Chapter 9

Show Me the Money

I can do something

I am but one,

But I am one,

I cannot do everything,

But I can do something.

What I can do

I ought to do.

And what I ought to do,

With God’s help,

I will do.

—ANONYMOUS

I have learned that success is to be measured not so much by the position that one has reached in life as by the obstacles which he has overcome while trying to succeed.

—BOOKER T. WASHINGTON

The phrase “show me the money” was widely popularized by the movie Jerry Maguire. In the movie, Cuba Gooding Jr. plays a professional football player and Tom Cruise is his agent. No matter what great position Tom would negotiate for Cuba, the bottom line was Cuba shouting, “Show me the money!” It was a funny and memorable line in the movie, but how do we approach it in our own work life?

Is it always self-serving, egotistical, and materialistic to say, “Show me the money”? Or is it a part of the process that we can learn to do well and in a way that is win-win for everyone involved? Why is it that people with the same title of “administrative assistant” earn anywhere from $18,000 to $80,000 per year. Some attorneys charge $40 per hour and some $400 per hour. Is there really that much difference in ability or training? What is reasonable to expect for the work you do?

How much initiative can you take in this process? Are salaries, bonuses, hourly wages, and benefits written in stone in every company? The answer to that last question is a resounding no. Compensation is a very fluid concept and one that can be negotiated in nearly every situation. Finding the right compensation package is still part of the interviewing process.

“A wise man should have money in his head, but not in his heart.” — Jonathan Swift

The first issue to be recognized is that you must totally believe that you are the best person for the position. That comes from being clear on your areas of competence and from having the confidence, enthusiasm, and boldness that can come only from having a clear focus. Then you are ready to present yourself in the most advantageous way. There can be nothing phony in how you see yourself fitting into the position in question. You cannot be enthusiastic about a position you don’t believe is a good match for you. And you can’t be confident about doing something you don’t really believe in. The biggest stumbling block for people in negotiating a reasonable compensation is that they don’t really want the position or don’t really believe they are the absolute best person for the job. In previous chapters we discussed how important it is to make a proper match between the work and what you offer. And yes, now it’s time to focus on the work you love.

Here’s the convoluted thinking of how we often approach work: Work is work. I have to just find a job to pay the bills. If I really did what I love doing, my family would live on beans and rice.

Isn’t that the typical belief? But guess what? It’s not true. Those who move toward the work they love tend to find not only a sense of fulfillment, meaning, and accomplishment, but often find a dam break in terms of what happens financially. Should it be easier to make money doing something you love or something you hate?

In Dr. Thomas Stanley’s wonderful book The Millionaire Mind, he relates how this issue is lived out by those who are now decamillionaires. Most love their chosen vocations, or, as one of the wealthier members stated, “It is not work; it is a labor of love.” Imagine that.

Dr. Stanley also says it’s hard for a person to recognize opportunities if he stays in one place and remains in one job—most self-made millionaires have had a rather wide experience with various part-time and temporary jobs. And finally, if you are creative enough to select the ideal vocation, you win big time. The really brilliant millionaires are those who selected a vocation that they love—one that has few competitors but generates high profits. If you love, absolutely love, what you are doing, chances are excellent that you will succeed.

“I have enough money to last me the rest of my life, unless I buy something.” — Jackie Mason

So you’ve endured the job search process, and now a company wants to have you on board. With the interviewing process coming to an end, it’s time to deal with the burning question of compensation. You are thinking, How much can I get here? and the employer is thinking, How much is this person going to cost me?

Don’t discuss salary until

• you know exactly what the job requires,

• they have decided they want you, and

• you have decided you want them.

The responsibilities of the job determine the salary, not

• your education,

• your experience, or

• your previous salary.

To win at the salary negotiation, don’t be the first one to bring it up. Instead:

• Show genuine interest in what the job requires.

• Refrain from asking about benefits, vacations, perks, etc., until you know you want the job.

• Say, “Let’s talk a little more about the position to see if there’s a match,” if they ask too early what you need.

Recognize that many things can fall under the title of compensation:

• a company car (preferably a BMW)

• a country club or YMCA membership

• free life insurance

• a medical plan

• a dental and vision plan

• profit sharing

• company stock

• an expense account

• tuition reimbursement

• additional time off

• relocation expenses

• your own laptop computer

• your own administrative assistant

• a free parking space

• a sign-on bonus

• weekly massages

• 2 weeks in the company condo in Hawaii

• a Rolex watch after 90 days

• your birthday off

• a production bonus upon completion of a project

• educational opportunities for your children

• a cell phone for business and personal use

• 401(k) contributions

• a low-interest loan for home purchase

You get the idea. Make this a fun process. I realize that negotiating anything is not very comfortable for some of you. If you don’t enjoy going to Tijuana and bargaining for the turquoise necklace you want, you may be somewhat intimidated by this process. But realize that negotiating salary is not a confrontational process and certainly not a win/lose proposition.

|

→Company Perks—A Brand New BMW? Believe it or not, in today’s desperate scramble for good employees, a BMW is not impossible. In fact, it’s a reality at Revenue Systems Inc. in Alpharetta, Georgia. All 45 employees—from secretaries to managers—get to drive a brand-new leased BMW at the company’s expense. The company simply knew what their average recruiting costs were and put the money into the luxury car leases instead. The response from applicants—thousands of whom have sent in their résumés—would be enough to make other CEOs green with envy. Ceil Diaz left her job working for the state of Illinois to join a Chicago ad firm. There she receives a basket of flowers and gift certificates on her 1-year job anniversary and got to meet with architects to help plan her work space. John Nuveen & Co., a Chicago investment bank, pays the bulk of college tuition for the children of employees who have been with the company for at least 5 years. How would you like to have someone walk your dog? What about an errand runner to pick up groceries for your family? Built in day care and on-site $3.00 haircuts? Starting to make that annual Thanksgiving turkey look a little slim, huh? |

Try this scenario. Let’s say Bob goes out to buy a car. He looks at a Toyota Camry and decides that is what he wants. It’s a basic model with no extras but seems to be a good buy on a dependable car to get him back and forth to school. Once he decides on the car, there are two possibilities:

The first includes an inexperienced salesperson will breathe a sigh of relief and lead Bob into the finance and insurance office before he changes his mind. He will take his little commission and go on to the next buyer.

In the second possibility, a mature, experienced salesperson will talk with Bob, asking if he has a favorite kind of music. Of course Bob does. “Wouldn’t it be nice to have a great sound system in this car?” the salesman asks. “With spring just around the corner, you know how much you would enjoy a sunroof. Since you are in school, it will be very important to make this car last for a long time. It would be advisable to have fabric protection, undercoating, and rust-proofing applied. For those long trips back home to family, wouldn’t it be nice to have cruise control?” And so on. Ultimately, Bob walks out, a happy customer, but with a purchase price of $1,500 more than he had originally agreed to. Has he been tricked? Of course not. He has simply been shown the benefits of some things he really did want. In the same way, once the company has made its initial decision to hire you, you can freely discuss additional benefits and compensation with little fear of changing the company’s basic decision that it wants you!

I recently worked with a young lady who had lost her job, in which she earned over $70,000. Panicked and convinced she could never find another job in that income range, she had decided she would have to start her own business. However, after identifying her unique areas of competence, I advised against that and encouraged her to do a creative job search. In a short period of time she had 2 offers on the table; the clearly better fit offered her a base salary of $89,000. We discussed the offer, the fact that it was a great fit, and she went back and asked for $98,000. They settled at a base of $94,000 with some additional benefits, bringing her package to approximately $105,000.

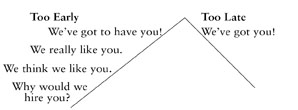

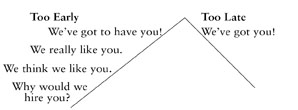

What are you doing in the salary-negotiating process? Keep in mind that if you have handled the interview as described, salary did not come up until you decided you wanted the job and the hiring manager decided he wanted you. At that point, and not until that point, you are in a position to negotiate. Also, keep in mind that if you have done an effective job search, you should be talking with more than 1 company anyway. Here is the timing for discussing salary. Speak at the peak.

|

→Poverty Living or Excellence? The Economic Policy Institute (www.epinet.org) recently identified what they call a “living wage.” They say $60,154 is needed for a family of 4. This accounts for a telephone, health insurance, and child care, but does not include restaurant meals, video rentals, Internet access, or vacations. That means someone has to be making $28.92 an hour or more than one person in the home has to be working. It may come as a surprise to know that 60 percent of American workers do not make $28.92 an hour. Incidentally, the U.S. Cesus Bureau shows $21,834 as the official 2009 poverty level for a family of 4. The troubling range is between $21,834 and $60,154 where a family is not eligible for government assistance but clearly has difficulty making ends meet. So the resulting questions are, How can I have areas of competence worth $14 per hour? Who else in the home is going to work? How can I add to my income? How can I escape the hourly income trap? Fortunately, there are opportunities in all these questions. You may not choose to have a second person in the home in a traditional job. Do you have areas of competence that you are overlooking? I once worked with a lady with a high school education in an $8-per-hour job. We looked for unique areas of expertise. She realized she was proficient in both Spanish and English and now books herself an average of 20 hours weekly at $50 per hour as a medical environment interpreter. If you clean houses for a cleaning service, you will likely be paid $7 to $9 per hour. But most of those cleaning services bill their clients at $25 to $35 per hour. If you can find 4 or 5 clients yourself, you may be able to cut your hours in half and double your income. Are you familiar with how Internet auctions work? I recently worked with a guy who had purchased a book for $6 and sold it on eBay for $150 to add to his meager income. Don’t get trapped or feel like a victim. You may never get ahead in an hourly job. Roughly 70 percent of jobs held by people with less than a high school diploma experienced negative real wage growth in the last 2 years; even with college graduates, 56 percent are in jobs with no real wage growth likely. For more information, check all the free articles at www.48daysblog.wordpress.com. |

At this point, you should be prepared. You should know what comparable salaries are for the position you are considering. (Check Internet salary sites updated in the Appendix—http://48daysblog.wordpress.com/no-more-mondays-appendix.) That and the responsibilities of the position determine what your compensation should be. A couple of years ago, I worked with a young lady who had been fired from a position in which she made $19,000 per year for clerical work. She decided that wasn’t what she wanted to do anyway and began to get focused on what she did want. It was somewhat of a redirection, but she was enthusiastic and confident. After having done an excellent job search, she began interviewing for positions in graphic design and marketing. She interviewed for a position advertised at $32,500. She came out of that interview with a salary package of $54,000. The company does not know to this day that in her last job she was making $19,000, nor does it need to know. That has nothing to do with what she is being paid now. She relayed the benefits of what she had to offer and was compensated based on the value of that.

“I’m living so far beyond my income that we may almost be said to be living apart.” — e. e. cummings

Always focus on the job you are going to, not where you are coming from. There is no law that says your pay will increase by only 4 percent a year or even 10 percent. The world is a very giving place, and if you can convey your benefits, the world will give you what you are worth. Many of my clients have increased their compensation dramatically because they learned to focus on what they were going to rather than looking at what they came from.

Also, recognize that your needs are not the determinant of how you are paid. If you apply at Taco Bell, it is irrelevant whether you have a $1,200 per month house payment and a $450 per month car note; Taco Bell is not going to pay you $40,000 per year. Your needs are not the company’s concern. Recently a young lady come into my office in distress. She had spoken to her boss that morning, explaining that she had just moved into a nicer apartment and purchased a new car and could no longer manage on what they were paying her. They fired her on the spot. And I laughed when she told me this story. I totally agreed with the company. What she did to obligate herself to higher payments had nothing to do with how she should be paid.

Be sure you know your value and then market yourself in that range. In my experience, I find that people often give themselves about a $10,000 window from which to work. If they have been making $60,000, they will look at positions that pay about $55,000 to $65,000. But if they see a perfectly matched position paying $85,000, they don’t bother to apply. Be careful of setting your own limitations. You will end up pretty much where you expect to end up.

|

→Getting Paid What You’re Worth How do you describe what you’re worth? Is it based on your age, 4 times your mortgage payment, your degrees, your years of experience, or your past salary history? None of these matter. The only criteria for determining your value today is your current contribution and level of responsibility. I’ve coached lots of people into significantly higher levels of compensation by using the phrase, “Based on the level of responsibility you describe, I would see that in the —— to —— range. Is that still within your budget?” The biggest mistake people make in negotiating salary is to discuss it too soon. Do whatever you can to avoid talking about salary until you get the job offer. Anything prior to that will work against you. Also, the best to-the-point book on this I have ever found is Negotiating Your Salary: How to Make $1,000 a Minute by Jack Chapman. |

Keep these principles in mind:

1. You must make the company money. As a rule of thumb, you must make the company 3 to 5 times your salary for your hiring to be worthwhile.

2. Your compensation almost always relates to your level of responsibility. If it’s easy to replace you, you aren’t worth a whole lot.

3. Your work is an intangible. Few salaries are written in concrete. Companies that budget $78,000 for a position will start out trying to hire someone for $65,000. Recognize that the first offer is probably not what the company has in the budget.

4. Once you agree on a package, get it in writing. If you have been creative in this process, it is necessary to write out what you verbally agreed on. That way, you don’t have to defend later what you thought was said.

Have fun in the process. Don’t say yes until everything matches your goals. If you’ve done a great job search, you should be considering 2 to 3 offers.

COUNTDOWN TO WORK I LOVE

1. Is negotiating on price uncomfortable for you? Describe 3 things for which you negotiated the purchase price.

2. Have you negotiated your income in the past?

3. Do you realize that in changing companies you may be able to increase your income by 40 to 50 percent though that is unlikely to happen while moving up in one company?

4. What are the guidelines for how much is reasonable? What is fair? Is it always reasonable to ask for more?

5. Read Matthew 20:1–15. How does this parable fit what you’ve learned?

6. What would you do if you tripled your current income? What could you offer that would merit that?