Chapter 6

BETTING ON THE FUTURE

“Leadership is about making others better

as a result of your presence, and making sure

that impact lasts in your absence.”

—Sheryl Sandberg

“Philanthropy is not about the money,” Melinda Gates once said at the World Economic Forum. “It’s about using whatever resources you have at your fingertips and applying them to improving the world.”1

While charity is a social palliative that provides immediate relief of suffering in crisis situations, philanthropy has a different agenda. According to Laura Arrillaga-Andreessen, professor of strategic philanthropy at Stanford, “Philanthropy is a proactive attempt to change systems and solve social problems by addressing their root causes. Philanthropy empowers individuals to become self-sufficient…”2

Obviously, the risks are far greater when you attempt to make a real difference. But it is those same conditions that make the rewards invaluable.

BOYS & GIRLS CLUBS

Giving generously to those who need it most can change your own life as much as theirs.

Of all the philanthropy in which I’ve engaged, the single most satisfying effort has been with the Boys & Girls Clubs of America.

It began in 1993 when I was looking for a charity that helped inner-city youth. A resident of the notorious Watts area in South Central Los Angeles directed me to the Challengers Boys & Girls Club.

After I’d researched the club and interviewed the references he provided, I offered to send a generous check, but he refused. “You need to come to Watts and meet Lou Dantzler first,” he insisted. “He’s the guy who started the clubs in LA.”

I wasn’t too excited about spending a day in Watts.

After World War II, tens of thousands of African Americans had migrated to California from Louisiana, Mississippi, Texas, and Arkansas, looking for more opportunities and less discrimination.3 Too many had ended up impoverished in Watts. The blame and bitter disappointments of those previous generations still hung palpably in the air.

Since the 1960s, those two square miles of the city had developed a reputation as a low-income, high-crime area prone to violence. It was where street gangs fought for turf on a tiny urban patch of steel and concrete with the highest population density in LA. The thing is, it also had one of the youngest demographics in the country.4 Those were the kids I wanted to help. So I reluctantly agreed. It was a fateful meeting.

Lou was a bear of a man with a mild demeanor and a warm smile. But he had more courage and steely determination than anyone I ever met.

“Challengers is an oasis in a war zone,” he explained to me. Kids came there for safety and encouragement to find a better life. Even gang members brought their younger siblings to the club so that they could have a better future. The gangs never damaged the clubhouse. Even during the infamous Watts riot of 1992, when rioters took over the freeway, blocked traffic, beat up motorists, wrecked and looted downtown stores, and set more than one hundred fires,5 Challengers had stood untouched, surrounded by burned-out buildings.

When I met Lou in 1993, he was looking for ways to expand farther into the inner city. I had the idea of using public schools to save on capital costs for buildings and recreational facilities. (The strategy has since been adopted nationally and has accelerated Boys & Girls Clubs of America growth.)

After our initial attempts to persuade the Los Angeles Unified School District to open their doors to Challengers after school hours failed, I called Tom Bradley.

A five-term mayor of Los Angeles, Bradley had made history when he was elected in 1973 as the first African American mayor of a big American metropolis with a predominantly white population. In the aftermath of the riots provoked by the beating of Rodney King in 1992, Bradley was at an all-time low. Some believed that the outpouring of civil unrest had shattered all hope that a black mayor could make a difference in the battle against inequality. Despite all he’d accomplished, Bradley himself was discouraged by his inability to do more, and he would announce his retirement within months.6

Using his influence to help Challengers seemed like just the kind of mission he might warm to. His own mother had moved to the city when he was just seven years old.7 He knew firsthand what it was like to face temptations, obstacles, and setbacks without the guidance of a father figure.

When we spoke, I explained that I had financially backed his campaigns, even though I lived outside LA. I told him that we all had a duty to help these kids.

“What do you want me to do?” he asked.

“Make the school board approve the use of schools with Challengers in Watts.”

Bradley agreed. But the school board, in my opinion, lacked the courage to follow through. Instead of making a decision themselves, they ruled that the individual principals of each school would decide whether to host the after-school programs or not. I was disappointed to see them offload the decision to the already overworked principals in tough neighborhoods. But these principals demonstrated the devotion that had led them to their profession in the first place.

Every principal heartily welcomed the Challengers Club. Sooner than expected, we had three branches in inner-city elementary schools. The principals’ dedication to their kids inspired me. Politicians took credit for the idea, the school board refused to take any responsibility, and the press got the facts wrong—reporting that my employer, not I, had provided the money, and misspelling my name while they were at it! But I was thrilled. Much is possible if you don’t mind letting others take full credit.

During 1995, Pete Silas asked me for a favor. Pete was legendary as the chairman of Phillips Petroleum and just about every other board on which he sat. I’d come to like and respect Pete when we were both serving on the board at Georgia Tech.

“Do you think any of your business partners would be interested in being a director of Boys & Girls Clubs of America?” he asked innocently.

“I don’t know, Pete, but I’ll ask around.”

“Well, actually”—he chuckled—“I had you in mind!”

My response was guarded. I was working sixty to seventy hours a week. My enthusiasm for Boys & Girls Clubs of America could not have been higher. I’d been giving an increasing amount of time and money to the Challengers Club for years, but where would I find the time to be a director of an organization with two million kids?

By way of persuasion, Pete arranged for me to meet some of the other Boys & Girls Clubs board members. With the active encouragement of the warm yet persistent Sandy Milbank, I signed on. I soon learned that, under Pete Silas’s chairmanship, the Boys & Girls Clubs’ focus had matured. Instead of simply trying to help the kids avoid a life of crime, the programs strove to prepare them to lead productive lives. The emphasis was on education, health, and career preparation. This approach attracted an even greater number of kids, and naturally the broader programs demanded more money.

Pete’s strategy really took off during the presidency of the wonderful Roxanne Spillett, who helped transform Boys & Girls Clubs into the largest network of facility-based youth development organizations in the world at four thousand club locations worldwide. With a staff of fifty thousand employees and two hundred thousand volunteers, Boys & Girls Clubs helps young people achieve academic success, lead healthy lifestyles, develop strong character, and engage in what the I Have a Dream Foundation calls “a level of civic engagement not seen since the founding of our nation.”8

Rick Goings, my great friend, who is the chairman and CEO of Tupperware, joined Roxanne in setting ambitious goals for growth when he became chairman in 1996.

That same year, five-star general Colin Powell joined the board. As the youngest person and the first African American to ever hold the position of chairman of the Joint Chiefs of Staff, Powell was an awesome role model for all the kids. He himself had grown up on the streets of the South Bronx, as the son of Jamaican immigrants, and he knew about the hardships these kids faced. In five years, his influence would become even greater when he became the nation’s sixty-fifth secretary of state and the first African American to hold that position.9

I had joined the board when it was floundering and helped them adopt aggressive policies that were paying off. The board wasn’t primarily made up of wealthy blue bloods, but of former club members who had worked their way to success.

|

BOYS & GIRLS CLUBS 10-YEAR TRACK RECORD |

|||

|

SCOPE |

1995 |

2004 |

change |

|

Number of Clubs |

1,810 |

3,681 |

1,871 |

|

Number of Youths Served |

2.4mil. |

4.4mil. |

2mil. |

|

STAFFING |

|||

|

Combined Full/Part-Time Staff |

13,500 |

44,000 |

30,500 |

|

Number of National Staff |

160 |

330 |

170 |

|

REVENUE |

|||

|

Combined local and national income |

$362mil. |

$1.1bil. |

$758mil. |

|

BGCA Private Dollars Raised |

$14mil. |

$45mil. |

$31mil. |

|

Federal Funding |

$5mil. |

$105mil. |

$100mil. |

|

State Alliance Funding |

$0 |

$30mil. |

$30mil. |

|

Pass-Through Funding |

$6mil. |

$97mil. |

$91mil. |

Colin Powell feeding cake to Daniel Boulud while I do the same to Alma Powell at the opening of Daniel’s new restaurant, with help from the Boys & Girls Clubs board members.

JOEL SMILOW

When Joel Smilow became a director of Boys & Girls Clubs, he focused on evaluating the impact of the programs, rather than just their size.

The former chairman and CEO of Playtex, Joel was a generous philanthropist, but every gift needed to adhere to the four categories of his philanthropic philosophy: “Do it now, leverage the gift, make a difference, and get accountability.”10

Joel liked to say that the most important of these was to do it now. “All of my money eventually goes to charity, but the more that can go now, the better. The big winner by doing that is me. I get the joy and satisfaction of seeing it do good things.”11 But when he came to Boys & Girls Clubs, he emphasized accountability. It was great to have a lot of programs motivated by the best intentions, but which ones were having the most impact? he wanted to know.

As a result, fund-raising broadened and increased in sophistication. Training programs increased and improved. Human resources policies were strengthened. Trustee recruitment targeted promising industries. Process improvements cut costs. And the individual clubs, long accustomed to operating as they wished, were increasingly required to comply with a uniform standard for the quality and quantity of programming.

Measuring program impact is always the toughest process for any nonprofit—especially since, as in the for-profit world, it is the most subject to gaming. Nonetheless, Boys & Girls Clubs eventually developed some very relevant metrics.

| Alumni who say the club saved their lives | 57 percent |

| High school graduation | 90 percent |

| Expect to earn a college degree | 26 percent |

| Know right from wrong | 85 percent |

| Ability to avoid difficulty with the law | 67 percent |

| Helping others is a priority of mine | 92 percent |

| Improved health and fitness | 80 percent |

| Average attendance | Four days/week |

A combination of a stronger and more productive board, inspired operating leadership and staff, and greatly improved fund-raising was fuel for growth in both the number of youth served and in the programs’ impacts. The quality of the effort was recognized by The Chronicle of Philanthropy, which has ranked BGCA consistently as the number one youth nonprofit organization as well as among the best of all US nonprofits.12

When I became chairman of the Pacific Region trustees, I helped expand and strengthen that group. For many years, I served as chairman of the investment committee, during which time the endowment fund grew from $159 million to $260 million. I also served for years as a vice chairman of the board, helping set policies and strategies. In 1997, I was honored to receive Boys & Girls Clubs’ highest volunteer award.

While I was serving as chairman of the investment committee, the BGCA national headquarters relocated from New York City to Atlanta. A generous grant from the Woodruff Foundation allowed us to buy and renovate a sixty-one-thousand-square-foot building in midtown that accommodated 104 people.

We were growing so fast that we quickly outgrew the space! Happily, a nearby office tower came up for sale at a bargain price of $139 per square foot. With renovations, new furniture, and moving costs, BGCA needed $29 million—a huge sum, considering our cash reserves. Regardless of the need for the space, many of the directors opposed the transaction.

I galvanized the investment committee to support the purchase. The $29 million was not what it seemed, I pointed out. We could commit some of the endowment cash, which would be repaid over time by charging BGCA market rents. Then, after selling our existing headquarters, we would only need $20 million. The unoccupied space in the building could be rented for $350,000 per year, which would service $7 million in loans at 5 percent interest. After that, as much as $15 million could feasibly be covered by naming gifts to make up the difference.

The board saw the logic. A $15 million, 3.5 percent bond was sold, which provided more than the cash we needed. And today, needless to say, the building is worth many times its original cost. It was the investment committee’s finest moment.

Our darkest hour was ahead. No good deed goes unpunished.

BGCA was not only growing larger, but its quality and outcomes were magnitudes greater than before. With its endowment fund performing in the top decile of its group, you’d think that people would be glad to see such good work being done. But, as is often the case, prominence of any kind attracts a low breed of people who salivate over the chance to attack big-name targets for no reason other than a desperate grasp for fifteen minutes of fame.

During 2010, BGCA received letters from certain senators demanding details about executive compensation, perks, travel, and other expenses. They purportedly suspected that we were “a top-heavy organization demonstrating questionable management of hundreds of millions in taxpayer dollars and charitable donations.”13

In return, we were suspicious of their motives, since they sent the letters not to us, but to the media! Their press release claimed that President Roxanne Spillett had earned over $900,000 two years earlier, while local Boys & Girls Clubs across the country had been forced to close for lack of funding. They also cited travel expenses of over $4 million, with $1.6 million spent on conferences and over $540,000 on lobbying.14

The Boys & Girls Clubs released a statement defending Roxanne, pointing out that the organization had doubled both its revenue and the number of young people served under her presidency. It also confirmed that her base salary of $360,774 had not increased since 2006.15 Roxanne had served for decades without an appropriate retirement plan. When we awarded one to her, accounting rules made us report its value as her income for one year.

While legitimate questions were raised, a great amount of time and expense was lost in answering them. Out of fear of harming the organization that she was so devoted to, Roxanne went so far as to forfeit some of her legitimate retirement benefits. A political power play trumped fairness.

By the end of 2010, the questioning had died down as the press lost interest. Only one issue remained: Was BGCA investing money outside the United States in order to dodge taxes? And we were.

The fact is, there was, and still is today, a defect in the US tax code that creates “phantom income” when most nonprofits invest in funds with outstanding loans. These loans trigger what is called unrelated business income tax (UBIT). It is well-known that this is a tax on purely fictional income.

Most leveraged funds offer a “feeder fund” based in a tax haven that invests in leveraged onshore funds. The IRS knows all about this and doesn’t seek to stop it.

As fiduciaries of Boys & Girls Clubs, I believed that we were obliged to maximize our investment returns by eliminating UBIT according to best practices (i.e., investing through the tax-haven feeder funds). I had long hated the added expense of feeder funds necessitated by a defect in the tax code.

While others on the board were nervously recommending that we close the feeder funds to moot the accusations of the senator, I proposed that we cooperate with the complaining senator and seek to fix the tax code together. This would both resolve his complaints and save us and other nonprofits this inefficient flow of funds into tax havens.

As I saw it, this course of action clearly was good for America as well. We would be taking the opportunity to save ourselves a needless expense, while helping the rest of the country—perhaps even the senator—do the same. The senator was unresponsive.

Sadly, at my last board meeting, most everyone voted to liquidate all our offshore holdings, while I abstained. The threat of Congress cutting off its support for Boys & Girls Clubs was greater than the benefit of avoiding a phony tax.

“It’s McCarthyism reborn!” I clamored, but I understood. Other institutions not so dependent on the US government have not capitulated to this pressure, and I salute them.

All things considered, I’m proud of our investment committee results. In 2003, we shifted out of US equities into international and alternative equities. We reduced fixed income and added inflation-sensitive equity. Then, in mid-2007, we increased our cash and our investment in US government bonds. We pioneered an accounting process to look through fund portfolios in order to calculate our true allocation by asset class, geographic exposure, and strategy. We also terminated misleading reports that equated volatility with risk. By spring 2011, our financial consultants wrote:

As we reported in January, the Clubs’ 5- and 10-year returns rank among the strongest in Cambridge Associates’ universe of clients (who have generally outperformed the institutional universe at large), and this remains the case after Q1. For the 5- and 10-year periods ended in March, the Clubs’ portfolio ranked 43rd and 21st among the 351 Cambridge Associates clients reporting returns for those periods, placing it in the top decile for both periods. Further, the Clubs’ performance among similar-sized institutions (defined as those with an asset size between $200 million and $500 million) has been even stronger—the Clubs ranked second and fourth out of 73 institutions for both periods.

Not a bad report card for our wonderful committee.

When I retired from the board, they made me a lifetime member. I loved the idea! One of the directors asked me to join him next to a large screen in front of the group.

“We want you to watch this,” he said, smiling, as someone turned down the lights.

As a video began to play, I saw so many people, including Lou Dantzler’s son, thanking me for my contribution. I started getting emotional. Then the lights came up and I noticed a guy wearing big round glasses like mine! That was odd, I thought. I hadn’t noticed before that we wore the same glasses. He was also wearing a bow tie like I do, but I had noticed that before.

As I glanced around, I saw the woman next to him was wearing a bow tie and glasses and the guy next to her and the guy next to him… Even Condoleezza Rice and Goldie Hawn were sitting there grinning in big round glasses and bow ties! What a perfect homage! We all started to laugh.

“I’m leaving this board at exactly the wrong time!” I said. Their affectionate joke left me doubled over with laughter. And teary eyed.

Condoleezza Rice and Goldie Hawn at my retirement party.

LOU DANTZLER

One hot summer day in South Central LA in 1968, Lou Dantzler came home early to find his neighbor’s eleven-year-old son breaking into his house. Lou was angry but not surprised. He’d caught the kid red-handed and could’ve called the police, but everybody knew that juvenile hall was nothing but a training ground for criminals. Sending an impressionable kid there wouldn’t help anyone.16

What the boy really needed—like dozens of kids in the neighborhood—was the influence of a father, taking an interest and providing the discipline to keep him out of trouble. That was the day Lou decided to step up.

He invited this boy and eleven other kids in the neighborhood to spend a fun-filled day at a nearby park. Their eyes grew wide when they saw it. Not a single one of them had ever been there before. It was like paradise.17

In the course of the day, a few of the boys felt comfortable enough to share their problems with Lou, and he gave them advice. When they got too rowdy, he firmly brought them back in line. His care, attention, and constraints were exactly what they’d been missing, and instinctively they knew it. As they were leaving, he asked if they wanted to do it again. The boys all cheered. Then one boy asked, “Can I bring a friend?”18

The next weekend, twelve kids turned into twenty-five. A month later, fifty kids showed up. Lou realized he was going to need help, so he invited his friends to join in. Before long, a network of parents were participating. By the end of the summer, a hundred kids showed up at the park.19

Sensing that the kids would benefit from an added sense of ownership and belonging, Lou decided to call it a club, the Challengers Boys Club. When the owner of the closed Vons Grocery on Fifty-First Street and Vermont Avenue heard what Lou was doing, he offered his empty store as a meeting place. It had been abandoned since the Watts riots in 1965.20

Eric Davis, who later played center field for the Dodgers, was a member from the time he was seven years old. He said that Lou took kids “that no one else believed in, and he made believers of everybody.”21

Lou had personal experience of how important it was to fill the empty places in a young kid’s life. He had grown up without a father himself, on a farm in South Carolina. Until his older cousin Willie took him under his wing, the only prospect in his future was picking cotton. From Willie he learned how to strive for something more than a “downtrodden, go-nowhere life.”22 From his mother, he learned to look after other people. In a 1999 interview with the Los Angeles Times, Lou said, “My mother was the kind of person who, when someone was sick, she’d take them food. And I’d think, ‘We need that food.’ But we always survived. That taught me a lot about how to live.”23 Lou told me of nights when the Ku Klux Klan rode through his neighborhood and his family would cower in the dark. What a childhood!

For forty years Lou was a deeply loved and respected guide to the boys and girls in South Central LA, who called him Papa Lou. Supporters and sponsors emerged from every walk of life: Sidney Poitier, Henry Kissinger, Barbara Walters, Denzel Washington, and Magic Johnson, among many others.24

Lou Dantzler built a home for kids in the heart of the toughest gang territory in America. Parents, kids, and even gang members respected Lou’s efforts to set positive standards for kids and consistently enforce them.25

After the Los Angeles riots of 1992, when President George H. W. Bush visited the club, he said, “This Boys & Girls Club stands unscarred, facing a burned-out block. And its leader is this wonderful man next to me, Lou Dantzler. And he started it in the back of an old pickup truck with a group of kids that wanted to get off the street. And its existence proves the power of our better selves.”26

Before his speech, I met with President Bush and asked if he had read the book I was holding, the Report of the National Advisory Commission on Civil Disorders. It had predicted continued inner-city violence until these kids had hope for a decent life. He admitted he hadn’t. I gave him the book, which he promised to read on the plane. Sadly, not much has changed.

Smithsonian Institution

Getting close to superior efforts to gain new knowledge stretches your mind and stokes your imagination.

Wayne Clough says that before he became the chief executive officer of the Smithsonian in 2008 people thought of it as:

the nation’s attic—a dusty place not going anywhere, looking backwards as opposed to looking forward.27 That hurt us a great deal when I went up on the Hill and spoke to Congress about the possibilities of funding for the Smithsonian. They tended to view us as … a museum, and museums are wonderful things, don’t get me wrong, but sometimes that was a pejorative term.

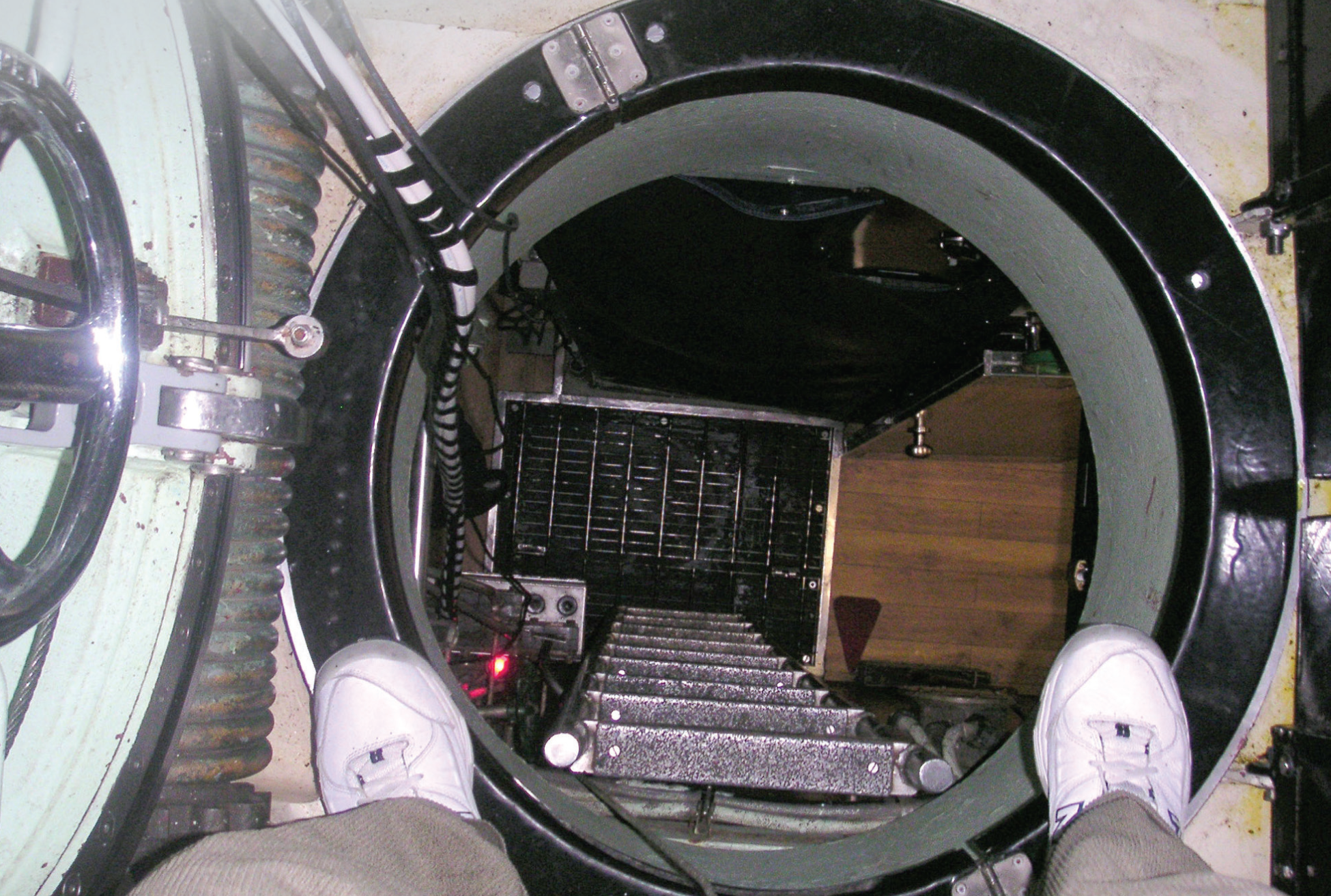

Greeting President Bush on his visit to Challengers.

The report I gave him that had predicted the riots—which he had not read.

Science was one of its most dynamic activities, but at the time, that important work of the Smithsonian was virtually invisible—and not just on Capitol Hill.28

“I was surprised at how few people in the science community knew—unless they were in a specific discipline—what the Smithsonian was doing in science,” Wayne said.29

Like everybody else, I knew little about the institution’s activities. When Wayne explained to me the Smithsonian’s wide range of engagement, it was an eye-opener. The institution clearly needed a higher profile. Wayne succeeded in raising it beyond all expectations.

Wayne and I had been friends for years. He graduated from Georgia Tech with a degree in civil engineering in 1964. Thirty years later, in 1994, he was the first alumnus to become president of Georgia Tech.30 When he made the move to the Smithsonian in 2008, his leadership launched a new era that gave the institution a powerful international relevance.31

“We are an unusual institution,” Wayne explained. “There are many great science museums—the California Academy of Sciences, the Field Museum, the American Museum of Natural History in New York City—and there are many great art museums. But the Smithsonian is an amalgam of all those things.”32

The Smithsonian is the largest museum/research institution/educational organization in the world. It generates a continuous flow of new knowledge on a massive scale. Given its complexity, it is a massive management challenge.

The Smithsonian includes nineteen museums, seven research centers, two giant telescopes, and the National Zoo. It runs research programs in more than one hundred countries. Taken together, these disparate activities make it a mighty force in education and research. Wayne has seen to it that the enormous museum collection will be completely digitized and available online free for people all around the world.

As Wayne began to educate me about the scope of the Smithsonian’s fascinating activities, I was immediately attracted to the prospect of getting involved. I love the opportunity to learn about new things to which I’ve had little previous exposure. Not only was the Smithsonian a preeminent source of knowledge, but the range of topics in its expertise was beyond imagination. Another new adventure!

I was delighted to participate, and the choices available were remarkable. Almost every one of the museums and installations has its own board, which means there is a huge range of topics and activities available for interested contributors. The duties of national board members were most interesting to me. Not only did we help with fund-raising, but we also gave advice on strategy and operations.

Since the time demands on board members were low and the work was constantly engaging, it fit into my life perfectly. And, of course, it didn’t hurt that our board meetings sometimes took place in exotic locales, where the leaders of the research teams came to explain their research and discoveries to us in person.

My first board meeting, in February 2012, was held in Panama at the Smithsonian Tropical Research Institute, which had begun as a simple biological survey in 1910. The Smithsonian now has scientists at ten locales around Panama, observing the changes in plant growth due to variations in geology and in climate.

One of the highlights of the trip was our visit to an ancient megalodon breeding pond from perhaps twenty-three million years ago.33 The fossil record shows that the extinct Carcharocles megalodon was the biggest shark that ever lived.34 Growing up to fifty feet long, the megalodon is thought to have weighed as much as 110 tons. For comparison, consider the African bush elephant, the largest land mammal on earth today. Among those elephants, the greatest body mass ever recorded was that of an enormous wild bull in Ngaruka who weighed 6.64 tons.35 It would require more than sixteen of the biggest bull elephants on earth to match the weight of one megalodon shark.

These creatures were so massive, they fed on whales. Their bite force ranged from twelve to twenty tons—more than four times greater than that of a Tyrannosaurus rex. With that kind of power, they were able to kill whales by simply biting off their tails!36 Yet as millions of years have passed, great white sharks and many species of whales have outlived megalodons. Catalina Pimiento at the Smithsonian Tropical Research Institute explains that, ironically, the strength and size of megalodon sharks may made them more vulnerable to extinction. “When food supplies dwindled, these giant creatures could have had a tough time finding enough food.”37

Also, they uncovered evidence that the Isthmus of Panama arose from the sea as many as fifteen million years ago. Prevailing views had been that this separation of the Atlantic from the Pacific is only about 3.5 million years old, which correlates with the North American Ice Age. This new dating casts doubt on the traditional assumptions about what caused the Ice Age.

Another board meeting was held in Hawaii, where we were introduced to the scientists’ studies of coral reef growth and their efforts to preserve coral sperm and eggs for reef regrowth around the world. We watched molten rock flow out from the very core of the earth as it continues to expand the island of Hawaii.

One afternoon, we were taken to the 13,755-foot peak of Mauna Kea on Hawaii’s Big Island to visit the Smithsonian Astrophysical Observatory’s Submillimeter Array. There, eight radio telescopes scour the known universe in coordination with each other to search for radiation signatures like those emitted by the cool dust surrounding newborn stars.38

The astronomers at the Smithsonian have been studying a young star that is the size of our own sun, but 450 light-years away. There appears to be a gap in the penumbra of debris around the star. In that gap, a Jupiter-size planet is being formed. At the top of Mauna Kea, Smithsonian astronomers are watching a planetary system, very much like our own, coming into existence. 39

It was thrilling to imagine the birth of other galaxies like ours. I asked the astronomers if they’d found other planets with conditions that could produce human life. They unequivocally said yes!

Back in the heart of Washington, DC, on 163 acres of Rock Creek Park, lies another Smithsonian marvel: the National Zoo. Established in 1889 by an act of Congress, the zoo’s mission is “the advancement of science and the instruction and recreation of the people.”40

Sumatran tigers, Asian elephants, giant pandas, Panamanian golden frogs, North Island kiwi, African kori bustards, and orangutans are but a few of the three hundred different species represented by the zoo’s fifteen hundred animals. Between thirty to forty endangered species are also protected there.41 But the Smithsonian goes further than merely providing refuge for these animals.

The Smithsonian Conservation Biology Institute (SCBI) is an international leader in conservation, working to save wildlife species from extinction and to teach the next generation of conservationists. More than twenty endangered species have been bred by the SCBI and released into the wild. In 2006, SCBI scientists cryogenically preserved eggs and sperm from the Great Barrier Reef coral to create the first genome repository for coral. Once extinct in the wild, black-footed ferrets and scimitar-horned oryx have been reborn.42 The last wild horse in the world, the Przewalski’s horse, was extinct in nature in 1969, but the Smithsonian has contributed to the rescue and reintroduction of the species. Herds amounting to nearly five hundred Przewalski’s horses now live in Kazakhstan, Mongolia, and China.43

The life span of these restored species will be greatly increased if care is given to the ecosystem of the planet they share with us. In 1910, the Smithsonian Tropical Research Institute was founded to do just that. The vast majority of animals, plants, and fungi on earth live in the tropics. Although it is a small area the size of South Carolina, there are more species of birds and plants in Panama than in the United States and all of Canada put together.44

The Smithsonian Museums include such diverse activities as the Anacostia Community Museum, the Arts & Industries Building, the Cooper Hewitt Smithsonian Design Museum, and the Freer | Sackler Gallery. The wide-ranging research centers further include the Archives of American Art, the Museum Conservation Institute and the Smithsonian Astrophysical Observatory.

Ultimately, I initiated an advisory committee to assist in developing the Smithsonian’s commercial operations (pay TV, magazine shops, travel, etc.) and helped fund a new project to study change in coastal ocean waters on a global scale.

TENNENBAUM MARINE OBSERVATORIES NETWORK

The work at STRI was inspiring, so when Wayne told me that they wanted to set up a similar group to study climate change under bodies of water, I was interested. With more than 70 percent of our earth’s surface covered by water and 75 percent of its people living within one hundred miles of a coastline, the oceans are of great importance to our quality of life. Not only do they help regulate the climate, but they are a major food source. Suzanne and I agreed to provide an initial gift of $10 million to the Smithsonian to launch the Tennenbaum Marine Observatories Network (TMON) in order to create a greater understanding of coastal marine life and the role it plays in sustaining resilient ecosystems on the planet.

Unlike most ocean research efforts, which study either the open sea or ocean characteristics, TMON integrates numerous scientific disciplines to study the functions of the ecosystems and biodiversity along the coasts over long periods of time, using standardized testing and covering large areas. Experts in ecology, biology, and anthropology are given the opportunity to use cutting-edge technologies like DNA sequencing to advance our knowledge of undersea life. Already thousands of new life forms have been discovered.

The Tennenbaum Marine Observatories Network is particularly close to my heart, because I have lived near the water for most of my life. For more than twenty-five years, I have nurtured my love for scuba diving in dives all over the world. I never feel more at home than when I’m underwater.

I know that the leaders of the Smithsonian are passionate about this important research. It is the study of the life of the planet itself. For such a huge task, passion and adventurousness are the basic requirements.

WAYNE CLOUGH

Born in 1941 in Douglas, Georgia, a small Southern town of only fourteen square miles and a little over five thousand people, Wayne Clough went on to distinguish himself in remarkable ways. As the twelfth secretary (CEO) of the Smithsonian Institution, one of his first initiatives was to create a new strategic plan laying out four grand challenges that gave the vast multidisciplinary resources of the Smithsonian’s museums and science centers a united mission.45

Ensuring that the institution’s vast collection is accessible to everyone was a priority for Wayne. Millions of objects and research data in the collection are being digitized, laying the groundwork for the Digital Smithsonian.46

While he was president from 1994 to 2008, Georgia Tech was in the top ten among public universities in the United States every year. The student body expanded from thirteen thousand to nineteen thousand.47 He developed research and education platforms in France, Ireland, Singapore, and Shanghai.48 Thanks to his efforts, Georgia Tech has become one of the leading universities in the country for graduating both minorities and female engineers.49

Wayne’s fund-raising legacy at Georgia Tech is unmatched in the university’s history. Funding for external research more than doubled, from $212 million to $473 million, during his tenure. In private gifts, he raised over $1.6 billion.50

At the local, state, and national level, Wayne has extensive public policy experience. No one else has ever been appointed by a United States president to both the National Science Board and the President’s Council of Advisors on Science and Technology.51

Acclaimed as both a teacher and researcher, Wayne has received nine national awards from the American Society of Civil Engineers, as well as the 2004 OPAL Lifetime Achievement Award for his contributions to education.52 Plus he and his wife, Anne, are delightful.

UCLA

Make risky bets on new knowledge for the greatest potential impact.

Phil Williams was the last real gentleman. Immediately upon graduating Harvard College in the early 1940s, he was commissioned as a navy officer and ordered to report to a destroyer in the Pacific War. After the war, he went back to Harvard to complete a graduate degree at the business school, then he embarked on a successful business career.

When first I met him in the 1980s, he was a senior executive at Times Mirror Company, a blue-blood establishment at the center of the Los Angeles power structure. Other men of his prominence might have behaved disdainfully toward a newcomer like me, but Phil consistently placed a high value on good manners so gracious that they almost seemed courtly in the ambitious financial wranglings of LA. As an unknown in town, decidedly off the society radar, I was glad to be treated with respect and consideration. We stayed in touch.

About fifteen years later, I invited Phil to join the advisory board of Tennenbaum Capital Partners. When I expressed my gratitude, he protested that it was he who was honored to join us—a posture he maintained throughout his ten-plus years on the panel—but I was well aware that he had done me a favor in lending his name to our fledgling enterprise. So when Phil asked me to join the UCLA School of Medicine Board of Visitors in 2000, I accepted without hesitation.

My connection with UCLA had begun in 1996, when I began receiving excellent personal medical care at the world-renowned UCLA Medical Center. But my philanthropic involvement came about because of Phil.

UCLA SCHOOL OF MEDICINE

The Board of Visitors was an advisory organization for Dr. Gerald Levey, the dean of the School of Medicine. Levey was a very successful fund-raiser. He did an amazing job of raising money for the new Ronald Reagan Hospital when it far exceeded its huge budget. What he lacked was business and financial experience at a time when a major crisis was brewing.

The UCLA School of Medicine was (and is) an amalgam of medical school, research center, charity, disaster recovery center, and health services provider.

In 2000, it provided about $751 million in health services, but that figure was understated by more than $400 million (53 percent) because of charity work and large contracts. California had led the way in a nationwide shift to health insurers at great cost to health service providers. The large volume of business that the health insurers acquired gave them enormous clout to negotiate major discounts on fees from providers like hospitals and doctors. Soon, the insurers transferred much of their risk by forcing their providers to agree to a fixed fee per month per person (“capitated medicine”). Any costs over that amount had to be borne by the provider.

The combination of tough industry conditions and an academic atmosphere caused UCLA’s cash to burn off in a few short years. From $100 million in the late 1990s, its cash had dropped to almost zero by 2001, while its long-term debt had risen to $200 million. This put the entire organization—and Dr. Levey, in particular—under serious pressure.

A subset of the visiting committee was tasked with solving the problem.

Our group decided that the quickest solution would be to seek improved government funding from both federal and state sources. This was well deserved by UCLA. As one of the world’s top research universities, it had made major breakthroughs that helped with treatment, diagnosis, and prevention of illness. It had been ranked number one among hospitals in the western United States since 1990.52 Its charitable work also had been exemplary.

Also, we decided to benchmark UCLA’s financial performance to other leading academic health centers (AHCs). But it became apparent that UCLA performed such a wide variety of activities that financial performance could not be compared easily. For example, any AHC might do costly organ transplants (or not), it might accept very seriously ill charity patients (or not), and it might earn great patient satisfaction (or not).

While we were developing our strategy, a wave of mergers and sales hit the AHC community. Five AHCs combined in Boston, two combined in San Francisco, and four combined into two in New York City. Georgetown and the University of Minnesota sold their hospitals. I didn’t think UCLA needed to increase its size under these conditions. Yet UCLA bought a money-losing hospital in nearby Santa Monica.

It was one of the most exciting times in medicine. Major breakthroughs were happening at rapid rates. Advances in biomedical research had never been greater.54 The race to sequence the human genome had been completed in 2001, finally giving us a blueprint for the human body.55 New technology had made doctors far more effective, giving them the ability to double-check pharmacology and symptomology on the spot. Thanks to drugs developed to treat a heart attack after it occurred, heart disease deaths had dropped by 40 percent. Promising treatments had occurred in stem cell research, and functional MRIs were revolutionizing the understanding of the human brain.56

The downside was that the new devices and treatments were expensive. At the same time that life-saving new procedures were being made available by health-care providers, insurance and government reimbursement rates were shrinking. The regulations—compounded by unwieldy state and federal paperwork—were stifling. Providers and insurance companies were fighting over shrinking profits. The health-care industry was in an uproar.

Inadequate attention was being given to improving the industry’s management practices—the areas that most interested me.

Best practices that would have been ingrained in the thinking of good businesspeople were either unknown to many health professionals or simply not on their radar. Management in elite professions such as law, medicine, investment, or consulting is chosen from among the most successful practitioners in the field. It’s logical, since such people have the greatest credibility and the kind of track records that appeal to their colleagues. However, they often are not the best managers. This is a chronic issue in professional services. And, unfortunately, UCLA Medical Center was no exception.

These fundamental problems won’t go away. They’re built into the very nature of the situation. I hope that the true gems among health service providers, like UCLA, find ways to preserve the excellent work they do, despite the system’s limitations.

UCLA NEUROPSYCHIATRIC INSTITUTE

In the summer of 2001, Phil Williams called me and recommended that I tour the UCLA Neuropsychiatric Institute (now renamed the Semel Institute). “I’d like you to meet its director, Dr. Peter Whybrow,” he said. “The work he’s doing is fascinating to me. I believe it will interest you as well.” As it turned out, that was an understatement.

Dr. Whybrow’s work on brain function and brain disorders has made him an international authority. He has focused especially on depression, bipolar disorder, and the effects of thyroid hormone on the brain and human behavior.57

When I met him, he had been the director of the UCLA Neuropsychiatric Institute (NPI) for four years. A prolific author, he had already written several books at that time. He predicted the credit crisis in the terrific book American Mania: When More Is Not Enough. In The Well-Tuned Brain, Dr. Whybrow adopted the provocative position that the affluent environments we live in disrupt the health of our minds and bodies, because these affluent environments are out of sync with our biological heritage. By returning to “ancient human truths” uncovered by science, he believes we can build a thriving future that better serves humanity.58

The range of Dr. Whybrow’s knowledge is captivating. The Semel labs are among the largest brain research centers in the world. Their work includes behavioral genetics, developmental neuroscience, cognitive neuroscience, neurobiology, brain imaging, clinical research, health services, policy research, sociocultural studies of human behavior, and psychopathology with a focus on illnesses and disorders of the brain.

The fact that the brain is central to our very being yet remains so mysterious is fascinating to me. I wanted to make a contribution to an interdisciplinary program in the hopes of accelerating our understanding of our brain’s functions, but I was aware that my own budget was relatively small, compared to the mammoth medical research funding by the National Institutes of Health and the National Science Foundation. These big funders’ emphasis has been primarily on disease and dysfunction. I decided my biggest impact could be on “superior function,” like giftedness and creativity.

UCLA TENNENBAUM CENTER

Suzanne and I funded the Tennenbaum Center for the Biology of Creativity at UCLA’s newly named Semel Institute for Neuroscience and Human Behavior. The creativity program helped spawn projects like the Big C Project, which attracted major funding and took on lives of their own. The initial mission of the creativity project was to study “molecular processes, cellular functions, neural circuits, and behavioral mechanisms that result in cognitive enhancements, and explain unusual levels of performance in gifted individuals, including those who manifest extraordinary creativity.” Four core cognitive processes were involved:

• novelty generation: the ability to adaptively generate unique products,

• working memory: the ability to maintain and use information to perform,

• declarative memory: the ability to store and retrieve information, and

• response inhibition: the ability to suppress habitual plans and substitute alternate actions when necessary.59

Our integrated research program aims to reveal the genetic architecture and fundamental brain mechanisms underlying creative cognition. The work holds enormous promise for both enhancing healthy cognitive performance and designing new treatments for diverse cognitive disorders.60

In the summer of 2002, we created the Tennenbaum Family Interdisciplinary Center with a $1 million gift. The center was designed to spur collaborative research and accelerate the development of new treatments. By bringing together scientists and clinicians at UCLA, it looked for unique ways to efficiently exploit the brain’s inherent flexibility.

The research was so continually fascinating and so much progress was being made that we accelerated our involvement from there, making changes and improvements almost every year.

• Spring 2003. A challenge was sent out to the UCLA faculty and graduate students to submit proposals for research projects analyzing human creativity. After screening the thirty-one proposals, a panel of experts selected seventeen for presentation at a two-day retreat in July. By the fall, three winners were selected and funded. Happily, two of these projects have added new knowledge to the study of the organic basis of creativity!

• Winter 2005. Our $1 million was mostly spent, but eight leading laboratories at Semel were researching aspects of creativity, advancing our understanding of giftedness through a greater understanding of a new gene.

• Spring 2006. A study of three hundred gifted undergraduates was underway, and outside grants were expanding our scale. Suzanne and I gave another $800,000 to fund two more years’ work.

• Summer 2007. I saw the need for a permanent structure for our interdisciplinary center, which had had such a strong influence despite existing only on paper. We endowed a chair for creativity research with an additional $1 million gift. It was the first such chair in the world.

Afterward, millions of dollars of outside funding came to UCLA, partly due to the interdisciplinary work and partly due to the work on creativity. As of 2018, the Big C Project study continues to employ interviews, personality and cognitive assessments, as well as magnetic resonance imaging (MRI) of the brain to study exceptionally creative scientists and visual artists.61

It was tough to get approval to do a study on superior capacity in a state school that emphasizes equal treatment. I guess it smacked of eugenics. Well, I’m not happy that so many people have abilities superior to mine, but owning up to those depressing facts makes me much more practical in the conduct of my life.

I am glad to have been able to develop and fund one of the first interdisciplinary centers at UCLA Medical Center. It is also the first center to study the organic basis for creativity.

HARVARD BUSINESS SCHOOL

Pay back the institutions that helped you—even if they’re rich.

With $500,000 of my gains in PSA airline stock, I endowed what was then one of the largest scholarship funds at Harvard Business School. As my success continued to grow, so did my gratitude for the mentors and education I received at Harvard. I had an increasing appreciation of how much those years had influenced my life. Now, because of that success, I found myself able to repay the source that had made my own attendance at Harvard possible. I’d come full circle.

When David Milton, a classmate and pal from Georgia Tech, first introduced me to the prospect of getting a Harvard MBA, the primary attraction for me was school’s 100 percent financial aid offer. As broke as I was, that was the one thing that allowed me to even consider going to graduate school.

Afterward, as my Wall Street career took off in the late 1960s, I grew ever more appreciative of what Harvard Business School had done for me.

Even more powerful than the skills I acquired was the friendship with other HBS graduates. These relationships founded on mutual admiration bolstered my self-confidence. I will always be obliged to Harvard. Without it, my life would be very different today.

The opportunity to deepen friendships with members of the faculty is one of the things I’ve treasured most. My friendship with Sy Tilles, my strategy professor in my second year, was a high point. Until his untimely death, we regularly confided in one another and shared books that fascinated both of us. I enjoyed a similar friendship with Ted Levitt, who had been my marketing professor in my first year. His creativity and joie de vivre brightened my life. I also prize my continuing friendships with Wickham Skinner, my first-year manufacturing professor, and with Warren McFarlan, then a senior dean, and especially with John McArthur, the previous dean.

Over the years, I’ve been eager to stay engaged with the school to express my gratitude and to help make the advantages I received available to others. In the 1980s I was elected to its visiting committee. The thirty-two members of the committee met once a year to assess the HBS programs. We each served for six years and reported to Harvard’s board of overseers every three years.

The issues we grappled with were real, and the efforts of our many outstanding members were surely helpful to the school. In 1989, for example, our chairman was John C. Whitehead, the former Goldman Sachs co-chairman. Our report included these observations:

• Harvard Business School case studies were being sold below cost, although 90 percent of all business case studies in MBA programs around the world were published by HBS and the research budget was 30 percent of HBS’s budget! (I couldn’t resisting asked the dean if he were subsidizing his competitors.)

• Talented people were discouraged from joining the faculty. Full professorships were bottlenecked because: (1) many professors refused to give up their tenure, (2) some changes in labor laws had eliminated an enforceable retirement age, and (3) there was a surge in private sector executive compensation that widely exceeded professors’ salaries.

• Unified fund-raising efforts were intended to help Harvard schools that had few rich alumni. But the incentive by HBS alumni to give was strongest when classmates solicited others in their program to contribute on behalf of needs in these shared activities. Forcing the “rich schools” (business, law, etc.) to subsidize the “poorer schools” (divinity, etc.) would dilute this very productive process.

I focused my attention on scholarships, which I hoped would help students who had no money at all but wanted to attend HBS. Having been in the same position myself, I knew what it was like. It was also important to me that the scholarships not give the recipients a sense of entitlement. In an effort to prevent that outcome, the loan was granted with a moral obligation to repay, when the students could do so. The Tennenbaum Fellowship Fund was based on a $502,000 gift made in 1987 and a $1 million bequest with this provision:

Upon receiving a Tennenbaum Fellowship, students will be informed that they have a moral obligation to eventually reimburse the Fund for both principal and some low rate of interest, except that one-third of their obligation will be excused for each year they spend in full-time employment for either a not-for-profit organization or for an institution of higher learning. Understanding that the school’s ability to accurately track such an obligation over the long term is limited, the students will be informed that it is their individual responsibility to meet the terms set forth by the donor. It is expected that the recipients will acknowledge these terms in writing to the donor.

With the recipients of my fellowship at Harvard Business School—then the biggest such group.

John McArthur was dean of Harvard Business School at the time. He too felt a deep devotion to the school. He fervently believed that Harvard could not rely on past momentum to sustain its leadership position among the great academic institutions of the world. In that spirit, he led sixteen major renovation projects and built three new buildings on campus. By making major changes to the cultivation of a fine faculty and committing unprecedented resources to curriculum development and research, he successfully secured HBS’s leading position in academia.62 When he saw my provision to the Tennenbaum Fellowship, he liked it so much that he made a personal contribution to my fund. It brought tears to my eyes. There’s a special place in my heart for Dean McArthur, one of the finest leaders I have ever known.

The financial aid folks, who were in a position to direct the Tennenbaum Fellowship to students, did not agree with the repayment provision. “Students are already struggling with an average loan debt of $58,000,” they worried. “It’s hard to recommend ‘aid’ when its repayment saddles them with an additional ‘obligation.’”

“It’s a moral obligation,” I clarified. “Not a legal debt. The point is that they can pay it off when it’s convenient. Further, it’s tax deductible when given as a gift, so it only represents about half the amount.”

The fellowship allowed for a third of the obligation to be canceled for each year spent in teaching, research, charity work, or government work. And students were better placed to repay the obligation than before—since starting salaries for students entering the business world had increased more rapidly than their HBS debt.

The financial aid people stonewalled me. For eight years, the fellowship received no contributions from recipients.

My multimillion-dollar fellowship fund had required a unique pledge by recipients that I hoped would inspire them to give back. In the end, I backed down due to political pressure, but I regret my lack of fortitude to this day.

When Howard Stevenson replaced Warren McFarlan, my ideas were received much more coldly. Howard did initiate annual dinners to connect fellowship recipients with donors. But, by 2003, the average student aid loans were only about 50 percent of starting salaries.

When I went to a benefactor group dinner, it was a thrill to see that the number of students who had benefited from my fellowship was too large to fit into the picture! There were twenty-nine of them. Being with them made the results of my efforts very tangible.

GEORGIA TECH

Find initiatives that will stay fresh.

I’ve always felt a great debt of gratitude to Georgia Tech and to Harvard, my two alma maters. There is no question that the education I received at those institutions accelerated my career and enhanced my skills.

In 1962, when my career in Wall Street was new, I began to send small annual gifts to Georgia Tech. Every year, I served on the periodic five-year reunion committees. For one of those years, I chaired the committee. Later my involvement would deepen even more.

Many people harbor a special fondness for their alma maters. It may be because college is a rite of passage, a major break from parental supervision where young people take their first tentative steps toward the enticing yet unfamiliar realm of adulthood. Or it could be all the parties. Probably both.

Georgia Tech had a work hard/play hard ethos. The work-hard times were the most important career preparation I’d ever had, and the play-hard times were the most fun I’d ever had. Thanks to Tech, I got a good start toward a successful life.

Unlike other premier tech universities, such as MIT or CalTech, Georgia Tech is backed by public funds. It was built in Atlanta after the Civil War by two former Confederate officers—Major John Fletcher Hanson and Nathaniel Edwin Harris—as part of the reconstruction of the South.

The years following the Civil War were a time of tremendous growth in America, primarily in the Northern states. The leading industrialists in the county were quick to realize that if they hoped to expand, their shops could no longer be run by machinists with a working knowledge of the shops and machines. They would need professional engineers with advanced education in science and mathematics to answer the challenges of running industrial machines and processes.63 It’s another lesson in the value of good education, one still overlooked by today’s politicians in the United States.

The prosperous agrarian society of the Old South had effectively vanished the moment the first shots were fired at Fort Sumter. Southerners believed that the best hope was to emulate, then surpass the North in industry and commerce—the emerging battlefields of the nineteenth century.64

Men like Henry Grady were convinced that education was the key to developing the trained technical minds necessary to advance manufacturing in the South. In the 1880s, Atlanta was an important railway hub, but it was responsible for only 10 percent of American manufacturing.65

The Georgia School of Technology was established as a direct response to this problem. John Fletcher Hanson and Nathaniel Harris both had deep ties to industry. A self-made industrialist who founded the Bibb Textile Manufacturing Company, Hanson would later become president of the Central of Georgia Railway. Harris was a lawyer from Macon with many industrial clients; he would later become governor of the state. Hanson was instrumental in getting Harris elected to the House of Representatives in Georgia so he could introduce a bill to create a state-sponsored technical school in Georgia.66

Bringing competitive industrialization to an agrarian culture was a challenge. In the early years, industrial development in the South was so far behind that it was hard to find shops with sufficient machinery to educate students, much less hire the graduates when they completed their studies at Georgia Tech.67

Today Georgia Tech is one of the best schools in the world. For the past decade, it has consistently been listed among the top ten American public universities. In 2018, US News & World Report ranked Tech’s undergraduate engineering program fourth68 and its graduate engineering program eighth in the country.69 It is the number one–ranked university in Georgia, and it awards more engineering degrees to women than any other school.70 And my Industrial Engineering School at Tech has been ranked number one for decades!

Still working to bring more technology jobs to Atlanta, the Georgia Tech Foundation had created Tech Park/Atlanta (TP/A) in the late 1960s. My former classmate Tom Hall called in 1971 to ask me to attend their New York City presentations. After attending the meetings, I gave Tom highly critical feedback, which led to my recruitment as a shareholder and ultimately a director of TP/A.

But the promising TP/A concept got off to a rocky start. The board soon asked me to become chairman to help rescue the company from insolvency. Among other things, I recommended that the members of the board personally guarantee a bank loan to build a new facility for an invaluable tenant. We did so, and that gesture sparked renewed growth at TP/A.

From the beginning the hope was that TP/A shares would one day be gifted to the Georgia Tech Foundation. I gave them a portion of the TP/A stock in 1974 and the rest in 1980. A portion of the gifts funded a lecture series by the finest economists in the country: Ezra Solomon, Lester Thurow, Martin Feldstein, Mike Boskin, and Alan Blinder. I wanted the engineering students to have a broader set of ideas.

Working together, the board and I salvaged the park. Since that time TP/A has thrived, bringing a critical mass of technology activity to the state of Georgia, as well as valuable new jobs. The total gifts from TP/A stockholders to the Georgia Tech Foundation totaled over $8 million. Since the foundation only had about $22 million at that time, our contribution was then one of its largest gifts ever.

During the financial crisis, trustees were asked what the funding priorities should be. Here was my answer:

Date: Thursday, February 12, 2009

Subject: Financial Summary

In response to your memo of February 6, 2009, I respectfully make the following recommendations:

1. The tradeoff between generations is not clear cut. A lapse in short run quality has a big effect long term. When I joined the Technology Park Board in about 1970, I think the Foundation had only about $10 million in it (prior to Tech Park stock). The accumulation since then has been just fine for future generations.

2. Priority funding should be to maintain and improve faculty. I would sit under a tree with a great professor and great students will be attracted to such faculty (I wasn’t exactly a great student).

3. Second priority should be the laboratories because we are an engineering school and need to do sophisticated experiments. Normally, getting corporate support for these labs in exchange for some information flow would be a good thing but the present business environment may make that tough.

4. The state politicians have to understand your need to raise your prices. You have to engage in appropriate effort to get this through. The tradeoff should be increased financial aid so needy students are not kept out but those who can afford it be made to pay—we are subsidizing other states who charge GA citizens higher fees.

5. Overhead should be slashed. Every nonprofit I know tends to accumulate overhead in excess of need. Now is the time to rationalize the business processes and to cut to the bone. The Financial Summary does not indicate what the current income yield is on the portfolio. At present prices, I do not see why this is not at least $50 million not counting alternative asset distributions. More granularity on alternative assets would be helpful; for example, some such investments do not provide income and have great future uncertainty, while others can provide very high current income.

I believe that the purpose of the Endowment Fund is not only to provide for future financial needs but also to buffer the school from short-term crises like the one at present. Invade the principal to maintain your momentum but make sure that you do it on the most efficient basis—and use the extra support to get price increases for all of your products and services.

I wish you well during these tough times.

Michael

When in 2018 Georgia Tech asked to increase the Tennenbaum Institute funding and convert it to a seed fund for high-leveraged new programs, I saw the logic. It had been a good catalyst, but this change makes it a more dynamic part of Tech’s future. As Georgia Tech’s Philanthropy Quarterly wrote, “Since 2004, the Tennenbaum Institute has focused on bringing problem-solving methods from industrial and systems engineering to bear on business practices and organizational cultures, with the aim of enhancing competitiveness and driving economic growth, particularly in health care delivery and global manufacturing.”

Instead of giving a conventional gift, I organized Georgia Tech’s first interdisciplinary institute with a $5 million gift, which was later expanded by $500,000, and then another $2.5 million. This multimillion-dollar fund allowed the top deans to fund new projects with high potential that would not attract funding from other sources. I considered it to be a high-risk/high-reward effort.

In 2017, the result enabled funding for a new multidisciplinary program which extends support to students from a wide variety of academic backgrounds and fields of study. “Income from the enhanced endowment will provide support, in perpetuity for programs and initiatives that promote enterprise innovation at Georgia Tech. These include strategic research, pilot programs, facilities construction or renovation, seed funding, startup funding, challenge grants, and other purposes.”71

Though the original mission of the Tennenbaum Institute is not now as unique as it was, the new institute, which is the first of its kind at Georgia Tech, aims to keep the future in sight and drive innovation. My goal has always been to boost cutting-edge ideas that will help in making an impact.

JOFFREY BALLET

Not all adventures have happy endings.

Not many guys in my high school in rural Georgia went with their moms, like I did, to see ballet. In the 1950s, the musical pulse beat to the rhythms of Frank Sinatra, Tony Bennett, and Patti Page, before Elvis came along. Ballet felt like an exotic foreign import when we were dancing the Shag.

Most Americans associated dancing on stage with the huge Broadway musicals like Show Boat, South Pacific, or Kiss Me Kate. None of the kids in my class seemed to know anything about the great European ballets. In the early twentieth century, America didn’t have a strong tradition in ballet at all. Its Russian and European origins may have felt too foreign for everyday Americans to call their own. But all that changed in 1940 when the American Ballet Theatre seized its destiny with both hands and took a daring risk.

Their new season featured classic pieces by Serge Diaghilev and Michel Fokine alongside the work of dynamic new American choreographers.72 It represented liberation from the past. A barrier had been broken. For the first time, Americans could infuse ballet with their own vital, earthy sensibilities. A thrilling state of flux ignited in the dance world. Exciting experiments were taking place on stage; adventure was in the air. After the first three weeks of the season, a critic at the New York Times wrote:

It looks very much, indeed, as if the foundations have been laid for a truly popular ballet, reconciling the best tradition of the past with a recognition of the intellectual and emotional necessities of today in America, without reliance upon esthetic snobbery.73

Twenty years later, when I was a new bachelor in New York City, eager to soak up all the culture I’d missed as a suburban family man, Dick and Nancy Miller invited me to a performance by the Joffrey Ballet. That first experience of ballet with my mother came flooding back. I remembered it as fondly and clearly as if it had happened the day before.

Dick and Nancy were what we used to call “worldly wise.” They were not only well-traveled, but they had lived abroad. As art collectors, they possessed an enviable knowledge of fine arts. Their intelligence, good taste, and generosity made them the ideal guides to a more cultural world, and I found them more than willing to oblige.

In 1961, ballet had made front-page headlines when the principal dancer of the Kirov Ballet, Rudolf Nureyev, broke away from his Russian embassy guards in Paris at Le Bourget Airport, crashed through the security barriers, and flung himself desperately into the arms of a Paris policeman, crying, “I want to be free!”74 Nureyev’s defection inspired a generation of Russian dancers. By the 1970s, Baryshnikov, Natalia Makarova, Alexander Godunov, and others had defected.

Thanks to my introduction by the Millers, I became an avid fan and regular subscriber to the Joffrey until I moved to California in 1977. Performances at the Joffrey had been a delight I’d looked forward to every season. Their repertoire was reliably eclectic and often amusing. So it was a happy moment when I learned, in 1983, that the Joffrey was taking up bicoastal residence in Los Angeles and New York City.

Later, Suzanne became just as much of a fan as I was. In our enthusiasm for this dynamic company, we ended up giving the lead gift to launch a new Arpino ballet, Italian Suite, in 1984 and became advisory directors to the board. Thus began my first philanthropy in the arts.

Like the company itself, the board of directors was divided between Los Angeles and New York. The agreement was that each city would raise $500,000 to pay the company’s debts, but Los Angeles quickly surpassed New York’s fund-raising, thanks to the Los Angeles co-chair, David Murdock.

As the Joffrey’s finances improved, the 1985 New York season was moved from the limiting City Center to the most elite venue in the city, Lincoln Center. Offering thousands of programs, initiatives, and events every year, Lincoln Center is the world’s largest presenter of performing arts to this day.75 It’s also one of the most expensive.

That move based the Joffrey in two very expensive theaters. In Los Angeles, the company was downtown at the Los Angeles Music Center. Renowned for the Dorothy Chandler Pavilion, Ahmanson Theater, and Mark Taper Forum, it too is one of the largest, most expensive performing arts centers in the country.

The glittering boards at these two prestigious venues were loath to negotiate their operating costs, which I believed to be excessive. But as no one else concurred, we began to move precipitously toward an untenable financial situation. Our bicoastal board had grown to include fifty-nine people, but some of them were contributing little to no money. That made Murdock’s contributions all the more vital to the survival of the Joffrey. Had we known that the company manager had failed, for the second time, to make tax-withholding payments, the situation would’ve been disturbingly clear, but he had carefully obfuscated the facts.

Then in 1988, the company’s beloved founder and visionary, Robert Joffrey, died. The loss was profound. A huge leadership void was left in his wake. To make matters worse, by the time the news of the company manager’s delinquent tax payments came out, the Joffrey was $2 million in debt and bleeding cash. Alarmed by the situation, as we all were, Murdock called to make an appointment with Joffrey’s partner and cofounder, the choreographer Gerald Arpino, to discuss an emergency course of action. Arpino agreed to the meeting, then didn’t show up. This led to a board revolt.

On April 30, 1990, the West Coast board adopted a charter amendment designed to put the board in charge of all officer elections, secure for the Joffrey and the Robert Joffrey estate all rights to the ballets created by Arpino, and retain the company manager who had repeatedly made such bad and costly decisions. The next day, the East Coast board also voted in favor of the charter amendment. A major contingent of the East Coast directors immediately resigned in protest, along with the co-chairs, including Murdock.

As the executor of Robert Joffrey’s estate, Arpino refused to grant the board the rights to any of the choreography created by Robert Joffrey or by himself. But blood was in the water, and the attorneys swarmed like hungry sharks. As soon as they discovered that Arpino had worked for the Joffrey without a contract for thirty-five years, they pounced. Coldly informing Arpino that he had no rights to his own work or that of his lifelong companion, they declared that the company had “the absolute right” to use the ballets against his will as long as he was with the Joffrey.76 Arpino promptly resigned.

The Joffrey was cut off from its repertoire. Astounded, executive director Penelope Curry told the press, “We really didn’t think any action like that would be taken until the end of the season, if it was taken at all… I can’t believe it could end like this. My heart is broken. We have failed.”77

The Joffrey Ballet was at serious risk of folding. The Los Angeles Music Center had prepaid the expenses for the entire spring season, but there was no money left for the performances. Although board members had guaranteed a $209,000 loan, nearly $700,000 was due immediately for payroll withholding taxes. Severe penalties were being incurred with every moment they remained unpaid. Meanwhile, the attorneys discovered, as they began to comb through the books, that our conference calls for the regular bicoastal board meetings were illegal! According to corporate law in New York, interstate board meetings could not be held without specific authorization by the documents of incorporation, authorization that they didn’t have. But that wasn’t the worst of it.

The coup de grâce was the defection of the dancers. Banding together in unqualified support of their former lead dancer and longtime mentor, Arpino, they declared themselves their own governing body and formally insisted that “no drastic action be taken … without informing us.”

Imagine you were a generous, well-intentioned board member and lover of the arts, supporting one of the most gifted ballet companies for years, only to learn that they had fallen so hopelessly into debt that they couldn’t afford to produce the season already paid for by the prestigious LA Music Center, potentially exposing the ballet company (and you, by association) to a humiliating breach of contract. What if you were then told that, thanks to a bitter power struggle between the bicoastal boards and the creative geniuses at the Joffrey, that the company now had no choreographers, no dance repertoire, and no dancers? And that when the scandal hit the papers, your name would be mentioned in connection with this mess? It’s understandable why so many board members fled. But it’s one of the great marvels of life that sometimes a leader emerges in such a crisis.

At the next board meeting on May 9, Director Dale R. Laurance announced that the Joffrey would be completely out of cash in two days. Then two days later, he not only came up with a fund-raising solution that would satisfy all the involved parties and serve as a good organizational format going forward, but he also persuaded the dancers and Arpino that it would work.

That night the season opened at the LA Music Center, and to their great credit, despite not being paid, the dancers danced!

The following week, the bicoastal board was reorganized. With the crisis postponed, I was elected to the board and to the ten-person executive committee, which was vested with the most legal power. Our very first act was to void the inflammatory charter amendment. Once those board members who had resigned in protest were reinstated, the transformation was complete. After that, if we wanted to stay in business, all we had to do was to raise $2.6 million within the next thirty days.

To attain that goal, Dale and I began to meet privately.

We calculated that the income from the Joffrey performances was about $6 million per year, divided evenly over the New York season, the Los Angeles season, and the international tours. Almost all of an additional $6 million came from nongovernment sources—quite a contrast to the European companies where governments support the arts with major subsidies.

All we needed was $2.6 million, but we needed it within the month. The size of Dale’s donations and my own was growing at an alarming rate. That’s what happens when you’re riding a tiger. Once you’re on, jumping off is tricky.

We knew we needed help—and fast! When we put our heads together, we both agreed that, under the circumstances, there was only one solution: begging.