CHAPTER FIVE:

How to Hold Your Investments

"The way to get started is to quit talking and begin doing."

—Walt Disney

Starting to invest is very similar to building a house—in that you need to have solid foundation before you start, otherwise, over time, cracks will begin to appear. The foundation of an investment portfolio involves determining the right structure in which to invest. In many cases this is fairly straightforward but you need to think what the portfolio will be like in ten, fifteen or twenty years from now. Any changes at that time could result in a significant capital gains tax issue. Selecting the appropriate structure for your investments at the outset is important, in that it can minimise the tax you pay, protect your investments in the event of an unforseen disaster—for example, bankruptcy, legal action etc.—and maximise any Centrelink benefit that you may be entitled to in due course.

The importance of getting the structure right can be illustrated by the financial fallout from the collapse of many solicitors mortgage funds over the last ten years. These mortgage funds operated by holding money on behalf of investors , paying them a variable fixed interest return similar to a term deposit rate and then on lending this to clients at a higher interest rate. The loans were secured with registered first mortgages against the borrower's property. The margin between what the investor received and what the borrower paid was around 1-1.50% and this was kept by the law firm as the gross profit. As you can imagine, when a mortgage fund was managing monies in many instances in excess of $50 million dollars, this was a considerable sum and this area was often more profitable than the legal side of the business. The lucrative nature of this revenue caused the checks and balances in many firms to be over looked such as obtaining independent valuations, having appropriate approval processes not simply a partner approving a loan to his best client, capitalising interest and extending the loan when a borrower couldn't afford to make the payment.

The flaws in this process were highlighted in the failure of a solicitor's mortgage scheme in Tasmania. As a partner in a law firm you are jointly and severally liable for all the debts of your fellow partners. Within this firm there were two commercial partners who oversaw the mortgage scheme, however all of the partners were responsible in the event of an issue. In 2001 after a series of defaults causing the fund to suspend interest payments and access to capital, after proactive investor action the Australian Securities and Investments Commission appointed a liquidator to oversee the return of approximately $12 million owing to more than 400 investors . After a long winded legal saga most of the investors received their capital back, but what is interesting about this story is what happened to the partners of the firm as a result of the collapsed mortgage fund. The majority of partners were declared bankrupt, however those who had structured their affairs to protect their assets with family trusts, using superannuation and having their house in their wife's name etc. were able to minimise the financial impact of this event on them at a personal level. Those that didn't have had to begin the financial journey again.

When investing, you generally have the following structures that you can use, each having their own advantages and disadvantages.

1. Invest in your personal name (i.e. outside of superannuation)

This is how most people invest initially and the main advantages of this approach are:

• There are no restrictions on what you can invest in; it is entirely up to you

• It is simple from an administrative point of view

• There are no restrictions on accessing your investments, you can buy or sell whenever you desire

The main disadvantage in having investments in your personal name is that the income and capital gains are fully taxable to you. All of the income from your investments will be taxable in your name. This will be in addition to any salary or wages which you earn. One other disadvantage that many people fail to consider, is that in the event of becoming bankrupt any assets which you hold in your personal name will go to the bankruptcy trustee or may be claimed by creditors in the event of a successful legal action against you.

Consider the following example:

Samara earns $45,000 from her employer and has $100,000 invested in a term deposit in her name earning 6% interest per year. Her tax rate is 30%, so any income which she earns will incur this rate of tax so the $6,000 gross return is subject to tax of $1,800 (30% tax rate). The net return is $4,200 or 4.2% on the original $100,000. However, one factor that many people forget to take into account is inflation, which is generally around 2.5% per annum. When this is taken into account, the return is only 1.7%

One other drawback of having investments in your personal name is that it does not allow for the intergenerational transfer of assets, e.g. giving your son your Woolworths shares, without potential tax implications. When you die, any assets which you own are usually sold and the proceeds distributed to the beneficiaries. This may create a CGT issue for your estate.

2. Invest in the superannuation environment

Superannuation has traditionally been the structure preferred by governments of both political persuasions to encourage people to provide for their own retirement income. The goal posts are constantly changing in this area, which has caused many people to disregard this as an option. However, despite these constant changes, superannuation is likely to remain as one of the more favoured structures in which to build wealth going forward.

The main advantages of superannuation are:

• When money is contributed to superannuation via a salary sacrifice arrangement, it is subject to a contributions tax of 15%, which is often lower than an individual's marginal tax rate. For example, if Roger earns $130,000 per annum (37% tax rate in 2011-2012) and contributes $20,000 into superannuation, he would be taxed at 15% ($3,000) when the money goes into the fund. If, on the other hand, Roger decided that he wants to have the $20,000 paid into his bank account to spend, he would be taxed at 37% or $8,000. This represents a tax saving of $4,400 by investing in superannuation. The benefits of this are obviously magnified for each year you undertake this strategy

• Once the monies are in the superannuation structure7, the earnings within the fund are taxed at 15% and the capital gains at 10%, which is generally less than most people's marginal tax rate

• Any monies held within the superannuation environment are exempt from creditors in the event of bankruptcy. Whilst no one intends to go down this path, it is handy to know that your superannuation cannot be touched, providing of course you have not undertaken any fraudulent activity in getting the money into the structure in the first place

• You are able to contribute $150,000 per annum of after-tax money into superannuation, or $450,000 over a three year period.8 Please note any after tax contributions to superannuation are referred to as "non-concessional contributions" and are not taxed when invested into the fund. This could for example be the proceeds from selling your car or an investment property

7These tax rates are payable when the monies are in the accumulation phase of superannuation. This is essentially where you are not drawing an income from your superannuation fund. You may also be building up the balance in the fund either through employer contributions, salary sacrifice or after tax contributions.

8 Please note if you are over 65 years of age the after tax contribution to superannuation is limited to $150,000 per annum and you cannot use the $450,000 averaging provision. These are the contribution caps for the 2010-2011 financial year.

The main problem with superannuation is that it is subject to constant legislative change and, each year, when the government presents its May budget, the rules change again. This has made it difficult for the public to embrace superannuation as every change further erodes public confidence in this structure. For example, some of the changes over the last ten years have included the following:

• Reducing the amount which you can contribute into superannuation

• Changing the way account based pensions are taxed

• Changing the way money is taxed going into superannuation

• Reducing the amount the government pays you under the co-contribution scheme

It is often difficult for a member of the public to keep up to date with these changes, let alone understand them.

The other main issue with superannuation is the lack of access to the monies once they are invested into this structure. As a general rule, you can't access these monies until you attain what is known as "preservation age", and this varies between fifty-five and sixty years old depending on when you were born9. There are some exceptions to this rule, such as ill health and financial necessity, but they shouldn't be relied upon. Going forward, it is likely that access to your superannuation will be restricted further. With the ageing population, it is likely at some point that future governments will legislate to ensure retirees can only have their savings paid as an income stream, rather than a lump sum.

9 Preservation Ages are

Born prior to 30th June 1960 - 55 years of age

Born between 1st July 1960 and 30th June 1961 – 56 years of age

Born between 1st July 1961 and 30th June 1962 – 57 years of age

Born between 1st July 1962 and 30th June 1963 – 58 years of age

Born between 1st July 1963 and 30th June 1964 – 59 years of age

After 1st July 1964- 60 years of age

Unfortunately, it is not uncommon for many retirees nowadays to take their superannuation on retirement as a lump sum, renovate the house, buy a new car, take a big holiday and rely on the age pension for a large part of their retirement income.

One of the major issues that have arisen in recent years within the superannuation environment has been the limits imposed by the contributions caps (i.e. how much you can contribute to superannuation). This has severely restricted the amount which can be contributed into this structure, and many would argue the current thresholds are actually to low to achieve a comfortable lifestyle in retirement. For example if you are 40 years of age and you contribute $25,000 into superannuation being the maximum amount for 2011-2012 and these monies achieve a return of 7%. At 55 years of age these monies would be worth $68,975.

3. Invest using a trust structure

When using a trust structure, there are two main types that are used—a discretionary trust, and a unit trust.

i) A discretionary trust

In the event that you will be investing over the long term (five years and over) and you are likely to have children, an accountant or a financial adviser may recommend what is known as a "discretionary or family trust" for you. These words should not scare you, as this is just another investment structure, and as such would need to lodge its own tax return. A discretionary trust is a stand-alone legal entity.

In very simple terms, a discretionary Family Trust is an asset ownership structure setup to hold family assets or run a family business. The main advantages of a discretionary trust are:

• it enables you to distribute investment income to family members (for example, children, grandchildren or other relatives) in a tax effective manner

• it protects the assets in the event of a bankruptcy or legal claim

• it allows the intergenerational transfer of assets, which is what generally occurs in wealthy families. In other words, the trust continues together with the assets upon the death of a family member as if nothing has happened. A trust can continue for a period of a life, in being plus eighty years (for the duration of your life and then another eighty years). At the end of that period, the trust must be wound up. The reason for having a defined period for the life of trusts in Australia is that, otherwise, most assets would be held in trusts indefinitely

In simple terms, a trust is an ownership structure in which assets are held by a trustee on behalf of designated beneficiaries (for example, your spouse, children , grandchildren, brothers, sisters etc.).

A discretionary trust works as follows:

To set up a family trust is a fairly straightforward process and involves drafting a trust deed, having this signed and applying for a tax file number for the trust. The establishment of a trust can be undertaken by your lawyer, accountant or financial planner and would generally take less than a week.

A trust can be particularly beneficial where there is a large amount of income to be distributed or assets need to be protected, as you never know what unexpected disaster or event is around the corner.

Let us look at how effective a discretionary trust can be for a person called Sophie earning $185,000 per annum in her employment with trust investment income of $69,000, three financially dependent children aged eighteen, nineteen and twenty—all of whom are at university—and a spouse who works part time earning $25,000 per annum.

If the trust income of $69,000 is attributed to Sophie, the tax on the investment income will be $32,085 or 46.5% including the Medicare Levy.

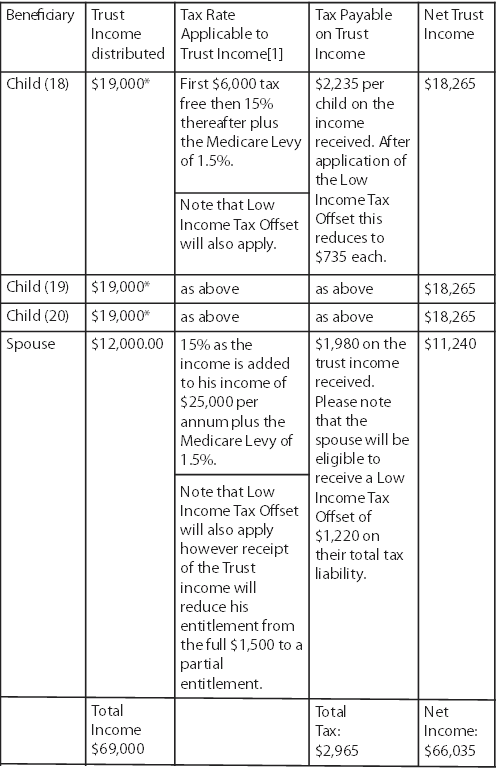

On the other hand the income of $69,000 could be distributed as follows†:

* Note that the Medicare levy low income threshold for singles for 2011-2012 was $18,839.

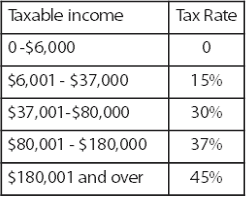

† The tax rates for the 2011-2012 financial year have been used in the previous example, and these are as follows:

Following application of the spouse's entitlement to the Low Income Tax Offset, the total tax payable in this instance was $2,965 and this represents a saving of over $29,120 in one year alone. Imagine how effective this structure would when these savings occur on an annual basis.

ii) A unit trust

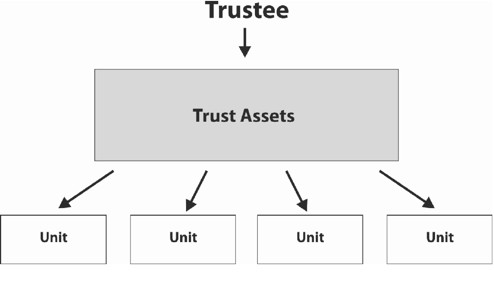

Unit Trusts (otherwise known as fixed trusts) are trusts where the beneficiaries under the trust own units in the trust. Income is distributed to the unit holders in accordance with their respective unit holding within the trust. This is very similar to owning shares in a company. The units in the trust can be sold or transferred in accordance with the terms of the trust deed. The assets within the unit trust are controlled by the trustee.

A unit trust deed works as follows:

In this example, you can see that the unit trust has four units and, if the value of the trust assets was $200, each unit would be worth $50. As the value of the trust assets goes up, the value of the units goes up, and vice versa when the value of the trust assets fall.

A unit trust is the most commonly used structure for managed funds and joint ventures between various parties. There are no limits generally on the number of units or unit holders in a unit trust.

iii) Invest in a company structure

The final option—and by far the most complicated—is to invest through a company structure. The government has set out in various acts of parliament the standards required from you when you operate a company. Most people use a company structure when they run a business and the owners are a number of unrelated parties. Companies are regulated by a government body called the Australian Securities and Investments Commission (see www.asic.gov.au ).

The rules relating to companies aim to ensure that each:

• Operates according to the law

• Reports their activities

• Maintains proper records, and

• Maintains an information database on company details

The main advantages of using a company include:

• It is a separate legal entity from the owners

• Assets can be owned in the name of the company

• There is usually limited liability for the shareholders (unless you have given a personal guarantee). In other words, if the company fails you won't be held personally liable

• The company tax rate is fixed at 30%

• It can be owned and operated by only one shareholder and director

• Allows for independent people to each own a share in the company

The main disadvantage for the average person is that a company is a complicated structure and expensive to establish and maintain.

A final word

In summary, it is important that you carefully consider which structure is the most suitable for you, not necessarily now, but in five, ten, fifteen and twenty years. As you get older, protecting your accumulated wealth and minimizing your tax become major objectives. Having the right structure at the outset goes a long way to assisting you in achieving your financial goals. You don't want to work all of your life and then, as you approach retirement, have an unexpected event occur, destroying your accumulated wealth.