CHAPTER 10

AI in Lending

By Joshua Xiang1

1CTO and SVP, CreditEase

Overview

The financial services industry is one of a few highly computerized industries. IT systems have automated all aspects of financial services processes and have thereby accumulated huge amounts of data. To many, artificial intelligence is yet another IT tool to help increase efficiencies and reduce costs. But to some industry pundits, AI is more than just another technical tool. It represents a paradigm shift – a new way of solving problems with human-like intelligence.

In many cases, such as customer engagement or telemarketing, AI’s lack of emotion is probably a disadvantage. For example, lack of empathy and sympathy makes a customer service chatbot unfriendly and unpopular. But in many other cases, lack of emotion turns out to be an advantage. For example, if AI is underwriting a loan or making an investment decision, it will do so purely based on hard data, without any bias towards a particular loan applicant.

As an important vertical in financial services, lending is a massive business which directly and indirectly touches almost everyone’s life and all parts of the economy. As of May 2019, consumer debt in the United States was just over $4 trillion. Credit card debt accounts for roughly $1 trillion, student loans around $1.6 trillion, and car loans around $1.1 trillion. In addition, total value of mortgage debt is over $15.5 trillion. Lending is clearly big business.

With tens of millions of Americans holding loans worth trillions of dollars, any technology that can make even a small improvement in a company’s returns on the loans they hold, or that can improve their share of the market, would be worth a significant amount of money. That is why both established banks and FinTech companies are constantly looking for ways to innovate – and AI might allow for just that.

Lending is essentially a big data problem, and therefore is naturally suited to machine learning. Part of the value of a loan is tied to the creditworthiness of the individual or business that took out the loan. The more data you collect about an individual borrower and how similar individuals have paid back debts in the past, the better you can assess their creditworthiness.

Use Cases

AI has been used in many lending scenarios. Here are some common use cases.

User Identification

In the old days, when people applied for loans, they went to banks or met with loan agents. Their identities and documents were easily verified and processed on the spot. In recent years, applicants with good credit records and completed documents can also apply for loans and sign loan documents electronically, without having to meet lenders in person.

But for borrowers who have less optimal credit scores and insufficient supporting documents, their chances of getting loans are reduced, and that’s without even talking about getting loans online. Today, AI technology is able to help. Those with urgent needs for relatively small loans can provide their personal ID and take live pictures and videos to identify themselves. AI models and facial recognition technology can instantly make creditworthiness decisions and verify user identities during the online loan application process.

Credit Decisions

The value of a secured loan is tied to assessments of the value of the collaterals – e.g. car, home, business, art collections – the likely level of future inflation, and predictions about overall economic growth. AI theoretically can merge and analyse all of these data points from various sources to make a holistic decision. For these reasons, “creditworthiness” is highlighted as one of the most common AI applications.

Thanks to companies like FICO, which create the well-known credit ratings used to determine creditworthiness, lenders have a common standard to screen loan applications. FICO uses machine learning both in developing FICO scores, which most banks use to make credit decisions, and in determining the specific risk assessment for individual customers. MIT researchers found that machine learning could be used to reduce a bank’s losses on delinquent borrowers by up to 25%.

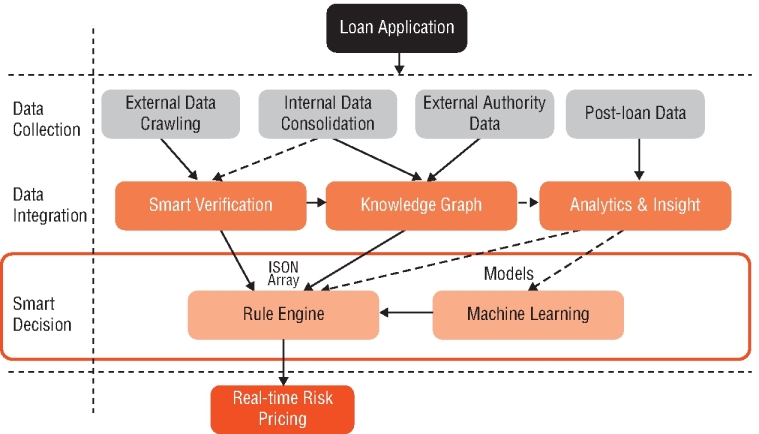

An AI-powered credit decision process is shown in the following diagram.

Figure 10.1 AI-powered real-time credit decision

Fraud Prevention

How can a financial institution determine if a transaction is fraudulent? In most cases, the daily transaction volume is way too high for humans to manually scrutinize each transaction. Instead, AI creates systems that learn what types of transactions are fraudulent. Some companies are using neural networks to predict suspicious and fraudulent transactions. Factors that may affect the neural network’s effectiveness include recent frequency of transactions, transaction size, transaction location, transaction type and the kinds of merchants involved.

Now let’s look at several examples of how AI is being used to help lending in China.

Consumer Lending: Proprietary Risk Management Based on Big Data

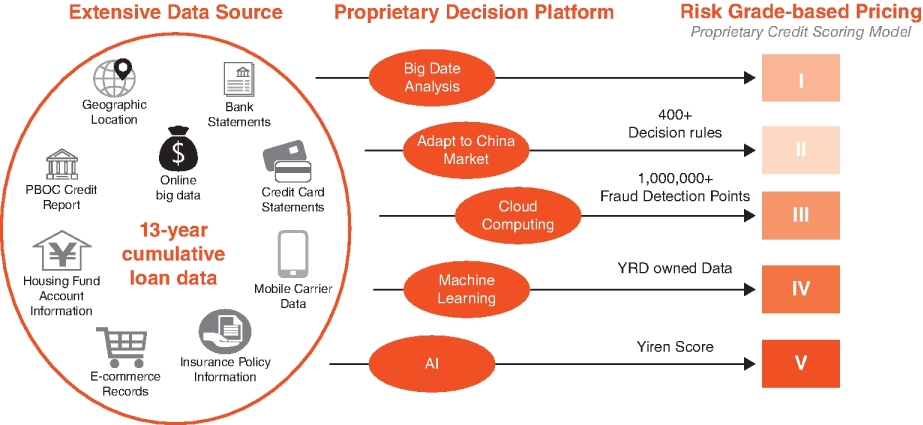

Compared with America, China’s credit system is relatively new. PBOC (People’s Bank of China) credit scores are not as accessible and comprehensive as credit scores offered by FICO and other US credit bureau agencies.

Whenever you apply for a loan or credit card, the financial institution, especially online lenders, must quickly determine whether to accept your application on specific terms, e.g. interest rate, credit line amount, etc. If someone doesn’t have good PBOC credit scores, will lenders reject his or her loan application? Banks may do just that. But other inclusive finance firms may still approve the loan, if they have the following risk management system based on big data.

Figure 10.2 Consumer lending: risk management based on big data (courtesy of CreditEase)

Credit Decision Powered by Knowledge Graph

Knowledge graphs can be used in lending to screen qualified loan applicants and identify fraud. Loan applicants’ personal ID, telephone number, device ID and home and work addresses are extracted and mined from various data sources, and fed into a loan applicant knowledge graph. The knowledge graph system processes and correlates a large number of unstructured data, forming a structured graph database that is ready for real-time query, mining and decision-making for creditworthiness and fraud detection purposes. The nodes (entities) and their attributes help make underwriting decisions. The links disclose valuable insights that assist with fraud detection.

SME Lending: Unsecured Loans Backed by AI and Machine Learning

Like their counterparts in the rest of the world, small and medium-sized enterprises (SMEs) are financially underserved in China. By working with cashier system and payment providers (e.g. 2DFire, PayPal) and e-commerce platforms (e.g. Amazon) via API (application programming interface), financial firms can get and analyse business data of SMEs (e.g. restaurants and online merchants) and provide unsecured loans to them accordingly. The creditworthiness decision is based on such data as business transactions, profitability, reputation, pricing, operational stability and cost, leverage, debt situation, growth, liquidity, shareholder background, etc.

Chatbots Used in Debt Collection

Chatbots are AI programs that simulate conversations with people via voice or messaging. It is widely seen in many human–computer interaction scenarios. Knowledge graphs are not only used in creditworthiness decision-making, but also used in customer service and telemarketing chatbots. Progress in the knowledge graph-based question answering (KGQA) area is making chatbots smarter and even more effective.

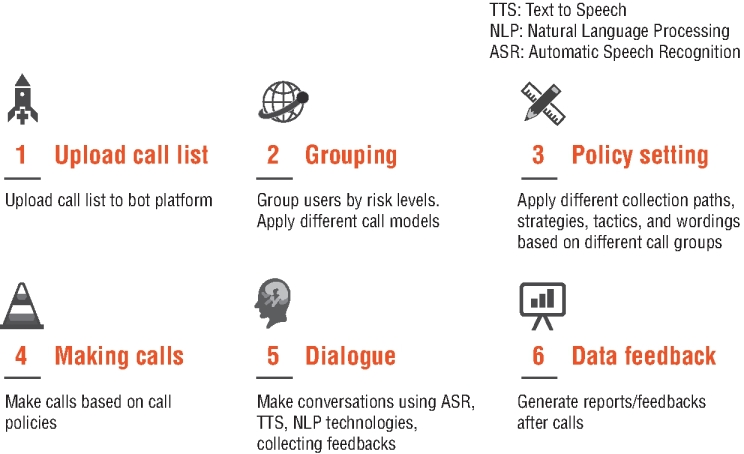

Let’s take a look at another chatbot use case: debt collection. Debt collection chatbots are more effective than human collectors in simple collection scenarios, such as informational and reminder phone calls. They can simultaneously “speak” to as many customers as desired, always politely and professionally, without becoming emotional in tense situations. Here is how a debt collection bot works:

Figure 10.3 Debt collection chatbot (courtesy of CreditEase)

Suggestions to Lenders

According to James Manyika, chairman and director of the McKinsey Global Institute (MGI) (speech at AI Frontier Conference, 11/3/2017), 30% of companies are uncertain about AI’s importance in business; 41% of companies are uncertain about AI’s benefit; 28% of companies are unable to put together an AI team; and only 1% of companies understand AI and are actively executing an AI strategy. Tech, telecom and financial companies are early adopters and pioneers of AI. Things have been improving since then. But lenders, like many financial firms, still face a steep learning curve to fully understand and benefit from AI.

For those financial firms that are embarking on an AI journey, some suggestions are worth considering.

Have a clear understanding of AI’s potential and limitations. Educate the management team and set the right expectations.

In layman’s term, AI is a computer system that is able to perform tasks that normally require human intelligence, such as visual perception, speech recognition, language translation, automobile driving and many other decision-making activities.

The key decision in the lending business is to decide on creditworthiness of a loan applicant and the loan terms. Like any new technology, or revived technology as in the case of AI, it usually generates a lot of hype at the beginning and takes quite a lot of time to mature. Business leaders in the financial services industry need to understand AI’s potential, limitations and applicability within their enterprises.

Unlike typical IT systems introduced in the past that automate business processes, AI assists (or even replaces) people to do things in an automated manner. While its potential and impact will be significant, it needs to be trained iteratively to reach a satisfactory level.

Clearly understanding and communicating AI’s power, uniqueness and limitation to key stakeholders is the No. 1 task for all of us. We should wholeheartedly embrace AI, but be realistic and patient, and set the right expectations to key stakeholders.

Engage with business groups. Understand their pain points. Evaluate and introduce AI technologies that deliver immediate business values.

Technologies are meant to solve business problems. AI is no exception. Unlike other IT technologies that essentially hard-code business logic in computer systems or customize a standard solution in various deployment scenarios, an AI system is more self-learning and evolving.

A simple configuration, customization or implementation of a shrink-wrapped software system is not enough. A process called “feature engineering” is needed. It involves selecting the right set of features based on existing data, training the model and then using the model to predict the future. This is a lengthy process that takes in a huge amount of real business data and gradually learns to generate better results.

This requires frequent and deep engagement with business groups that provide real training data, such as bad loans and frauds. By engaging with business groups, lending institutions can identify tedious data-intensive and error-prone tasks such as customer services, loan underwriting and auditing and debt collection, and use AI to improve efficiency and customer satisfaction. It is always wise to focus on solving immediate business problems by engaging with business groups early.

Bring in industry leaders and train internal teams to become AI savvy. Hire and train AI product managers who are the key to success of AI implementation.

Financial institutions, especially those without strong in-house technology expertise, desperately need AI expertise and talents. At the same time, AI technology providers need application scenarios and real business data to polish their AI models and algorithms. AI tech companies have a strong incentive to work with businesses that have real data and significant problems to solve.

Lenders that lack AI expertise can form joint labs with leading AI research institutions and technology providers. Besides recruiting a few full-time AI experts such as a chief AI scientist or chief AI officer, they can hire advisors and consultants on a part-time basis. With the help of those AI experts, companies can then train and grow internal AI engineers and especially AI product managers to successfully implement AI solutions in multiple application scenarios. It is a simple borrow and grow approach.