CHAPTER 28

Artificial Intelligence: The Next Leap Forward in the Payments Revolution

By Tamsin Crossland1

1Senior Architect, , Icon Solutions

The financial payments sector is undergoing a revolution, leading to an increase in the volume of digital payment transactions across the world. In emerging markets, especially in Southeast Asia, this is due to a rapid increase in smartphone ownership and improved internet access. In Europe and the USA, the development of new technologies driven by open banking in the European Union, along with the growing use of contactless payments and e-wallets are leading to ever-increasing numbers of digital transactions.

This rise in digital transactions is further increased by artificial intelligence, with both virtual assistants and recommendation engines generating additional sales. Additionally, the emergence of faster payment technologies enables settlements to be performed within seconds. This increase in payment volume and speed means that existing manual labour-intensive fraud detection processes are proving inadequate.

Meanwhile, machine learning is finally becoming commercially viable, and has the potential to revolutionize fraud detection. Although machine learning has existed since the 1950s, the technology has only recently become commercially viable due to the increase in processing power of computers predicted by Moore’s Law and the emergence of big data.

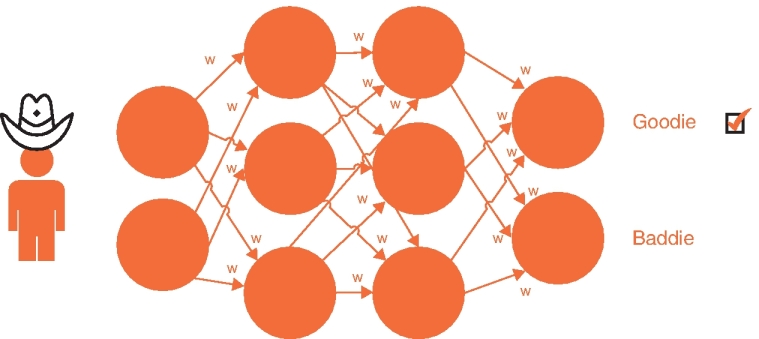

Machine learning is a technology built using artificial neural networks that are based on the internal structure of the brain, which consists of interconnected neurons, individual cells that receive signals from other cells via the dendrite (the input) and then pass them through the cell body which may pass the signal to other neurones via axons (the output). Within artificial neural networks, neurones are modelled by interconnected “nodes”, which trigger an output signal when a certain value is reached.

With machine learning, patterns of behaviour can be created by adjusting the weights within an artificial neural network; for the first time since the creation of Babbage’s Analytical Engine, a human-built machine can learn behaviour without having been given precise instructions on how to behave. Instead, machine learning “learns” behaviour by adjusting the weights given to nodes within an artificial neural network as data is loaded. In fraud detection, this ability to detect patterns from a data set can lead to detection of previously-unknown fraud techniques and much faster detection of new fraud techniques.

There are two main techniques for machine learning:

- Supervised learning

- Unsupervised learning.

Supervised learning is the most commonly used technique in machine learning. With supervised learning, an artificial neural network will be “trained” using multiple sets of inputs and outputs (results). As each set of input and desired output is loaded, the weights within the neural network are adjusted.

Let us consider the following example which is based on the old Western movie tradition of “goodies” wearing white hats and “baddies” wearing black hats.

The first set of input and output is shown in Figure 28.1.

The input is an image of a person with a white hat and the desired outcome is the first output, a “goodie”. In order to load the image, it would be converted into an array that represents each pixel with a numeric value. This array for the image would then be loaded into the leftmost row of nodes, the input layer. On the rightmost row of nodes, the desired result would be that the first node (the “goodie”) is triggered.

The learning process involves the neural network adjusting the weights (in Figure 28.2) so that the input results in the desired output.

As more sets of inputs and outputs are loaded during the learning process, the weights will be further adjusted and the accuracy should improve.

Figure 28.3 shows another set of inputs and outputs that includes an image of somebody wearing a black hat and that the desired outcome is to return the second value (“baddie”).

With sufficient training, the weighting configuration should be such that the neural network determines that a black hat means the person is classified as a “baddie”, whilst a white hat means the person is a “goodie”.

It should be noted that the neural network has not been given specific instructions on what a hat or a person is; the network is only learning its behaviour by adjusting its internal weights according to combinations of numeric representations of the pixels that constitute an image along with the desired outcome.

This simple example illustrates one of the advantages of using machine learning in fraud detection: patterns can be detected that may not have been noticed before, in the same way that there may be people that have not heard of the tradition in Western movies of “baddies” wearing black hats. A neural network may thus be able to detect a new fraud technique faster than human analysis.

By contrast, in unsupervised learning the outcomes are not specified; in the example the outcomes of “goodie” or “baddie” are not supplied. Instead the unsupervised system would group together related items. In the example, the unsupervised system should highlight the hat as a grouping criterion.

In addition to detecting fraud, machine learning can be applied to the know-your-customer (KYC) and anti-money laundering (AML) processes, to spot inconsistencies and patterns undetectable by manual processes, especially when there are highly complicated links with ultimate beneficial owners (UBOs), politically exposed persons (PEPs) or prohibited states.

The ability to rapidly detect patterns from big data can also be used as an upselling tool, to suggest customer requirements and identify when there is the risk of losing a customer.

While the ability to learn from data is extremely powerful, there is a risk that the data may contain biased data which could result in prejudiced behaviour. For example, there have been cases where an organization has historically been more inclined to recruit candidates of a specific race or gender; in that case, machine learning would be at risk of inheriting that bias from the data. Given this risk and the difficulty of analysing weights within a neural network compared to inspecting code, testing needs to include ensuring that the system does not display bias.

With the ability to detect previously unseen patterns of fraud and to detect new patterns of fraud more quickly, the advantages of deploying machine learning are now accepted in most financial organizations. This ability to detect patterns can also be applied across the financial sector whether it is to identify new sales opportunities or to detect customers that are at risk of moving their business to another organization. At a time when the payments industry is seeing ever-increasing volumes of digital payments and the emergence of faster payments, machine learning is emerging as a highly beneficial technology to the payments revolution.