Why Are Large Firms Good for Growth?

In the ideal world of many philosophers since ancient times, individuals and groups should be rewarded economically for their enterprise—but not excessively so. But modernization in what is today the developed world enriched a new class of superwealthy in a pattern that is now being repeated in less developed countries. The rise of a class of extremely wealthy individuals in less affluent countries can be offensive in the sight of those who work hard with less reward. But this chapter mobilizes research to show that the rise of a superrich category of people in emerging markets is a natural and inevitable part of development and modernization because they are also the people who create the mega firms that transform an economy. This chapter argues that large private firms and the entrepreneurs that lead them increase the efficiency of resource allocation in a country. In terms of production, value added, and wages, one highly productive firm with 10,000 employees making apparel is more beneficial than 1,000 firms with 10 employees. Development is spurred the most when resources are drawn to the best firms. Like it or not, that leads to the dominance of a few highly successful companies and individuals. Thus the emergence of rich people and rich companies in poor countries is a reflection of a healthy economy.

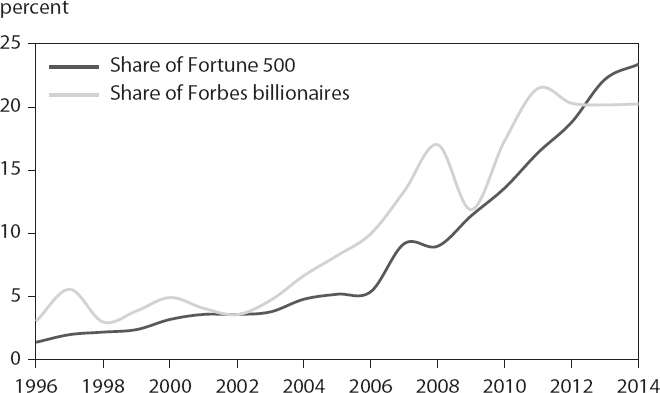

The growing number of emerging-market company founders is driven by the growing number of emerging-market mega firms. In 1996 less than 3 percent of global Fortune 500 companies were from emerging markets. In 2014 nearly 30 percent were. Emerging-market firms also made up 30 percent of the 2014 Forbes Global 2000 list of largest companies, twice their share in 2007.1 Twenty percent of emerging-market billionaires are directly connected to firms on the Forbes Global 2000 list.

The takeoff of large companies from emerging markets led the Financial Times to launch an Emerging Market 500 list in 2011. The firms on the 2014 list had a combined market value of $7.5 trillion, net income of $706 billion, and more than 19 million employees. Their net income was equivalent to that of more than 30 Microsofts.

Many of the top companies in emerging markets have historically been in resources and finance and benefited from political connections. A traditional example of a company-billionaire connection is Reliance Industries the most profitable company in India, which is connected to Mukesh Ambani, India’s richest man. Reliance is in the business of resources and telecommunications. Another classic example is Halyk Bank of Kazakhstan, working in investments and retail banking, connected to Timur Kulibaev, the son-in-law of Kazakh president Nursultan Nazarbayev.

But the rise of relatively young manufacturers and tech firms without such helpful political and family connections is notable. One-third of the emerging-market billionaires who made their fortunes in a firm now in the top 2000 are company founders. This figure is higher than the share of company founders in the overall list.

Near the top of the list is Foxconn, China’s largest exporter, which employs nearly 1 million people. Like Steve Jobs, Foxconn’s founder, Terry Gou, got his start working for Atari. After starting a company with $7,500 and a few friends in 1974, he won his first big contract in 1980, making parts for Atari. From there Gou quickly pivoted from plastic parts to patents and technology. After the Atari deal, he knocked on the doors of all the top US companies, hanging around until he got a big order. Some business journalists have compared the revolution in supply chains for electronics that he initiated to the revolution Ford achieved with the assembly line.2

The Brazilian company WEG—founded by an electrician, a manager, and a mechanic, whose first initials form the company name—started by producing electric motors. It has since moved into other areas, including industrial automation. It has manufacturing plants in Brazil as well as other parts of Latin America, China, and India.

Bharat Forge, of India, a manufacturer of auto parts and metal forgings for machines, earns most of its revenues from overseas sales. Baba Kalyani, its chair, transformed the small firm his father started, which had annual turnover of less than $2 million, into a company valued at more than $2 billion. Before the 1990s the firm’s business was mainly with Russia. Economic reform allowed the firm to compete more broadly. It now supplies auto industry leaders like Audi, Mercedes, and Ford.

This breed of large and fast-growing companies is exactly what economic researchers would expect to see in a successful economy. Productivity gains are the main source of improvements in living standards. The availability of firm-level data has made it possible to disaggregate productivity growth into its various components. Research shows that the allocation of resources between firms in narrowly defined industries is a major factor in productivity growth (Bartelsman and Doms 2000; Foster, Haltiwanger, and Krizan 2001). When the business climate allows the most productive firms to grow rapidly, they attract resources away from less productive firms. As a result, output expands. As economies develop, large highly productive firms tend to employ a greater share of the labor force and account for a growing share of value added in an economy.

The empirical literature reveals three pertinent findings. First, there are numerous small firms for every large firm, but large firms account for a huge share of production, jobs, and trade. Second, the ability of high-productivity firms to grow explains a great deal of country productivity. Third, large firms and startups are generally responsible for net job creation. When resources move to the most competitive firms in the industry, countries grow faster. In some industries larger firms are a necessity in order to take advantage of returns to scale. (Car producers, for example, are typically inefficient at less than 200,000 units per plant a year.)

The ability of firms to grow large also helps individuals amass huge fortunes. Growth and development, whether at the country or the industry level, are thus likely to favor large highly productive firms and lead to extreme wealth. In a political context, the dominance of such firms and the influence of wealthy individuals might be controversial, but such a development can be beneficial for a nation’s economic efficiency and growth. To the extent that large-scale entrepreneurs face competition, they drive resources to their most productive uses and expand profits. In advanced and flexible economies like the United States and the United Kingdom, for example, the largest or fastest-growing firms tend to be the most productive in the industry. The emergence of fast-growing productive firms that generate large profits can benefit emerging markets in particular, because entrepreneurs are likely to be much better intermediaries of capital than governments. In addition, wealth concentration in regions that lack deep financial markets may make the big investments needed for industrialization more feasible.

That said, the presence of a few large firms is not always an indicator of efficient resource allocation. Especially where business regulations are cumbersome and firms are shielded from international competition, unproductive large firms can dominate a market, depressing growth. These large firms will look different from the dynamic ones because they will not be especially productive nor will they tend to compete in contested markets. Such anticompetitive big business stymies growth. Only when size and productivity move together is size an indicator of allocative efficiency.

Overall, the gains by emerging-market firms in global markets are consistent with improved allocative efficiency, as many of the new large firms are competing in global markets, and exporting firms are very likely to be among the most competitive in a country.

Firm Size and Allocation of Resources among Firms

Richer countries are richer because they produce more goods and services for each employed worker. Traditional thinking among many economists has been that workers produce more output in developed countries because they have more capital, better technology, and better skills. But it turns out that access to capital, technology, and skills only partly explains the success stories of developed countries. Economists then turned to resource allocation between industries. Putting capital and labor in the sectors where they are most productive contributes significantly to growth. But that was not the end of the story. Resource allocation among firms within industries is even more important for growth and development. Firms are very different, even in the same country within narrowly defined industries. Studies typically find that a firm in the 90th percentile of productivity is many times more productive than a firm in the 10th percentile: Using the same inputs, a firm at the top of the distribution produces about four to five times as much as a firm at the bottom.3

Despite these vast differences between firms, the earlier growth literature assumed a representative firm, whose resource use and productivity were replicated many times. This eliminated resource allocation between firms as a source of growth. But in all countries, there are many small firms and a few large firms, with large firms dominating markets for many goods and services. In Mexico, for example, Walmex controls by far the largest share of Mexico’s supermarket business, but numerous smaller chains and individually owned stores compete as well. In China, Alibaba dominates ecommerce, just as Amazon dominates it in the United States though many specialty sites exist. And country superstars are often global superstars. Anheuser-Busch and Samsung each have over 20 percent of the world markets for beer and smart phones, respectively. Toyota, GM, and VW together share one third of the global market for cars.

One reason why richer countries are able to produce more goods and services is that they use their resources more efficiently. Highly productive firms in particular absorb a disproportionate share of resources, raising output levels. In contrast, in developing countries the largest firms are not always the most productive. This misallocation of resources among firms is a critical element explaining why poor countries are poor and why growth stalls in many middle-income countries. Wide heterogeneity in firm performance, which is common in most developing markets, is taken as an indicator of resource misallocation. The intuition is that the most productive firms should absorb most resources, grow large, and hence be relatively similar in performance.

An even more precise indicator of allocative efficiency is the covariance between firm size and productivity. An economy is more productive when more efficient firms have a larger and increasing share of activity. If firm performance and size are uncorrelated, resources are not being pulled into their most productive uses.

Consider the following example. Imagine the Chinese steel industry has two firms, each with 100 workers. The first firm produces three units of steel per worker, and the second produces one unit per worker. If resources are split evenly between the two firms, average industry productivity per worker will be two units per worker ((3*100+1*100)/200 = 2). Assume that 50 workers move to the more productive firm. Average productivity would rise to 2.5 units per worker ((3*150+1*50)/200=2.5), a 25 percent productivity boost just by shifting resources between firms. The variance of labor productivity, which describes how widely the productivities are spread, was 1 in the first case; after reallocation it falls to 0.75.4 Firm size (measured by employment) and productivity are uncorrelated in the first case and positively correlated in the second.

Alternatively, the growth of relatively unproductive firms can be an indication of public largesse or crony capitalism; the rise of such firms may be immiserating for the country. To see why, imagine that the 50 workers moved from the more productive firm to the less productive firm, perhaps because of government favoritism. In this case productivity would fall and firm size and productivity would become negatively correlated.

Just as large firms are good for growth when they are the most productive but bad for growth when they are relatively weak, the individuals behind them are lauded when they are innovators but criticized when they are cronies. In the United States, the prevailing mythology of the 19th century, when the country was booming, was that large firms grew from small firms by dint of the hard work and perseverance of entrepreneurs or “self-made” men. Indeed, the term “self-made man,” attributed to Henry Clay in the 1830s, was used to suggest that the transformation of the United States from an agrarian into a modern commercial economy was a positive development.

The popular aversion to large firms in developing countries—and to some corporations in advanced countries—is related to concerns about political dealing, monopoly power, and/or cronyism. These are all situations where growth stems from special deals given to the firm owners or barriers to entry erected to protect the firm as opposed to the inherent strengths of the firm, and thus productivity and size are unlikely to be positively correlated. Reflecting this view that the dominance of large corporations is not necessarily healthy, a body of literature has grown among economists theoretically exploring the economic costs of cronyism. Anne Krueger (1974) applied the term “rent seeking” to the practice by companies of lobbying for lucrative government licenses and presented evidence of the costs to an economy.5 More recently firm-level data combined with information about political connections have been used to empirically estimate such costs. But the key intuition is that the capacity for the most productive firms to grow large is critical to economic health.

Evidence on Firm Size

In an efficient and well-managed firm, the most talented and driven employees get promoted; they gain experience and improve their skills, and ultimately earn a spot in a large C-suite office where they have a decision-making role and reap high rewards. Productive and organized workers rise to middle management, while others perform best specializing in a specific and sometimes limited role in a firm. The workers that repeatedly make mistakes, fail to show up, or cause other costly problems are fired.

Just as workers differ and this leads to various outcomes for employees in a well-run firm, productivities differ and this results in a range of outcomes for firms in a dynamic economy. Some highly productive firms enter, produce the products that are most profitable, reinvest their earnings, and grow. Other firms earn just enough to cover costs and stay in business but have little left over to invest. These firms remain in the market but never grow large. There are also firms that fail to cover costs and these firms exit. Over time, a few very large and highly productive firms account for a disproportionate share of revenues and profits in any given industry.

In fact, a highly skewed firm-size distribution is precisely what is seen across different industries in most countries: a small group of large firms accounts for a very large share of output, exports, and profits. But countries differ in terms of what type of firm rises to the top of the distribution and how large a share of total output the top firms account for.

This section discusses what the firm-size distribution can tell us about the health of the economy.

Larger Shares of Big Firms in Advanced Countries

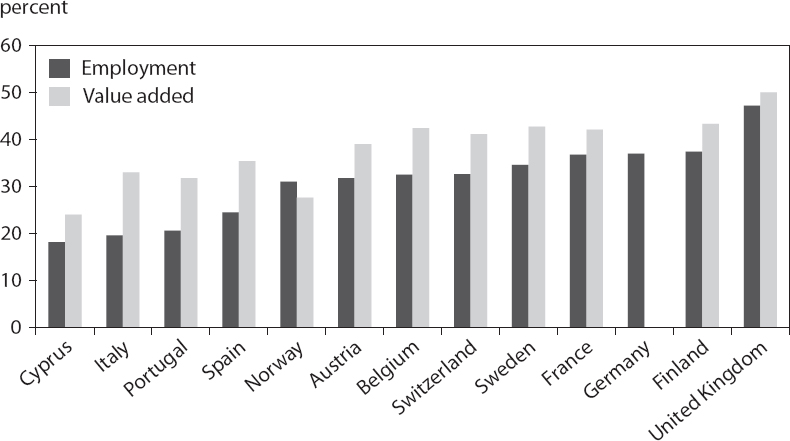

Firm-size distributions show that the share of resources controlled by large firms tends to increase with the level of development. In the European Union, in higher-income countries like Finland, France, Germany, and the United Kingdom, more than 35 percent of employment in the nonfinancial business sector was in large enterprises (firms with more than 250 employees) in 2010. In contrast, in struggling countries like Italy, Portugal, and Spain, less than 25 percent of employment was in large firms (figure 3.1). (The corresponding share for the United States was 53 percent.)

Large firms account for an even greater share of valued added than employment, implying that they have higher average labor productivity than small firms. Large firms’ contribution to value added in Spain and Portugal (34 percent on average) is more than 10 percentage points higher than their contribution to employment, suggesting that if workers moved from small and medium-size firms to large firms, output would increase.

The gap between employment and value added offers information about how much reallocation or labor could improve aggregate productivity. When the gap is large, as in Spain and Portugal, reallocation of labor could greatly boost productivity. In the richer countries of Europe, the gap between employment and value added share is just 3 to 6 percentage points, suggesting that these countries are operating at a higher level of allocative efficiency.

Figure 3.1 Large firms’ contribution to employment and value added in Europe, 2010

Note: Large firms are firms with more than 250 employees. Data on value added in Germany are not available.

Source: Eurostat, 2010.

There are problems with this simple approach, as the industries of large and small firms within countries may be very different. The wider gap in Spain and Portugal could be because they specialize in industries that tend to have smaller firms where labor is less productive, but workers from these sectors may not be able to move to the large firms because those sectors require a different set of skills.

But detailed studies of resource allocation across firms within industries find that allocating more resources to the best firms, allowing them to grow large, explains a significant share of the productivity differences across countries. Eric Bartelsman, John Haltiwanger, and Stefano Scarpetta (2013) estimate the covariance between productivity and size in narrowly defined industries in a group of European countries and the United States. They find that allocative efficiency is significantly greater in the United States than in France, Germany, and the United Kingdom. In other words, the most productive US firms absorb a greater share of capital and labor than the most productive European firms. They also find that the covariance between size and productivity was near zero (or negative) at transition in Eastern Europe. Its increase since the early 1990s suggests that allocative efficiency improved sharply in recent decades.

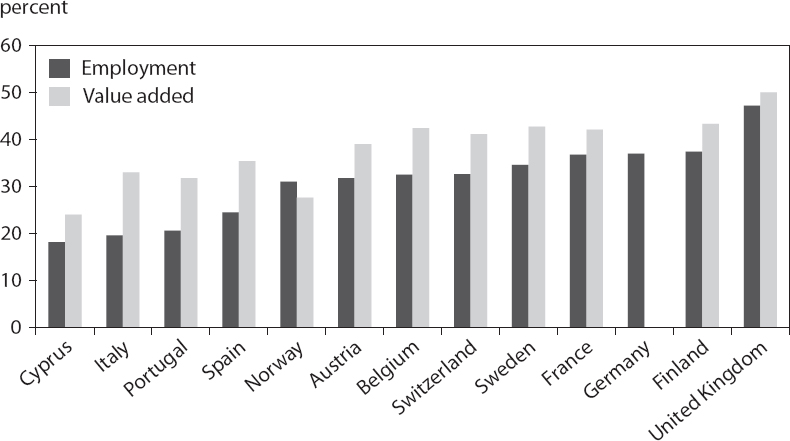

Figure 3.2 Correlation between GDP growth and large firms’ share of employment in the United States, 1994–2013

Source: US Bureau of Labor Statistics.

Correlation between GDP Growth and Large Firms’ Share of Employment

The United States has a long time series on the share of private sector employment by firm size. Over the past two decades, the employment share of large firms (defined as firms with at least 250 workers) rose from 49 percent to 53 percent.6 These firms account for a larger share of employment now than in the past, meaning that they accounted for more employment growth than smaller firms.

Large firms in the United States nearly always expand faster than small firms. Figure 3.2 shows the growth in large firms’ share of employment and GDP. Both are positive on average, indicating that as the economy gets bigger, large firms attract a larger share of employment. The positive correlation between the two variables (0.49) indicates that large firms absorb more workers during periods of economic growth.

Correlation between Firm Size and Economic Development in Emerging Markets

The World Bank’s Enterprise Surveys allow the comparison of firm-size distributions between advanced countries and developing countries. In high-income countries, almost 50 percent of employment is at large firms (defined as firms with more than 100 workers) and 20 percent is at small firms (defined as firms with fewer than 20 workers). In contrast, in developing countries 40 percent of employment is in small firms and 30 percent in large firms (IFC 2013). As countries get richer, the share of employment at large firms rises.

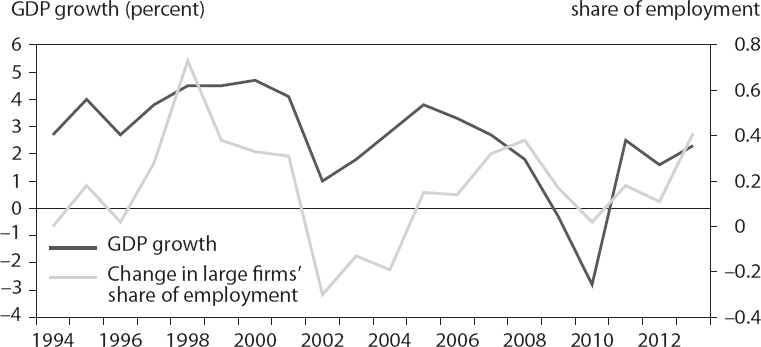

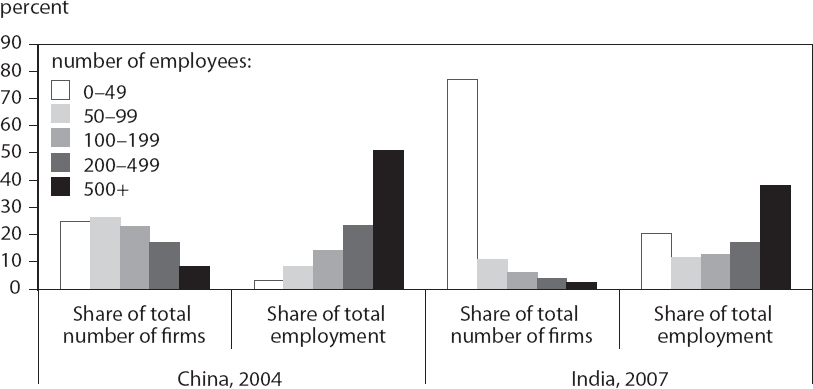

Figure 3.3 Manufacturing firm size distribution in China (2004) and India (2007)

Source: van Ark et al. (2010).

The Enterprise Surveys cover only a representative sample. Firm-level data covering the universe of firms have recently become available for a number of developing countries. These data show a highly skewed firm-size distribution in which richer countries have larger firms than poor countries on average. Pedro Bento and Diego Restuccia (2014) use comparable firm-census data for 124 countries with size measured by employment. They show that average firm size increases with the level of development: Every 10 percent increase in per capita income is associated with a 2.6 percent increase in average firm size.

Small firms represent a large share of the total number of firms in an economy but not a large share of employment or value added. In both China and India, the greatest share of manufacturing employment is at large firms (figure 3.3). Such firms account for more than half of manufacturing employment in China, despite accounting for less than 10 percent of firms.

Myth of the Missing Middle

The evidence overwhelmingly suggests that a greater share of large firms is good for growth and development. But until recently many economists considered the problem in developing countries to be the “missing middle”—the absence of a group of mid-sized firms to drive growth and compete with large firms. Indian policymakers were so convinced that small and medium-sized firms drive growth and jobs that in the mid-1970s they restricted 14 percent of the manufacturing sector (about 1,000 products) to small firms. The restrictions remained in place for more than two decades. Indian manufacturing did not thrive during this period, and the restricted sectors missed the boat on global value chains. The firm-size restrictions were removed over a six-year period during the 2000s.

Comparison of the periods with and without size restrictions offers a natural experiment on how small firms perform in the presence and absence of competition from large firms. Leslie Martin, Shanthi Nataraj, and Ann Harrison (2014) find that controlling for other factors of industrial growth, on average removal of the restrictions led to a 7 percent increase in employment, as more productive firms grew. This estimate represents a lower bound, because their research was conducted using data for 2000–07, when adjustment was ongoing. Manuel García-Santana and Josep Pijoan-Mas (2014) estimate that removing the restrictions increased output per worker by roughly 7 percent. The increase in employment coupled with higher labor productivity led to a huge boost in manufacturing growth. Allowing firms to grow large supported both workers and output in India.

Cross-country evidence finds the “missing middle” to be an incorrect characterization of firm distributions in developing countries. Chang-Tai Hsieh and Benjamin Olken (2014) use data from India, Indonesia, and Mexico to underscore that if anything it is large firms that are missing. They find that large firms have higher average productivity and that the fraction of missing firms is increasing in firm size. In other words, there are more missing large firms than missing medium-size firms, one reason why poor countries are poor. Ana Fernandes, Caroline Freund, and Denisse Pierola (2015) find similar results using exporter data and restate the problem as a “truncated top” of the firm-size distribution in developing countries. Exporters tend to be the most productive firms in an economy, so exporter data allow researchers to examine the distribution of a country’s good firms. They find that an important reason why developing countries export less is that they are missing the largest superproductive firms—the firm-size distribution is truncated at the top.

Work from a wide variety of developing countries shows similar patterns. Cross-country studies of Africa (Van Biesebroeck 2005), Latin America (Ibarraran, Maffioli, and Stucchi 2009), and the rest of the world (IFC 2013) find that small and medium-size enterprises (SMEs) tend to be less productive than large enterprises and account for a smaller share of productivity growth. A sizable share of the productivity gap between developed and developing countries can be explained by the fact that the estimated share of SMEs in economic activity is 50 percent in developed countries and 70 percent in developing countries. SMEs in developing countries tend to be exceptionally stagnant compared with their developed country peers. Chang-Tai Hsieh and Peter Klenow (2014) estimate that the failure of small firms to grow into large firms reduced productivity growth in manufacturing by 25 percent in Mexico and India compared with the United States.

Big Firms, Fast-Growing Firms, and Job Creation

Small firms are also not big creators of jobs: Rigorous studies based on industrial surveys tend to find that net job growth comes from large firms and startups. The most comprehensive work has been done on the United States, where researchers examine firms as opposed to establishments. Establishment data may lead to size misclassifications. At Walmart, for example, each store may be counted as a medium-size enterprise, but the company is the largest private employer in the world.

Census data include information on entry and exit, which are not observable in subsamples of the universe of firms. Recent work on the United States shows that once firm age is controlled for, most employment creation is by new and young firms and large firms (Haltiwanger, Jarmin, and Miranda 2013). Using census data on Tunisian firms, Bob Rijkers et al. (2014) find similar results: Startups and large firms account for the bulk of net job creation.

Exporting as a Big-Firm Occupation

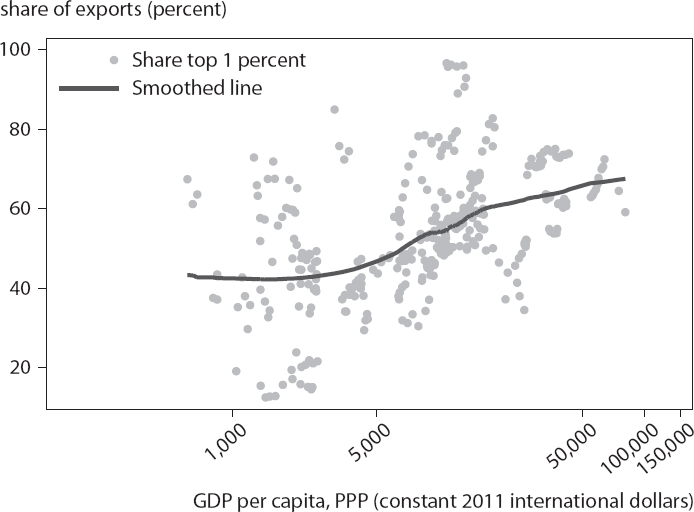

The skewed distribution of firms is magnified among exporters, among which the top 1 percent of firms account for the lion’s share of exports. Large firms account for 80 percent of exports by the United States, more than 50 percent by European countries, and about 50 percent by developing countries. As countries develop, a larger volume of exports tends to come from the largest exporters (figure 3.4). Fernandes, Freund, and Pierola (2015) find evidence that average exporter size grows as countries get richer because allocative efficiency improves: the most productive firms absorb more resources and export more.

Large firms produce and trade on a global stage. They engage in related-party trade (trade between a parent firm and its affiliates), which now accounts for one-third of US exports. Andrew Bernard, Brad Jensen, and Peter Schott (2009) show that these globally engaged firms dominate not only trade flows but also employment among trading firms.

Figure 3.4 Correlation between per capita GDP and share of exports by top 1 percent of exporters, 1995–2014

PPP = purchasing power parity

Note: Years vary by country.

Sources: Share of exports: World Bank, Exporter Dynamics Database; GDP per capita: World Bank, World Development Indicators.

A similar pattern emerges in Europe, where exports are concentrated in large firms in the richer and better-performing countries. In France, Germany, and the United Kingdom, large firms account for about 70 percent of total export value. In contrast, in Italy, Portugal, and Spain, such firms account for just 51–56 percent (Cernat, Norman-López, and T-Figueras 2014).

Importance of Individual Firms for Exports

Within the top 1 percent of firms, individual firms explain much export behavior, especially in emerging markets. Using a sample of more than 30 developing countries, Freund and Pierola (2015) show that on average the top firm accounts for 15 percent of a country’s exports. The top five firms account for one-third of the value of all exports.

These findings imply that attracting a “superstar” exporter can transform a country’s industrial specialization.7 Sometimes countries attract such a firm through foreign investment (for example, Intel’s investment in Costa Rica gave the country a comparative advantage in semiconductors). In other cases, the investment is indigenous (for example, Ahmet Zorlu and his Vestel Group significantly expanded Turkey’s television exports). Whatever the source, individuals and their companies can help countries diversify their export basket.

Individuals Matter

Just as the old view was that firms were all the same, the traditional view in the management literature was that individuals did not matter. Capital, labor, and technology mattered; CEOs were regarded as substitutable. Moreover, power was dispersed in large corporations, so no single person mattered.

Anecdotal evidence has always pointed in the other direction. A large and growing body of new research now shows that company leaders matter tremendously. Large private firms create economic growth, but individuals drive firm expansion, especially in the early years of a company’s life. When Steve Jobs was forced out of Apple in 1985, the company languished. When he returned more than 10 years later, he reinvented Apple, now the largest technology company in the United States. Warren Buffett is credited with creating a hugely successful conglomerate, despite following a model that is inefficient, according to corporate finance experts. Either Buffett had a unique ability to pick companies or successful companies yearned to be picked by Buffett. Either way a single person made a difference.

Tarun Khanna, Jaeyong Song, and Kyungmook Lee (2011) attribute Samsung’s global success to innovations by Lee Kun-Hee, the company’s second chair. Lee developed a strategy to ensure that Samsung adopted Western best practices, including merit-based pay and quick promotion for star performers. He brought outsiders into Samsung, required senior Samsung employees to train outside the company, and protected long-term investments in corporate structure and innovation from short-run financial volatility. In a culture where seniority and loyalty are highly valued, these transformational shifts were difficult. An outsider appointed as chief marketing officer for the electronics company is credited with the marketing campaign that made the firm a global brand. Samsung staff who spent time abroad and learned foreign languages and cultures are credited with bringing Samsung to places like Thailand and Indonesia. Joint programs with top design institutes, including Parsons in New York, allowed Samsung, once an industry follower, to become a frontrunner. Samsung went from being a Korean leader to a global leader under Lee’s tenure, with “a brand more valuable than Pepsi, Nike, or American Express,” as Khanna, Song, and Lee (2011, 142) note.

Dynamic leaders at emerging-market firms are exhibiting the same traits. As Silicon Valley tycoons focus on smart watches and self-driving cars, China’s tech leaders are applying technology to meet Chinese consumers’ demands. For example, one of the biggest concerns of consumers is food safety. Tech leaders are developing apps that can scan a product’s lifecycle from plant to shelf. Robin Li, of Baidu, is developing smart chopsticks that can test for gutter oil (a major source of illness), ph levels, and calories. Jack Ma ensures that Alibaba adheres to strict rules for pesticides in the products it carries.8

Antônio Luiz Seabra of Natura Cosmeticos, the largest cosmetics company in Brazil, was a leader in developing a natural cosmetics line that is environmentally friendly and does not test on animals. His company was ranked second on Corporate Knights’ sustainable companies list. He also developed direct marketing to consumers, which had been untried in Brazil, and expanded to other Latin American countries using social networks. Both the product and the customer reach, developed in 1969, were well ahead of their time.

Sam Goi—known in Singapore as the popiah king—moved to Singapore from China when he was six. He dropped out of secondary school after English proved difficult for him. His first attempt at entrepreneurship was a flop. His second company, repairing machines, was a success. But his huge fortune came when he invented a new way to make popiah skins (spring roll wraps). He bought a popiah skin company with 23 people that produced 3,200 skins a day. By mechanizing the process, he turned the company into one that produces 35 million pieces a day, 90 percent of them sold outside Singapore. The company has brought him enormous wealth while bringing consumers throughout Asia lower-cost staples.9

Recent literature on management confirms that a firm’s size and value are connected to its leader. Xavier Gabaix and Augustin Landier (2008) find that firm size explains patterns in CEO pay across firms, over time, and between countries. They show that the sixfold increase in CEO pay in the United States between 1980 and 2003 can be fully attributed to the sixfold increase in the market capitalization of large companies during that period.

Using data from the largest 800 US firms for 1969–99, Marianne Bertrand and Antoinette Schoar (2003) find that CEOs explain a large share of the variation in firm policies and outcomes over time, controlling for firm fixed effects and other standard determinants of firm performance. Their results imply that a manager at the 75th percentile invests several times more than a manager at the 25th percentile.

One concern about studies using manager tenure is that the removal of managers when firms perform poorly could drive the results. To get around this problem, Sascha Becker and Hans Hvide (2013) examine entrepreneur death, which is a more exogenous form of leadership change. Using data from Norway they find that entrepreneur death is associated with lower firm growth and higher rates of exit and that the effects are stronger when founders have high levels of human capital.

Using data from Denmark, another study goes a step further to look for an exogenous shock and examines what happens to companies when CEOs unexpectedly die (Bennedsen, Pérez-González, and Wolfenzon 2007). The study finds that the death of a CEO leads to on average an 11 percent decline in the operating return on assets. The effects are even stronger in fast-growing industries. Studies of the United States find a high and rising CEO effect, affecting the return on assets and sales by 10 percent in 1950 and 20 percent in the 2000s, and that CEOs matter most at the largest companies.10 Partly because of CEOs, private companies perform better than state companies. Individuals who build great companies are not easily replaceable, explaining the high rewards they reap.

Prithwiraj Choudhury and Tarun Khanna (2013) evaluate leaders in 42 state-owned research and development (R&D) companies in India. A unique feature of their analysis is that bureaucratic rules, not firm performance, determine leadership turnover. They find that changes in leadership resulted in a 3–15 percent change in the number of patents per government dollar of assistance.

Timothy Quigley and Donald Hambrick (2012) take a different tack; they look at what happens when new leaders are more or less constrained to determine whether individual talent and power matter. They explore what happens when a former CEO remains in a leadership position after the appointment of a new CEO. They examine recent CEO successions at 181 high-tech firms. They find that keeping the old CEO on as a board chair restricts the new CEO’s power, reducing his or her ability to make changes, such as acquisitions, divestitures, or management restructuring. As a result of these limitations, the likelihood of improved performance is reduced (but the likelihood of worse performance is unaffected). Overall, their results demonstrate that CEO power is one reason why some firms are superstar performers.

Firm leaders are likely to matter even more in emerging markets, where company founders or their descendants tend to run companies. Renée Adams, Heitor Almeida, and Daniel Ferreira (2005) show that when CEOs have more decision-making power, there is significantly more variance in firm performance. Using data on Fortune 500 firms, they find that firms with higher levels of CEO power fall at both ends of the spectrum (best performance and worst performance). They focus on structural power (the power the CEO has over the board and other top executives). They find that having a firm with a CEO founder increases profits by nearly 20 percent.

Flood of New Emerging-Market Mega Firms

The rise of extreme wealth is closely related to the emergence of large firms headquartered in four countries: Brazil, Russia, India, and China. In 1996 these countries were virtually absent from global Fortune 500 or billionaire lists (figure 3.5); in 2014 their wealth and companies captured more than 20 percent of both lists. By 2025 emerging markets are expected to have 45 percent of Fortune 500 companies and 50 percent of the world’s billionaires (Dobbs et al. 2013, Knight Frank 2014).

Total revenue from the top five publicly listed firms accounted for 14.6 percent of GDP in Brazil, 20.5 percent in Russia, 15.0 percent in India, and 14.9 percent in China in 2013. This high concentration is not unusual. Even in the United States, which has much deeper markets (with nearly twice as many listed companies and twice the GDP of China in 2013), revenues from the top five listed US companies represented nearly 10 percent of GDP.11

Nicholas Lardy of the Peterson Institute for International Economics, an expert on the Chinese economy, highlights the importance of the private sector in China’s growth. While a number of the largest companies in China are state owned, the private sector is rising fast. State enterprises accounted for nearly 80 percent of industrial output in 1978; that share had fallen to just over half by 1990 and to about a quarter by 2011. There were roughly 250 million employees in private firms in urban China in 2011. The growth of employment at these firms accounted for 95 percent of the growth of employment in urban China between 1978 and 2011 (Lardy 2014).

Figure 3.5 Shares of Fortune 500 companies and billionaires in Brazil, Russia, India, and China, 1996–2014

Sources: Data from Fortune 500 and Forbes, The World’s Billionaires.

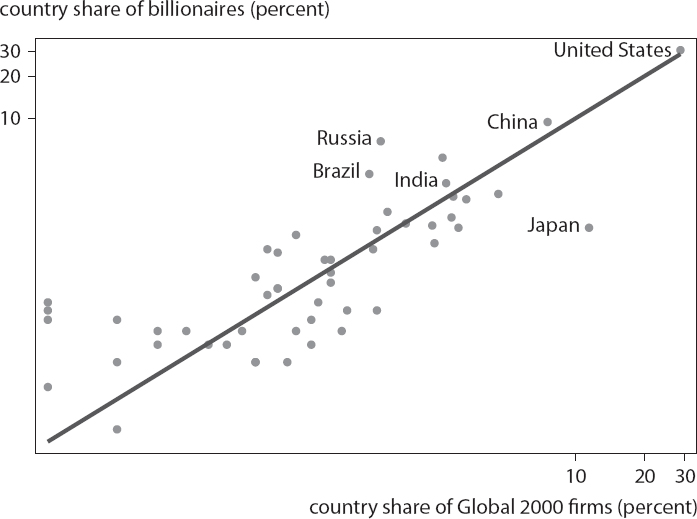

Connecting Firms and Individuals

Figure 3.6 plots the share of Global 2000 companies against the share of billionaires in selected countries in 2014. A point on the 45-degree line indicates the country has the same share of both. Three patterns are clear: (1) Big companies and big money go together, (2) China and the United States have a great deal of both, and (3) some countries are outliers. Brazil and Russia have too much big money given their shares of large corporates, potentially reflecting politically connected money, as opposed to the largely market-made money in other emerging markets. Japan is also an outlier, with relatively little big money given its share of large firms.

China has the lead among emerging markets in its share of large firms, with mainland China alone accounting for 10 percent of firms on the Global 2000 and one-quarter of the FT Emerging Market 500. India comes next, with about half that share.

Figure 3.6 Correlation between share of billionaires and share of big firms, 2014

Sources: Data from Forbes Global 2000 and Forbes, The World’s Billionaires.

Firms behind Emerging-Market Growth

The new large companies and their founders have been a constant force behind structural transformation and growth. Brazil, Russia, India, and China together contributed 30 percent of the new fortunes and an even larger share of the new Fortune 500 companies between 1996 and 2014. The four countries accounted for more than 40 percent of real global growth (measured in purchasing power parity, which controls for exchange rate fluctuations) over this period.

Antoine van Agtmael coined the term emerging market in 1981 to remove any stigma associated with third world in a proposed equity fund to help finance a new group of dynamic corporates (van Agtmael 2007). In his book The Post-American World, Fareed Zakaria (2011) talks about the “rise of the rest,” referring to the high rates of growth and growing prosperity in Asia and other emerging markets. In Eclipse: Living in the Shadow of China’s Economic Dominance, Arvind Subramanian (2011) hypothesizes about a future in which China bails the United States out of a financial crisis. The forces behind the phenomenal growth in emerging markets that has captured the attention of these authors are the mega firms and their founders.

The emergence of extreme wealth in emerging markets is a natural part of development and modernization. To the extent that it emanates from mega firms competing in the export sector or other domestic industries with competition and free entry, it is very likely to be progrowth. In general, large private firms and the entrepreneurs behind them help improve resource allocation in a country.

A growing body of literature examines the importance of resource allocation across firms and within industries. It offers support for the importance of highly productive and large firms in development. When resources are drawn to the best firms, a few stars dominate and production grows. Large and more productive businesses come with big rewards, implying that the rise of extreme wealth in emerging markets may be a sign of health—at least to the extent that it is used in competitive industries.

Not only do firms matter, but individuals matter. Extraordinary firm performance is tied to specific leaders and the power they have to make changes at the firm. As a result, high returns accrue to the founders of highly productive large firms, creating a link between wealth and big business.

1. Forbes measures size, weighting revenues, assets, profits, and market valuation equally.

2. Frederik Balfour and Tim Culpan, “The Man Who Makes Your iPhone,” Bloomberg Business, September 9, 2010.

3. Using data from the 1977 US manufacturing census, Chad Syverson (2004) finds that a firm in the 90th percentile in a four-digit Standard Industrial Classification industry (443 industries) is on average four times as productive as a firm in the 10th percentile, with several US industries seeing much wider differences. This gap widens as one moves out in the distribution: A firm in the 95th percentile is seven times as productive as a firm in the 5th percentile. Productivity differences tend to be even larger in developing countries (Hsieh and Klenow 2009).

4. The sample variance in the first case is (100*(3–2)2+100(1–2)2)/200=1). After reallocation it is (150(3–2.5)2+50(1–2.5)2=0.75).

5. Jagdish Bhagwati (1982) describes a broad range of directly unproductive profit-seeking activities that support firms but are costly to the economy.

6. Growth in the importance of large firms is not subject to the definition of firm size: If 1,000 employees is used as the threshold for large firms, their share of employment increased from 36 to 39 percent.

7. A country is said to have revealed comparative advantage when its export share of a product is greater than the global export share of the product. The intuition is that exporting a larger share of a product than the average country suggests that a country is a relatively efficient producer.

8. Alexandra Stevenson and Paul Mozur, “China’s Long Food Chain Plugs In,” New York Times, March 2, 2015.

9. “Business Guru,” FT Wealth, June 2015.

10. Walter Frick, “Research: CEOs Matter More Today than Ever, at Least in America,” Harvard Business Review, March 12, 2014.

11. Company data from Bloomberg and GDP data from the World Bank.