Mathematics in Real Estate

In This Chapter

- General mathematical concepts used in real estate

- The theory of unit analysis

- Real estate commission calculations

- The math of appraisals

- Calculating area, depreciation, taxes, and more

Real estate professionals perform many different types of calculations. Real estate math is more arithmetic than mathematics, although you can expect a bit of geometry when dealing with square feet of sites or structures.

In this chapter, we review some of the mathematics you can expect to perform as a real estate professional.

In general, real estate calculations using arithmetic consist of commission calculations, appreciation and depreciation calculations, area and perimeter measurements, loan-to-value ratios, simple interest payments, discount points and origination fees, proration of bills, real estate taxes, transfer taxes, and sales-to-list price ratios.

HELPFUL HINT

This chapter was written with the presumption that you have a basic understanding of decimals and fractions and their manipulations. If you need a refresher on some of these topics, myriad resources are available online, including examples and practice problems.

Unit Analysis for Real Estate

Unit analysis, or dimensional analysis, is perhaps the coolest and most useful math trick you’ll ever learn. Understanding unit analysis is much easier than learning algebra formulas—and it’s a lot more useful as well. Unit analysis is simply converting one thing to another.

Let’s first agree that everything in the world has a number, or unit, of measure when we talk about it. A unit could be dollars, feet, miles, acres, etc. The best way to explain it is to show you an easy example.

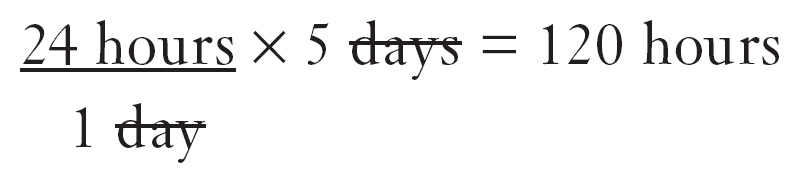

Example 1: Five days is how many hours?

First, read the problem and then ask yourself, “What units will the answer be in?” The answer is hours. You now can rearrange the question to what you know:

So the question is: 5 days is how many hours:

See the units that can cross out because there’s one in the numerator (the top number) and one in the denominator (the bottom number)? Mentally get rid of those.

Now the only unit left is hours, which is the unit you want the answer to be. So now you can do the math:

Therefore, 5 days is 120 hours.

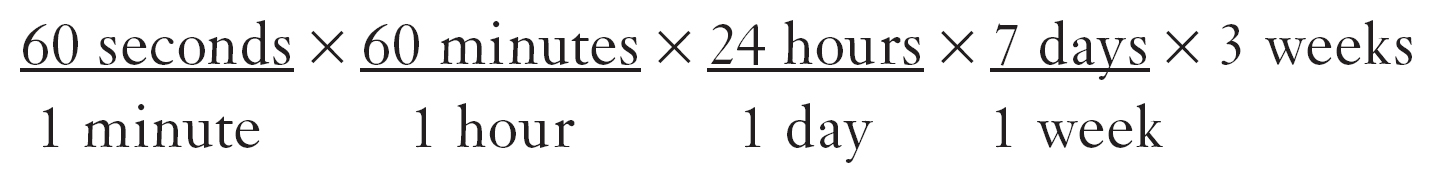

Example 2: How many seconds is 3 weeks?

This is the basic setup. Please note, plural units don’t matter. Day and days are the same unit, just plural.

Again, the units can cross each other out, one on top and one on bottom. So now just do the numerical calculation:

60 × 60 × 24 × 7 × 3 = 1,814,400 seconds

Therefore, 3 weeks = 1,814,400 seconds.

With a little practice, you’ll be able to use unit analysis like a pro.

Real Estate Math

Real estate is really a set of simple arithmetic calculations that, once learned and understood, will serve you well in your career. I’m going to cover these basic operations in example form for the best illustration.

HELPFUL HINT

Most calculations in the real estate world, once learned, are used in many scenarios. Learning the basics will allow you to apply the same technique in many different situations.

Commission Calculations

Commissions are negotiated between the listing broker and the seller of the property. The listing broker has the right to make his commission anything he wants, but of course the market must be willing to pay it. Commissions are expressed in terms of a percent, or a portion of the final agreed-upon sales price between the seller and the buyer.

For example, what is the commission on a sales price of $247,500 if the listing broker charges 6 percent commission?

$247,500 × 0.06 = $14,850

That’s an easy one to get you started. Let’s continue.

Appreciation and Depreciation Calculation

Appreciation is an increase in the value of a property over time.

Example 1: Ten years ago, a property was worth $100,000. In today’s market, the value is $150,000. The property has appreciated $50,000. This is a 50 percent increase, or appreciation, over the 10-year period, which is also a 5 percent annual increase.

$150,000 – $100,000 = $50,000 in appreciation

$50,000 ÷ $100,000 = 50% over the 10-year period is 5%/year

Appreciation can be used most often to forecast values of a property by using today’s value and historical data.

Example 2: In a market with 3 percent appreciation, what would be the value of a property in 20 years if the value is $300,000 today?

20 years x 3%/year = 60%

Therefore, $300,000 × 0.60 = $180,000 projected appreciation, so the value in 20 years would be $480,000.

Now let’s look at some depreciation calculations. Remember, depreciation is a decrease in the value of a property for any reason.

Example 3: Two years ago, a property was worth $110,000. In today’s market, the value is $100,000. Therefore, the property has depreciated $10,000. This is a 9 percent decrease, or depreciation, over the 2-year period, which is also a 4.5 percent annual decrease.

$110,000 – $100,000 = $10,000 in depreciation

$10,000 ÷ $110,000 = 9% over the 2-year period is 4.5%/year

HELPFUL HINT

Please note this is assuming simple appreciation and depreciation rather than compound appreciation and depreciation. That’s a more difficult calculation beyond the scope of this book. If you want to learn this method, hop online and look for tutorials.

Area and Perimeter Measurements

Land area and perimeter measurements require knowledge of basic geometry and shapes. In most cases, rectangles and triangles are used singularly or in combination to determine an area or perimeter.

Example 1: How many acres in a piece of land that measures 250 feet long by 350 feet wide?

Area of rectangle is L × W, or 250 feet × 350 feet = 87,500 square feet

An acre is 43,560 square feet, so there are 2.01 acres in the subject property.

Oftentimes, commercial developers are more interested in the frontage along the road to allow access of traffic into their development. This is called the front foot.

Example 2: What is the cost of a 2-acre property that has a depth of 250 feet if the seller wants to get $10,000 per front foot?

The first step is to determine the land’s square footage:

Area = L × W, so we can see this:

So, the width, or front footage, is 87,120 ÷ 250 feet = 348.48 feet front footage.

Further, we can see that 348.48 front foot × $10,000/front foot is a sales price of $3,484,800.

Another common area calculation would be irregularly shaped properties, such a lot on a cul-de-sac. The best way to calculate the area of such shapes is to consider the parcel a combination of simple geometric shapes, such as a rectangle added to a triangle.

HELPFUL HINT

The area of a rectangle is length multiplied by width and the area of a triangle is 1⁄2 the area of a rectangle.

You can see that this shape is really a rectangle 300 feet × 50 feet and a triangle of 300 feet × 150 feet. Therefore, the area would be 300 feet × 50 feet = 15,000 square feet for the rectangle plus the area of the triangle (area = 1⁄2 base × height) or 1⁄2 × 150 feet × 300 feet = 22,500 square feet. The total area would be the addition of the two areas:

15,000 square feet + 22,500 square feet = 37,500 square feet or 0.86 acres

Oftentimes, the perimeter of the parcel may be needed, such as when your client wants to build a fence. The perimeter is the distance around the border of the property.

When faced with an irregular shape (top), rethink it as a combination of familiar shapes, such as a triangle and a rectangle (bottom).

Example 3: A client wants to build a fence around his 150 feet × 300 feet lot. How many feet of fence is required to build the fence?

A simple addition of the distance around the property is needed:

150 feet + 300 feet + 150 feet + 300 feet = 900 feet of fence

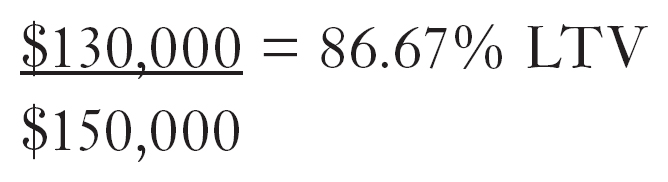

Loan-to-Value Ratios

The loan-to-value (LTV) ratio compares the loan amount to the value of the property. Lenders use this to determine the risk undertaken when making a loan. Typically, a lender’s risk is higher with higher LTV ratios than with lower LTV ratios. Additionally, a loan with a high LTV ratio might require the borrower to purchase private mortgage insurance (PMI) to offset the risk. A higher LTV ratio loan might incur a higher interest rate on the loan, too.

Example 1: A borrower needs a loan in the amount of $130,000 for the purchase of a $150,000 house. What is the LTV ratio of the loan?

Example 2: A buyer makes an offer on a $220,000 house, and it’s accepted. The house appraises for $220,000. If the buyer wants to get a conventional loan with an 80 percent loan amount, how much is the down payment required?

$220,000 × 0.80 (80%) = $176,000 loan made by the lender

So:

$220,000 – $176,000 = $44,000 down payment needed

HELPFUL HINT

The LTV ratio is a common calculation used by mortgage brokers as well as the real estate brokers. Speaking the common language of others in the industry will increase your success at you own profession.

Simple Interest

Interest is the money you pay to borrow someone else’s money. Simple interest payments are calculated as the amount of the loan multiplied by the interest rate on that loan.

Example 1: If a borrower borrows $250,000 at an interest rate of 3.5 percent per year, what’s the simple interest for the first year of the loan?

Loan amount × interest rate = interest payment

$205,000 × 0.035 = $7,175

A client may not know, or have forgotten, their interest rate; however, it’s possible to determine the rate based on the annual interest paid and the initial loan amount received.

Example 2: Your client has paid $5,500 in interest this year on his purchase of $150,000. However, he got an 80 percent loan with his 20 percent down payment at closing. What was the interest rate of the loan?

Loan amount = purchase price × LTV or $120,000

His interest rate can be determined by this equation:

Or:

Discount Points and Origination Fees

Discount points and origination fees are front-end charges the lender might impose when making a loan. Both are calculated as a percentage of the loan amount and expressed as 1 percent, called a point. The loan documents the borrower signs will expressly state the loan origination fees and discount points.

DEFINITION

A point is 1 percent of the loan amount taken by the borrower.

The lender charges loan origination fees to cover the costs associated with processing the borrower’s application, examining his or her credit, and performing other administrative functions for the loan.

Example 1: A lender makes a loan to a borrower of $150,000 at 3.875 percent interest plus 2 points loan origination fee. How much does the borrower pay in fees?

$150,000 × 0.02 (2%) = $3,000 in fees

The lender uses discount points to increase his rate of return on the loan without raising the interest of the loan. This would raise the monthly payment for the borrower.

Example 2: A lender makes a loan to a borrower of $150,000 at 3.875 percent interest plus 2 discount points. How much does the borrower pay in fees?

$150,000 × 0.02 (2%) = $3,000 in fees

You can see that loan origination fees and discount points are calculated in the same manner. Therefore, a borrower could add the two to determine the overall cost of the loan. (Understand that there is actually a difference between the two technically.)

Example 3: A lender makes a loan to a borrower of $150,000 at 3.875 percent interest plus 2 discount points and 1 point for origination. How much does the borrower pay in fees?

$150,000 × 0.03 (2 + 1 = 3%) = $4,500 in fees

Proration of Bills

During the closing process, expenses and sometimes income must be divided between the seller and buyer so each pays only for the expenses used during their respective ownership periods. Some of these expenses and income include real estate property taxes, rents on income property, homeowner association (HOA) fees, insurance, etc.

Proration deals with dividing these expenses or income between the buyer and the seller in some fashion. An important element of this division of expense is whether the items are prepaid or in arrears.

DEFINITION

A prepaid expense is one that’s paid prior to the use of the item, such as HOA fees. Expenses paid after the use of the items are called in arrears. In many states, real estate taxes are paid in arrears.

Example 1: Assume property tax payments are due on December 31 of each year—that is, in arrears. The annual property taxes are $5,000. The property is sold on June 30. What is the proration?

The seller owned the property for 181 days, and the buyer will own it for the remainder of the year, or 184 days. The buyer will be liable for the tax bill that comes due on December 31, so the seller needs to compensate the buyer for the period he owned the property, or 181 days.

$5,000 ÷ 365 days = $13.70 per day or $2,479.70 (181 × $13.70) is due to the buyer from the seller at closing

In the situation of a prepaid bill, the seller pays the bill first and then seeks money from the buyer for the unused portion during the period the buyer will own the property.

Example 2: Assume HOA fees are due on January 1 of each year, or prepaid. The fees are $300 annually. The property is sold on June 30. What is the proration?

The seller owned the property for 181 days, and the buyer will own it for the remainder of the year, or 184 days. Because the seller was liable for the HOA fees in January, the buyer will reimburse the seller for the days the buyer will own the property—that is, the days the seller won’t be using the item he already paid for.

$300 ÷ 365 days = $0.82 per day

Therefore, the buyer must reimburse the seller:

184 days × $0.82 per day = $150.88

In some states, real estate taxes are based on the assessed value of the property as determined by the taxing authority located in the state, county, or municipality where the property exists. In some states, the assessed value of the property may be presumed to be the sales price of the property. Other states may use a fixed percentage of the market value of the real estate as the assessed value. Check your local area to see what the taxing authority uses for your specific tax calculation.

Other items that must be known are the tax rate used by each taxing authority, usually express in mills, and the equalization factor used in many states to balance the properties in a neighborhood (see Chapter 19).

Example 1: A property valued at $145,000 has an assessed value of 75 percent of the market value and a tax rate of 45 mills. How much are the annual taxes?

$145,000 × 0.75 (75%) = $108,750 assessed value

Therefore:

$108,750 × $0.045 (45 mills) = $4,893.75 annual taxes

Example 2: A property valued at $175,000 has an assessed value of $150,000, an equalization factor of 0.8, and a tax rate of 12 mills. How much are the annual taxes?

$150,000 × 0.8 × $0.012 (12 mills) = $1,440 annual taxes

Transfer Tax

At the closing, the property transfers from the seller to the buyer—that is, from the grantor to the grantee. In 37 states and the District of Columbia, taxes are imposed by states, counties, and municipalities on the transfer of the title of real property within the jurisdiction. The seller pays the tax. However, if the seller doesn’t pay the tax, or is exempt from it, the buyer must pay it.

The tax is expressed in one of two ways: a flat percentage of the sales price, such as 1 percent of the sales price, or a dollar rate per unit of money, such as $2 per $1,000 of the sales price. Most states use the second method. An important factor to understand when using this method is that there can be no fractional units.

HELPFUL HINT

Think of a taxing unit as a car. If a car only holds four people, but five people are going to dinner, how many cars would you need to drive? You can’t take 11⁄4 cars; you’d have to take 2. Furthermore, you could add a sixth, seventh, and eighth person and still have the same number of cars going to dinner.

Example 1: If a state charges $1 per $1,000, or any fractional portion thereof, on $145,900 sales price, how much tax is paid?

First, figure the number of taxing units:

$145,900 ÷ $1,000 is 145.9 units

However, you can’t have a fraction of the taxing unit, so you must round up to 146 units. Therefore:

146 units × $1 per unit = $146 transfer tax

You can see that a sales price of $145,001 up to and including $145,999 has the same number of taxing units and the same transfer tax.

Example 2: What is the transfer tax collected on a property sold for $225,000 in a state that has a 1.5 percent transfer tax rate?

$225,000 × 0.015 (1.5%) = $3,375 transfer tax

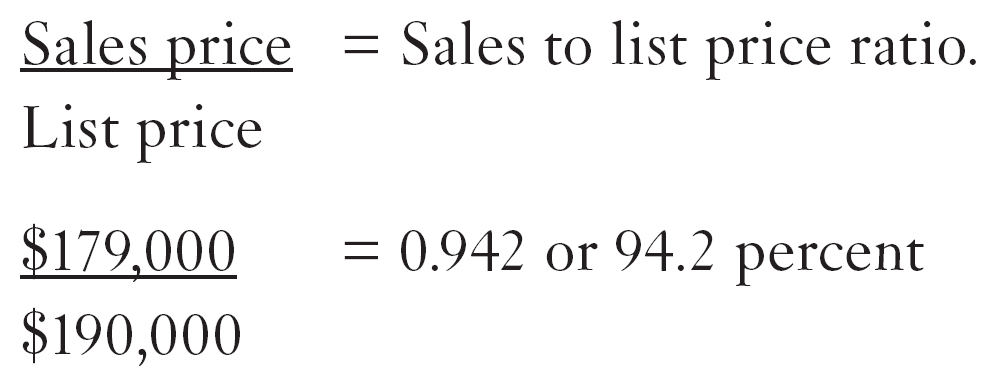

Sales-to-List-Price Ratios

Brokers and sales associates who list a property with a seller price the property so that the property sells within a reasonable time in an open market with good market exposure. This is traditionally done using a comparative market analysis (CMA).

Another factor agents use to determine the strength of a market is the ratio of what a property sells for compared to the original price it was listed.

For example, if a property was originally listed at $190,000 but finally sold for $179,000, the ratio of sales-to-list price was 94.2 percent. While there is no magic ratio number, agents can use the ratio of similar homes in an area to estimate the approximate starting list price.

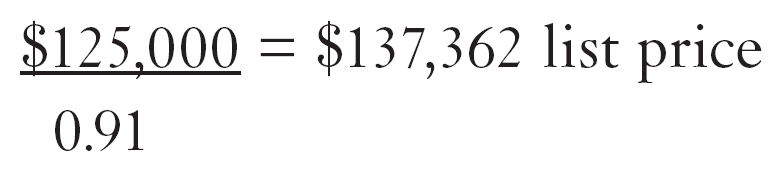

Example 1: If a seller wants or needs to get a sale price of $125,000 from the sale of their home and the REALTOR knows, on average, the sales to list ratio is 91 percent, he can estimate a good starting list price of $137,362:

Most probably, the agent would suggest a starting list price of $132,500 to fit conventional pricing strategy.

- Mathematics is an integral part of being a licensed real estate professional.

- You can use many different calculations to help your clients with their real estate needs.

- LTV ratio is a great number to understand as it describes the amount of indebtedness your client has incurred with his loan.

- In states that use the transfer tax, you must be able to calculate the tax as well as remember to explain to your client this added closing cost he may incur.

- During the closing of a property, there are numerous bills that will get prorated between the parties. Being able to understand and verify these amounts is paramount for your client.

- Understanding the sales-to-list price ratio in a neighborhood will provide you with some great statistics when setting your list price with your client.