Let’s be honest. Most of us are trying to make money and get rich. And there is nothing wrong with that. After all, money is money. But behind the greed in your eyes are deeper aspirations. You want to make all that money to support not just yourself, but your loved ones—your family, your children. You want to leave something behind for your children so that they can get a head start in life.

But even though you have all this money in the bank and live a comfortable life, bear in mind that a few uninformed money-managing decisions can deplete all your savings. This is why it is important to learn to manage your money and not allow money to manage you. That is the heart of investing—to turn what you already have into more.

The bottom line is, stop wasting your time making money. Start making investments.

When I lived in China in early 2000, credit cards and cheques were not widely accepted and I had to carry a bundle of cash with me when shopping. Of course, pulling out a wallet filled with cash made me feel rich. But at the same time, it meant that I had to hold more cash than necessary under my mattress. My money was just sitting there, stagnant.

Many people argue that cash is king and this might be true to some extent. We might want enough cash to ensure that we are not squeezed into a corner during tough times or to be able to take advantage of an investment opportunity. If you are saving for a vacation or university education or, more generally, have firm plans requiring the use of cash within the next three to five years, it makes sense to keep cash or maintain deposit accounts in high-rate, low-risk products such as fixed deposits or certificates of deposit.

The cash I’m referring to, however, is money you plan to keep for the long term, such as for retirement or that you have no need of for the next seven years or more.

Many wealthy individuals do not hold all of their assets in cash. Specialised banks and a division of private bankers actively seek out these wealthy individuals to invest their cash into a diversified portfolio of investments. Even Warren Buffett, the American business magnate, once said that “the worst investment you can have is cash… cash is going to become less over time”. So why is cash not a popular choice in the overall investment portfolios of wealthy people?

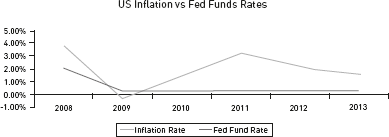

One of the biggest enemies of your hard-earned savings is inflation, which erodes the value of cash. In the five years after the 2008 financial crisis, banks were offering a meagre 0.25% in savings rates, while inflation rates in both American and Asian economies were averaging between 1% to over 4%. This means that the longer your cash sits in your account or under the mattress, the less you can buy with it each year.

Cash is fantastic to have on a rainy day or for short-term needs, but it is not an asset that will appreciate in value on its own over the long term. You can place cash in fixed deposits or certificates of deposit that earn more than the normal savings rates but even that may not be sufficient to offset the inflation rate over time.

The chart below illustrates the average federal fund rates1 that commercial banks would benchmark their savings rates against the inflationary rate from the 2008 financial crisis to 2013. America was seriously affected by the crisis and you can clearly see how inflation would have eroded the value of your savings if you had kept your assets in cash.

Even Asian economies such as Singapore, which were not so badly affected by the financial crisis, had average inflation rates of 5.2% in 2011 and 4.6% in 2012, while banks were offering meagre average savings rates between 0.05% to 0.1%. As an example, $100,000 placed into a savings account for one year with a savings rate of 0.05% would get you a mere $50 in return. You could probably get higher returns by simply spending the money on discounted items.

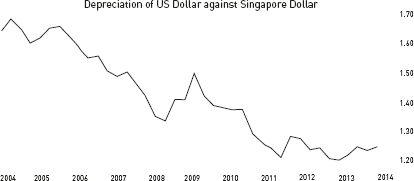

With any investment strategy, you always want to establish some control over the value of your assets. However, the value of a country’s currency is primarily influenced by its economic, financial and macro policies. This means that you have no control over its value and your assets are highly dependent on your government’s policies. For example, following the devastating financial crisis in America and Europe, the values of the USD and Euro have taken a beating over the past decade against more resilient Asian economies such as Singapore. The chart below shows the steadily declining value of the US Dollar against the Singapore Dollar—an approximately 26% fall from an exchange rate of 1.70 down to 1.25.

Of course, the argument for holding on to cash in Singapore Dollars would be applicable as you have gained 26% in value, but the key point here is that you cannot control a country’s economic situation. If Singapore were to experience an Asian financial crisis similar to that in the late 1990s, the tables would be turned.

In today’s uncertain and volatile economic climate, it is difficult to predict what will happen next. As such, many of us have stayed on the sidelines and held on to our cash savings. On hindsight, equity markets have hit new highs since late 2011 and property prices have escalated to levels not seen for several years. We now regret holding on to our cash, but that’s the price for being ‘safe’.

The investment landscape has changed dramatically over the past decade and the cycles for economic and financial downturns are getting shorter. We must thus embrace new strategies of investing in a world of uncertainties as low yields from cash investments will prevent you from reaching your financial objectives.

Aside from the usual three- to four-year economic downturn cycles that each country experiences, there have been an increasing number of financial crises on a global scale within the last decade. These include:

1992–1993 |

European exchange rate mechanism crisis |

1997–1998 |

Asian financial crisis and Russian financial crisis |

2000–2001 |

Dot-com bubble, European Union recession |

2002–2003 |

US recession |

2008–2012 |

US financial crisis / Sub-prime mortgage crisis / European sovereign debt crisis |

The road to recovery from these crises is littered with potholes that most economies have to navigate cautiously given the fragile state of affairs. A misstep can easily cause panic in the global markets. The worst part of today’s chaotic financial turmoil is that your cash investments returns are dwindling faster as governments are forced to stimulate or maintain recovery by cutting interest rates to unprecedented levels. Ultimately, you need to ask yourself whether the low returns from cash are worth the ‘safety’ or outweighed by the financial growth you need to achieve upon retirement.

In the current financial landscape, there is a wide selection of investments for the average person to consider. These include traditional investment forms such as real estate, various forms of deposits offered by financial institutions, trading on organised exchanges like equities or commodities and insurance, and alternative forms such as art, wine, watches or jewellery. Whichever type of investment you decide on, it is best to start with what you know and move up from there.

Most of us would have been exposed to investments from a young age with our parents’ help, likely in the form of a savings account. Let’s explore some of the common investments that most people will encounter.

Bank savings accounts are one of the most common and basic forms of investment, where you earn interest from the bank based on the amount of money you deposit. Most of us would have had a savings account from a young age and would have saved as much as possible until our teenage years without withdrawing a cent. Different currencies earn different interest rates and to attract fresh deposits or to retain a minimum balance, some banks may entice clients with higher rates than other banks.

In recent years, financial institutions such as insurance companies and brokerage houses have also been trying to attract retail deposits by offering higher interest rates to boost their liquidity base. Generally, these basic savings or deposit accounts allow clients to withdraw their funds at any time, with or without a small fee depending on the terms.

As we grow to understand the concept of savings and the importance of investments, we tend to explore fixed deposits in our teenage years, knowing that our current savings will not be touched until we go for further education. Like the term denotes, fixed deposit accounts involve investing a fixed sum of money with a bank or any other type of financial institution for a fixed period of time in order to earn a higher interest rate.

However, fixed deposits do not encourage early withdrawals, which means that there may be a penalty fee and/or the agreed interest rate will not be paid if you withdraw the money before the agreed timeframe. So before you commit to a fixed term deposit, make sure you do not require the money within the designated timeframe.

As a regular visitor to the bank, it is highly likely that a bank employee may have tried to promote various structured deposits to you. Some of these deposits will give you a 100% guarantee on the principal amount deposited, while others may be more risky.

A structured deposit is a combination of a deposit and the performance of an underlying financial investment product or benchmark such as a market index, foreign exchange rate or interest rate. An example of a structured deposit is a deposit linked to the performance of a stock exchange index. If the index performs above a predefined level, the bank will pay the depositor a 10% higher interest rate. But if the index performs below that predefined level, the depositor then gets nothing.

These structured deposits can be very attractive and provide a good return on investment but unlike fixed deposits, there is usually a longer designated timeframe of three to five years, as well as penalty fees and/or management fees in the event of an early withdrawal. The possible returns are usually higher than fixed deposits but are dependent on the performance of the underlying asset. These deposits require a thorough understanding of the terms and conditions because while they may seem simple at first and give the impression that you have got nothing to lose, the early withdrawal fees may cost you a pretty penny.

As you enter the workforce, one of the common long-term investment products that you will be introduced to is a life insurance policy. Some of your parents may also have invested in some form of life policy that is linked to your education or endowment. Simply put, investing in life insurance helps to financially provide for our loved ones in case of our death or permanent disability. However, there is also a savings component that we tend to overlook.

The break-even point for most insurance policies is after 12 to 15 years when the premium paid is recovered—this is referred to as the cash value of the policy. Endowment or policies linked to education usually provide a higher cash value in exchange for a higher premium. Insurance companies often provide annual bonuses or dividend payments, which tend to be accumulated and paid out when the policy is cashed in, matured or claimed upon. The cash returned from top insurance companies can be quite attractive in comparison to normal savings or fixed deposits.

These days, insurance agents often encourage you to buy policies that combine both life insurance and investment components. The portion of the premium used to pay for units in the investment fund varies, but life protection coverage is usually a small component. The range of available investments are managed by professionals, and similar to investing with a fund management company, the available portfolio coverage can be both local and international funds with the flexibility to switch in and out of the funds offered.

As you develop your skills and expertise with basic investment products, investing in shares will probably be next on your radar. We will discuss this category of investment in more detail in later chapters because you will need to hone in on and develop specific investment and trading skill sets. With advancements in technology, trading in shares is now easily available to the masses and any retail investor can trade in most developed stock markets around the world.

Investing in shares means that you are a shareholder of the company whose shares you are buying. Being a shareholder entitles you to receive dividends, bonus issues or priority to warrants and rights issues. With shares, you have a platform to invest as well as to trade—investing can generally be defined as holding the shares for an average duration of five years or longer, while trading involves buying and selling the shares within a short period of time ranging from a few months to just a few minutes.

Bonds are a form of borrowing by governments, financial institutions or companies seeking to raise funds from the financial markets. They are also known as fixed income securities because a fixed interest rate—more commonly known as a ‘coupon’—is paid to investors on a regular basis throughout the term of the bond. In some cases, coupons are not offered, but the bond is sold at a discount value of the face value (or the principal amount). These are called ‘zero-coupon’ bonds. Upon maturity, the investors or bondholders are paid 100% of the face value (principal) by the issuer of the bond.

Buying bonds is usually regarded as a good alternate investment and fixed income source to counter the volatility of the stock markets. However, like any investment product, it is important to select high quality bonds to safeguard your long-term investment. In the bond markets, each bond yield (that is, the total return including coupons) is linked to the credit quality of the issuer (or the risk of default). In most cases, from a local market point of view, the highest quality bond is usually associated with government bonds while corporate bonds are regarded as relatively lower in quality. However, when comparing bonds across international markets, corporate bonds may have higher credit quality than government bonds depending on the assessment by independent rating agencies.

Funds pool money from investors to buy into an investment portfolio of assets that can consist of a mixture of shares and fixed income securities or a global selection of shares. These funds are managed by professional fund managers and are ideal for investors who would like to have a diversified pool of assets and/or do not have time or the means to actively monitor their investment portfolio, or have limited access to the markets.

To invest in a fund, investors purchase units that are priced based on the fund’s market net asset value divided by the outstanding units. As such, these funds offer investors a cheaper way of purchasing a selective class of assets. This is a good way to start a diversified portfolio while you learn or build up your portfolio. However, as the portfolio is professionally managed, there are usually higher fees such as management, subscription and switching fees involved.

Many investors see investing in real estate, be it residential or commercial property, as a primary long-term goal. However, due to the high initial upfront costs and expensive mortgage payments, it is usually out of reach for many young and lower income investors. In big cities such as New York, London or Tokyo, or land-scarce countries such as Singapore or Hong Kong, property prices are known to continue rising in the long term, making it a prime investment target.

Although governments adopt cooling measures ever so often to tame rising property prices, most properties (if not restricted by a lease period or government controls) will usually appreciate in value and returns on rental yields can be rather attractive, especially in prime districts.

Generally, the commodities that come to mind for most retail investors are gold, silver or other precious metals in their physical form, over-the-counter (OTC) commodity markets or through exchange rated funds (ETF) in the stock exchange. More experienced investors can opt to trade in other commodities such as oil, rubber, coffee and wheat.

Gold is considered to be a safe investment haven during times of economic turmoil and as a reserve to support the value of the country’s foreign exchange currency. In Asia, we also view it as a symbol of wealth and as a gift for special occasions. As such, even though the price of gold has declined since its peak in 2011, the demand for gold in countries such as India and China has not waned. For the older generation and retail investors, gold is still a worthy long-term investment. In recent years, more banks and other financial institutions now offer services for investing in commodities, particularly gold accounts.

As with all investments, there is always an element of risk involved. Do not believe anyone who tells you that your investment is risk-free. As mentioned earlier, even holding cash itself is subjected to the risk of devaluation or reduced purchasing power due to inflation. Although there is the misconception that your bank savings deposit is safe, the truth is that when a bank goes into bankruptcy, only the portion of your savings that is covered by insurance will likely be returned to you. The recent global financial crisis has clearly demonstrated how many Americans and Europeans lost their savings as banks collapsed.

This is why financial advisers will always ask you to diversify your investment portfolio. Remember that when the possible returns are high, the associated risks are also high. For example, although trading activities such as shares and foreign currencies can generate unlimited profits, they can also wipe out your entire investment and more. In the next chapter, I will discuss how to safely chart your course of investment to enhance your returns.

1 An overnight interest rate which depository institutions actively trade balances held at the Federal Reserve.