CHAPTER 41

Introduction on AI Approaches in Capital Markets

By Dr Aric Whitewood1

1Founding Partner, XAI Asset Management

Setting the Scene

This chapter introduces the key considerations, trends and use cases for artificial intelligence (AI) in Capital Markets. It’s meant for non-specialists, and, in particular, decision-makers needing to understand the benefits, pitfalls, and how to approach AI projects in the financial domain.

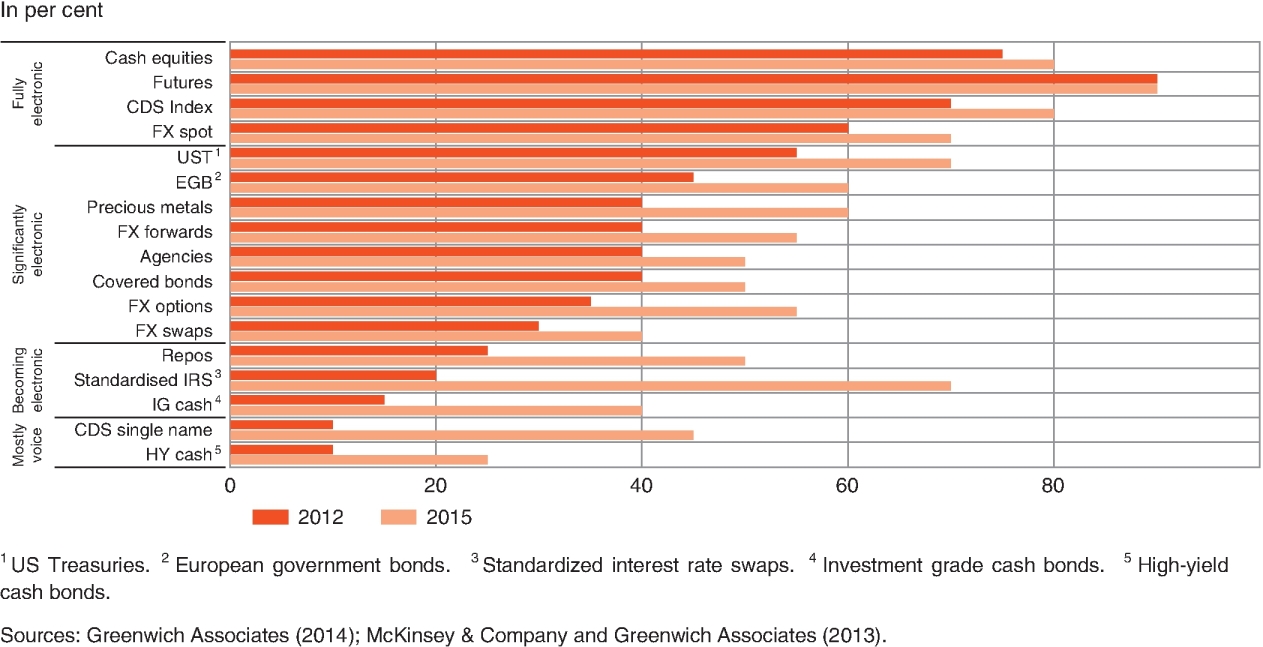

One can draw parallels between AI and other technological drivers like computerization of trade, which first took hold in the 1970s. Trading is now close to fully electronic, particularly in the case of cash equities, FX, futures and CDS indices, all assets that are highly liquid and standardized. Figure 41.1 shows different asset classes (listed on the left) and how trading becomes less electronic as we move down that list, from cash equities at one extreme (fully electronic trading), through to high-yield cash bonds at the other (mostly voice trading). The trend will continue; it’s possible that almost all assets will be significantly electronic in the next decade.

Figure 41.1 Chart of computerization of trade1

Cloud computing and new data processing techniques have enabled an ecosystem of FinTech startups to flourish and challenge incumbents in such areas as banking, insurance and investing. The availability of cheap data storage and processing power has also, in parallel, enabled both small and large firms to make better use of AI techniques for processing data, fundamentally providing better insights into these data sets, as well as higher quality predictions. In some cases, the actual AI algorithms have not changed much in decades, since they were first published in academia; instead, readily available, cheap, compute power has made it possible to run them in a reasonable time. In other cases, real improvements in algorithm design have been behind the improvements, e.g. some of the more recent progress in both deep learning and reinforcement learning. Legacy plays a part here. Traditional econometric-based models have a long history, but as a result of their origins in other scientific fields, and emphasis on linear models and structured data, they’re not that well-suited to many problems in finance.2 Finance problems can involve structured and unstructured (e.g. text) data, hierarchical relationships, high dimensionality, limited observations, changing data distributions and a low signal-to-noise ratio. Having access to the latest tools, algorithms and compute power is often necessary to building higher-performing models.

What Is Artificial Intelligence?

There are multiple definitions of AI, since the term itself was first coined by John McCarthy in 1956. At a high level, AI is concerned with machines that exhibit some characteristics of natural intelligence demonstrated by humans (and in some respects animals), for example learning and problem solving. As a broad field in itself, there are a variety of subfields within AI, focused on particular aspects, such as vision, natural language processing, robotics, expert systems and machine learning.

Of all the subfields, arguably one of the most popular is machine learning, which applies statistical models to data in order to learn from them and make predictions. Contrast machine learning with rule-based models, or expert systems:

- Machine learning (ML) learns from historical data – training. Model is then run on data it hasn’t seen before in order to make predictions – inference. ML models can be relatively simple or indeed more complex, especially in the case of deep learning.

- Expert systems emulate the decision-making process of an expert. The decisions and behaviour are encoded in terms of a set of rules. Expert system complexity is related to the number of rules and their interactions.

These two examples are interesting, because in some respects they sit on opposite ends of the spectrum, in terms of flexibility and the emphasis on learning from pre-existing knowledge, vs learning from data. Many of today’s trading models are rule-based and relatively simple encodings of financial expert knowledge, while adaptive statistical methods – like ML – are still a minority contribution.

Using Data Science to Solve Business Problems

The professional field most closely linked to AI, and especially ML, is that of the data scientist. This is a field that I have been involved with for years, running teams in banking and more recently a business in asset management. The definition of data science is related to the definition of ML, that is extracting knowledge and insights from (structured and unstructured) data. It is a multidisciplinary field, for which the key skills lie at the intersection of mathematics, computer science, domain knowledge and communication, as shown in Figure 41.2.

Figure 41.2 Venn diagram of the data science skill set – computer science, statistics and AI (incl. machine learning), domain knowledge, communication

I emphasize the last skill – communication – because data science is a business-facing role, where complex models and analysis must be condensed and simplified for a non-specialist audience. Domain knowledge is also important: understanding markets themselves and price action, regulations, or other aspects of the domain, is essential in order to successfully apply machine learning and other techniques to the problem of insight and prediction.

One of the most important tasks that a data scientist can perform, in collaboration with stakeholders, is that of translating a business problem to a specification for the AI-based system. This involves the following steps:

- Defining the problem as prediction, recommendation, alerting, or other.

- Selecting and understanding the data to be used and ensuring it is available (including an adequate history and quality).

- Deciding on the appropriate model or candidate models. The process of choosing a much simpler, linear model as a baseline is useful here. Then we can determine whether more sophisticated, non-linear techniques such as machine learning, really add any value.

- Defining the success metrics.

- Considering the end user(s).

Indeed, it could be argued that the most valuable step comes before all of this: identifying which business problems for that firm are most amenable to AI techniques. What should be noted is that the approach here is top-down from the business perspective, rather than bottom-up from the perspective of the technology.

Capital Markets Use Cases

The key use cases for AI in Capital Markets can be split into four groups: Customer, Trading/Portfolio Management, Regulatory, and Operations (taken from the author’s past experience.3 Example use cases from each of these groups are shown in Table 41.1.

Table 41.1 The four main types of AI Use Cases in Capital Markets, together with some examples for each

| Customer | Trading / | Regulatory | Operations / |

| Portfolio Management | Back-Office | ||

| Recommendation engines (e.g. for stock trading) | Trade execution | Trader surveillance | Capital optimization (such as risk-weighted assets, RWA) |

| Credit scoring | Indicator creation | Regulations processing and codification | Server monitoring, capacity scaling and failover recovery |

| Insurance processing (including pricing, underwriting and claims) | Portfolio optimization | Know-your-customer (KYC) processing | Cybersecurity |

| Chatbots | Asset price prediction | Use by regulators themselves for surveillance and fraud detection | Model risk management |

| Market impact analysis |

- Recommendation engines: A key use case is that of recommending financial products to clients, either directly or via an established sales force. Recommendation engines are a particular application of both statistical techniques and machine learning, the most well-known examples of which are associated with Amazon and Netflix, for shopping products and videos. They involve an interesting mix of user interests, product characteristics, both explicit and implicit feedback, and the ideally relevant intersection of users and products in the form of a useful recommendation. The financial markets case is complicated by the interaction between the client’s existing portfolio, the financial products on offer (or indeed securities), and the market itself – for example, investing in a particular product may make more sense for a particular market regime or point in the business cycle, such as selecting value factor indices during a recovery phase in the economy. As a result, conventional recommender algorithms need to be modified to take into account the more complex and dynamic drivers within financial markets.

- Trade execution: Here, algorithms execute orders, most often with the aim to minimize transaction costs. Volatility and liquidity are important considerations, with large orders being broken down into smaller orders which are placed into the market over some period of time. One particular subset of execution tasks, that of limit order placement, has been successfully paired with machine learning – for example the LOXM system from JP Morgan,4 which uses reinforcement learning to achieve this goal.

- Trader surveillance: ML combined with natural language processing (NLP) applied to a variety of data sources, including trader communications, is used to alert supervisors to unusual or suspicious behaviour. Data sources can also include logs of activity (computer logins, building entry times), human resources records and any other information supporting models of behaviour. Complexity arises from the processing and merging of these disparate sources of information, as well as a potential lack of training examples for instances of behaviour which are “suspicious”. In addition, some examples of trader communication data such as instant chat messages, are difficult to process as a result of the abbreviated nature and use of codewords or slang.

Trust, Transparency, and Human Interactions

This is a broad topic that intersects with all of the potential use cases covered previously, and is relevant for other domains as well. The subfield of explainable AI is commonly called XAI for short, an abbreviation first suggested by DARPA.5 Key drivers behind the recent resurgence in interest include the rapid development of commercial AI-based systems (some of which are used as decision support tools together with a domain expert, in medicine, for example), the increase in complexity of these systems, and regulation. Explanations themselves are useful for designers of systems, in order to understand what they are doing at different points in time, as well as, of course, to end users.

XAI intersects with a number of other fields and areas of study, including human–computer interaction, social science, philosophy, psychology, cognitive science, data visualization and others. The concept of explanations has been studied in great depth over the last 50 years by researchers in philosophy, psychology and cognitive science, while philosophers have been studying the topic for hundreds of years before this. What makes a good explanation is intrinsically intertwined with human behaviour and thought processes and, indeed, is dependent on the specific audience, and their own biases. It is here that the concept of mental models (from human–computer interaction) – how people create models of technological systems in order to better interact with them – becomes useful.

Some examples of XAI systems, initiatives and reports in the financial domain:

- The UK Financial Conduct Authority (FCA) is partnering with the UK National Institute for Data Science and AI, the Turing Institute, on transparency and explainability in financial services.6

- XAI Asset Management is a hedge fund, founded in 2017, specializing in the application of explainable AI to macro-based investing.78

- simMachines is a software startup, founded in 2016, providing transparent, machine learning-based models for a variety of finance use cases, including customer-focused and fraud prevention.9

- World Economic Forum report on AI in Finance, published in Autumn 2019; there is a section in this report which presents several XAI-based approaches.10

It’s worth noting that XAI will, at some level, be mandated on finance firms by regulators. One example already in place is the European Union’s General Data Protection Regulation (GDPR), and the “right to explanation”, the scope of which is still the subject of debate.11

State of the Art: Selected Highlights 2018/19

- Pre-trained language models

- Specifically, the algorithm called GPT-2, by OpenAI, used to generate realistic passages of text.12 This first example is controversial due to its potential application in the creation of “fake news”. It uses a type of model called a generative adversarial network, or GAN. These models are trained on a large amount of data, and can then “generate” data just like it. For example, a generative model trained on images of cars can then create its own, plausible, images of cars. In so doing, the model has learnt the features and building blocks needed to create these images. GANs show a lot of promise in different application areas and have attracted much attention in the AI community. Generative models can potentially be used to create synthetic data that matches the characteristics of real financial data, which can be a consideration where data is limited, allowing models to be trained and potentially providing higher prediction accuracies.

- Imperfect information games

- Deepmind have demonstrated their AlphaStar system, which beat a world class player at StarCraft II, by five games to zero.13 Although there are various constraints in place, this is still considered to be a difficult problem which has been at least partially solved.

- The playing of games may not, on the surface at least, seem particularly relevant, but there are some parallels, certainly in the case of imperfect information. Imperfect information-based models could, for example, provide improved macroeconomic forecasts, which could in turn provide better asset pricing models.

- Common sense reasoning

- Researchers created a knowledge graph of over 300k events associated with 877k inferential relations, which are combined with neural network models in order to reason about previously unseen events.14

- The common-sense reasoning example depends on the intersection of logical and statistical models, two quite different approaches to AI. This is a combination that has previously been highlighted as a fruitful area of research by several experts, including Pedro Domingos.15 Embedding domain or expert knowledge into AI systems via common sense logical rules, particularly in the case of limited data and low signal-to-noise ratio, is likely to be a sensible approach.

- It’s possible that the eventual structures and algorithms for more general, or flexible artificial intelligence (rather than the fairly narrow systems we see today) will use some combination of information representations and approaches.

- Automation of ML algorithm selection

- AutoML is a service, typically hosted on the cloud, where non-specialists can train machine learning models to meet business needs. Researchers at the University of Texas have made good progress on automatically training neural network models,16 and there are other good examples of systems from Google and Amazon.

- These AutoML systems offer a potentially useful service to firms without the specialist knowledge or human resources to train machine learning-based models.

- However, it is likely that AutoML systems particularly tailored to finance are required, rather than more general solutions. This is especially important for use cases in the customer and trading categories. It’s also debatable whether truly performant, robust solutions that provide competitive advantage can yet be delivered via such platforms.

The state-of-the-art examples given above are a cross-section of different application areas and techniques, but do not tell the whole story. The family of AI techniques is large, and describing them all would easily fill another book. It’s best to remember that the most popular model or models today are not necessarily the best fit for a particular business problem, sometimes less fashionable methods work better. And in some cases, AI is not needed at all! But where it is required, an open-minded approach to choosing the correct techniques is required, or even better, experience should lend a guiding hand.

Where Next?

In many respects, Capital Markets are a challenging application area for AI. Some financial institutions and FinTech startups have already developed AI-based systems and deployed these successfully, while many others are still in the process of catching up. Part of the challenge here is in embedding expert knowledge into the systems, as well as providing some level of transparency on their operations. More broadly speaking, it seems the near future is one of AI being an embedded or ubiquitous part of everyday life. In some cases, these systems will replace human effort, and in others they will augment it. It’s important that we ensure best practices on their design, taking into account human factors, transparency and ethics. In so doing, we can best combine machine and human intelligence, and realize the full benefits of this revolution.

Notes

- 1From “Electronic trading in fixed income markets”, Bank for International Settlements, 2016.

- 2Marcos López de Prado, The 7 Reasons Most Econometric Investments Fail (Presentation Slides) (16 April 2019). Available at SSRN: https://ssrn.com/abstract=3373116.

- 3Also: “Artificial intelligence and machine learning in financial services”, Financial Stability Board, 2017.

- 4LOXM System, JP Morgan.

- 5DARPA Explainable AI Program.

- 6UK FCA Partners with Turing Institute, 2019.

- 7XAI Asset Management, Explainable AI, 2019.

- 8Disclaimer: I am a co-founder of this firm.

- 9simMachines

- 10“Navigating uncharted waters”, World Economic Forum Report on AI, published in autumn 2019.

- 11GDPR, “right to explanation”.

- 12OpenAI GPT-2 System.

- 13Deepmind AlphaStar System.

- 14Maarten Sap et. al., “ATOMIC: An Atlas of Machine Commonsense for If-Then Reasoning”, 2019.

- 15Pedro Domingos et. al., “Unifying logical and statistical AI”, 2006.

- 16Jason Liang et. al., “Evolutionary Neural AutoML for Deep Learning”, 2019.