceptable breakage. The Lowell-Moody approach was to simplify the problem. Rather than try to create highly flexible power trains, they focused on tough fabrics with sturdy threads.

The first successful Lowell-Moody loom was actually a fairly crude instrument. For instance, there was no stop-action on the batten—the wood piece that banged the weft threads together after each shuttle pass. Instead it was stopped just by the resistance of the cloth. That would have been unacceptable for high-margin, finer-threaded fabrics, but that wasn’t the market that Lowell and Moody were interested in.

Where they did lavish attention was on achieving a single flow-through model of cotton cloth making. Moody’s 1818 warping and dressing machine was a major advance in that direction. It first sized the threads—rolled them through a starch mixture to strengthen them for the weaving—and then automatically dressed the loom, the once-tedious task of loading each of the individual warp (long) threads into the proper heddle positions. (A stop-action mechanism suspended the operation if a thread broke, so an operator could repair it.) Other innovations, like conical pulleys to adjust thread speeds and faster spindles to increase thread twists for a harder, more durable thread, were all designed to achieve higher processing speeds and fewer interruptions. The narrow range of output also ensured uniform machinery, quicker repairs, and shorter downtimes, exactly the ticket for high-volume manufacturing.

yLowell made yet another historically original contribution. Both he and Appleton had come away from their trips to Great Britain deeply disturbed by the human degradation in the great textile mills. They feared that Britain was teetering on the brink of social upheaval and did not want to replicate British conditions in America. They were also ready to pay higher than normal wages if they could get the assurance of a reliable work force. Lowell’s solution was to create decent mill housing for young farm girls willing to work away from home for a few years to earn their own cash stake—for a dowry, to pay for training as a teacher, or to help out the rest of the family. The hours were long but the work not too physically demanding, and by the standards of the day, the housing was spartan but clean. When Charles Dickens visited the new town of Lowell, the second great development of Boston Company mills, in 1840, he was deeply impressed, even moved:

I happened to arrive at the first factory just as the dinner hour was over, and the girls were returning to work; indeed, the stairs were thronged with them.... [They] were all well dressed: and that phrase necessarily includes extreme cleanliness.... They were healthy in appearance, many of them remarkably so, and had the manners and deportment of young women: not of degraded beasts of burden.... The rooms in which they worked were as well ordered as themselves.... In all, there was much fresh air, cleanliness, and comfort as the nature of the occupation would possibly admit of.... I solemnly declare, that from all the crowd I saw in the different factories that day, I cannot recall or separate one young face that gave me a painful impression; not one young girl whom . . . I would have removed from those works if I had had the power.

I am now going to state three facts, which will startle a large class of readers [in England] very much. Firstly, there is a joint-stock piano in a great many of the boarding-houses. Secondly, nearly all these young ladies subscribe to circulating libraries. Thirdly, they have got up among themselves a periodical called THE LOWELL OFFERING . . . [of which] I will only observe ... that it will compare advantageously with a great many English Annuals.

20Dickens’s favorable impression would have been reinforced by the design of the mill village. The attractive arrangement of the buildings, the walkways and plantings along the canals, the attention to cleanliness and order, as recently reconstructed, is quite beautiful. (The Scottish “new town” movement was much in the air when Lowell was in Scotland, although he doesn’t seem to have visited any sites.) And farm girls who had never been far from their villages were easier to impress than Dickens. They had much more privacy at the mill than on the farm, and compared to mill work, farmwork was dirty, brutally hard, and often dangerous. Farm life could also be isolating, and the girls seem to have taken great delight in meeting and living with so many girls of their own age. It’s no surprise that most of them seem to have remembered the mills with fondness.

The first Waltham mill started operations in February 1815 with twenty-three yarn-making machines—carders, rovers, and spinning jennies of various kinds—and twenty-one looms, seven wide and fourteen narrow ones. The initial machinery was rapidly added to, replaced, and rebuilt, as operations expanded and Moody piled on his process improvements. One of Nathan Appleton’s firms, a wholesale distributorship, took care of the marketing at a modest 1 percent of sales.

It was hardly an auspicious time for a textile venture. If 1812 had been a bad time to embark on a new venture, 1815 may have been the worst possible time to open a new mill. Manchester textile mills had been amassing unsold yarn and cloth for three years. When the war ended, they poured it into the American markets at rock-bottom prices. Slater survived handily in Providence, but the dumping wreaked havoc among the rash of new textile mills that proliferated during the war. Nevertheless, the Boston Company sailed serenely through. In October 1817, a month after Lowell’s death, it declared its first annual dividend, a handsome 17 percent, and for the rest of the first decade it averaged a stunning 18.75 percent.

Lowell died in 1817, just as his great enterprise was getting off the ground. His last contribution to the company was to lobby through a textile tariff bill that basically eliminated British competition in the low-end textile market (predominantly from re-exported and very cheap Indian cotton). Both Appleton and Jackson seem to have adopted Lowell’s vision completely as their own, and the company proceeded on an orderly course of steady expansion.

Three mills on the Charles River at Waltham were the most the site could support, so in 1820 the company commenced development on a new site on the Merrimack River, at a location that the directors named Lowell. After the first Lowell mill was up and running, the company made yet another conceptual leap, creating a new kind of organization not unlike the business network the Japanese call a keiretsu—an intricate alliance of affiliates and subsidiaries acting as if guided by a single intelligence. The Lowell Locks & Canal Company offers a good window into its operations.

The Locks & Canal Company

The waterwheel is one of the most ancient of mechanical power sources, but it needs reliable rainfall, hilly contours, fast, narrow rivers, and bedrock river bottoms to minimize silting—in other words, countrysides much like those of Scotland, England, and New England.

From medieval times, Great Britain was dotted with water-powered grist mills, saw mills, and fulling mills (washing and pounding woven wool cloth for a tighter finish). In earlier periods they were more often simple paddle wheels sitting in streams, but by the early eighteenth century hydraulic power was transforming into quite serious technology. Mill operators built dams and mill races, or artificial channels, to raise the height and velocity of the water. Gates controlled mill-race water flow and directed surpluses into storage ponds for dry spells. Overshot wheels, in which wheel buckets were loaded from the top, greatly increased power. The water entered the wheel buckets at higher velocity, and because the buckets on the descending side were all full, the wheel’s descent weight and momentum were much higher.

New England operators, however, standardized on the “breast-fed” wheel, in which water enters at a point below the apex of the wheel. While it is theoretically not as efficient as the overshot wheel, it worked far better in practice, especially in fast water conditions.

z Well maintained breast-fed wheels achieved energy conversion rates in excess of 60 percent. Gating and metering systems were developed to measure and modulate the quantity and velocity of the water flow, and hydraulic engineers in both England and the United States chipped away at the basic mathematics of fluid dynamics and energy conversion.

21 The British, however, were much quicker to shift to steam, since the urban concentration of their industry did not lend itself to waterpower.

The Boston Company’s 1820 expansion to Lowell and the Merrimack River was accomplished by taking over the financially strained Pawtucket Canal in East Chelmsford, about twelve miles from the site in Waltham. Although the directors stipulated that they had conducted an extensive search for a suitable property, Patrick Jackson’s father was a major Pawtucket shareholder who must have been anxious to unload a white elephant.

22The site was nearly ideal for hydraulic power development. The canal had been built to circumvent the falls of the Merrimack River, which had a total head, or drop, of thirty feet within the East Chelmsford area. The river was also fed by several large lakes, so it had an unusually reliable year-round flow, even during dry summers. The existing canal intercepted the Merrimack just before the falls and then circled to the south for about thirteen miles before rejoining the river at its Concord branch to the east of the village. There were two locks to step down barge and other boat traffic. The Boston Company had to maintain those, since the Pawtucket Canal charter required that it be open to public transportation.

After striking an unpublicized deal with the canal company, the directors quietly assembled the land of nearly the entire island encompassed by the Merrimack and the canal, including all associated water rights. (Ransom had to be paid, however, when one sharp-nosed landowner sniffed out what was going on and started buying sites in competition.) Design and development of the site was assigned to Kirk Boott, who had just graduated from Sandhurst, the British military academy. He was good at math, but like most American engineers of the time, he was entirely self-taught in his new profession. Boott did fine, although Moody, who was building the water-mill machinery, was at his side at every stage. Boott also consulted with leading engineers of the day, including Myron Holley, Alexander H.’s uncle, who was one of the senior engineers on the Erie Canal.

The land in the vicinity of the falls was all rocky outcrop unsuitable for mill building, so Boott devised a plan whereby the mills would be located on the relatively flat plain on the western end of the island. The old canal, which was badly deteriorated, was widened and extensively rebuilt, and was intercepted by the new Merrimack Canal running about a half mile across the island to the river. Both canals had good heads, or water drops, followed by long flat runs ideal for mill siting. Work started in the spring of 1822, with as many as five hundred laborers on site at one time.

The first mill wheel, a breast-fed thirty-foot monster on the upper level of the Merrimack Canal, started turning in September 1823. Like Moody’s wheels at Waltham, water flow was controlled by gates that were opened and closed by a fly-ball governor. The device consisted of spinning iron balls on a vane driven from the wheel shaft. As the shaft speeded up, the balls extended horizontally, and as it slowed down, they fell toward the vertical, in each case moving a set of levers that modulated the gate settings accordingly. Watt used a similar device on his early steam engines.

Shortly after that first mill opened, the directors made a critical, and as it turned out, brilliantly right decision. Appleton and Moody had calculated that the Merrimack site could support up to sixty mills, but as they began to plan the next few years’ development, they were daunted by the potential management and financial challenges of such a massive enterprise. They therefore recommended spinning off the canals and waterworks as the Locks & Canal Company, with a separate but interlocking board of directors. In effect, they created a wholly owned subsidiary operating as a hydraulic power utility, open to any customer who could pass muster within the still tightly knit core group of the original founders and investors.

The directors invented the waterpower unit to calculate a water-leasing rate. They started with the volume of water required to run the first Waltham plant, adjusted it for the greater head at Lowell, and defined that as one waterpower. They estimated how many waterpowers the works could support and set a unit price that presumably would amortize each new extension of the works. The unit price was finally reduced to a per-spindle price, based on the approximately 3,600 spindles in the reference plant at Waltham.

Lowell was also the site of one of Moody’s simplest but most important insights: it dawned on him in 1828 that he could connect the main plant’s drive shaft to the waterwheel with a broad belt. British mills used cast-iron bevel gearing for drives in both water- and steam-driven applications. The gearing was heavy and consumed a great deal of power. Worse, if a gear cracked, it could take a week or more to get replacement casts. Belts frequently broke but were easily replaced. Over time Moody’s drive-shaft belting became standard everywhere.

Map of Lowell Canals and Mills, 1836

The Locks & Canal Company was by far the greatest industrial development in the country, and its impact on machining, metalworking, and other industrial technologies is hard to overestimate. George Gibb, the historian of the Lowell machine works, puts the case:

The manufacture of cloth was America’s greatest industry. For a considerable part of the 1813–53 period the manufacture of textile machinery appears to have been America’s greatest heavy goods industry, occupying the primary position in point of size and value of product among all industries which fabricated metal.... From the textile-machine shops came the men who supplied most of the tools for the American Industrial Revolution. From these mills and shops sprang directly the machine tool and the locomotive industries, together with a host of less basic metal-fabricating trades. The part played by the textile machinery industry in fostering American metal-working skills in the early nineteenth century was a crucial one.

23Considered solely as a hydraulic operation, Locks & Canal was world class. By the mid-1830s, it serviced twenty-five textile mills plus a variety of other water-powered businesses, including Moody’s machine shops, and by the late 1840s, its waterpower canal network was more than seventeen miles long. Much of its success was due to its long-serving chief engineer, James B. Francis, another self-taught prodigy who assumed his post in 1837 at the age of twenty-two. Over the course of the next half century Francis became arguably the world’s leading authority on hydraulic power. His Lowell Hydraulic Experiments were masterpieces of adroitly combined theoretical and empirical exposition. They were issued and regularly revised and reissued for a quarter century, especially advancing the fields of flow measurement and hydraulic-power transmission efficiency. Francis was a leader in the conversion of waterwheels into turbines starting in the late 1840s, and his underwater turbines achieved energy conversion rates in excess of 90 percent. A comparison of two advanced mid-century water sites illuminates Francis’s contribution to hydraulic engineering.

In 1851, Henry Burden, one of America’s great inventors, iron men, and waterpower innovators,

aa built the world’s most powerful waterwheel at his works in Utica, New York. It was sixty-two feet in diameter, weighed 250 tons, was beautifully geared for smoothly efficient operation, generated up to 300 horsepower in work output, and ran almost without interruption for a full half century.

Also in 1851, Francis and a superb Lowell Machine Shop mechanic, Uriah Boyden, installed a Boyden-Francis turbine at the Tremont Mill in Lowell. Boyden had done the lion’s share of the design and development work, while Francis, as Boyden’s primary customer, had created a rigor-ous design and testing environment to guide the conversion of Lowell waterwheels to turbines. The 1851 Boyden-Francis turbine was five feet in diameter, a twelfth the size of Burden’s wheel. It weighed four tons, a sixtieth the weight of the wheel. And it generated up to 500 horsepower in work output, or 60 percent more than that of the wheel.

24The high-efficiency Francis turbine

ab is still used in almost every hydroelectric plant in the world, generating about a fifth of the world’s electricity. Francis retired in 1884, although he lived in Lowell and remained a consultant to the company until his death in 1892.

The Keiretsu Extended

The “Boston Associates” is the name the historian Vera Shlakman pinned on the founding group of the Waltham-Lowell venture, along with the other investors drawn in as the companies prospered, and it has stuck ever since. Robert Dalzell lists seventy-five members of the Associates between 1813 and 1865. With five Appletons, three Cabots, three Jacksons, four Lawrences, four Lowells, and two Lymans, they were as ingrown as the Hapsburgs.

The durability of the group was partly a consequence of the loosely affiliated nature of the businesses. By spinning off Locks & Canal, the original Associates got diversification—they received their pro rata shares in the spin-offs and could invest further if they chose—and retained a voice in protecting their investment in the waterworks.

Locks & Canal, however, was also a real estate and manufacturing company. It leased land and water sites and, since the spin-off included Moody’s machine shops, constructed lessors’ waterworks and much of their machinery. Over time, the real estate and manufacturing businesses were spun off as well. Locks & Canal remained Lowell Manufacturing’s most important client, of course, but Lowell Manufacturing also developed a line of steam engines and was quite profitable in its own right. Intercompany relationships were simplified by the fact that the first wave of independent mills at Lowell were mostly owned by Associates. Kirk Boott had two, for instance, and Appleton was an investor in several.

The Lowell arrangement became a favored venture investing model for the Associates: Acquire water rights on an undeveloped river, construct the required power hydraulics—dam, canals, power supply for the first plant—build a textile factory and a machine shop, then lease the remaining waterpower to other entrepreneurs. James K. Mills, for example, was a prominent Boston merchant and an Associate. He was involved in at least four such ventures both as an investor and a director, two of which, at Chicopee and Mt. Holyoke, have been extensively researched by historians. There was no assurance of great financial rewards. The Mt. Holyoke group raised $2.45 million—a huge sum for the day. Most of it went for a 1,000-foot-wide dam on a river with a 57-foot head, that collapsed on the day it was opened. It was expensively rebuilt and then rebuilt again, and the investors lost every penny. Nevertheless, Mt. Holyoke became a successful paper manufacturing city, partly because of the sunk capital investments of the pioneers. Mills was wealthy and hardly a patsy; one imagines he worked so hard on his start-ups because he enjoyed it.

25The Associates also controlled more subtle networks of power. The Massachusetts Hospital Life Insurance Company was not specifically an Associates company. It was chartered in 1818 and awarded a monopoly on the state’s life insurance business, so long as one-third of its life insurance profits went to the Massachusetts General Hospital. Only the great and the good are awarded such franchises, and by the time the company was fully operative in the mid-1820s, it was firmly within Associate control. From its founding until mid-century, two-thirds of its directors were Associates, as were all its finance committee members, prominently including Nathan Appleton and Patrick Jackson. There were three lines of business: annuities and life insurance for young men of modest means, life annuities for widows, and trusts for the better off. Profits from the trust business didn’t have to be shared with the hospital, and it filled a real need for Associate families, who were suddenly amassing large sums of cash from textiles.

Layout of Advanced Mid-Century Water Plant:Robbins&Lawrence, Windsor, VT, 1846

Within just a few years after it went into operation, Massachusetts Life was by far the largest financial institution in the state, operating almost as an Associate investment club. At first the company followed its charter strictly, limiting its investments to high-quality mortgages, government bonds, and similar instruments, but by the 1830s roughly half of its investments had shifted to textiles. To comply with the charter, textile investments were usually reclassified as personal loans collateralized by small amounts of textile shares. The conflict of interest is stark, since many such loans generated lower returns than less risky blue-chip paper. Loans were also regularly extended or reworked when friends or family of Associates had trouble making payments. It is not likely that any of the Associates perceived a problem. The Massachusetts Life trusts still had decent returns, and since they were mostly funded with Associate money, who could object to their being invested in their own businesses? Similar patterns of ownership and control prevailed in Massachusetts banks and railroads.

26The “model village” aspect of Lowell and its mill-town clones came under pressure during the tough economic times of the 1830s. The once-docile mill girls walked off the job at Lowell and other mills when managers imposed wage cuts and rent increases on the mill girls. On the first occasion, in 1834, the Lowell girls retaliated by withdrawing all their savings from the local banks. During another walkout in 1836, one of them took to the stump and made “a neat speech,” marking the first time a woman had ever spoken in public at Lowell.

27 Note that these actions occurred

before Dickens’s visit.

By the 1840s, conditions that had appeared enlightened twenty years before were looking considerably harsher to independent observers. A ten-hour-day law was bitterly opposed by the mill owners. The Lowell Female Labor Association was formed in 1844 and led ten-hour petitioning and organizing drives throughout the state. (The fact the mill girls lived together and had developed experience in print publications made them formidably effective.) Although mill organizing was a major advance toward woman’s emancipation, the legislature resisted ten-hour-day legislation for another thirty years.

Even deeper problems were coming to the surface. Boston was the epicenter of the American abolitionist movement, and all cotton-related industry was built on slave labor. The entanglement of leading Boston shipping and mercantile families with slavery was a long-standing one, for Boston had been the headquarters of the three-cornered “slaves, molasses, and rum trade,” and not a few New England sea officers had captained slavers. The split between Cotton Whigs and Conscience Whigs became irretrievable during the political battles over Texas and the Mexican War. In 1848, Charles Sumner denounced the alliance between “the cotton-planters and flesh-mongers of Louisiana and Mississippi and the cotton-spinners and traffickers of New England—between the lords of the lash and the lords of the loom.” Families were riven over the question. Sumner himself was an in-law of Nathan Appleton, the de facto leader of the Cotton Whigs.

Appleton, the last of the original Associates, died in 1861. The keiretsu did not survive the Civil War. A number of mills had gone out of business during the financial panic of 1857, and the inability to buy cotton during the war wiped out many others. The younger generations of Associates were generally quite wealthy and in the main not especially interested in textiles. The textile business itself did recover after the war, but it was meaner and much more competitive. Mill working conditions deteriorated dramatically in the second half of the century, as farm girls gave way to immigrant labor. American factory conditions in general, not just at the mills, converged with those in England and in some industries, like steel, became even nastier.

Of Shoes, Stoves, and Steam Engines

America has always been a nation of consumers. Probate inventories from the Middle Atlantic states show how one generation’s luxury item, like looking glasses, are middle-class necessities for the next, but simplified and standardized. As higher volumes drive down prices, the same products become commonplace even in poorer homes.

28 Terry’s, Slater’s, and the Waltham/Lowell experience illustrate how new products could tap into deep peddler networks that ran westward through rural New England, southward down the Hudson to New York and beyond, by packet to Philadelphia, Baltimore, and New Orleans, and in the early days by wagon west of the Appalachians. But there were many other possible models for mass production and distribution businesses.

Lynn, a town about twelve miles north of Boston, traditionally had a small concentration of shoemakers, producing cheap shoes that merchants exported for West Indian plantation slaves. The distribution networks were expanded in the 1780s by a local merchant, a Quaker named Ebenezer Breed, to supply shoes to Southern slaves.

Shoemaking was a craft industry with many specialty tools but few power machines until mid-century. Merchants in and around Lynn organized a massive putting-out manufacturing system. The merchants bought and cut leather and supplied the leather and supplies to home shoe workers: women sewed liners and finishes, while men did the heavy-leather sewing. The Southern slave population exploded with the cotton textile boom of the early 1800s, drawing more and more of the Boston region into the shoe business. As volumes rose, towns began to specialize in specific types of shoes. Higher quality products expanded the market to farmers and working people. Shoe models were standardized, and organization improved, driving down prices and expanding markets even further. As established merchants began to stock standard sizes and models, the peddler network shifted from retail to wholesale distribution. By mid-century or so, the great majority of ordinary people were wearing store-bought shoes, and local shoemakers had been forced to shift their business to the repair of commercially made shoes. By 1860, New England produced about 60 percent of the nation’s shoes.

29The history of stoves is necessarily different. Stoves were relatively easy to cast at iron foundries but too heavy for peddlers. Still, it was a killer product: every housewife with a bad back and burnt fingers from fireplace-cooking dreamed of life with a “civilized” stove. The challenge was in marketing and distribution. No single manufacturer ever dominated the industry or constructed a Lowell-style master plan, but over fifty-some years, virtually any household that could afford the modest price had acquired a stove.

Clear signs of organization began to emerge in the 1820s in the iron district of Philadelphia and New Jersey. Instead of casting and selling individual stoves, the foundries began to produce stove plate, or the unassembled pieces of a stove, and ship it to Philadelphia for assembly at merchants’ establishments. Initial sales were to upper-middle-class households in towns all along the available water routes, a market that was greatly expanded by the opening of the Erie Canal.

Decentralized production and distribution centers sprang up around major water routes—at Albany and Troy for the Erie Canal region, at Cincinnati and Louisville for the Ohio Valley, and at St. Louis for the Mississippi Valley. Local stove foundries, using cupola furnaces to melt scrap iron and steel, shortened transportation networks. As stoves proliferated, stove stores appeared in most medium-sized towns, typically with a catalog of designs and an assembly and finishing shop. Stove finishing became an important subtrade for tinplate craftsmen and simplified quality control at the foundry. Prices steadily dropped even as designs and quality steadily improved. In 1860, stoves accounted for a third of the value of all cast-iron products, with a value-added about the same as rail manufacture. By then, the industry was tilting toward maturity. A postwar shakeout left fewer, larger companies, which paid greater attention to branding and catalog selling, supplemented by retail stores and floor inventory in the biggest markets—in short, a modern industry.

30Steam engines, finally, illustrate the extreme end of the transportation challenge in early America. They were also a key to solving the transportation problem by improving water transport and freeing powered industries from water sites.

Oliver Evans was a Delaware merchant who became one of the most prolific of American inventors. (He patented a highly automated flour mill and sold one to George Washington.) He is best known, along with the British inventor Richard Trevithick, as the father of the high-pressure steam engine. Newcomen and Watt engines condensed steam to create a vacuum and used the vacuum to move the piston. The Evans/Trevithick designs used steam expansively, pushing the piston with steam pressure. Evans came up with his design in 1801, when as one scholar put it, “No more than six engines could be mustered in the whole of the States; mechanical construction and skill were at least fifty years behind those of England.” Robert Fulton’s steamboats used Boulton & Watt low-pressure engines imported from England.

31High-pressure engines used much more fuel but were much cheaper and easier to build. A 24-horsepower Evans engine—powerful enough to run a saw mill—weighed in at about 1,000 pounds, with a piston cylinder nine inches wide and about forty inches long. A Boulton & Watt 24-horsepower engine weighed four times as much and had a twenty-six-inch-diameter, five-foot-long piston. Most good American machine shops could execute an Evans piston by 1820 or so, but only a few in New York and Philadelphia could handle an equivalent Boulton & Watt–scale piston. In the words of Louis C. Hunter, the historian of American power, “The advantages of the simple, compact, low-cost high-pressure engine ... were so clearly manifest and so appropriate to American conditions—scarcity of capital and skilled labor, scarcity of repair facilities and limited scale of operations—that a wide consensus was early reached, with virtually no debating of the issue.”

32Unfortunately, high-pressure engines were very dangerous. With boiler pressures routinely as high as 100 pounds per square inch, small construction flaws could result in devastating explosions. Explosions on Hudson River steamboats in the 1820s were frequent enough that passengers sometimes insisted on being towed behind on “safety barges.”

33 Improvements came very slowly. It took fifty years to develop accurate steam gauges. Safety valves were often poorly made or poorly maintained, and often intentionally disabled. Riveting was mostly by hand, often with rivets of dubious integrity and boiler plate of poor quality. Steamboat explosions were closely tracked, since they were so public. In the twenty years from 1816 through 1835, there were forty steamboat explosions, causing 353 deaths; 88 percent of the explosions and 83 percent of the deaths were on western steamboats, which were almost exclusively powered by high-pressure engines. Even as much safer designs became available in the last half of the century, they were strongly resisted because of their cost. As steam engines proliferated, disasters kept rising. A study covering 1867–1870 showed about a hundred major explosions a year, killing about 200 people and injuring a similar number.

34 The dominance of efficiency over any other value may have also been characteristic of American industries.

Evans died in 1819; by then his Mars Works in Philadelphia had produced more than one hundred steam engines for both water transportation and industrial power. After his patents expired in 1824, his designs were widely copied and improved on. Robert L. Stevens, an important railroad executive, may have been the most original American contributor to steam-engine technology after Evans.

There was an adroit division of labor in the early manufacturing and distribution of Evans-model steam engines. Eastern manufacturers, who had the most advanced metals operations, constructed the pistons, the flywheel, shafts, and other moving parts, while local contractors, perhaps with on-site supervision from the eastern supplier, executed the heavy castings for the engine housing and boiler and assembled the engine. Even with those arrangements, the distribution of Evans’s engines still clearly tracks established waterways and so was likely limited by high overland transport costs. By mid-century, manufacturing of engines was becoming quite decentralized at cities like Pittsburgh, Louisville, and Cincinnati, while the western steamboat had opened many smaller waterways to freight traffic.

THERE WAS NO SIMPLE MODEL OF AMERICAN MASS PRODUCTION manufacturing. In clocks, a series of brilliant manufacturing insights of Eli Terry made it possible to make ordinary clocks on a mass scale. Clocks were a relatively lightweight product and were readily picked up by peddler networks built to distribute buttons and cloth. Textiles were already a mass market in Great Britain when the Boston Company was founded. Lowell and Moody focused on creating a single-line, mechanized-flow manufacturing system tuned to the mass-market, working-class customer using existing distribution networks. Mechanization was not invariably a prerequisite for moving to a mass-market scale: Shoes were a mass-manufacturing industry well before the advent of shoemaking machinery. Stoves and steam engines were mass-scale industries without any mass manufacturers. Both were extremely heavy products, so the ingenuity went into the distribution and assembly. Indeed, it is likely that through much of the first half of the century, as many homes had stoves as had clocks.

The most famous example of American mass production, however, was the manufacture of guns, which will be the subject of the next chapter.