In this chapter, we will discuss three popular investment assets that are commonly considered to be readily accessible means of wealth creation, as well as a large secondary market to facilitate trading and/or a stable long-term investment that can be liquidated in times of need. They are:

1. Shares Trading

2. Real Estate

3. Currency Trading (Foreign Exchange)

The guiding principles required to successfully unlock the wealth of these assets or to maximise their value can be adopted to other classes of assets, such as commodities, structured financial products and even specialty items. That being said, whether you intend to trade or hold assets for the long term, the general properties of a good investment or tradable asset are:

• Value Creation—Where the purchase price is always lower than the selling price.

• Accessible Trading Platform—There should be a trading market to sell the product, such as a stock exchange, auction house or even an online platform.

• Future Demand—Where the asset class does not disappear overnight.

• Regulated—There must be established regulations and guidelines set by the government or by a recognised legal establishment.

There are numerous books about each class of asset and it is not our objective here to drown you with technical and trading details, but to highlight the key factors and how to use it to your advantage. For example, having an understanding of share trading gives you a fundamental idea of how to apply strategies to other over-the-counter products. Similarly, foreign exchange trading provides insights as to how structured financial products can be applied and investing in big ticket items such as real estate can applied to other fixed assets or specialty assets.

Whether you call it stocks, equity or shares trading, what you are doing is simply buying or selling a piece of a company through a stock exchange. Many rookies tend to overlook that fact that by buying a share in the stock exchange, you automatically become an owner of the company. This is unlike trading in forex, commodities or bonds, since you have now a say or voting rights as to how the company is to be managed. Of course, there are variations in terms of special investment products being offered by the stock exchanges, such as EFTs (Exchange Traded Funds) or warrants whereby you buy based on the performance of an index or the option to buy into a company at a pre-determined price at a fixed exercise date instead of owning a voting right in the company. However, these investment products represent a small percentage of the market volume. Shares trading is the first choice for most of us who are looking to set up a trading investment portfolio. Why? It is easy to learn the basics and it is a safer form of investment trading for most newbies.

Let’s take a look at the fundamental characteristics of a stock market:

Trading in stock markets is primarily about investing and taking partial ownership of a company that is listed on a specific country’s stock exchange. The share price is generally a direct reflection of the perceived value of the company by its investors in terms of its profitability, future prospects and earnings and financial status. Sometimes, external influences such as market research reports by independent financial analysts or market rumours can easily affect the value of the share price. Unlike currency trading, which is dependent on a country’s economic and monetary policies, or commodities trading, which is dependent on world demand and supply, shares trading is all about the company and the environment it is operating in.

When a company is listed on a stock exchange, it needs to meet stipulated exchange and regulatory requirements. Any listed company in major markets has to be transparent with its corporate governance and financial performance, and submit independently audited financial accounts and annual financial reports to its shareholders. Through these, investors are given some assurance or protection and are able to make an informed decision before committing their finances.

The market liquidity in developed and most developing countries stock exchanges is high, making shares trading a highly preferred investment platform among professional and amateur investors. The average daily trading value of the world’s largest exchange, the New York Stock Exchange (NYSE), in 2013 was an estimated US$169 billion. Even a small exchange such as the Singapore Stock Exchange has an estimated average daily trading value of over US$1 billion. Since investors can buy a single share or a single lot of shares (a lot can be multiples of 10, 100 or 1,000 shares) at relatively low prices, you generally don’t need to invest a huge amount of money to begin trading.

Every stock exchange has its own official operating hours, and this break allows novice investors or traders to strategise and reflect on news that may affect the company that you have or plan to include in your portfolio. For most retail investors, shares trading is usually for long-term investment and not about gambling. So learn to master your local market before venturing forward.

Professional or more seasoned traders may want to take advantage of pre-market or after trading hours, or even have full access to multiple stock exchanges in order to virtually trade around the clock by switching from one stock exchange to the next in different time zones. When the Asia markets closes, for example, the European markets open and the US markets follow suit a few hours later.

These days, equity trading can be easily done via personal devices such as mobiles, handheld tablets, laptops etc. and you don’t necessarily need your brokers to close the deal for you. The information that you need, especially if you are trading in domestic markets, is in real-time and you will probably be able to get it and react faster than through your brokers.

The introduction of technological interfaces has dramatically changed the trading scene and real-time information is readily accessible for you to make better time-sensitive decisions. Annual company reports, market research reports and even investor forums are just a click away. This is one reason why there is a growing trend of younger investors coming into the markets and trading with such confidence.

These days, the major difference between retail and institutional players is the size of the trades that are made. However, the advantage that institutions have is marginal in terms of realised profit percentage so long as you keep up to speed with your homework on your target companies.

You don’t need to know about every company listed in the stock exchange in order to decide which shares to invest in. Thankfully, most major exchanges have identified a list of blue-chip stocks (named after the blue chips in poker, which have the highest value) that are generally considered to be quality, stable and safer shares to hold for long-term investment as they can withstand the cyclical nature of markets better than most shares.

The most popular index for US blue-chip stocks is the Dow Jones Industrial Average, which tracks the price-weighted average of 30 stocks regarded as leaders in their industry. Even the Singapore stock exchange, the Straits Times Index, has its own 30 blue-chip stock index. These blue-chip indices are the barometers of corporate health in their respective countries.

You don’t have to buy the most expensive or cheapest blue chip if you want to start your investment portfolio. Instead, you can narrow the list to a particular business sector. For example, you can segregate shares into various industries such as financial, real estate, medical or food and beverages, etc. Decide which sector you are an expert in, perhaps you might even link it to the industry in which you work. This is the beauty of investing in shares, where you have a wide selection and varying risk levels to choose from.

Investing in equities is not just about an appreciation of share prices to increase the value of your portfolio. Capital gains can come in the form of dividends, bonus issues, rights issues and even the issuance of warrants.

In 2013, it was estimated that Apple Inc. had been hoarding a cash reserve in excess of US$145 billion. Its major shareholders have been lobbying for the cash to be returned to its shareholders as dividend, so as part of its capital return programme following an impressive September quarter results for the group, the company announced a dividend payout of US$3.05 per share in November. Dividend payment for some companies can be a regular exercise, and given the low savings rates that banks now offer following the financial crisis, you can earn a better return with shares as top companies can declare annual dividends of 3% to 5%.

In addition to dividends, the value of your portfolio may be boosted by the issuance of bonus shares, for example one bonus (free) share for every 10 shares held. As companies may need to raise funds for future investment plans or to repay existing debts, they may also sell shares or warrants (an option to exercise the right to convert to shares at a future date) at a discounted price to existing shareholders through a rights issuance. This is why investing in shares can be so appealing—when you are able to balance your portfolio correctly, there is added value on top of price appreciation.

Given the numerous books on ‘guaranteed’ investment strategies or seminars by self-made millionaires who made it overnight just by trading, many novice investors are confused as to where and how to begin investing in shares. It is important to know that many factors will influence the success or failure of your investment. There is no single magical strategy that guarantees success. If that were the case, we could all sit back and simply apply this strategy to make our millions. Before plunging in to create your portfolio, it is useful to decipher the complex web of information by understanding the ways in which you can invest.

The low-risk route is one of the most popular recommendations for new investors to take. The investor selects shares of companies that are deemed as to be ‘safe bets’, such as well-established companies with large market capitalisation and a proven performance record. Shares regarded as blue chips—well-known international companies such as Apple Inc., Singapore Airlines or Coca-Cola, for example—will often be the preferred choice. However, most blue chips can be expensive in relation to general shares, and the slow process of accumulating the shares and realising a meaningful return is usually for the long term.

Other types of ‘safe’ shares are defensive shares that do not fluctuate much during cyclical periods of the economy, such as utilities, medical or transport. Due to the stable nature of these businesses, the share prices don’t increase much. These defensive shares tend to be a safe haven during economic downturns, but the demand for them is often flat during economic growth. Their trading price tends to be range bound and you will seldom see volatile movements.

Lastly, there are shares that are not considered to be in the big league but have been trading for a long time and are considered to be safe companies due to their connection with their parent company, links to the government or their long-established name in a matured industry. So keep a look out for these ‘safe bets’ as companies that you can start investing with.

A Bloomberg report in December 2013 quoted an economic study in stating that “Warren Buffett isn’t just a great investor. He’s the best investor.” The study mentioned that “he has been rewarded for his use of leverage, coupled with a focus on cheap, safe, quality shares”.

Value investing is all about doing your homework to identify good quality shares that are ‘underpriced’. For example, an investor would focus on the quality of the company’s management team, whether the company has new products or innovation that can maintain its growth potential, a low price to equity ratio, strong balance-sheet figures and even dominance in the market.

Shares can sometimes fall under the radar or out of favour with investors during a crisis. During the 2012 financial crisis, for example, many top financial firms lost up to 90% of their value—such as in the case of Citigroup, whose shares were trading at the US$550 level but collapsed to US$10 levels when the crisis hit. Given its financial strength, it was soon trading above US$50 by 2013, i.e. at over 500% of their value. Another example of value investing is when Warren Buffett purchased shares worth US$1.2 billion in Coca-Cola in 1988, despite many Wall Street analysts being sceptical because of increasing competition in the industry and reduced earnings. By 2013, his holdings in Coca-Cola were worth over US$16 billion and the company was reported to earn approximately 20% higher profits than its competitors and gave good dividends annually.

Most new investors will usually focus on value investing as they will do their homework to minimise risks and get it right the first time. However, most of us tend to get overly confident and forego patience and careful analysis for quick returns instead.

New trends or technology can sometimes influence the way a company performs in the markets. For example, since the introduction of smartphones in 2007, Apple and Samsung have effectively killed off the competition from Blackberry and Nokia. When we notice a company’s potential with innovative products or revolutionary strategy, it is sometimes good to take a closer look at the company. In 2003, Apple Inc.’s share price was hovering around US$10. By 2007, with the introduction of innovative products such as the iPod and strong management under Steve Jobs, it crossed the US$100 mark. By late 2012, its share price surpassed the US$700 mark as the company continuously gained market share with innovative products such as the MacBook, iPhone and iPad.

In recent years, social media companies or technology-related companies such as Facebook, Twitter, Google and Apple are hot companies to invest in. These days, investors rush to identify prospective startup companies as the low share price can skyrocket overnight when the business is acquired or they create a revolutionary new product or business. Of course, in identifying growth companies you are also identifying companies that may also be threatened, as such you should also develop exit strategies to ensure that your portfolio is well managed.

An investor needs to thoroughly understand the sector in which he/she is investing because the share price in growth companies can be volatile until they successfully launch their product. The share’s growth cycle may be short, such as for Blackberry or Dell, so you need to monitor the company closely. Don’t worry if you are not an expert in every sector as there are research reports and market information that you can look into. The next hot item can be in the field of energy or even in medical research, as such it is important to not jump in until you have sufficient information to make an informed decision.

This method is used by day traders and speculators who buy and sell shares within a few minutes or a few days, or when it hits the set target price over a short period. It is all about trading rather than making investments. This is high-risk trading and experience is essential; many traders who have taken this route have lost large amounts of money when they misread the market. On the flip side, because of the speculative nature of the trade, you can also make a good return when the price is artificially pushed upwards.

Generally, small cap stocks or penny shares are favourite targets for speculators. You are trading on the sentimental aspect of the market and taking a bet that the price will not fall before you cash out.

Here are some common reasons why many retail investors are drawn to speculative trading:

• Affordability—the low price levels means that you can buy a sizable number of shares with a few hundred or couple of thousand dollars, instead of the tens of thousands that blue-chip shares may command.

• Higher percentage return from low prices—a one-cent increase on a $0.10 share represents a 10% profit but a mere 0.1% profit for a $10 share.

• Volatility—due to the speculative nature of these shares, the intraday price can fluctuate at higher ranges compared to more stable shares. For impatient traders looking to make a quick profit, this can provide the stimulus.

• Diversity—for a small portfolio, small cap or penny shares allow the trader to diversify the portfolio into different industrial sectors.

• Limited downside—since the share is already priced close to $0, psychologically we assume that there is no room to fall further. Although this a misconception (as small cap companies have a higher risk of going bankrupt or delisted ‘overnight’), traders find it to be a more acceptable risk.

Trading of this nature is not for newbies, low-risk takers or when you can’t take on such an expensive gamble. The temptation to make a fast and fat profit is enticing, but the flip side can be just as dangerous. Additionally, both fundamental and technical analyses almost never come into play—trading is usually based on rumours or so-called ‘hot tips’ that will drive the prices up or down.

As the term suggests, this is about buying into shares when the price takes a dip and slowly accumulating it or buying a few shares at certain preset intervals. Over time, you average out your purchase price to get a decent return based on the share’s current value. This is usually when you have identified shares that are relatively safe, steady and give a good dividend return, and buy some whenever the price falls or corrects from high levels. Blue chips or large capitalised companies usually fall into this category.

With cost averaging, you are not chasing the market and instead gradually parking your savings for long-term investing. Every company will have its ups and downs, so in a way you are pacing your investments. As a case in point, Warren Buffett bought his first 100,000 shares of Coca-Cola in 1988 and slowly accumulated the shares to 400 million by 2013. When you know you have a steady and stable share with low risk, averaging helps to build your nest egg.

When we don’t know where to begin or are too busy to monitor our investment portfolio, we can call in the experts, i.e. the fund managers, hedge funds, asset management or insurance companies. This is a ‘hands off’ approach where we leave it to the people with the expertise to select and invest on our behalf for a fee. Your contributions to the managed portfolio are to select the type of portfolio in terms of risk tolerance, business sectors, regional or global coverage, and/or category of shares (e.g. blue chips, mid-cap, etc).

Before you leave your savings to others, it is important to select a fund manager who has a good track record. There are many underperforming funds and those that perform below par against benchmark indices, so it is still important to do your homework. Most fund management institutions will also allow you to switch from one fund to another, so make use of this option to maximise your returns.

Successful stock market investing is about identifying good, stable companies with share prices that have good growth potential. However, it is easier said than done given the many factors to consider. Most investors look for shortcuts to success and are constantly on the lookout for the slightest advantage that will fatten our wallets overnight. We are hence quick to jump on any tips from friends or colleagues, or pounce on market rumours without a clear picture of what to expect.

This is considered to be speculative trading as mentioned earlier and it is definitely not for the faint-hearted. Even though we do not see ourselves as speculators, most of us would have, in one way or another, dipped into these high-risk trades to try and make a quick profit—and in doing so, would likely have gotten our fingers burnt.

Although there is no clear price level for penny shares, they generally refer to a class of shares from small-cap companies that trade at a relatively low price per share. In the US, for example, penny shares are shares under US$5, in the UK they are under £1 and under S$1 in Singapore. They are the equivalent of ‘junk bonds’, ultimately they are not a class of shares that institutional players would include in their portfolios.

For retail investors, penny shares are an attractive high-risk, short-cut route to speculate on in the hopes of striking it rich. Because of the low price levels, retail investors are tempted to purchase large lots of shares in the hope that a small movement in price, even a one-cent increase, can equate to a high percentage return. Although the price can escalate quickly, it can also plunge overnight and catch everyone off guard because there is no fundamental or technical support when the share price is artificially inflated.

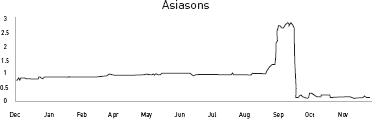

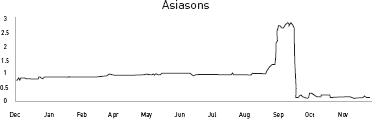

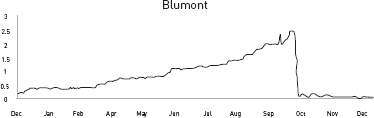

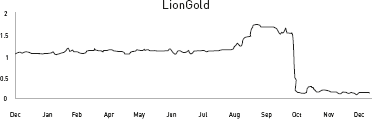

In the first week of October 2013, the Singapore stock market experienced the crash of three penny stocks—Asiasons, Blumont and LionGold—wiping out over S$8 billion in their combined market value within three working days. The share prices of these three companies fell by 96%, 94% and 87% respectively.

In retrospect, when we try to make sense of what caused the share price collapse, a typical scenario emerges:

• extreme price appreciation over a short time

• unrealistically high valuation

• business fundamentals do not justify trading valuation

• hyped-up retail sentiments

Until 2012, Asiasons, Blumont and LionGold were trading close to their initial public offering of $0.46, $0.148 and $0.14 respectively, or within a relatively tight price range. However, just weeks before the collapse, all three shares were reportedly trading at historically high levels. Both Asiasons and Blumont were trading at $2.84 and $2.54 respectively—in excess of 500 times their usual earnings—and even though LionGold was reporting an annual financial loss, retail interest was still driving it to new highs with every bit of positive news.

Trading penny shares is purely speculative, so do not expect any sound logic, especially when the price is inflated beyond reason. As with the collapse of the three shares, even though the price bubble had clearly formed, investors’ sentiments were blinded in pursuit of riches that the early speculators would have pocketed and bragged about. If a speculator had purchased Blumont shares in January 2013 and sold it at its peak price in September, he or she would supposedly have made close to 800% in profits. Blinded by ‘fantastic’ returns, speculators simply pile in with the intentions of a quick buy and sell, resulting too often in a ‘death trap’ for many novice traders.

Despite having to pay the costly price after the brutal plunging prices of many penny shares, many investors will resume trading in them after a brief cooling-off period. So rather than kid ourselves that we will stay clear of risky shares, it is better to understand the nature of these trades to increase our success rate.

Those who wish to try and speculate in penny shares have to closely monitor their stock picks before taking the plunge, and once you have taken a position, you must always stick to your exit strategy without hesitation. I have made great returns playing speculative shares as well as been burnt badly as a result of not paying attention to market signs or taking unnecessary risks.

My initial attempts at trading speculative stock as a novice were painful and expensive. The prospect of scoring a huge return is so enticing that it is difficult to resist jumping in when you see your friends and family making profits. Most novice traders, especially those who do not have the time to actively monitor their portfolio, will tend to rely on ‘hot’ tips. These tips may make you money initially, but the chances are that they will flip and drag you down when you don’t pay close attention.

A typical scenario is one where your tip is good and looks like it is gaining upward momentum, so you pump in more money and hope to reap further gains. However, speculators suddenly start to take profits and the price dips a little, but you hold on as you trust your source. A few days later, the price drops even further and results in a panic. As sell orders pile without warning, the mad rush for the exit leaves you with shares well below your purchase price.

Before jumping into any speculative stocks, you need to understand who is most likely to ‘influence’ the market. It is unlikely to be reputable financial institutions or fund managers, but rather a group or ‘syndicate’ of seasoned traders who have the financial muscles to push up prices to stir the interest of regular retail traders, who will in turn create a ‘snowball’ effect to sustain momentum until the target price level is reached. There is then a quick pullback to lock in the profits before the next move. If the regular retail traders can maintain a support level, the chances are that the ‘syndicate’ will push forward. If interest starts to wane, the ‘syndicate’ often steps away, leaving the smaller retail players to fend for themselves.

Sometimes, a simple word of mouth or well-placed ‘insider’ tip, whether it is innocently passed on through brokers or friends, can cause the market to react on the slightest up-tick in price. If the rumour is not squashed in a timely manner, speculators will take every opportunity to benefit from it.

Speculative shares often remain dormant or within a tight price range over long periods, until it comes under the radar due to interest in a related industry or an announcement of bigger players entering the industry or looking for potential mergers and acquisitions. This is when the major speculators will stir up interest to accelerate the price increase.

Getting in early when the price is low provides a buffer for you to react when the market turns negative. Most inexperienced traders chase the market even when the price has escalated beyond acceptable or risky levels, exposing themselves to potential loses. Remember never to chase the market; there will always be other opportunities to make a profit.

Over time, you will notice that speculators often adopt a ‘rotational play’ scenario in which they will focus on a few stocks, quickly ramp up the price and exit, before moving on to the next target. When interest momentum builds up, the cycle may return to the earlier group of stocks. So do not get greedy and chase the market even though you feel that you can make some money, because if basic fundamentals do not support the high price level, it will correct itself in time.

As most analysts would not follow up on speculative shares, information on them will be scarce. However, as they are public listed companies, you will have access to the companies’ annual reports and recent financial statements. This basic information will help you to establish a baseline about the company and a fair price value. Once this is achieved, you can at least track the company’s performance and react with more certainty than going in blind.

A play on a stock is usually sparked by a catalyst, such as:

• Positive performance or financial results.

• An injection of funds by a prominent investor.

• Rising purchase volumes.

• Rumours—As long as the rumour is plausible, speculators will try to benefit from it.

• Industry trends—There will always be economic trends that will produce favourites. Interest in oil and gas exploration focuses attention on companies in shipping building and oil rig construction, while increasing housing prices focuses attention on property counters.

• Interest in a related industry—e.g. if Apple or Samsung smartphones do well, its component suppliers will benefit from the attention.

• News reports from reputable sources—Whether it is news of a business venture into untapped markets or raising capital for a proposed new venture, as long as a positive spin can be made, traders will jump at it.

Success in speculative trading is all about setting realistic targets and not being drawn in by greed. Do not assume you can generate millions with one big bet, as seasoned traders know how to pace their entry and exit based on realistic expectations. Your success will ultimately be measured by your ability to close the trade with a profit. Even though there could be a potential of increasing profit margins by holding on, successful traders understand that locking in profits is more important than chasing profits that could easily reverse without warning.

The challenge is always to know when to take your profits or cut your losses, so do not rush the process as your fortune is never tied to one company. Traders are generally patient and learn how to read market volatility, particularly when to exit the market because they know they can re-enter at another time. When the risks are too great, there will be a pullback because a company’s value will always fall back to its fundamental value and not its perceived value.

This is traditionally the most preferred long-term investment that most of us aspire to acquire during our lifetime. Over time, real estate prices have been constantly appreciating and reaching new highs every decade or so, particularly in land-scarce countries such as Singapore and Hong Kong, or in prime districts within international cities such as New York or London.

Many working-class investors channel the bulk of their life savings to owning their first home before allocating any spare funds into other investment products. As investors move closer to their retirement and their mortgage payments are fully settled, the home becomes an even more important asset since it can either be sold to provide a comfortable retirement lifestyle or rented to provide regular income. Real estate provides a form of security, whether as a roof over our heads or a source of income, which makes it a prized and often sought-after asset.

Real estate financing is one of the retail banking industry’s key revenue generators. Just look at newspaper advertisements or attend a property launch and you will notice how competitive banks are in offering home loan packages to credit-worthy clients. Such easily accessible financing supports home ownership and fuels a vibrant property industry and we investors can derive income from rental yields or active resale activities.

When there is financial liquidity in the market, rest assured that market forces will create the momentum to fuel the speculation or demand for real estate. Many prominent billionaires such as Donald Trump or Li Ka-shing are known to have built their wealth from property investments. They did not have millions in cash to start with but were sharp enough to maximise bank financing to their advantage to fund their property investments.

Unlike shares or currency trading, real estate has a hefty price tag and associated legal paperwork, so do not expect to make a quick profit overnight. That having been said, because a detailed and careful selection process is normally involved before purchasing property, buyers do not jump in or out recklessly and have a preconception of what they want to do with their investment. This means that investors are not subject to sudden steep price volatility spikes in a very short timeframe as the market reaction is spread over a period of time.

Although there are few assets in which governments would regularly intervene, real estate is high on their radar, especially to prevent housing bubbles or negative equity from forming in order to prevent an economic or social crisis. This helps to maintain a gradual increase in the asset value in the long run. We have witnessed the negative effects on property prices during the Asian financial crisis in the late 1990s and the effects of the 2008 financial crisis in the Western countries, and how they struggled to recover over time. As such, governments are now more willing to be proactive to stabilise the market, which ultimately protects investors.

For example, as Singapore emerged from the 2008 global crisis, escalating property prices saw even its public housing resale prices crossing the $1 million mark. With a potential crisis looming, the government had to implement up to seven cooling measures over several years to prevent a ‘hard landing’ and to stabilise the market.

One indicator that economists use to assess the health of the economy is housing data. An increase in new housing or existing home sales denotes economic growth as consumer confidence picks up and this tickles down positively to other sectors. As the economy grows, it is logical that property prices and even rental yields will rise too, which means that real estate investments are seen as protection against inflation as they are closely correlated. For example, if labour and material costs increase, property developers will mark up their sales prices to cover these additional costs, which indirectly lifts existing property prices and investors can benefit from the higher prices. In any case, when new price levels are firmly established, the general industry will follow.

Those who own real estate will always try to justify increasing value or rental yields with the slightest hint of inflation, and this is one reason why it is a preferred investment asset because it plays on general market sentiments and is linked to inflation.

As with most investments, today’s technical advancements allow investors access to very comprehensive information about the real estate sector in order to make an informed decision. But unknown to inexperienced investors, property agents can sometimes have access to information on transacted deals or rental prices, down to the apartment unit. Agents may not share all the available information due to the commission-based fees they earn, so do ask as many questions as possible.

There are also plenty of independent valuations and research readily available to the general public, so do use these to your advantage. Even using Google Maps these days can provide an incredible overview of a property’s surrounding area. This valuable information was not available a decade ago but is a standard tool today.

As the world becomes increasingly integrated and information is more accessible, retail investors are no longer restricted to the domestic market, but can confidently venture overseas to seek out better and higher-yielding real estate investments. Investing overseas can have added advantages such as lower taxation, lower prices per floor area or higher rentals, as such investors have greater incentive to seek new markets. For example, Asians—and especially the Chinese—have taken advantage of depressed overseas property prices in America and Europe in recent years as their domestic markets become increasingly more expensive. That having being said, many foreigners took advantage of China’s cheap real estate market in late 1990s and early 2000 and made significant investments.

For most of us, the thought of investing in real estate conjures images of a simple house or apartment to provide a roof over our heads, and it being sold over time to meet financial needs. As we learn to appreciate real estate as an investment that can provide a decent cash flow or long-term financial return, we will see that it offers investors a wide selection to choose from, be it land for development or agricultural use, residential housing, commercial and industrial development.

Within each category are several subcategories for investors to consider. Residential properties, for example, can include new developments that may take two to three years to complete, newly completed projects and resale properties. Investors can also choose from different types of residences, such as bungalows, terrace or apartments.

A good incentive to invest in real estate is that you do not need be an expert in every segment of the industry. Identifying your niche area and specialising in it will often be sufficient because of the size of the industry. However, given the high investment costs for real estate assets (unlike investing in shares or financial products where the portfolio can be spread among different sectors), it is best to develop expertise in a niche area to build up your cash base.

As with shares, you need to establish a starting point and have the required training and tools to successfully invest in real estate. Every asset class has its challenges and our primary objective is to understand how to safeguard our investment and maximise the returns.

The key areas that we should consider are:

• Adequate Financing

• Select a Niche

• Location

• Generating Income

Given the large price tag involved with real estate investment, access to adequate financing is a key determinant to success or failure. Payments for most real estate are conducted progressively—this involves making an initial down payment to reserve the investment, followed by payment on signing of the contract and final payment on handover of the key and legal documentation. Buyers seldom initiate full cash payment using their own funds and instead prefer to borrow money from the banks, especially when interest rates are low.

Unlike shares or financial instruments that require settlement to be completed immediately or over a few days, housing loans are usually for a long duration of between 10 to 25 years, which means that the buyer does not own the asset until the final payment on the mortgage is made. Failure to meet regular payments will result in the financial institution exercising its right to repossess the property and auctioning it to recover the outstanding amount owed.

One of the common mistakes made by investors is over-leveraging themselves or underestimating the financing needs to cover themselves over an extended period of time. Although there is an existing market of buyers and sellers, the reality is that real estate investments are considered illiquid. This means that even though the buyer intends to flip the asset, real estate transactions often don’t happen overnight. Without a cash buffer of anywhere between six months to a year to meet the monthly payments until the sale of the asset, there is a high risk of the property being repossessed.

The diversity of real estate is very attractive for investors. Investors can purchase land or tear down existing housing to focus on new property development or even transform the parcel of land for agricultural or commercial use. In addition to land, there are other general categories of real estate that we are familiar with, such as residential, commercial and industrial properties.

When purchasing real estate, most investors tend to overlook the fact that each category requires different knowledge and/or expertise, and there is no one formula for success. There are various types of real estate investment, from simple public housing to office space for commercial activities, and from industrial sites for manufacturing to storage. Each sector has its own unique requirements and unless the investor is well acquainted with the respective sector, it is advisable to hold off such costly investments. For example, an investor who plans on being a developer requires a range of skills (or at least access to such skills) such as architecture design, construction and marketing. Although not many investors would be able to start at this level, those who succeed as developers stand to benefit substantially in financial terms.

When choosing between investing in developed residential properties versus commercial properties, the key considerations such as unit price, location, neighbouring amenities, infrastructure, design etc. can be very different, especially when your target buyers or tenants have differing requirements. The macro economic factors may also have a different impact on each category. For example, the economy may have hit a downward cycle leading to a fall in office rental yields, while the residential sector may be on an uptrend as there is a push to increase the population.

Other factors such as the relocation of industries to another country due to costs or a refocusing of the government’s foreign investment strategy can and will have serious financial consequences on the investment. Unless you have deep financial reserves, most investors do not diversify from their area of expertise and comfort.

When looking for rental housing or even to buy a home, it is common for someone to easily view 20 properties before making a decision. So as an investor, you do not want to be stuck with a property that does not make the preferred list. The value of the asset is always driven by demand, and knowing the buyer or tenant ‘hot buttons’ equates to better odds of closing the deal. This is one reason why it is important to identify and hone your expertise in a niche segment.

Never assume that buying real estate will equate to a reasonable profit if it is held over the long term as the general perception may be. It still requires homework, due diligence and prudence. When buying a residential property for investment, you need to consider the following factors:

• Target market—Is it for singles, students, professionals, small-sized families, families with young children, etc.?

• Location—Does the direction in which it faces offer a view or privacy? Is it near amenities or the target tenant’s place of work or school, etc.?

• Type and size—Is it a studio apartment, two- or five-bedroom apartment, a house, condominium, etc.?

• Rental yields—Does it generate the expected returns?

If you buy into a property rumoured to be redeveloped from residential to a commercial property, for instance, are you able to independently verify its viability? Which means you need to know the following:

• Zoning—Has the current site been zoned as strictly residential or does it allow commercial development?

• Expected timeframe for redevelopment—Rumours may not be reliable, so how long is your holding power?

• Type of commercial activity—Is it a basic office complex or specialised centre for medical or research facilities? Does the area meet the minimum criteria for redevelopment, such as height restrictions or traffic access etc.?

How often have you heard experts say that the secret to successful real estate investment is “location, location and location”? Most real estate in prime districts command the highest resale value or rental yields. That does not mean that your entry point must be in prime districts, but neither would you look into rundown or depressed districts.

An address in a prime location does not mean that it is a prime investment target. You will need to visit the site to assess its precise location, because you could be buying a property that no one is interested in for various reasons. The property could be facing another unit, which means there is no privacy or view, there could be a busy highway preventing the opening of windows or resulting in it being noisy throughout the day, or the unit could be near a power station that may interfere with electronic devices.

The same logic could apply in non-prime districts where quality assets could exist, such as substantial human traffic or proximity to public transportation. This is why property in the same area or even same floor of a building can command vastly different prices. Over time, an area can lose its prime status and non-prime districts can be the next hot site. For example, in the 1990s, the city of Shanghai started to redevelop Pudong from agricultural land into a financial district. People initially disliked moving to this new district as it did not have the infrastructures and comforts of life across the river in Puxi. However, today Pudong has transformed itself into a bustling district and real estate prices have skyrocketed to command one of the highest per-square-metre prices in China.

In your search for an ideal location, do take note that every real estate category commands its own unique set of requirements. For example, if you are targeting young families with children, the value of your investment will be increased if it is near popular schools, within a family-friendly estate, located near a school bus route or within easy access to public transport and supermarkets, etc. If your target is retail food outlets, high pedestrian traffic is important, as well as a noticeable shopfront with easy access for both patrons and suppliers, and it should be near public transport or have ample parking facilities.

Always put yourself in the shoes of your potential tenants and anticipate their ideal requirements. If your intended property cannot match your standards, your potential tenants will be unlikely to consider it.

When we refer to an investment in this section, the property that you are buying should generate an income within months. Therefore, let’s exclude owner-occupied homes or properties that still have a few years to completion. Unlike shares or bonds where the capital outlay is relatively low, real estate investments can range from several hundred thousand dollars to millions. So unless you have a fat bank account or are fully paid up on the asset, any investment of this size must generate income.

The primary investment objective for ordinary investors is always to grow wealth at a steady pace. As such, the real estate should either be flipped within a reasonable timeframe or rented out to generate a decent income to cover mortgage costs. If the asset does not meet the basic criteria, it is best to consider other investment options.

A typical financial mistake made by the average investor is to assume that holding power will be sufficient insurance to ward off a downturn. But as we have learnt from the 1997 and 2008 financial crises, even the deepest pockets suffer casualties. Even property developers will often try to recoup their initial costs by selling proposed property launches before laying the foundation, and banks will never offer 100% financing on the purchase price of a property, instead they offer 70% or lower, plus full control on the title deed. If the professionals are covering their financial exposure, shouldn’t the average investor do the same? Rental income offers better security and the faster your debt is paid off, the less risk there is of losing the investment.

When taking the first steps to buy an investment, we always want to preserve and grow the capital investment. As mentioned earlier, unlike most asset classes that are purchased with your personal funds and you take 100% ownership immediately or within a few days, real estate investments involve the long-term borrowing of funds, thereby increasing the costs significantly. Hence it does not pay to have the investment waiting to be sold while you make payments each month to settle the loan.

The challenge when investing in property is not about whether it can generate rental income, because there will eventually be a taker if you set the rent low enough. It is about maximising the returns and contributing to the bottom line to release the financial pressure on yourself.

This is the most commonly used strategy to arrive at an average price range, be it for a piece of land or a developed property. Although it has its merits, it can also be misleading and potentially hide the reality of the current price levels if similar baseline comparisons are not used. As mentioned earlier, a property’s location, usable space, layout, etc. can adversely affect prices. Do not rush to draw a conclusion just because a neighbouring unit is rented below or above your asking price, until sufficient details are known. Although most rookies tend to rely fully on the real estate agent to set a price, there may be a conflict of interest due to the commission earned from closing the deal. Ensure that the agent can always support their recommendations with substantiated facts and not just word of mouth.

For example, a ground-floor unit is an important prerequisite for a bank to operate its teller services so as to provide convenience to its walk-in clients. Regular offices, however, often prefer a unit on higher floors. With this in mind, a ground-floor unit can earn a premium if rented to retail related businesses, while a normal office setup will probably get average rental income. Similarly, retail-related businesses that rely on walk-in clients dislike higher floors and will probably look for rentals on lower floors.

By knowing how to use the fundamental principles of supply and demand, you can directly influence your rental prices; that is to say, stir up sufficient demand for your property and be able to set a higher price level. For instance, during my banking career, the supply of good ground-floor units that met retail banking requirements were usually limited, therefore it was not unusual for us to offer a premium price to secure the property. Similarly, expatriates (especially those with children) in a new country are often more willing to pay more for housing in a better location, and the price variation can be significant.

What happens with a hot property market launch that attracts more speculators or investors rather than first-home buyers? Firstly, with high demand it is the developer that benefits while buyers pay high prices as everyone is chasing a limited supply of units. Secondly, when the units are available for resale or rental, the market is suddenly flushed with an oversupply, which is also bad for investors as prices will fall. This is why we cannot overemphasise the importance of studying the market demand and supply in order to make a timely investment decision.

Every investment has a cycle and understanding the various stages can allow the investor to adopt the appropriate strategy. Typically, the real estate market cycle will comprise of:

1. Confidence—Where overall confidence in market sentiment is positive, there is an increase in prices and the demand for new and existing home sales show a healthy gradual increase.

2. Growth—Sellers start to dictate the market and cash-over-valuation pricing shows that buyers are willing to offer higher amounts to secure the property. Generally, buyers first target prime districts and the demand accelerates before spreading outward to the suburbs.

3. Peak—The property bubble is near busting point, be it for land, developed properties or rentals, and prices start hitting new highs for no obvious and sustainable fundamental logic. Property launches or land sales become the focus of attention, and supply is limited.

4. Decline—The month-on-month price trend shows a sustained downward trend, speculators start to offload their holdings and developers start offering significant discounts to lure buyers. Banks show increasing foreclosures or restrict the level of financing. Fear starts to kick in as demand falls while the market sentiment takes a nosedive.

5. Bottom—Prices have reached rock bottom and serious investors start to mop up the excess supply. Bargain deals are plentiful and buyers dictate the market.

Given the recent increasing frequency of global crises, the real estate cycle now tends to be shorter and governments and investors alike are taking a more proactive stance to avoid bubbles from unexpectedly bursting. Investors who derive rental income from their properties need to know when to take advantage of the market being in its confidence and growth phases, while pulling back sufficiently in the decline or bottom phases to ensure that there is reasonable cash flow to tide over the difficult periods and not to leave assets idle.

Regardless of whether you own property in the residential or commercial sector, it is important to find a good tenant. Commercial landlords always prefer to lease their property to major well-known companies, including having them as anchor tenants. Similarly, residential landlords prefer to lease to individuals from reliable companies where the companies act as guarantors.

In financial terms, a good and responsible tenant equates to timely rental payments, which is an important component of balancing cash flow. While late payment is not an immediate justification for eviction or termination of the lease, it does cause unnecessary inconvenience. Any subsequent deterioration of the tenant’s financial standing can result in unpaid rent or additional costs to replace the tenant.

Having been both a leasor and leasee in my banking career and as an expatriate, I have noticed that experienced landlords often conduct detailed background checks and are selective about which and what type of tenants they are willing to accept, and are willing to compromise on higher rent if necessary. During the Asian financial crisis in the late 1990s, many of the small companies in the 50-storey complex in which my office was located were either forced to relocate to reduce costs or defaulting on rental payments, while the anchor tenants were steadfast and weathering the crisis well (in terms of rental obligation). Having good tenants was significant in ensuring the building management could meet its own financial obligations.

Trading in the foreign exchange markets was once a field reserved for suited bankers in their looming skyscrapers, casting a dark shadow on the individual investor. Fortunately for you, technology has levelled the playing field for the little guy. With the technological advancements over the past two decades—from faster computing speeds to the introduction of tablets and multifunctional smartphones—individual investors now have a fighting chance of performing as well as their peers in banks and other financial institutions such as global macro hedge funds. As the tools of the trade have become more accessible and user friendly, foreign exchange trading (commonly referred to as ‘forex trading’) is gaining popularity among the younger generation as well as seasoned investors.

Perhaps it is this apparent association with technology and the abstract nature of trading a country’s currency for another country’s currency—as opposed to trading shares of some company for currency—that a demotivating misconception has developed; that is, forex trading is only for bankers and financial geeks. But, this is by no means true. Many retirees and even housewives have joined the frenzy that is the forex markets. With the right tools, information and training, the individual investor can trade confidently and competently in the forex markets.

Over the past five years, the daily trading volume has increased by over 20% to today’s astonishing amount of US$5 trillion across the world. Unlike some investments that are country specific (such as shares and properties), forex trading is accessible on a global platform, 24 hours each business day, where financial institutions, corporations and private individuals pit themselves against one another to maximise profitable returns.

Forex differs from the other asset classes that we discussed earlier in another critical way. The style of trading that occurs in the forex markets is different from the trading style in the stock markets. Forex is purely about trading. Even though you can buy and hold different currencies for a period of time, the time horizon of our investment is almost never for the long-term (unlike shares, real estate or gold).

With improved technology and more data, today’s investors are more educated and exposed to a variety of forex investment products. They are more inclined to trade for quick profits than to hold out for the long term. As such, there is a willingness to speculate, or, in other words, trade in more risky classes of shares or to flip properties for a quick profit. As the younger generation is exposed to more crises and uncertainties in recent years, there is a growing urgency to build their nest eggs faster and earlier than ever. This is why forex popularity is catching on.

Do not let the big numbers and technology scare you away from a very profitable asset class. The first step to dispelling the misconception that forex trading is only for elite traders and financial geeks is asking a simple question: what is money really worth? After all, it is just paper! But, before we can answer that question, we have to ask ourselves an even simpler, more fundamental question: what is money? As you read that question, you might be thinking, “Well, money is money.” Such a response is not uncommon to those just entering the forex game and it shows how little we think about what money actually is.

Let us consider ‘what money is’ by first thinking about ‘what money does’. The most obvious thing that money does is serve as an effective means of exchange for trading goods and services. Just consider how difficult life would be if every purchase you make requires you to barter a good you own or a service you are able to provide. From a tangential point of view, money also serves as an effective means of measuring the relative value of goods and services. Imagine if you had to measure the value of an Apple computer in apples and the value of apples in repairing your computer or making apple pies.

So far, we have been thinking of money in contrast to goods and services. That is, we have been looking at money as though it is not bought or sold like goods and services. But, money too is bought and sold just like any other good or service. In fact, money is no different from the stocks and bonds bought and sold in financial markets or even the cheese and crackers in supermarkets. But aren’t stocks and bonds or cheese and crackers bought with currency, or conversely, sold for currency? How then could money be similar to those things? Is money nothing more than fiat currency—paper that we just say is worth something?

It is a bit confusing, but bear with me here. Just like cheese and crackers, money too has a price. The key difference is that while the cheese you buy at the supermarket is bought in, say, Singapore Dollars, the Singapore Dollars that are bought in the foreign exchange markets are purchased in, say, Chinese Yuan. To generalise, the price of a given country’s money is simply the amount that someone is willing to sell it for another country’s money. That is, in the forex markets, the price of money expressed in terms of another country’s money is the foreign exchange rate. Moreover, money serves as a means of storing value for future use. As you will see, it is this realization that money stores value for the future—not forgetting that its value may change in the future—that will help us develop a way of thinking about how to approach trading forex in the markets.

So, we now know that money is similar to goods and services in the lexicon we use to describe its characteristics. Unfortunately, the similarities in terminology end here, which makes it a tad confusing. Fortunately, the concepts are not radically different.

The core of any strategic forex trade is the concept of appreciation and depreciation. Going back to our original example, it is uncommon to think that the dollar we used to buy some stocks has appreciated against the stock itself. It simply is not how laymen think about trading stocks—or cheese, for that matter. A direct corollary of the idea of money having a price is that money is traded in what are called ‘currency pairs’. Rookie traders may take some time to understand that forex trading involves the trading of currency pairs, i.e. the buying of one currency and selling of another. This is an important concept as a currency can be appreciating against one currency while depreciating against another. The unique feature about trading currency pairs is that it allows traders to profit from the appreciation or depreciation of the currencies.

The price of the Singapore Dollar, for example, is expressed in terms of US Dollars, which means that, at the same time, the US Dollar is also expressed in terms of Singapore Dollars. But while currency A is appreciating against currency B, currency B can be depreciating against yet another currency C. A more concrete example regarding the Eurozone crisis can help clarify this easily:

Suppose that you have 1 US Dollar (USD) and would like to trade it into Euro (EUR). A simple web search of the current exchange rate on the financial news websites states that the exchange rate is USD/EUR 1.3333. That is, traders in the forex markets are willing to trade 1.3333 EUR for your 1 USD.

When sudden negative economic news hits Spain, resulting in an even bleaker situation for the Eurozone, traders that are holding EUR positions in the forex markets now find the EUR less attractive and decide that they no longer want to hold it. They want to sell, but given the Eurozone crisis, traders with EUR positions in the markets decide they are going to have to accept less USD for their 1 EUR. The exchange rate has dropped from USD/EUR 1.3333 to USD/EUR 1.3332. This is a nominal appreciation of the USD against the EUR. In the lexicon of forex traders, the USD has become ‘stronger against’ the EUR. This is because for every 1 EUR, you will get less USD in exchange; the EUR is not worth as much relative to the USD.

Yes, the terminology can get a tad confusing. Although the exchange rate for the USD has fallen against the EUR, traders say that the USD has become stronger. Typically, one would associate anything stronger with rising, and not falling, prices. But when we state that the exchange rate is USD/EUR 1.387, we are expressing how much USD we can buy for EUR 1. So a drop in the USD/EUR exchange rate would mean that you are now able to buy less USD for EUR 1, which is in line with the USD getting stronger against the EUR.

Conversely, how much USD can EUR 1 buy? The answer can be found by taking the reciprocal of the USD/EUR exchange rate, which is approximately EUR/USD 0.7500. We can thus conclude that when the USD gets stronger or appreciates, the EUR by definition gets weaker or depreciates against the USD.

The tricky thing about forex trading is that you don’t often get such a clear picture about what will happen to a given exchange rate. News will rarely be so isolated. Instead, there will be several other tangential news stories that will only add noise to an already noisy problem. This stems from the fact that there are many different currency pairs—the USD has perhaps the most currency pairs given its perceived safety. Going back to our earlier example, while traders may be trading USD for EUR in one part of the world, traders in other parts may be trading USD for the Chinese Yuan (CNY). Before the Eurozone news was announced, there could be sudden news concerning a negative trade imbalance between America and China that caused the USD to depreciate against the CNY.

This is why forex trading seems so difficult to the layman investor and yet is so profitable. It requires careful analysis of the presently available information and deciphering what is important and what is merely noise. Amid the chaos, one must execute a profitable trading strategy. But you do not need to be a top trader or financial geek to do so; all it requires is clear and structured thinking and a contingency plan.

As mentioned earlier, a market’s liquidity is dependent on the volume and speed of execution of trades. With an average daily trading volume of US$5 trillion, the forex market is considered to be a highly liquid market in which trades can be completed in a matter of seconds. This high turnover allows traders to easily enter or exit the market and thus equates to quick profits or loss.

For example, a trader sells the Japanese Yen against the US Dollar in anticipation that the Yen will weaken with the Japanese government increasing its stimulus package, and to buy back at a profit later. However, if the Japanese government decides to eventually delay the stimulus and the Yen strengthens, the trader will want to buy to cover the position as quickly as possible to minimise potential loss.

In addition to allowing for a quick exit and avoiding being ‘stuck’ in a potentially risky position, a highly liquid market is less likely to be subjected to large price volatility, thus giving investors time to manage their portfolio. Sudden large spikes in prices often lead to panic which in turn creates unhealthy speculation. As trading is on a global platform, there are more controlled price movements.

The forex market can be accessed 24 hours a day on any given business day. Unlike trading in shares, which depends on the trading hours of the respective country’s stock exchange, forex trading (especially when trading in major currencies), is not constrained to any country, time zone or trading centre. Trading can be done at your convenience because the currency market is continuously open. When Asia winds down for the day, currency traders in Europe take over, followed by American traders later on. This happens around the clock every business day, regardless of holidays or disasters that may affect a country.

This means that traders can react to and capitalise on breaking news the minute they are announced and there is no need to wait for the respective financial market to open.

Forex trading has been around for decades and each currency pair has historical trading trend patterns that can provide valuable insights (especially for those who rely on technical analysis). Such information can be effectively used to identify trading opportunities. Forex traders often rely on macro economic events that affect a country or global events to influence the exchange rates beyond the normal trading bands. Hence, in some ways, there is a degree of predictability with currency trends.

There is, of course, no guarantee of success based on historical trends, but unlike shares, the forex market is a global market where a single speculator seldom has the upper hand to influence exchange rates without the support of the big players or market makers. Therefore if a trend starts to gather momentum, it usually indicates that there is reasonable support by major players to create volatility.

In this section, we discuss the most basic type of forex deal—the FX Spot. This is when two traders enter a contract to exchange two currencies at an agreed fixed rate of exchange, called the spot rate. It’s called the ‘spot’ rate because the rate at which both parties agree to exchange occurs ‘on the spot’. Although the rate is settled on the spot, the payment of FX spot deals (that is, when money actually changes hands) is not settled on the date of the transaction but two business days later, which is commonly referred to as the spot value date.

Don’t let the terminology of a spot rate confuse you. The spot rate is actually the exchange rate that we have been discussing this entire time. In most cases, the exchange rates reported in the financial news are spot rates.

So how does an FX spot transaction actually work? Take for example an FX spot transaction involving two currencies, the US Dollar (USD) and the Euro (EUR), made by two traders across the Atlantic—an American trader who wants to sell the USD and buy the EUR, and his European counterparty (the trading party on the other end) who wants to sell the EUR and buy the USD. Both traders will agree on a spot rate and two business days later, the American will receive his EUR from the European counterparty, and the European will receive his USD from the American through their respective settlement banks.

The rate of exchange, or spot rate, is normally quoted in terms of the base currency (usually the stronger currency) and then the counter currency. In the above example, the EUR is the base currency and the USD is the counter currency and the exchange rate quoted is relative to one another with the base rate as 1, i.e. EUR/USD 1.3150 refers to EUR 1 = USD 1.3150. Notice that the rate is always quoted to four decimal places.

As you can tell from this example, the rate of appreciation is typically very small—barely an entire cent. This is indeed usually the case except for the occasional cases of high volatility. The possible profits—or the profit margin—for trading a single currency pair is usually low. Therefore as a trader you need to aim for a high volume.

It was mentioned that forex trading is purely about trading. As a trader, a core part of your job is to make expectations on what the future spot rate will be in the short run. The spot rate is affected, or in other words, determined by many factors, but it is easier to visualise it as being set by demand and supply forces.

Advancements in technology have made such an impact on the forex industry that even major financial institutions today are reportedly recruiting fewer forex traders and instead developing automated algorithms to assist with trading. These days, retail traders can approach any reliable trading brokerage company that offers forex trading platforms to start trading. You don’t need to be a computer expert to use the user-friendly systems that are available on multiple platforms and the sophisticated proprietary software usually allows you to simulate different trading scenarios and to backtest your assumptions. This puts you on a level playing field with the major institutions.

As bandwidth and internet speeds keep improving, we will no longer have issues accessing real-time information or subscribing to professional news feeds. As the world becomes more interconnected, so will our access to global information and events, which will affect our trading decisions.

Forex rates are not as volatile as shares and a small percentage daily change of 0.5% is considered significant. As such, trading profits are usually made with large amounts of money and/or with many transactions. However, retail traders do not need to have a six-figure amount in their account before commencing to trade. Many currency brokerage firms offer margin accounts, i.e. deposit a small amount and the brokerage firm will allow you to trade values up to 10 to 20 times or even higher. For example, a US$5,000 deposit may allow you to trade up to US$100,000 in value. To attract retail players, brokerage firms even allow small deals of several thousand dollars for major currency pairs.

The FX forward is a foreign exchange contract between two parties that is almost identical to an FX spot. The only difference is that the FX forward establishes a transaction date that is either 30, 90 or more days from the date the contract is established. In other words, the forward contract is no more than a simple spot contract with the transaction date pushed ‘forward’. The exchange rate at which the counterparties agree to exchange currencies on the future date is called the forward rate.

The benefits of such a contract are quite clear. The forward contract is an effective way of hedging against future downside exchange rate risks. At the same time, however, the forward contract also runs the risk of establishing a forward rate that is lower than the spot rate on the future transaction date. At the very least, the forward contract reduces uncertainty about the potential value of your future position while still weighing in on your expectations about future spot rates.

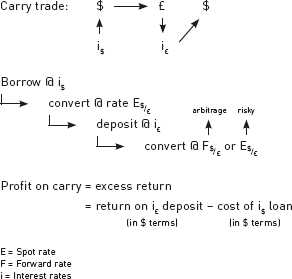

The forward contract is a key tool in what many forex traders in banks and investment funds use to implement a carry trade. The carry trade implemented using a forward contract is an arbitrage on interest rate differentials between two countries. Suppose that the deposit interest rates are much lower in the US than in the UK, making it desirable to hold British Pounds (GBP). The way to capitalise on this arbitrage opportunity is by borrowing money at the low interest rates in the US to invest in the higher interest rates in the UK. This involves four simple steps.

First, borrow USD at the interest rates in the US. Next, trade USD for GBP at the spot rate. At this point, you can either engage in a forward contract to ensure an arbitrage opportunity (i.e. removing exchange rate risk) by establishing a forward rate at which you will convert back to USD or you can use your forecast of the future spot rate. Then, you deposit the newly converted GBP at the UK interest rates. Lastly, you convert back to GBP either at the forward rate or the spot rate. This is depicted in the diagram below.

This trade is highly utilised by many forex investors. For example, the carry trade on the low interest Japanese Yen and the Australian Dollar has been profitable on average. However, this is not without risks. Losses arose from the Yen appreciation against the Australian dollar and other major currencies during the 2008 financial crisis.

Even though the concept of trading is relatively similar to trading speculative shares (in which you are in and out of the market quickly, buy low and sell high etc.), forex trading is done around the clock. You are competing with international players and there is no pause button, unlike other over-the-counter trading forms where the official trading hours are in place.

Forex trading is akin to stepping into a warzone. Only the best survive, especially when money is on the line. It is not for everyone, so don’t expect any leniency when you step into this arena as the sharks will go for the kill the minute they smell blood. Faced with such fierce competition, you don’t want to go in without a plan.

Banker traders always have a strategy before the start of each trading day. There is always a morning briefing to take stock of the current market situation. You should do the same. Your plan need not be an elaborate one but it should allow you to strategise for the day, taking into account various news events that have taken place since you last traded. Your plan should at least incorporate a checklist of your opening positions, establish and review positions, and evaluate the effects of external events and market news affecting forex movements. A simple plan may decide your success or failure—never leave it to chance as that is pure gambling.

Pilots always have a pre-flight checklist as they can’t afford to crash and burn. The same principle needs to be applied to trading, especially if you want to avoid burning your investments. The first task of the day is always to know your current open trading positions and what actions need to be taken the minute you start trading. Always establish a trading band for your positions, i.e. what rate levels are you going to sell at to close the position, or buy to enlarge the position, or even just to sit and do nothing. A clear channel of thought allows for quick and decisive action—procrastination increases the risk of failure.

The next important item on your checklist is to ensure that there are sufficient funds in your trading account or liquidity to continue trading, or to hold onto positions should the rates move against you. Never be caught in a situation where you are forced to sell as you will probably lose more than you bargained for.

Lastly, do ensure that you are aware of the trading limits assigned to you by the brokerage firm. Even though it is possible to request for an extension of limits, this will take time. You don’t want to be caught off guard holding on to a position that you need to clear immediately but can’t do so because you maxed out your limit.

In a banking environment, there are even more limits to contend with and multi-currency accounts to monitor, hence the importance of a checklist should not be underestimated.

The minute you start trading it is every man for himself, so the positions you hold are vital to your success or failure. The strategy you adopt will determine if the currency position is worth holding onto or if you should enlarge your position to maximise potential gains or if you ought to withdraw in order to trade another day. All traders will experience bad trading days, and if a trader fails to plan for such days, he is ultimately planning to fail. It is perfectly alright to lose a few battles and to take on defensive positions—this is when contingency plans kick in. However, we must never lose the war.

Experienced traders will always keep a close eye on all their currency positions and will pounce on opportunities or clear positions when threatened without hesitation. Strategies are fluid as the day evolves, hence you should not stick to just one strategy as your opponents will always try to outsmart you. It is possible to discard your strategy midway as events unfold; at least you are aware of what is happening instead of running blind. Knowing when to enter and exit a position is half the battle won.

As long as the earth does not stop rotating, there will always be external events and news that will affect the currency markets. We are living in a interconnected world with global economies still reeling from the 2009 financial crisis, and the slightest news may spark the currency markets to react in a big way. Forex traders love this volatility as it gives them an opportunity to make big bucks.

Financial markets react to news instantaneously, especially if they are comments from the US Federal Reserves about quantitative easing or from an European member state regarding its financial health. Hence, always start your trading day by knowing the global events that will affect your positions and be ready with contingency plans on how market reactions will affect your trading for the day.

There is no better way for newbies to feel the pulse of the market than to use a practise account. Banks will never let new traders execute a single trade without first undergoing serious training. Even though the newbies are all raring to trade, they will have to be contented with sitting on the sidelines watching and training on practise modules. The first step to knowing when a trainee is ready is when he or she exhibits a feel for the market, i.e. the pulse.

The pulse is what you feel is happening in the market. It’s the heartbeat when you feel the pounding of excitement or fear or panic or calmness in the markets. Only when you can sense these differences by training on simulation models can you say that you are ready for the next step. Without a feel for the market, you cannot anticipate its next moves. With a training account, you get a taste and feel of the markets but with no financial risks attached. Use it until you feel the pulse, but don’t expect quick results—it may take an individual between two to six months just to develop a feel.