Part 2

Deposits and Lending

Banking, and the core activities of deposit-taking and lending, have been around for many hundreds of years, offering individuals and businesses the opportunity to manage their financial affairs more safely and efficiently, and expand their horizons.

However, it is only quite recently that the banking landscape has begun to evolve significantly. Technology is empowering new entrants to the market and stiffening the competition facing incumbents. Today, legacy institutions are under immense pressure to overhaul their product and service offerings in order to remain relevant in the face of changing customer expectations.

Part 2 takes readers on a sweeping tour de force, looking at the role of technology in banking from today through to tomorrow’s world. In examining the value chain of deposits and lending, we explore the societally important underbelly of these critical services and the way they contribute to the well-being of citizens and the functioning of our economies.

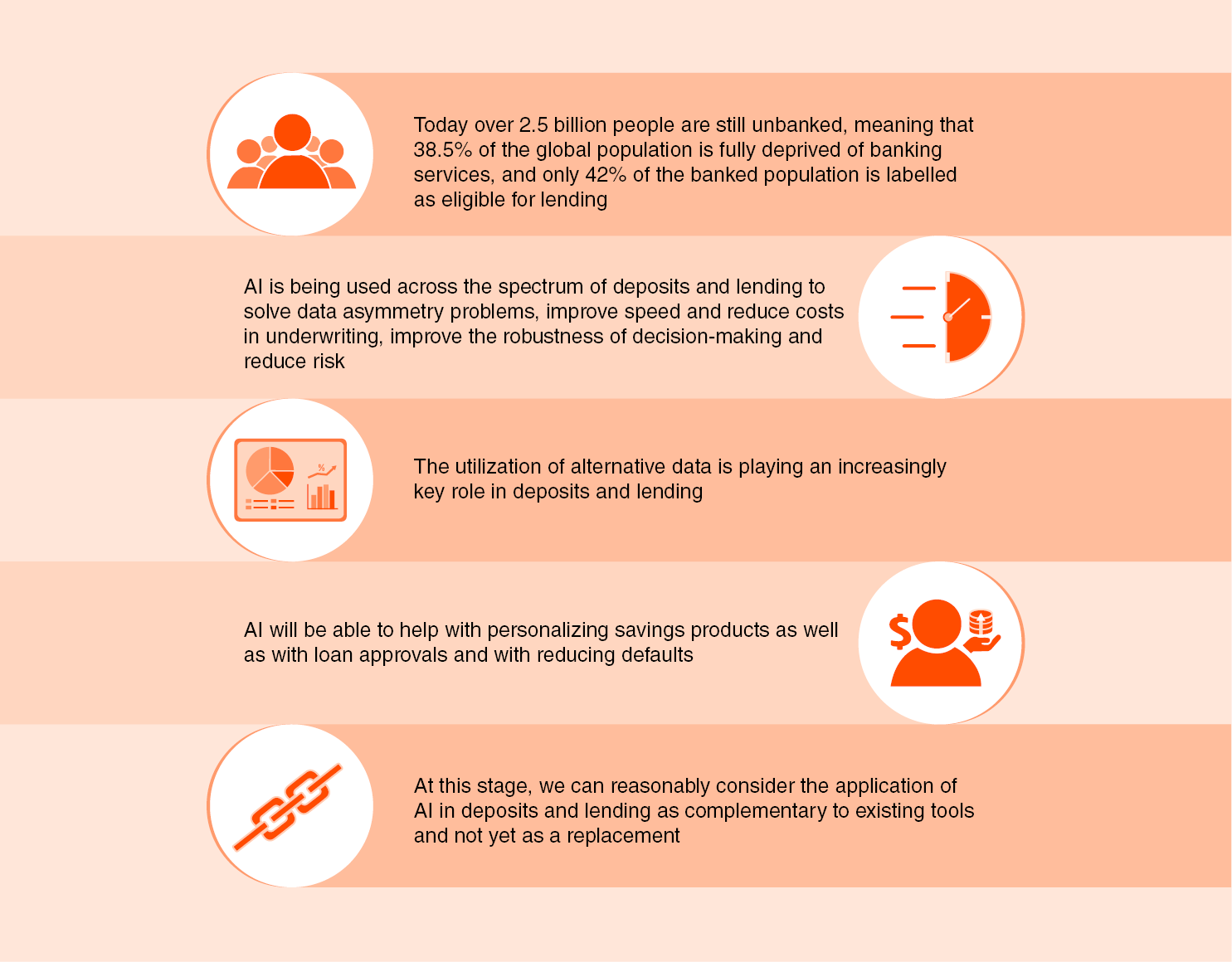

We take a look at how the availability of large quantities of high-quality alternative data is enriching credit-scoring models and facilitating the extension of responsible credit to borrowers in underserved market segments, who otherwise would find themselves excluded from traditional bank lending because of being judged “too risky”.

We also see how AI is being used by banks and FinTechs to personalize new offerings for increasingly demanding customers. We discuss the pervasive role that chatbots are playing, particularly in the retail segment, and how they are creating value for customers through innovative approaches to creating customer intimacy, through financial coaching for example.

Lastly, we revisit the theme of financial inclusion and gain an understanding of the vibrant dynamic in the African financial sector, where AI and related technologies are improving access to secure financial services by offering people in local markets pragmatic and useful solutions that are adapted to their situation.