A recent survey of U.S. adults and business decision makers, conducted by HarrisX on behalf of Guardian Life Insurance Company, looked into views regarding necessary job skills and employment among these two populations.

KEY FINDINGS

Half of business decision makers (BDM), and 33 percent of U.S. adults, are currently looking for new work.

• Forty-one percent of employed U.S. adults in a lower-income bracket (less than $75k) were looking for a new job. In comparison, only 33 percent of employed U.S. adults who earned more than $75k per year were looking for a new job.

Future economic outlook is more positive for business decision makers than for general U.S. adults.

• U.S. adults had a generally less optimistic view of employment prospects from companies in their area, with only 44 percent saying that companies are more likely to be hiring new workers, whereas 71 percent of business decision makers said that companies in their area were more likely to be hiring new workers.

Business decision makers, in general, are more optimistic about job creation than U.S. adults.

• Whereas 53 percent of business decision makers thought that more jobs will be created in the next 12 months, only 39 percent of U.S. adults agreed with this.

In comparison with business decision makers, U.S. adults felt more negative about their company’s ability to prepare them for the future.

• Fifty-one percent of business decision makers felt that their current job had prepared them very well for advancement at their current employer. In comparison, 29 percent of U.S. adults shared this sentiment.

• Thirty-seven percent of business decision makers felt that their current job had prepared them very well for automation of jobs in the future, but only 19 percent of U.S. adults felt this way.

Business decision makers from smaller companies found collaborative and interactive skills to be the most important, whereas medium-sized and large company business decision makers found technical skills to be more important when hiring a new employee.

The small company business decision makers are less likely to be planning to outsource or automate their labor.

• Fourteen percent of small company business decision makers are planning to outsource any of their labor within the next year, whereas 38 percent of medium-sized company business decision makers and 43 percent of large company business decision makers are planning to do the same.

• Overall, 69 percent of business decision makers plans on outsourcing their labor to U.S. companies rather than to the offshore companies.

• Eighteen percent of small company business decision makers are planning to automate their day-to-day processes within the next year; 47 percent of medium-sized company business decision makers and 54 percent of large company business decision makers are planning to do the same.

Business decision makers expect revenue growth in the next five years.

• More medium-sized company business decision makers anticipate revenue growth in the next five years than small and large company business decision makers, though optimism is high. 75 percent of medium-sized company business decision makers (top two box) responded that they anticipate revenue growth in the next five years. In comparison, 67 percent of small company business decision makers and 65 percent of large company business decision makers anticipate revenue growth in the next five years.

In terms of job market and skill changes, small company business decision makers are less likely to anticipate that any changes will have an impact on their business.

• Twenty-eight percent of small company business decision makers did not anticipate any changes to the nature of jobs or skills required at their companies in the next five years.

‐ In comparison, only 11 percent of medium-sized company business decision makers and 6 percent of large company business decision makers responded similarly.

Business decision makers typically have a longer commute than U.S. adults and are more willing to commute longer distances in general.

• Business decision makers are more willing to travel long distances to work, with 18 percent saying they’re willing to travel for more than 60 minutes. In comparison, 10 percent of U.S. adults are willing to travel for more than 60 minutes.

‐ Ten percent of business decision makers currently commute for more than one hour to get to work, whereas 7 percent of U.S. adults commute more than one hour to get to work.

Business decision makers are more likely to have done some sort of freelance work in their careers.

• Sixty-three percent of business decision makers have done some sort of freelance work in their careers, whereas 41 percent of U.S. adults have done some sort of freelance work.

DETAILED FINDINGS

Worker Demographics

Half of business decision makers, and one-third of U.S. adults, are currently looking for a new job.

• Forty-one percent of employed U.S. adults in a lower-income bracket (less than $75k) were looking for a new job. In comparison, 33 percent of employed U.S. adults who earned more than $75k per year were looking for a new job.

• Thirty-three percent of U.S. adults in a lower-income bracket were employed full time, in comparison with 53 percent of U.S. adults in a higher income bracket.

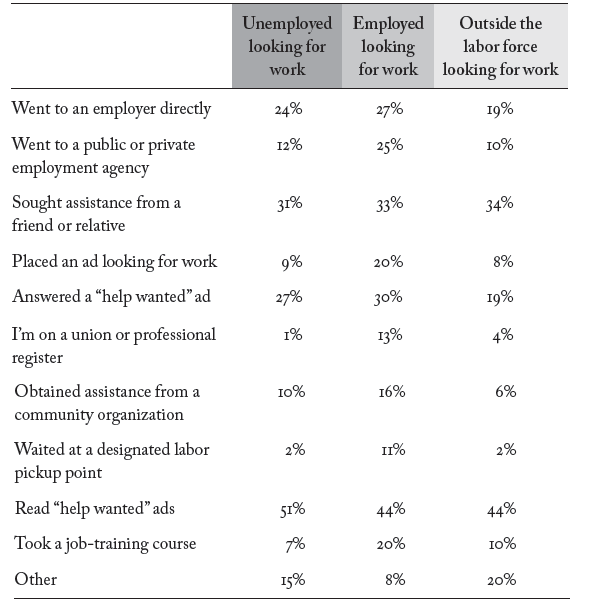

Employed job seekers were slightly more likely to be active in their job search in a variety of ways compared with unemployed job seekers or job seekers outside of the labor force.

• Twenty-five percent of employed job seekers went to a public or private employment agency, whereas 12 percent of unemployed job seekers and 10 percent of job seekers outside of the workforce did the same.

• Twenty percent of employed job seekers went to a job-training course. In comparison, 7 percent of unemployed job seekers and 10 percent of job seekers outside of the workforce did the same.

What are all of the things you have done to find work during the last 4 weeks?

Ill health and disabilities are the top reasons that the unemployed and those out of the labor force are not looking for work, and why unemployed people left their previous jobs.

• Sixty-eight percent of unemployed people not looking for work choose to do so due to ill health or other disabilities.

• Thirty-three percent of unemployed people left their previous jobs due to health reasons.

Views on the U.S. Economy

Business decision makers had an overall more positive outlook on their own finances and the economy in comparison with U.S. adults.

• Thirty-three percent of business decision makers rated the U.S. economy as “excellent”; only 14 percent of U.S. adults did the same.

• Business decision makers also had a more positive outlook on the state of the economy, with 49 percent saying that the economy is getting better. In comparison, only 31 percent of U.S. adults feel the same way.

• Whereas 32 percent of business decision makers rated their personal finances as “excellent,” only 15 percent of U.S. adults shared a similar view of their own finances.

• 56 percent of business decision makers feel as though their personal finances are getting better, compared with 32 percent of U.S. adults who held similar sentiments.

• U.S. adults had a generally less optimistic view of employment prospects from companies in their area, with only 44 percent saying that companies are more likely to be hiring new workers. In comparison, 71 percent of business decision makers said that companies in their area were more likely to be hiring new workers.

Younger business decision makers displayed more of a positive outlook than older business decision makers. In comparison, older members of the general American population held a more positive economic outlook, whereas the younger population felt more negatively.

• For example, 42 percent of business decision makers between the ages of 18 and 34 rated the U.S. economy as “excellent.” In comparison, only 23 percent of business decision makers between age 65 to 99 did the same.

State of Employment and the Labor Market

Forty-six percent of U.S. adults feel that the typical forty-hour work week is obsolete, and nearly seven in ten business decision makers feel the same way.

Business decision makers typically find opportunities to gain connections as a very important factor when considering a job, in comparison with U.S. adults.

• Business decision makers are more likely to

‐ find that the opportunity to travel for business is very important (38 percent for business decision makers compared with 17 percent for U.S. adults);

‐ find that the job where they gain the experience that could lead to better jobs in the future is very important (60 percent of business decision makers vs. 43 percent for U.S. adults); and

‐ think that having friends who work for the company is very important (30 percent for business decision makers compared with 14 percent for U.S. adults).

Business decision makers are more optimistic about the state of employment than U.S. adults.

• Whereas 53 percent of business decision makers thought that more jobs will be created in the next twelve months, only 39 percent of U.S. adults thought so.

• Business decision makers (45 percent) thought that more jobs would be created for highly skilled workers; U.S. adults (36 percent) thought that an equal amount of jobs would be created for both low-skilled and high-skilled workers.

• Business decision makers also expressed more faith in the information services and data processing industry, with 49 percent saying that it was one of the top three industries for job creation in the next twelve months. 36 percent of U.S. adults agreed with this, though 48 percent of U.S. adults thought health care and social assistance was one of the top three industries.

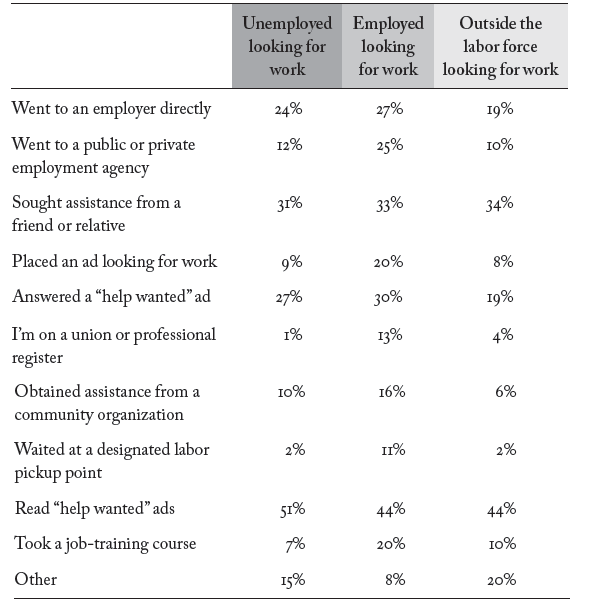

What do you think are the three most important hard skills to be competitive in the labor force today?

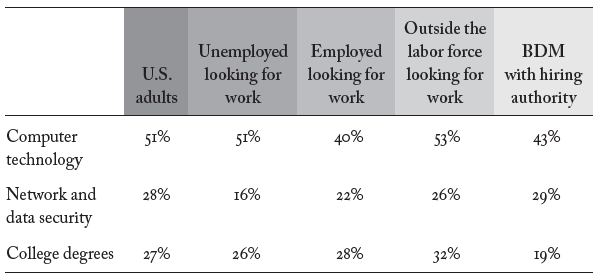

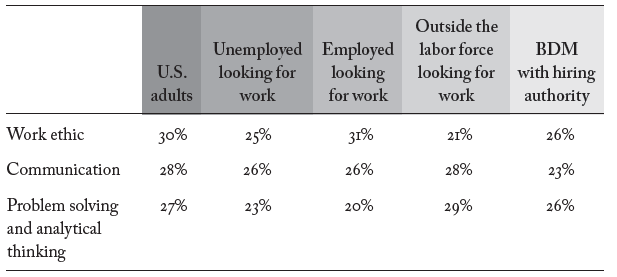

What do you think are the three most important soft skills to be competitive in the labor force today?

• Business decision makers overall agreed that computer technology was an important hard skill to have in the labor force today. However, business decision makers with hiring authority found cloud computing (27 percent) and network and data security (29 percent) to be more important than did business decision makers without hiring authority.

• In comparison, 51 percent of U.S. adults found computer technology to be one of the three most important hard skills in the labor force.

• Most business decision makers and U.S. adults agreed that employers value hard skills over soft skills (62 percent of business decision makers vs. 63 percent of U.S. adults).

• Both business decision makers and U.S. adults agree that individuals themselves hold responsibility to make sure that they obtain the skills necessary to succeed in today’s economy (67 percent of business decision makers compared with 62 percent of U.S. adults).

• Forty-six percent of business decision makers felt that automation would be a threat to their job in the next three years, whereas 34 percent of U.S. adults felt the same way.

Skills Training at Work

Compared with business decision makers, U.S. adults felt more negative about their company’s ability to prepare them for the future.

• Fifty-one percent of business decision makers felt that their current job had prepared them very well for advancement with their current employer. In comparison, 29 percent of U.S. adults shared this sentiment.

• Thirty-seven percent business decision makers felt that their current job had prepared them very well for automation of jobs in the future, but only 19 percent of U.S. adults felt this way.

More business decision makers received different types of professional training in comparison with the general American population.

In the past year, have you had professional training in any of the following?

|

U.S. adults |

Business decision makers |

| Leadership training |

26% |

57% |

| Language training |

17% |

32% |

| Technical skills training (data science classes, coding classes) |

23% |

50% |

| Social and digital media training |

20% |

46% |

| Writing and effective communication training |

24% |

44% |

| Math and science training |

19% |

35% |

| Professional certifications |

26% |

56% |

| Career and technical education |

24% |

46% |

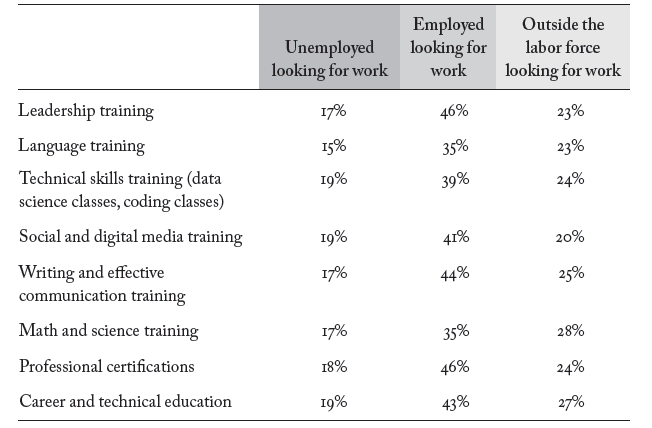

Employed job seekers were much more likely to have taken any sort of professional training, compared with unemployed job seekers and those out of the labor force.

In the past year, have you had professional training in any of the following?

• Business decision makers have more access to public transit and typically own a car.

‐ Eighty-three percent of U.S. adults own a car, whereas 97 percent of business decision makers own a car.

‐ Fifty-four percent of U.S. adults have easy access to public transit, and 72 percent of business decision makers have access to public transit.

• Business decision makers are more willing to travel long distances to work, with 18 percent saying they’re willing to travel for more than 60 minutes. In comparison, 10 percent of U.S. adults are willing to travel for more than 60 minutes.

‐ Ten percent of business decision makers currently commute for more than one hour to get to work. Six percent of U.S. adults commute more than one hour to get to work.

Sixty-three percent of business decision makers have done some sort of freelance work in their careers, and only 41 percent of U.S. adults have done some sort of freelance work.

Business decision makers and U.S. adults generally agree on the top skills required to be successful in freelance work today.

• Both business decision makers and the general U.S. population agree that computer technology is one of the top hard skills required to succeed in freelance work today (39 percent of business decision makers compared with 42 percent of U.S. adults).

• Twenty-seven percent of business decision makers and 33 percent of U.S. adults said that hard communications skills are important for succeeding in freelance work today

• Business decision makers and U.S. adults find work ethic and communication to be the most important hard skills.

‐ Twenty-five percent of business decision makers rated work ethic as a top three soft skill, and 27 percent of U.S. adults did the same.

‐ Twenty-three percent of business decision makers said that communication is a top three soft skill, and 28 percent of U.S. adults did the same.

A Deeper Look at Business Decision Makers

• Forty-five percent of business decision makers have recently hired workers, and 30 percent are looking to hire in the next three months.

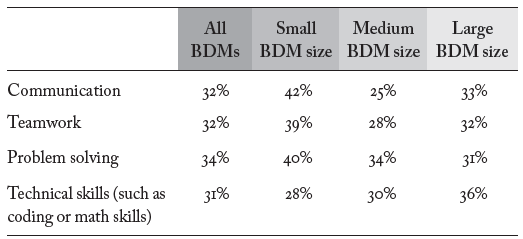

• Problem solving, communication, and teamwork are viewed as the top three skills that business decision makers look for when hiring a new employee.

• Half of large (54 percent) and medium-sized (50 percent) company business decision makers agreed that their organization has had difficulties in finding candidates to fill open positions. By comparison, 33 percent of small company business decision makers faced a similar challenge.

‐ The top two reasons given for this difficulty in filling jobs are “Candidates today do not have the technical skills required to fill positions at my organization” and “Candidates today expect too high of a salary, or too many benefits.”

‐ For large company business decision makers, “Candidates today do not have the social/soft skills required to fill positions at my organization” was second in the list of difficulties in finding candidates to fill open position.

Small company business decision makers found collaborative and interactive skills to be the most important, whereas medium and larger company business decision makers found technical skills to be more important when hiring a new employee.

• For example, although, overall, business decision makers ranked communication and teamwork as the second most common important skills to have, there was a large discrepancy between responses among smaller business decision makers and larger business decision makers.

‐ Larger business decision makers found technical skills to be more important when hiring a new employee.

When you are hiring a new employee for your organization, what are the top three skills that you look for?

• Small company business decision makers are less likely to feel that they have an adequate number of qualified applicants in their area.

‐ Sixty-two percent of small company business decision makers feel they have a qualified enough applicant pool near their business; 78 percent of medium-sized company business decision makers and 81 percent of large company business decision makers feel the same way.

Small company business decision makers are less likely to plan to outsource or automate their labor.

For those who plan to outsource, overall, the sentiment is the same across the board.

• Fourteen percent of small company business decision makers are planning to outsource any of their labor within the next year, whereas 38 percent of medium-sized company business decision makers and 43 percent of large company business decision makers are planning to do so.

• Overall, 69 percent of business decision makers plan on outsourcing their labor to U.S. companies rather than to offshore companies.

• Eighteen percent of small company business decision makers are planning to automate their day-to-day processes within the next year, and 47 percent of medium-sized company business decision makers and 54 percent of large company business decision makers are planning to do the same.

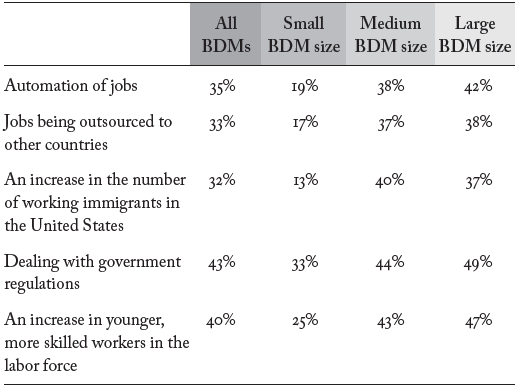

Unlike large company business decision makers, small company business decision makers also typically do not find job market changes to be as important to the future of their company.

How important do you think the following things are to the future of your company? (Very Important)

All business decision makers expect revenue growth in next five years. In terms of changes, small company business decision makers are less likely than decision makers at medium and large companies to anticipate that any changes will have an impact on their business.

• Twenty-eight percent of small company business decision makers did not anticipate any changes to the nature of jobs or skills required at their company in the next five years.

‐ In comparison, only 11 percent of medium-sized company business decision makers and 6 percent of large company business decision makers responded similarly.

• Thirty percent of small company business decision makers believed that their business would make changes associated with, or be affected by, automation, whereas 52 percent of medium-sized company business decision makers and 64 percent of large company business decision makers felt the same.

• Sixty-two percent of large company business decision makers believed their business would make changes associated with, or be affected by, “greater industry competition”; 59 percent of medium-sized company business decision makers and 51 percent of smaller business decision makers felt the same.

• Similarly, 67 percent of large company business decision makers believed their business would make changes associated with, or be affected by, “More efficient processes (e.g., less reliance on paper, more digital),” and 62 percent of medium-sized company business decision makers and 43 percent of smaller business decision makers felt the same.

• More of medium-sized company business decision makers than small and large company business decision makers anticipate revenue growth in the next five years, with 75 percent (top two box) responding that they anticipate revenue growth in the next five years. In comparison, 67 percent of small company business decision makers and 65 percent of large company business decision makers anticipate revenue growth in the next five years.

This survey was conducted online by HarrisX in the United States from November 22 to 26, 2019, among 2,044 U.S. adults and 1,000 business decision makers. The sampling margin of error of this poll is plus or minus 2.2 percentage points. The results reflect a nationally representative sample of U.S. adults. Results were weighted for age within gender, region, race, and income where necessary to align them with their actual proportions in the population. For the business decision maker sample, the sampling margin of error of this poll is plus or minus 3.1 percentage points. The results reflect a nationally representative sample of U.S. adults who have decision-making authority in their place of employment. Results were weighted for employment size in accordance with U.S. Census data.

ABOUT HARRISX

HarrisX is a leading opinion research company that specializes in online polling, mixed-mode polling, and data analytics. The company has a thirteen-year history assessing public opinion and behavior in the telecom, media, and technology industries through syndicated and custom research services. HarrisX runs the Mobile Insights and Total Communication Surveys, the largest syndicated consumer insights trackers in the United States for the TMT space, which includes more than 60,000 monthly respondents; the Telephia (beta) metering application, which captures behavioral data; and HarrisX Overnight Poll, which delivers results of general population and voter surveys within twenty-four hours, looking at U.S. adults’ opinions on society, politics, technology, and the economy. For more information visit www.harrisx.com.