CHAPTER TWELVE:

Tax

"Nothing hurts more than having to pay an income tax, unless it is not having to pay an income tax."

—Thomas Robert Dewar

Paying tax is a social expectation and a commitment. All citizens must contribute in the form of tax, which allows governments to fund the infrastructure of a developed country. There are contradictory and competing views on how much a citizen should pay in the form of a tax. As the late Kerry Packer once said when he was called to appear before the Print Media Inquiry in November 1991,

"I am not evading tax in any way, shape or form. Now of course I am minimizing my tax and if anybody in this country doesn't minimize their tax they want their heads read because as a government I can tell you you're not spending it that well that we should be donating extra."

It is a prudent financial strategy, despite the competing views, to legitimately minimise the amount of tax which you pay each year.

The Major Taxes You Pay

The major taxes that you are likely to pay are:

• Income tax

• Capital Gains Tax

The two other common business taxes that you are likely to encounter are,

• Fringe Benefits Tax

• Goods and Services Tax, the GST

Income Tax

Income tax refers to the tax in which you are required to pay on the taxable income which is attributed to you each financial year. The higher your income, the more tax you will pay.

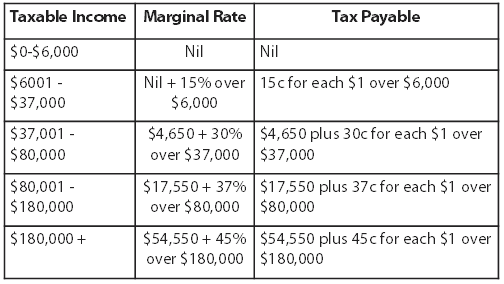

The current marginal tax rates for the 2011-2012 financial year are as follows:

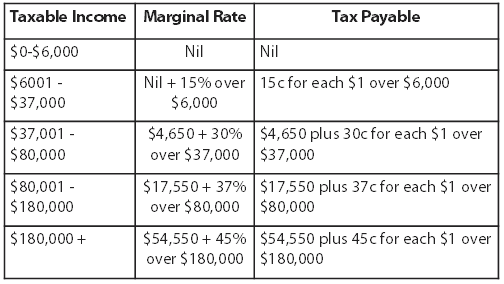

The marginal tax rates will adjust as follows for the 2012-2013 and 2013-2014 years:

It is worth noting that for the first time in nine years there were no changes made to the personal income tax rates and thresholds in the May 2011 Federal Budget.

When looking at these tax rates it is important to be aware that if there is a change of government these rates are likely to change, and it is also the prerogative of the government in the Federal budget in May of each year to change these also. In a nutshell, don't start making long term plans based on these rates as the Federal Governments regularly "change the goal posts" for taxpayers in Australia.

Capital Gains Tax

Capital gains tax is a tax which is payable on the increase in the capital value of investments, and is paid in the financial year in which the capital gain is made; i.e. when the investment is sold. In other words, you pay a tax on the capital gain you make on the sale of an investment and this capital gain is added to your taxable income in that financial year. The capital gain is then taxed at your marginal tax rate so once again the more you earn the more tax you pay. Any capital losses which you have incurred—including those from previous financial years—can be carried forward until your death and offset against any capital gains. For example, if you have a carried forward capital loss of $10,000 and you make a $10,000 gain on the sale of share investment you won't pay any capital gains tax as the loss will offset the gain.

Capital gains tax only applies for assets acquired after the 19th September 1985.

There are a number of methods used in calculating capital gains tax, the most common being the discounting method. The discount method is calculated as follows:

Sale price of the asset

Less

Purchase price of an asset

Less

The costs associated with the sale and purchase

= the capital gain

Where an investment has been held for twelve months or more the capital gain can be reduced by 50%.

Let us look at how these calculations work in practice where you have sold an investment property for $350,000 after purchasing it three years earlier for $200,000. For the purposes of the example, we have assumed that the cost of buying and selling the investment property was $17,000:

*These costs would include stamp duty, agent's costs, legal costs etc.

The assessable capital gain ($62,500) is then be taxed at your marginal tax rate. Whilst this is a fairly straightforward example, you can understand the importance of:

• Maintaining accurate records of any expenses incurred on any asset to which to CGT may apply

• Holding investment assets for at least twelve months to take advantage of the discounting provisions, as this allows the capital gain to be effectively halved

Principal Residence Exemption

It is important to note that your principal residence; i.e. where you live, is exempt from capital gains tax. This has allowed many people to accumulate a significant capital gain by using the principal residence status to avoid paying capital gains tax. For example, a work colleague is married to a builder and their wealth accumulation strategy is to purchase a rundown property which they live in. Over a six to twelve month period, whilst living in the property, they fix the kitchen, bathroom and make a number of superficial adjustments such as painting, fixing the front fence etc, and then sell the property at a profit. The gain is not assessable, as they have sold their principal residence, then they buy another one and start the process again. Everyone makes a joke at work that they are running drugs or been kicked out of the neighbourhood again without having any idea on how or why they pursue this strategy. They are building wealth using their skill set. It is worth noting also that with a deceased estate you usually have 2 years from the homeowners date of death to access the full capital gains tax principal residence exemption.

Fringe Benefits Tax

Fringe Benefits Tax is a tax which is paid on benefits that an employer provides to an employee or an employee's associate. Examples of a fringe benefit would be:

• Providing free food, alcohol or membership to a sporting organisation

• Providing a discounted or free loan to an employee

• Providing a work motor vehicle that can be used privately

• Paying for private school fees

The aim is to deter employers from reducing an employee's salary and paying an employee with fringe benefits, which without fringe benefits tax would not have been subject to tax. Fringe benefits are taxed at 46.5%. In the event that your marginal tax rate is less than 45%, you are generally better off cashing out the fringe benefit (i.e. taking the cash instead).

Fringe benefits tax is separate from income tax and is paid by the employer. The FBT year runs from the 1st April until the 31st March.

Goods and Services Tax

The Goods and Services Tax (commonly known as GST) was introduced into Australia on the 1st July 2000 and is a tax on the supply of goods and services. GST of 10% is levied on most goods and services apart from those which are exempt, such as school and university fees, and medical costs.

Unfortunately, if you live in Australia and you use a service, it is inevitable that you will pay GST. It cannot be avoided.

Tax Planning Strategies

As the end of each financial year approaches (June 30), there are a number of simple strategies that you can use to minimise the amount of tax which you pay and these include:

1. Crystallising your capital losses

If you hold underperforming investments that are currently valued at less than they cost, you may want to consider selling these investments to incur a capital loss that may be used to offset any capital gains made during that financial year. This strategy will allow you to reduce your potential taxation liability.

2. Prepaying interest on an investment loan

If you have an investment loan and you choose to pay a lump sum interest payment in June of one financial year for the following financial year, which commences of July 1, the interest which you pay is tax deductible in the current financial year. In other words, you can pay the interest for next financial year this financial year and claim a tax deduction for this. In addition to this if you prepay the interest the rate is often lower than if you pay the interest as and when it falls due. In most instances this represents a discount of 0.25% to 0.5%.

3. Make tax deductible contributions to superannuation

The government has introduced a number of incentives to encourage you to make additional contributions to superannuation for which a tax deduction may be available.

As a self-employed person, you are able to claim a tax deduction for concessional contributions you make into the superannuation structure. The amount contributed to superannuation will be tax deductible up to the concessional contribution caps25 as shown below:

25 Concessional Contributions simply refer to any payments made into superannuation which are subject to a 15% contributions tax. For an employee this refers to the amount contributed by your employer and any amounts which have been contributed to superannuation pursuant to a salary sacrifice arrangement. For a self employed person this refers to any amount for which a tax deduction is claimed.

*Transitional provisions in place (until June 30, 2012) for anyone aged 50 or over on or after July 1, 2007. The existing law states that from July 1, 2012, the contributions cap for all age groups is $25,000 plus any $5000 increments to the $25,000 limit due to indexation since July 1, 2009. Note that the Government has announced that the $50,000 (indexed) limit will remain in place for Australians who have less than $500,000 in their super account (yet to legislated and not much detail available on this measure at the time of writing).

A self-employed or unsupported person is generally defined as a person deriving more than 90% of their assessable income from self-employment or investment income; i.e. less than 10% of income from an employer source. If you meet these criteria as an individual, you are able to claim a tax deduction for contributions up to your concessional contribution cap.

It should be noted that a 15% contributions tax will be levied on funds contributed to superannuation for which a deduction has been claimed.

4. Co-contributions for low income earners

In the event that you earn less than the threshold amount, $61,920 per year and in the 2011 Federal Budget it was announced that this cap has been frozen until the 30th June 2013, you may be eligible to benefit from the government co-contribution if you make a personal superannuation contribution from your after-tax funds. Under this scheme, where you contribute money to superannuation on your own behalf, the government will also make a contribution for you providing you meet the eligibility criteria.

To be eligible for the co-contribution you must satisfy the following conditions:

• You make personal superannuation contributions; i.e. an after-tax contribution by June 30 to a complying superannuation fund or retirement savings account

• Your total income (assessable income plus reportable fringe benefits) is less than the higher income threshold. Please note this may be different from taxable income

• 10% or more of your total income is from eligible employment, carrying on a business or a combination of both

• You are less than seventy-one years old at the end of the income year

• You do not hold an eligible temporary resident visa at any time during the income year

• You lodge an income tax return for the year

There is no need to apply for the co-contribution. The ATO will use the information from your tax return and superannuation fund to assess whether you are eligible. If you are eligible, they will simply make a payment directly into your superannuation fund and send you a letter advising you of this payment. Don't be surprised, though, if this payment is not made until 6-9 months after you lodged your tax return.

The amount of co-contribution which you receive depends on your total income during the financial year and is calculated as follows:

26 This is the threshold for the 2010-2011 financial year and has been frozen until the 30th June 2013.

27 This is the threshold for the 2010-2011 financial year and has been frozen until the 30th June 2013.

28 This is the threshold for the 2010-2011 financial year and has been frozen until the 30th June 2013.

5. Small business owners

For small business owners, one strategy that is popular is the ability to defer income receipts until the new financial year and bring forward expenses to the current year. This presents an opportunity to effectively and legitimately minimise potential taxation liabilities for the current period.

6. Splitting of income

Income splitting essentially involves dividing income between two or more people to minimise the amount of tax payable rather than having one person pay the tax on that income. With the sliding scale of the marginal tax rates, being able to split your income can result in significant tax savings. For example, based on the 2011-2012 tax rates, if one person earns an income of $180,000 they will pay tax of $54,550 and end up with a net income of $125,450. However, if the same income of $180,000 is split amongst two people, for example a husband and wife, the combined tax will be $42,500, a saving of $12,050. This situation may occur where a husband and wife have a business partnership together.

Splitting of income needs to be considered in addition to other issues, such as asset protection and the personal services legislation, which may not allow this in any event.

This is, however, a common strategy amongst business partnerships and family trusts.

7. Salary Sacrificing to Superannuation

As explained earlier, salary sacrificing to superannuation has the effect of reducing your taxable income. The tax saving results from contributions to superannuation being taxed at 15% versus your marginal tax rate. The higher your income and subsequent marginal tax rate the greater the savings.

For every dollar ($1) which you contribute to superannuation, you will save the following in tax for every dollar contributed in 2011-2012:

*Please note these rates do not include the Medicare levy

The amount which you can contribute to superannuation is limited by the contribution caps which are set by the Federal Government.

8. Invest in Investments that Pay Fully Franked Income

One of the major benefits of investing in Australian shares and unlisted public companies in some instances is that the income, otherwise known as a dividend, which you receive is often fully franked. This refers to a situation where the company, such as ANZ Bank, has already paid company tax at the company tax rate of 30% on the income before it is paid to you. This is referred to as dividend imputation. You are then entitled to a tax credit, which can be offset against your tax liability on the dividends. In simple terms this means that any fully franked income which you receive you get the benefit of the tax that has already been paid on this income.

It is important to note that you can also be paid unfranked dividends, which are dividends you receive where the company tax has not been paid. In this instance, you must include the unfranked dividend in your tax return and you will be taxed on this sum at your marginal tax rate. This is essentially the same as if you were to receive the income from a term deposit.

To further confuse the situation, you can also have a partially franked dividend. This refers to a situation where only part of the dividend has had company tax paid on it and the other part of the dividend is unfranked. If for example the income was 50% franked, you would only get a tax credit for 50% of the company tax rate, 30%, which would be 15%. This concept sounds complicated but it is fairly straightforward. As a general guide the more a company operates overseas the lower the franking on the dividend income.

Let us look at how this works in practice if you as a taxpayer receive a dividend from an Australian share:

Fully Franked Dividends

A Partially Franked Dividend of 50%

As you can see from the table above, investing in shares that provide you with a fully franked dividend is an effective strategy for minimising your tax on your investment income.

Tax Effective Investments

In the past, there have been numerous tax effective investment schemes that are advertised and offered to investors to assist with reducing their tax. Many high income earners in the past have been tempted by these schemes as a means of obtaining an instant tax deduction. Traditionally, these schemes include activities such as agriculture, olives, tree plantations, grapes, apricots, etc, and entertainment, e.g. films. With recent changes in government policy, the incidence of these schemes has decreased significantly. To be eligible for a tax deduction, the product or scheme needs to have a product ruling issued by the Australian Taxation Office. It is worth noting that this product ruling can be withdrawn at any time in the future where the investment no longer meets the relevant criteria.

These investments are typically characterised by:

• A very high fee structure with upfront commissions usually between 4-14% and ongoing fees of up to 7% per annum. With the changing nature of the financial services industry it is likely that this fee structure will be legislated against at some stage

• Ambitious growth forecasts that are rarely accurate

• A strong emphasis on the importance of getting an upfront tax deduction

• Being difficult to understand and compare with other alternative investments

The ATO in recent years has cracked down on this area of tax planning, disallowing a number of tax deductions that had already been claimed years earlier. For example, in 2005 the Federal Court held that a taxpayer who invested in a project called the Main Camp Tea Tree Oil Project No 3 over three years earlier was not entitled to a deduction for this investment. The reason for disallowing the tax deduction was that the dominant purpose for entering into the scheme was to obtain a tax benefit not for investment purposes. The project was involved in the production and export of tea tree oil29.

29 http://www.ato.gov.au/print.asp?doc=/Content/27144.htm

The Federal Government in 2007 announced that investors in non-forestry schemes could no longer claim an upfront tax deduction for their contributions. This has limited the attractiveness of many of the non-forestry schemes and many would argue substantially contributed to the demise of listed agri-businesses such as Great Southern Plantations, Timbercorp and Forest Enterprises. Tax effective investments are heavily dependent on the tax concessions provided by the Federal Government. This legislative risk can change the attractiveness of an investment overnight.

Investors in forestry schemes are still entitled to an upfront deduction providing at least 70% of the expenditure is directly related to developing forestry. Forestry schemes are a risky investment with many variables—weather, consumer sentiment, environmental issues, ongoing management costs, future demand etc., and without a tax deduction, most people would not consider investing this way in any event.

One issue that has long concerned me about these schemes is that there is an inherent conflict of interest between getting the best return for the investor and also being able to charge a large management fee which obviously benefits the investment provider. Unfortunately this conflict has led to many investors being charged high ongoing management fees which in turn has had a substantial impact on the final investment return they receive.

As a general view, I recommend that you avoid tax effective schemes where possible. When you invest money it should be an investment decision first and foremost, not a tax decision. In addition to this, where the person recommending you an investment gets a 5-10% upfront commission and encourages you to borrow to get the investment, you need to ask questions like, what are the motives behind this strategy and who benefits most?

The Secrets to Tax Planning

The secret to tax planning is to minimise your income, maximise your deductions and keep accurate records of your affairs.

1. Minimise your income

The main methods of minimising your income are salary sacrificing part of your salary to superannuation, and maximising any tax deductions which you are entitled to.

2. Claim all tax deductions

According to the Australian Taxation Office, if you spend money on something to help you earn your income, you may be entitled to claim that cost as a deduction. In other words, whenever you spend money to make money, this is generally a tax deduction. Many Australians fail to include all of their available tax deductions and as a consequence pay too much tax.

A tax deduction reduces the amount of income you have to pay tax on. However, as we all earn an income in different ways, what is allowed as a tax deduction for one person may not be allowed as a tax deduction for another person. For example, if a lawyer buys a hammer, he cannot claim it as a tax deduction, but if a builder buys a hammer, he can.

Alternatively, if you work at a fast food outlet and belong to a gym, you would not be entitled to claim the gym fees as a tax deduction because you would not be paid to be fit. These expenses would be a private expense. However, if you were a professional cricketer your fitness would be essential to earning money so the gym fees would be a deductible expense for you.

Let us look at how a tax deduction works in practice.

Nicholas goes to university studying a law degree and also has a part-time job working as a labourer on a farm. He earned $11,300 in wages in the last financial year.

He purchased a pair of boots, a pair of gloves and some overalls to protect himself at work, all of which costs him $250. Protective items are allowable as deductions, so Nicholas can claim them against his income.

To work out his taxable income Nicholas would use the following formula:

= Assessable income - allowable deductions

= taxable income

= $11,300 - $250

= $11,050

In this example, Nicholas would have saved the grand total of $37.50 in tax. Without any deductions the tax on his taxable income would be $795, as he is in the 15% tax bracket. By claiming $250 in deductions, his tax has been reduced to $757.50. Had he been in the highest tax bracket (earning over $180,000 a year), he would have saved $112. In other words, if the items which cost $250 could not be claimed as a tax deduction, they actually would cost Nicholas $138 net after tax, if he was in the highest tax bracket.

Your tax saving as a result of a deduction will vary depending upon what marginal tax bracket you are in. If your taxable income is less than $6,000 and you were a resident of Australia for the full year, you would not receive any benefit from your deductions because your income was below the taxable level. However, if you earn over $180,000 any tax deduction will result in a 45% saving on that purchase and the more deductions you have the more tax you will save.

It is important to note that no one has ever become financially wealthy on tax deductions alone. Chasing a tax deduction for the sake of getting a tax deduction is a very dangerous approach. For example, you often hear people saying "I spent $100 on X so I could get a tax deduction". Assume you spent $100, you have only really received a discount on the item as follows:

So, in actual fact, you have still spent money, and if you have spent money on something that is useless, you have in fact wasted your money. No one has ever become financially comfortable on tax deductions alone. The size of your tax deduction is directly related to your ability to keep accurate records of all of your potential deductions.

3. Keep accurate records

It is important to keep accurate records of your financial affairs for three reasons:

• To assist you in preparing your tax return

• To ensure you claim all of your entitlements (deductions, rebates, offsets)

• To protect you in the event of an audit from the Australian Taxation Office

It is advisable to keep records of:

• Any payments you have received

• Any expenses related to the payments you have received

• Any asset that you have disposed of during the financial year

• Any tax deductible gifts or donations

• Any medical expenses

You are generally required to maintain your written records for five years after a Notice of Assessment has been sent to you from the Australian Tax Office.

Frequently Asked Questions

What happens if I am subject to an audit from the tax office?

If you are unlucky, you will be subject to an audit from the Australian Taxation Office. An audit is aimed at ensuring taxpayers have complied with the tax laws. The focus of a tax office audit is generally on ensuring that you:

• Have declared all of your assessable income

• Are entitled to all of the tax deductions and tax offsets which you have claimed

The nature and extent of an audit will vary depending on the complexity of your affairs. It can consist of a phone call, a letter, or a visit from a tax officer. The ATO has a filtering mechanism where they identify potentially high risk targets, or where significant variations occur between various taxpayers in the same industry, or a significant unexplained variation in your affairs from year to year. These high risk targets may then be audited at the ATO's discretion.

The ATO receives information from a number of sources; Centrelink, financial institutions and superannuation funds etc., at the end of each financial year. This information often highlights inconsistencies, which need to be explained. For example, banks are required to provide the ATO with details on the earnings of each account, and it is easy to cross reference to see whether or not a taxpayer has declared the interest on their tax return. As technology has increased, the level of data matching has also become more sophisticated making it increasingly likely that if you try to defraud the tax office you will be caught.

You never know how a tax investigation will start. For example, in 2004 a laptop was seized in a raid from a Melbourne hotel room of a Swiss-based promoter, and the details on that lap top led to a chain of events that led to Glen Wheatley spending time in jail and Paul Hogan also being charged. After the raid, when the Australian Crime Commission started to investigate the material on the laptop, they found evidence of international tax schemes that significantly reduced the tax that a number of high profile Australians were paying. According to the ATO website, Wickenby has raised over $850 million in tax liabilities, 57 people have been charged with serious offences, more than 1,400 audits and reviews have been conducted, and a number of criminal investigations are still underway.

There are often situations where you will make an innocent mistake and forget to include something. If this occurs it is likely the ATO will issue you with a Notice of Amended Assessment advising how much you are required to pay. This amended notice may or may not include a penalty and interest component.

Many accountants now offer what is known as audit protection insurance, which basically covers the professional fees incurred by an accountant if you get audited. If you are an average tax payer with nothing to hide and fairly simple affairs, you really do not need this type of insurance. It often just represents another income stream for the accountant.

If the tax office contacts you, I strongly suggest you co-operate to the best of your ability. If you do not address the issue head on, what was potentially a small problem can develop into a big problem.

What is the Medicare levy surcharge?

The Medicare levy underpins Australia's health system in that all resident taxpayers are subject to the levy. The Medicare levy is 1.5% and this is paid as a percentage of your taxable income.

The Medicare levy surcharge is an additional payment that is levied on taxpayers who don't have private hospital cover and earn above the threshold amount. This surcharge is designed to encourage people to have private health insurance with private hospital cover. Having private hospital cover in turn reduces the strain on the public health system.

It is important to remember that at the end of the day your health is your wealth. There is no point having two million dollars sitting in the bank if you don't have the health to be able to enjoy it. I visited a friend in the Oncology Unit of a large public hospital once, and there were six patients in the room separated by a curtain for each cubicle. All six had terminal cancer, all were dying, and all were being visited by friends and family over their final few days. It was the most depressing room I have ever been in and it would be a terrible place in which to spend your last few weeks with death all around you. If you want the ability to make choices at this time, keep your private health cover.

The Medicare Levy Surcharge is a further 1% of the taxable income.

The Medicare levy surcharge is payable if you are:

• A single person with an annual taxable income greater than $80,000

• A family or couple with a combined annual taxable income greater than $160,000. This threshold increases by $1,500 for each dependent child after the first and you do not have an appropriate level of private hospital insurance. This levy is indexed by the Federal Government. The cost of medical treatment is horrendously expensive and will inevitably increase in the future

The Medicare levy is the reason you need to provide your health insurance annual statement to your accountant when they prepare your tax return.

Do I have to lodge a tax return?

It is important to note that not everyone in Australia needs to lodge a tax return. Over the course of your life, there will be some years where you need to lodge a tax return and others where you don't. Whether or not you need to lodge a tax return will depend on a number of factors, including the amount and type of income you have received, your personal circumstances and whether or not any tax has been withheld.

As a general rule you have to lodge a tax return if:

• Your income exceeded the tax free threshold. The threshold is currently $6,000 for most adults, but differs significantly based on your age, income, expenses and personal circumstances

• You are receiving or paying child support, government allowances, tax offsets, commencing a retirement income stream, claiming the private health insurance tax offset, carrying on a business, tax instalments have been withheld from your pay, or claiming a loss made in a previous year

• You are a non-resident and you have income in Australia that is taxable. It is important to distinguish this from income from which withholding tax has been deducted. Withholding tax is simply tax of 10% that is deducted from the investment income on investments held by non-residents in Australia. For example, if you are a non-resident and have money in a term deposit, withholding tax of 10% will be deducted from the income before it is paid to you. You will not need to lodge a tax return on this income as withholding tax has already been paid

To find out more about your specific situation, visit www.ato.gov.au.

What is a wash sale or tax washing?

In its simplest form, this strategy involves selling an investment at a capital loss and then purchasing the same investment on the same day or shortly thereafter at the same or a similar price. The purpose of this strategy would be to create a capital loss, which can be used in that financial year to offset a capital gain and re-set the cost base of that investment.

For example, if you purchased 1,000 Telstra shares at $7.00 in 1997, you sold them for $4 per share in 2011 and purchased them again in the same quantity for $4 on the same day, you would create a capital loss of approximately $3.00 per share or $3,000 and re-set your cost base to $4 per share. By doing this, you basically end up in the same position except that you have been able to offset a capital gain and reduce your tax.

The ATO has issued a number of warnings in recent years on the danger of wash sales as in certain circumstances they may contravene the anti-avoidance provisions in Part IVA of the Income Tax Assessment Act. As a consequence, you need to be very careful when using this strategy as unless it is a genuine sale the ATO may determine that a wash sale is a scheme with the objective to reduce tax.

What is a PAYG instalment?

Pay as you go instalments, referred to as PAYG tax, are basically payments which you make towards your expected tax liability for the current financial year. The PAYG instalments are based on your previous year's tax return and if this is inaccurate you can apply to the ATO to have this varied.

Your actual tax liability is calculated when you lodge your tax return with your PAYG instalments being credited against your assessment. It is likely that the PAYG instalments will be either more or less than your actual tax liability and an adjustment is made with you either receiving a refund or having to pay more tax.

PAYG instalments are generally paid quarterly.

Do you need an accountant?

The more complicated your affairs, the more likely you are going to need an accountant. With the recent changes to the taxation laws many accountants are now screening their client base and often do not want to simply do a tax return for you each year. Accountants are very busy with the tax office effectively outsourcing a large part of the tax system to them to administer. For example, Business Activity Statements, Pay as you go tax, GST returns etc. An ideal client for an accountant today in most offices is someone who has a business or complicated financial affairs and generates fees in excess of $2-3,000 per annum.

If your affairs are simple, you may be better off using a specialist tax agent or an accountant that is happy doing tax returns to the mass market. The more prepared you are when you see your accountant or tax agent, the less it will cost you. Going forward the Federal Government has indicated that the process of lodging a tax return will be simplified even further. This may even lead to the demise of the traditional "tax agent".

The Tax office has now developed a very user-friendly website for those interested in doing their own tax and if your circumstances don't vary much from year to year.

Closing Word

Whenever you are dealing with the ATO it is important that any correspondence, request or notice of assessment be treated with the highest priority. If you ignore the tax office, you do this at your own peril. If they pursue you, your problems will only compound. For example, if you owe the ATO money, the interest rate on that money is approximately 14 % per annum compounding. Imagine you owe $10,000 and you do nothing after 3 years, you will owe $14,815 plus any additional charges that you may have incurred.

Useful websites

Australian Taxation Office.

This is a virtual cardboard shoe box where you send in receipts in reply paid envelopes (supplied by the company) and they will scan, enter and organise the data for you.

This website will give you a complete overview of your financial position in an instant. Xero let's you organise all your bank accounts in one place and automatically tracks your spending for you.

This website provides an online document management and storage system for both individuals and businesses.