Appendix A

Financial Statements

You can read all day about financial statements, but until you take a peek at the real thing, you don’t have a complete understanding of what they show, how they’re set up, and what you can expect to find. On the pages that follow, we show you examples of reports from two companies, Tesco and Marks and Spencer. Both companies are in the retail industry, which makes comparing them that much more valuable.

You’re likely to notice a lot of similarities and some striking differences. For example, companies differ in where they give out information that is not covered by the rules and regulations. Some will choose to put a particular item in the statements, whilst others could choose to put the same item in the notes to the accounts.

Not every company presents the information on its financial statements in the same way, but every company has to follow the reporting guidelines set out by the International Accounts Standard Board (see Chapter 19) and must provide the information according to generally accepted accounting principles (GAAP: See Chapter 18). So no matter how the information makes its way onto the page, it must be complete and accurate. (And if it isn’t, the reporting company may end up in a heck of a scandal.)

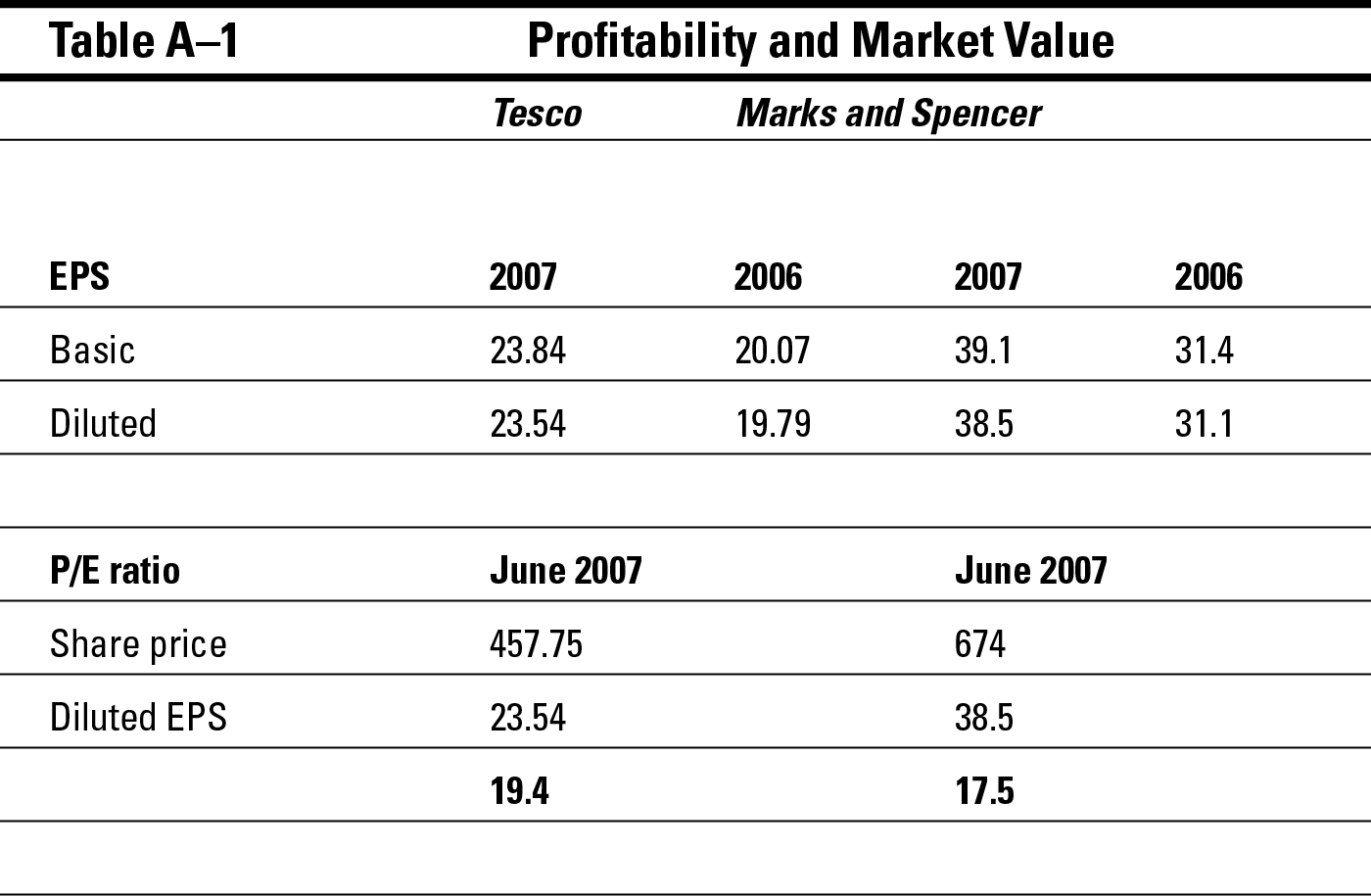

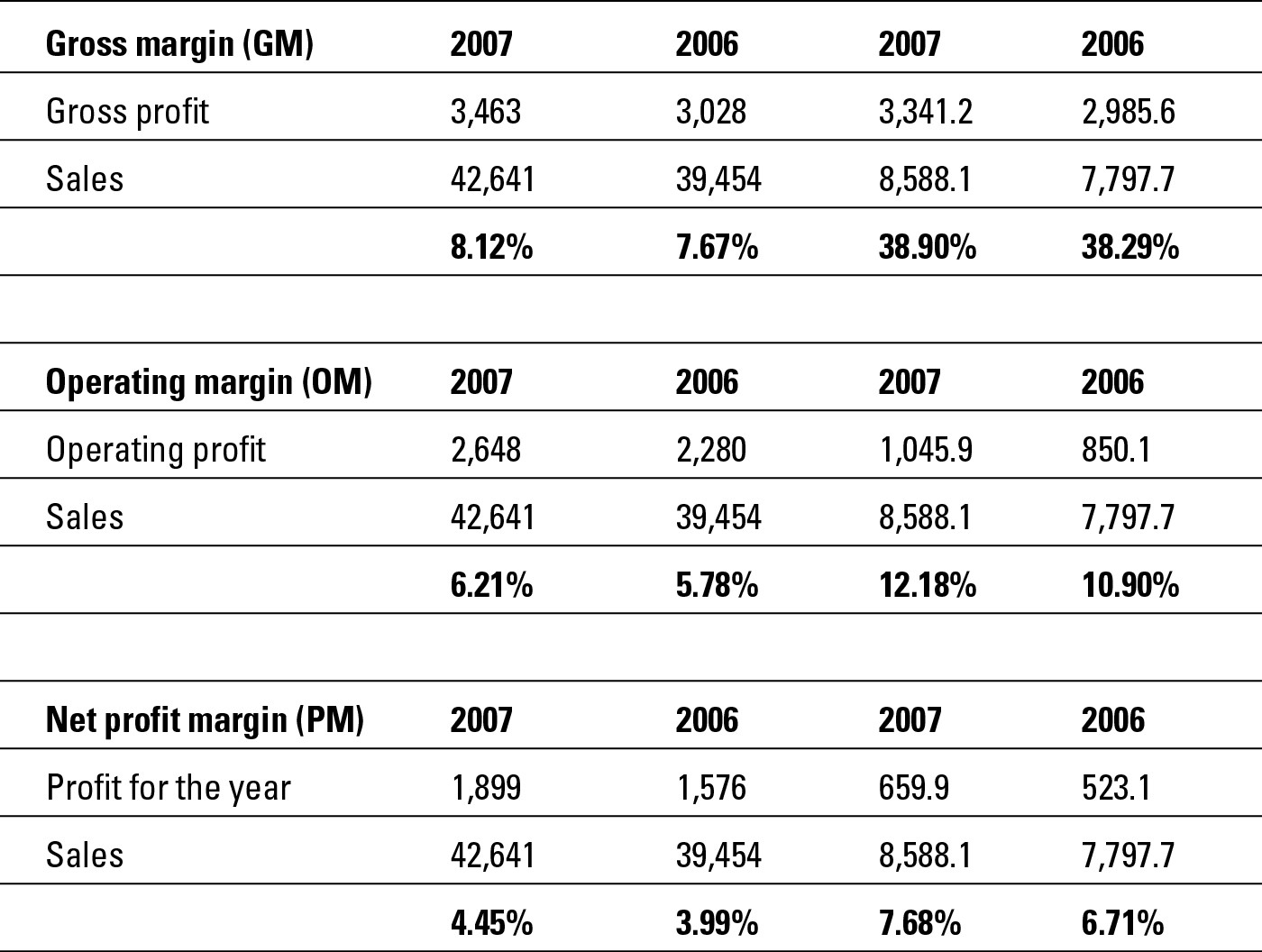

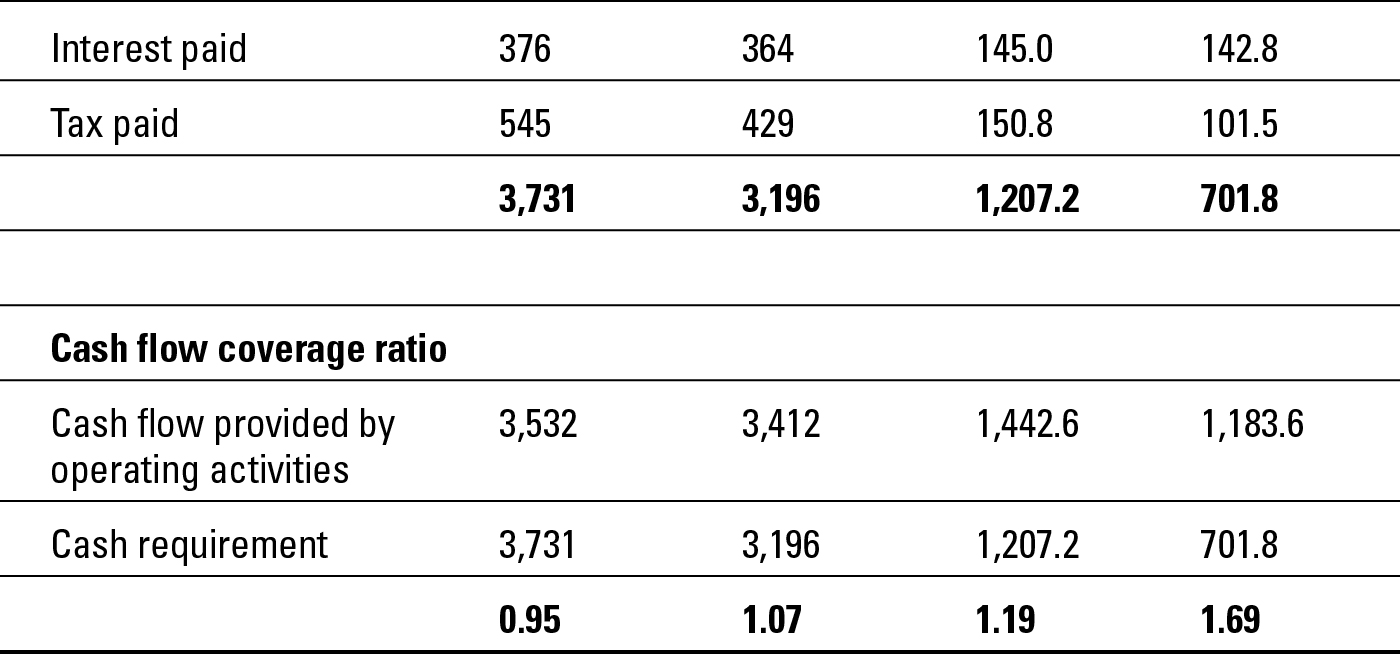

It is also very useful to make comparisons between the company last year and the company the year before. In the second part of this Appendix we have given a summary of all the figures and ratios you are going to learn how to identify in the course of the book.