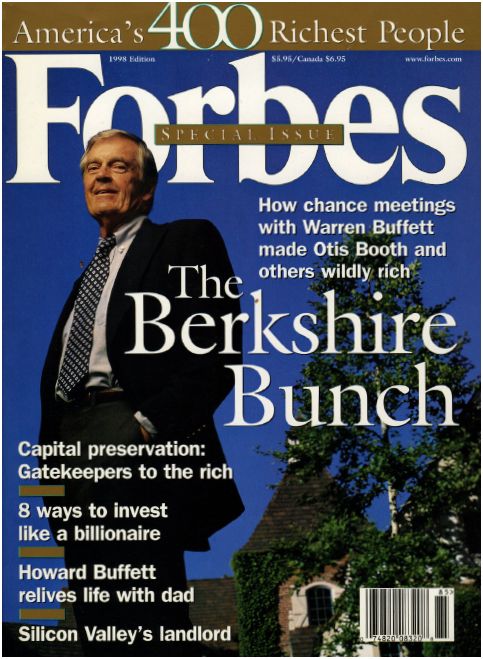

THE BERKSHIRE BUNCH

THE BERKSHIRE BUNCH

BY DOLLY SETTON

This feature appeared in the 1998 Forbes 400 edition.

IN 1952 A 21-YEAR-OLD aspiring money manager placed a small ad in an Omaha, Nebraska, newspaper inviting people to attend a class on investing. He figured it would be a way to accustom himself to appearing before audiences. To prepare, he even spent $100 for a Dale Carnegie course on public speaking.

Five years later Dr. Carol Angle, a young pediatrician, signed up for the class. She had heard somewhere that the instructor was a bright kid, and she wanted to hear what he had to say. Only 20 or so others showed up that day in 1957.

You will by now have guessed the teacher’s name: Buffett. Warren Buffett.

“Warren had us calculate how money would grow, using a slide rule,” Dr. Angle, now 71, recalls. “He brainwashed us to truly believe in our heart of hearts in the miracle of compound interest.”

Persuaded, she and her husband, William, also a doctor, invited 11 other doctors to a dinner to meet young Warren.

Buffett remembers Bill Angle getting up at the end of the dinner and announcing: “I’m putting $10,000 in. The rest of you should, too.” They did. Later, Carol Angle increased her ante to $30,000. That was half of the Angles’ life savings.

Dr. Angle still practices medicine, as director of clinical toxicology at the University of Nebraska Medical Center. But she doesn’t work for the money. Her family’s holdings in Buffett’s Berkshire Hathaway have multiplied into a fortune of $300 million.

Carol Angle is a charter member of the Berkshire Bunch, a diverse tribe scattered throughout the land whose early faith in Warren Buffett has led to immense riches.

In Omaha alone there may be at least 30 families with $100 million or more worth of Berkshire stock, according to George Morgan, a broker at Kirkpatrick Pettis who handles accounts of many Berkshire holders.

Mildred and Donald Othmer died recently, leaving an estate almost entirely in Berkshire Hathaway stock worth close to $800 million.

Mildred’s mother was a friend of Buffett’s family. When Mildred married in the 1950s she and her husband each invested $25,000 in a Buffett partnership.

That was before Buffett had accumulated enough money to buy control of a struggling old New England manufacturer of textiles, handkerchiefs and suit linings called Berkshire Hathaway. At the time his first converts signed on, Buffett was running essentially what we would today call a private investment partnership. When he disbanded the partnership in 1969, explaining that bargains were then hard to find, he returned most of the investors’ money and their pro rata Berkshire shares. He recommended to some of his investors that they turn their money over to the smallish Wall Street firm Ruane, Cuniff & Co. and its Sequoia Fund—a recommendation that neither he nor they have reason to regret.

For a while, he tried running Berkshire as a textile company, with investments on the side. In the end, he liquidated the business and concentrated entirely on investments. The ebullient stock market of the mid- and late-1960s had turned Buffett off, but things were changing.

The overpriced markets of the late 1960s collapsed amid recession, oil crises and inflation, and stocks became cheap again. Speaking to Forbes in late 1974, Buffett proclaimed that stocks were irresistible bargains. (Actually, he put it more colorfully. Looking at the stock market, he said, “I feel like an oversexed guy in a harem.”)

THE STORY OF HIS INVESTMENT SUCCESS has been told often, here and elsewhere: his devotion to the rigid analysis of balance sheets and P&L statements advocated by his teacher Benjamin Graham; his partnership with Charles Munger, which influenced Buffett to modify some of his earlier concepts. Suffice it to say that Buffett has done in stocks and companies what shrewd collectors have done in art: recognized quality before the crowd does. Today Berkshire Hathaway has a market capitalization of $73.5 billion and Buffett is an American hero.

He is No. 2, behind Bill Gates, on the Forbes list of the 400 richest people in the U.S, with $29 billion in Berkshire Hathaway shares.

Munger, the acerbic lawyer and Buffett’s partner for 40 years, ranks 153, with $1.2 billion. Buffett’s wife, Susan, whom he married in 1952, has $2.3 billion, ranking her 73 on The Forbes 400. Though Forbes could not find them all, we are confident that there are literally scores of Berkshire centimillionaires.

The Bunch has a few things in common: By and large they haven’t used their new wealth to finance jet-set living. Dr. Angle is perhaps typical. She doesn’t fly first class; she wouldn’t dream of buying a Mercedes. “There isn’t that much to spend money on in Omaha … and if you do, you’re highly suspect,” she laughs.

They have this, too, in common: a faith in Buffett that transcends bull and bear markets, a dislike for paying unnecessary capital gains taxes that has influenced them to hang on even when the stock sometimes seemed overpriced—and an understanding that it’s smarter to look for a steady 15% or so compounding of your money than to search for hot stocks that could double or treble in a short time. There has never been a shortage of naysayers warning that Berkshire was overpriced. (Only last month the New York Times so proclaimed.)

At times its price has been volatile; by September the Class A shares were down 27% from their July peak of $84,000 per share. For many of the Berkshire Bunch that meant paper losses running into the hundreds of millions.

THE BERKSHIRE BUNCH grew slowly. The first members were friends and family from Omaha. Daniel Monen, 71, the attorney who drew up all of Buffett’s partnership papers, borrowed $5,000 from his mother-in-law to invest in 1957. “Most lawyers die at their desks,” he chuckles. “I could quit when I was 55 because of Warren Buffett.”

A wealthy Omaha neighbor, Dorothy Davis, invited Buffett over to her apartment one evening in 1957. “‘I’ve heard you manage money,’ she said,” Buffett recalls. “She questioned me very closely for two hours about my philosophy of investing. But her husband, Dr. Davis, didn’t say a word. He appeared not even to be listening.

“Suddenly, Dr. Davis announced, ‘We’re giving you $100,000.’ ‘How come?’ I asked. He said, ‘Because you remind me of Charlie Munger.’”

Who? Buffett didn’t even know Munger yet.

The meeting boosted Buffett’s money under management from $500,000 to $600,000. More important, it planted a seed that sprouted two years later, when Davis introduced Buffett to Munger, a fellow Omaha native who had moved to Los Angeles.

Many of the second wave of the Buffett Bunch were Columbia Business School classmates of Buffett’s. There is Fred Stanback, a wealthy native of North Carolina who was later best man at Buffett’s wedding. In 1962 he entrusted $125,000 to Buffett.

Others joined the Bunch because they recognized in Buffett a fellow admirer of investment guru Ben Graham. These included William Ruane of the Sequoia Fund, David Gottesman of First Manhattan and the late Phil Carrett of the Pioneer Fund.

“Anyone who came in contact with Warren bought the stock. It was one of the clearest decisions a person could make,” says Gottesman. His firm holds over 6,000 shares, worth some $368 million, for its clients.

Ruane’s Sequoia Fund holds 20,975 shares, 34% of its total portfolio.

Later in the 1960s the big money began to catch on. Laurence Tisch and Franklin Otis Booth Jr., cousin of the Los Angeles Chandler family, became investors.

Some members almost stumbled in. In 1962 Buffett started buying shares in Berkshire Hathaway. Its chairman was Malcolm Chace, scion of an old New England family. To Buffett, Berkshire seemed a classic Ben Graham situation, selling as it was at $7.50 a share versus net working capital of $10 a share. Buffett took control in 1965 and gradually liquidated the working assets.

The stubborn Malcolm Chace didn’t sell to Buffett. His holding, now controlled by his heir Malcolm Chace III, is worth about $850 million.

Ernest Williams, former head of Mason & Lee, a Virginia brokerage, read an article by Buffett and, in 1978, began buying as many shares as he could get; today, he and his family own more than 4,000 shares, worth some $250 million.

Legendary MIT economics professor Paul Samuelson is a big Berkshire shareholder. To his students, Samuelson preached the efficient market theory of investing, which says it’s just about impossible to beat the market. In his own investing, however, Samuelson picked a market-beater.

BESIDES ITS STOCKHOLDINGS and insurance companies, Berkshire shelters a raft of small and medium-size companies that publish newspapers, make shoes and sell candy, jewelry, furniture and encyclopedias. Buffett prefers to buy such businesses for cash, but he can be arm-twisted into parting with Berkshire stock if he wants your company badly enough. William Child, the chief executive of R.C. Willey Home Furnishings, a Salt Lake City, Utah-based furnishing store, is one of those fortunate ones.

Just before selling out to Buffett, Child got some sage advice from grandsons of Rose Blumkin, the then-99-year-old former owner of Nebraska Furniture Mart in Omaha, who sold out to Berkshire in 1995.

“My friends the Blumkins told me they made a very bad mistake selling their company to Buffett for cash. They told me, no matter what, you don’t take cash, and no matter what you do, don’t sell your Berkshire stock. And I didn’t,” says Child.

Child got 8,000 shares in June 1995. The price then was $22,000 a share. Today it is $61,400, giving Child a net worth of almost $500 million.

Harold Alfond and his family exchanged their ownership of Dexter Shoe Co. for 25,203 shares of Berkshire in 1995. Alfond never sold a share; the position today is worth $1.5 billion.

As you might expect, there are a lot of people out there kicking themselves for not keeping the faith. In the 1970s bear market the carnage was terrible. Berkshire fell from $80 in December 1972 to $40 in December 1974. Gloom and doom were everywhere. Year after year people withdrew more money from mutual funds, and a Forbes competitor emblazoned “The Death of Equities” on its cover. All this suited Buffett fine. As he has put it many times, “You pay a steep price in the stock market for a cheery consensus.” Others were buying bonds; he was buying stocks. But some of his followers bought the consensus and sold out.

Black day, for them.

Along the way, others have bailed out for different reasons. Marshall Weinberg, a Columbia classmate who became a stockbroker at Gruntal & Co., sold some stock to make contributions to various causes. William (Buddy) Fox left Wall Street and cashed in his Berkshire stock to move to Australia. Laurence Tisch sold his position to avoid, he claims, being criticized for being a Buffett investor when both men might be interested in the same stocks.

When Berkshire’s takeover of General Reinsurance in a $22 billion stock swap is accomplished in the fourth quarter, Berkshire will inherit an entirely new group of investors: Seventy percent of Gen Re is held by mutual funds, insurance companies and pension funds. Will they stay with Berkshire? Buffett fully expects a fair number to defect. He says: “The first investors just believed in me. The ones who had faith stayed on; you couldn’t get my Aunt Katie to sell if you came at her with a crowbar. But the people who came in later because they thought the stock was cheap and they were attracted to my record didn’t always stay. It’s a process of natural selection.”

Buffett can never resist a chance to throw out a quip (though we must say, it wasn’t one of his best): “You might say it’s the survival of the fattest—financially fattest.” F

Leon Charney

$1.3 billion. Real estate. New York City. 72. Inherited just $34 from his sewing supply salesman father, paid his way through Brooklyn Law School singing in synagogues. Entertainment lawyer represented stars including Sammy Davis Jr. Built his practice by maximizing tax benefits for oil partnerships. An adviser to Jimmy Carter, he helped broker the Camp David Accords between Egypt and Israel in 1978. Bought his first building, One Times Square with 1.2 million square feet of commercial space.

From the Forbes 400 2013 Issue

William Conway Jr.

$2.5 billion. Carlyle Group. McLean, Va. 58. Divorced, remarried; 1 child.

Daniel D’Aniello

$2.5 billion. Carlyle Group. Vienna, Va. 61. Married, 2 children.

David Rubenstein

$2.5 billion. Carlyle Group. Bethesda, Md. 58. Married, 3 children.

Leveraged buyout titans founded Carlyle Group 1987; used politically connected advisers—including former President George H.W. Bush and former British Prime Minister John Major—to buy defense-oriented companies, turn them around, sell for big profits. Vilified in Michael Moore’s 2004 movie, Fahrenheit 9/11, for investing Bin Laden family money; rehabbing image ever since. Cut ties with lightning-rod advisers; brought on ex-IBM chief Louis Gerstner, former Time Inc. editor in chief Norman Pearlstine. Diversified portfolio. Today firm manages $78 billion across 55 buyout, leveraged finance, real estate, venture capital funds. Big deals: with partners, bought pipeline outfit Kinder Morgan for $22 billion last year; paid Ford Motor $15 billion for rental-car firm Hertz in 2005. Conway: Dartmouth grad earned M.B.A. at U. of Chicago. Took a job at First National Bank of Chicago, became chief financial officer at MCI. Runs Carlyle’s investment committee. D’Aniello: Grew up in Butler, Pa., bagged groceries; mom was an insurance claims agent. Studied economics at Syracuse, then Harvard M.B.A. Early career included posts at Trans World Airlines, Pepsi. Became executive at Marriott. Runs Carlyle’s day-to-day operations. Rubenstein: Baltimore native sold magazines in high school. Studied political science at Duke, then law at U. of Chicago. Became a lawyer; then deputy assistant to President Carter for domestic policy 1977. Road warrior: rumored to spend two-thirds of the year traveling to raise funds. Vice chairman of New York’s Lincoln Center.

From the Forbes 400 2007 Issue

Doris Duke

Inheritance. Somerville, N.J. et al., 71. Twice divorced, no children. Daughter of James Duke (Duke Univ.), self-made founder of American Tobacco Co. She inherited $70 million at 13. Became object of relentless press scrutiny: “I wish I could go into a store and shop for things just as a girl.” Lavish homes in NYC, Newport, R.I., Honolulu, etc., but greatest luxury is “not to be known as Doris Duke.” Sole contributor Newport Restoration Foundation, which refurbishes 18th- and 19th-century homes. Major beneficiary of the Doris Duke Trust. Her interest and other assets believed to exceed $250 million.

From the Forbes 400 1984 Issue

Frederick Woodruff Field

$1.1 billion. Media. Beverly Hills. 45. Divorced 3 times, 6 daughters. Marshall Field department store scion, now unlikely champion of rap music. His Interscope Records one of industry’s biggest purveyors of so-called gangsta rap. Sold 50% to Time Warner for $125 million, bought back at discount after Time Warner came under fire for label’s violent lyrics 1995. Sold same 50% months later for $200 million to Edgar Bronfman’s Universal Music Group. Entertainment giant now said to be figuring out way to slice off label’s cancerous Death Row imprint. “Ted” got into entertainment after clash with half-brother Marshall forced liquidation of family’s retail, media empire. Left Chicago for Hollywood, started Interscope movie company (Jumanji, Mr. Holland’s Opus); eventually sold to Polygram. Interscope Records is the hottest label in the music business. Member since 1982.

From the Forbes 400 1997 Issue

Raymond A. Kroc

McDonald’s. Chicago and La Jolla, Calif. 80. 3 marriages, 2 divorces. One daughter, deceased; has adopted daughter of present wife. High school dropout, served in WWI at 15. Radio music director, piano player, paper-cup salesman. At 52, still small-time, seller malted-milk machines; discovered Richard and Maurice McDonald doing $2 million a year on 15-cent hamburgers. Franchised them; bought them out 1961 for $2.7 million; kept name (“What are you going to do with a name like Kroc?”); revenues today $2.7 billion. Still owns over 7 million shares. Bought MLB team San Diego Padres 1974. Minimum net worth: $450 million.

From the Forbes 400 1983 Issue