CHAPTER THIRTEEN

China, Russia, India

IF THE WORLD is to rapidly decarbonize, that process will depend heavily on what happens in three large countries. China is by far the largest emitter of CO2 but also building more nuclear reactors than anyone else, as well as more solar and wind power. Russia is a fossil-fuel giant exporting to the world, but Russia also exports more nuclear power plants than anyone else. India is the world’s third-largest CO2 emitter, though a distant third after China and the United States, with a coal-based generating system that will need to grow rapidly to keep up with fast-growing energy demand for a huge, poor population.

Much of the discussion of climate-change solutions has revolved around the Western industrialized democracies and especially the United States. It’s true that those countries created the problem with their historical use of fossil fuel and also that they use a lot of energy and still add a lot to CO2 pollution. But these countries have some advantages not shared by the poorer parts of the world. Using technology, they have made energy use more and more efficient in recent decades, so that their carbon emissions are slowly declining—not dropping fast enough, but not rising either. And the rich countries are rich enough that if they decide to spend more for cleaner energy, they can do so without courting disaster. Furthermore, the United States can largely drop coal because of its cheap fracked methane.

The world’s poorer countries face greater constraints. The farmers in India who desperately want electricity, so their children have light to study by at night, cannot afford to pay a premium rate for it. Russia’s economy depends on oil and gas exports and would collapse if those suddenly stopped with no comparable income stream to replace them. China’s rapid economic growth would grind to a halt, possibly with severe consequences for its social stability, if energy supplies could not keep up. In all three cases, affordable energy is not a luxury but an economic and political necessity. In each case, however, a rapid expansion of nuclear power could fill the gap (in Chinese and Indian energy consumption and in Russian energy exports). It helps that all three countries have well-developed civilian nuclear industries as well as already owning nuclear weapons, making proliferation a nonissue.

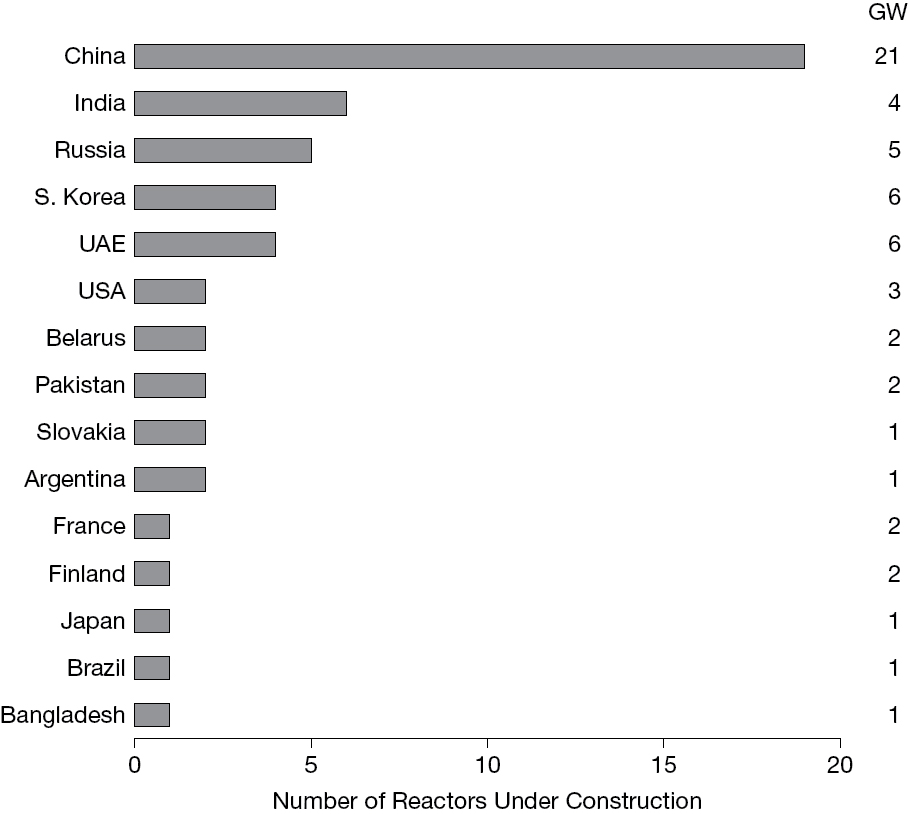

People in Western democracies might have the impression that nuclear power is dying out, but this is not true worldwide. Some 449 reactors in thirty-one countries are in operation, producing 11 percent of the world’s electricity, second only to hydropower as a clean energy source.1 In 2018 of the 53 new reactors under construction in fifteen countries, the majority were in China, India, and Russia.

Figure 46. China leads in nuclear power construction. Data source: World Nuclear Association.

China

China is key to the climate crisis. Its breathtaking economic growth over thirty years has not only raised Chinese citizens’ standard of living dramatically but also made China the industrial workshop of the world. China has taken the lead in producing solar and wind equipment ever more cheaply for use worldwide. At the same time, China keeps burning huge amounts of coal, and its emissions remain dangerously high, with smog choking its major cities. Worse yet, one new method for reducing the smog involves using coal in distant rural locations to create gas that can be burned more cleanly in the cities, but at the cost of even higher total greenhouse emissions from the gasification process.2 Chinese companies are also major players in building coal plants in other developing countries, with hundreds of gigawatts of new capacity planned.3 Solving the world’s climate problem without solving the Chinese coal problem is flat-out impossible. The Chinese government says its CO2 emissions will peak around 2030, and many experts think this will happen even sooner. But, as we saw in Chapter 1, merely flattening out high emissions at their current levels does not solve the climate problem.

What, then, can replace coal in China, and quickly? The country is building vast solar and wind farms as fast as it can, but these just chase after rising demand while the existing coal plants churn on. Energy use is not going to suddenly decrease. The only practical answer is to do what Sweden did, but on a bigger scale. One of us (Qvist) recently visited China to recommend just this program to the leadership there. The response was that, among other things, China lacked the number of trained and experienced experts to be able to expand that far and fast. However, this problem can be overcome.

First, China can import expertise from elsewhere, especially from places like Germany, where nuclear power plants are being shuttered. China can also develop stronger cooperation with the United States to build human resource capacity.4

Second, China can standardize and replicate. In both France and South Korea, a key to success was picking a standard reactor design and building it over and over, with the same team of experts moving on from one to the next. South Korea created the Korean Standard Nuclear Plant (KSNP). China has not settled on a standard design but is still building a number of different designs, and it is arguably a large-enough economy to pursue a variety of designs at scale simultaneously. But by choosing a small number of main technology tracks, China could quickly get really good at building reactors and begin to produce them more like Boeing jets rolling off an assembly line and less like bridges uniquely designed for a particular site.

The keys to low-cost nuclear power, according to a recent review of the history of the industry, are standardized design applied repeatedly, government support, and building multiple reactors at each site.5 China could readily achieve all three. It need not follow the US model of multiple designs built and operated by a variety of private companies. While the United States has seen an escalating cost curve for new reactors, the trend in South Korea has been downward, as lower costs followed from greater experience. Already, China is able to build a 1 GW plant for $2 billion and generate nuclear electricity for around 3–6 cents/kWh, cheaper than any source other than hydropower.6

China is currently operating thirty-seven reactors and building nineteen more. Its main design for new builds is the Westinghouse AP1000 and Chinese variants of it, notably the CAP1400.7 But China is also building EPRs and several Chinese designs, including both large reactors and Small Modular Reactors, as well as Russian and Canadian designs, very small reactors, and floating reactors. China hopes to transition, in several decades, to “fast” neutron reactors and fourth-generation technology.8 China is spending $3 billion to build two prototype molten salt reactors by 2020.9

Figure 47. China’s wide variety of reactor types includes the important third-generation CAP1400, here under construction in 2014. Photo: Conleth Brady / International Atomic Energy Agency.

The only problem with China’s shotgun approach using so many reactor designs is that coal, meanwhile, continues to burn at ruinous rates. China could focus on mass production of existing light-water reactor technology and transition quickly away from coal while maintaining a robust R&D budget to seriously prototype and commercialize one or more fourth-generation technologies within the next decade. The AP1000 (and its Chinese follow-on, the CAP1400) reactor might be one of the workhorses replacing coal plants in the near term. The first Chinese AP1000 began electricity generation in 2018, with the second set to begin shortly after.10 If successful, many more could feasibly follow in short order. The Chinese-designed Hualong One, another third-generation reactor, is to follow a year later. If scaling up these designs proved problematic, China could look to the Korean KSNP, bringing in Korean engineers who may be out of work if South Korea stops building nuclear power plants and who have recent export experience from the four nuclear power plants they are building in the UAE. By paying handsomely for technology transfer, and creating a crash program to replicate the proven design widely across China—rather than spend years to prove out a new design or variant—China could make a very fast Swedish-style transition from fossil fuel.

A small set of standardized, proven designs replicated on a large scale across the country would provide China a path out of coal, arguably doing more to fix the climate crisis than any other single action in the world. It would also boost the popularity of the Communist Party leadership and President Xi Jinping by making city air breathable again.

As a rollout along these lines across China reached maturity, China could export nuclear power plants to the poor countries of the world. China’s specialty recently has been building infrastructure, such as ports, railroads, roads, and indeed a large number of coal plants across Asia and Africa, as part of its so-called One Belt, One Road initiative—sometimes called the New Silk Road. China often operates what it builds; for instance, the person sweeping up a railroad station in Ethiopia may well be a Chinese citizen. What works for transportation infrastructure might work for energy infrastructure. China has already begun to export nuclear power plants along with other infrastructure to developing countries. When China mass-produces nuclear power plants that can safely produce cheap electricity, it could sell a lot of them to energy-hungry countries, although there is no guarantee of success.11 As Japan, South Korea, North America, and Europe drop out of the game—if indeed that trend continues—China could clean up.

Russia

Russia is a bit more complicated. Domestically, it could in theory replace coal (about 20 percent of generation) with methane and nuclear power with some good effects. But Russia can get more money for its methane by exporting it, so in practice only nuclear power can replace coal. Russia already operates thirty-five nuclear reactors,12 accounting for almost 20 percent of electricity generation, similar to the United States. But unlike the United States, Russia is building a new reactor each year to replace retirements and raise nuclear power’s share of electricity generation to 50 percent by midcentury and three-quarters by century’s end.13

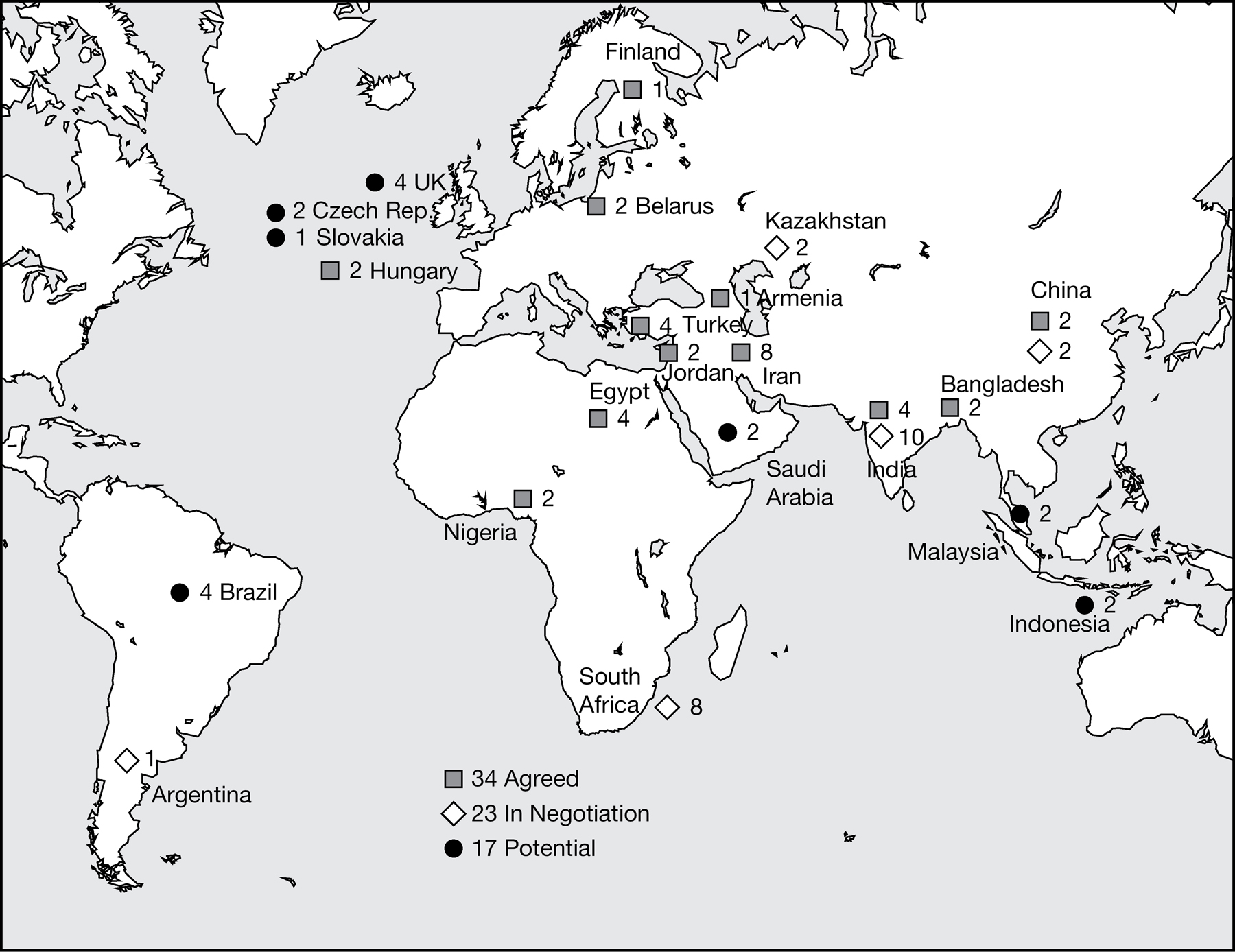

The unique potential of Russia lies in its status as the world’s current leader in exporting nuclear power plants, with about 60 percent of world exports.14 Russia specializes in exporting turnkey plants that it will design, build, and operate. Electricity prices are projected at a competitive 5–6 cents/kWh. Current export orders include thirty-four reactors in thirteen countries at a total cost of about $300 billion.15 In 2017 the government decided to reduce financial support to the national nuclear power company, Rosatom, making exports all the more important in the company’s future. Russian export reactors are already finished and operating in China, India, and Iran. More are contracted in Bangladesh, Vietnam, Turkey, and Finland, and orders have been placed by Belarus, Bangladesh, Turkey, Hungary, and Egypt.16 Broad agreements have been reached, but without specifics, in other countries in Asia, Africa, and Latin America. Many more energy-hungry countries contemplating new coal plants could, instead, consider nuclear power plants built and operated by Russia.

Figure 48. Russian nuclear power export projects, 2016. Data source: Rosatom, Performance of State Atomic Energy Corporation Rosatom in 2016: Public Annual Report, 2017 (Moscow: Rosatom, 2017), 80.

Russia has its own version of fourth-generation technology, a program called Breakthrough, to develop fast reactors with closed fuel cycles. (Fast reactors use neutrons that are not slowed down as in conventional “thermal” reactors and include the “breeder” reactors that create their own fuel, plutonium, as they burn uranium.) The Breakthrough designs can run on nuclear waste, with characteristics that somewhat resemble the Bill Gates–backed Terrapower design discussed in Chapter 12. Russia is firmly placing its future energy bets on nuclear power and does not have a strong program supporting wind or solar power as major sources of energy in the coming decades. With the Breakthrough program, the country hopes to generate almost 50 percent of electricity from nuclear power by 2050.

Because these new concepts recycle the fuel, they would reduce the volume of fuel and waste far below the already low levels in previous nuclear power plants. A plant the size of the Swedish Ringhals nuclear power plant would use only 3 tons of fuel and produce 3 tons of waste per year.17 That compares with the Jänschwalde coal plant at about 50,000 tons of fuel and waste per day! To put this in another perspective, the average American uses on the order of one gigawatt-hour of electricity in his or her lifetime. With the Breakthrough (or a similar fourth-generation) design, this lifetime supply would require one-quarter of one pound of fuel and generate the equivalent amount of waste. That’s the weight of the beef in a single hamburger for a lifetime of American-level electricity use.

The Breakthrough program is proceeding at nine coordinated research centers with strong government support. As with other fourth-generation projects elsewhere, the goals are to create inherently safe reactors with closed fuel cycles (little waste), low cost, and prevention of proliferation. The plan is for a tenfold expansion of Russian nuclear power generation by the end of the century using the new designs.

Russia has a head start on the rest of the world when it comes to these designs. It has been operating what in many ways amounts to a fourth-generation plant since 1981, producing electricity at competitive rates on the Russian grid. The BN-600 reactor, in central Russia, is living proof that these technologies can work commercially in the real world, not just in theory. Its bigger sister, the BN-800, another fourth-generation reactor, has recently entered commercial operation and is supplying the Russian electric grid. These designs will culminate in a larger reactor, the BN-1200, planned for construction at several sites in the next twenty years. The head of Rosatom said in 2017 of the Breakthrough technology that “today we are leading in this field. It’s necessary to make this leadership absolute and to deprive our competitors of their hopes of overcoming the gap in the technological race.” (Listen up, US government.)

Figure 49. Russia’s four-reactor Beloyarsk power plant includes the BN-600 and new BN-800. Photo: Rosenergoatom.ru.

Russia’s first small floating nuclear power plant is scheduled to start producing in 2019 in the remote Northeast of Siberia. This ship and one coming soon in China have the mission of providing heat and electricity in remote areas. But a more significant use of floating power plants, in theory, is for export to any number of coastal locations in the world—and most of the world’s big cities are coastal—to sit offshore and supply competitive CO2-free electricity. The floating plant reduces problems with siting, as land tends to be expensive near big cities and populations may have “Not in my back yard” attitudes. When the plant is ready to decommission, it can be towed back to its home country. The American fourth-generation company ThorCon has a similar concept, as does a group at MIT (both mentioned in Chapter 12), but the Russians are closer to realizing the concept with a more conventional light-water reactor similar to those already used in their nuclear icebreaker fleet.

In recent years, Russia has seemed to show indecision about its energy future. It has a lot of cheap methane, which could supply electricity. (Russia is also expanding its hydropower, which currently supplies a bit less than 20 percent of electricity.) But the methane can make more money being exported to Europe than generating electricity at home. If Russia succeeds in sharply increasing its nuclear power capacity, it could export much more gas to Germany, which could use it to replace coal. This would moderate the negative climate effects of Germany’s decision to phase out nuclear power. Such gas exports, however, are currently tangled in sanctions and geopolitics because of the war in Ukraine.

If Russia mastered commercialization and mass production of fourth-generation Breakthrough technology ahead of the rest of the world, it could significantly and quickly expand the world’s clean electricity supply. This would transform Russia’s role in the world climate picture from part of the problem (massive fossil-fuel producer and exporter) to part of the solution.

India

India expects, and deserves, large and rapid increases in its electricity use in the coming few decades. Currently, it meets this growing demand primarily with coal and is the second largest consumer of coal in the world, albeit far smaller than China. Far from phasing out coal, India continues to increase coal-fired generation capacity, although at a slowing rate.18 India’s large, ambitious, and well-publicized foray into solar power, though laudable, will at best slow the growth of coal power.19 Something else is needed if India is to phase out coal and meet its growing demand without large CO2 emissions. It is hard to see what else that “something” could be if not nuclear power.

India is an unusual case when it comes to nuclear power. It did not sign the Non-Proliferation Treaty in 1970, and it set off nuclear weapons test explosions in 1974 and 1998. India’s arsenal of nuclear weapons is estimated at about 125 warheads.20 Because of its status outside the NPT, India was subject to international restrictions during most of the time its civilian nuclear power industry was developing. After 2008 the international community came to terms with India’s nuclear weapons status and began making deals for nuclear fuel and technology trade with India, under specific arrangements for IAEA safeguards. The plutonium India uses for weapons comes from plutonium production reactors that do not produce commercial electricity and are not under IAEA supervision.

Since the 1950s, India has pursued a three-stage nuclear power program: first, set up Pressurized Heavy Water Reactors (PHWRs); later build a series of fast breeder reactors that use a mix of uranium and plutonium as fuel; and, eventually, create a fleet of thorium-fuel-based reactors regenerating most of their fuel with the fissile material produced in the fast reactors. India’s long-term target of developing thorium-fueled reactors reflects the fact that the country has little uranium but plenty of thorium, which can change into fissile uranium in a reactor.

The unusual choice of PHWRs for the first stage of nuclear power expansion is primarily due to international restrictions on enriched uranium.21 The first and second stages of the nuclear power expansion program are technically in operation, but at a surprisingly small scale. In 2018 India was putting into operation the 500 MW “Prototype Fast Breeder Reactor,” which is its commercial prototype plant for fourth-generation fast-reactor technology that makes up the second stage of the program. If India is to decarbonize, it is imperative that the enormous efforts put into the PFBR are followed up by commercial fast-reactor units in the near future.

These aspects of Indian nuclear power put it on a self-sufficient path but one that does not mesh very well with the rest of the world. India plans to build new nuclear power plants but not very many of them, and it plans to import some plants but not very many of those, either. This would keep the Indian economy firmly in the fossil-fuel camp for decades to come—decades of anticipated rapid growth of electricity demand for a huge population.

A viable route for India to decarbonize is to accelerate its build-out of available reactor technology (PHWRs and, if it is able to source them from the international market, light-water reactors). In 2018 India took a big step in this direction by signing an agreement to build six EPR reactors totaling 10 GW.22 India can also move toward commercialization of its indigenous advanced-reactor research programs. Essentially, it would follow its three-stage program but on a vastly larger scale and faster timeline. India also has much work to do in modernizing its electric grid. On the positive side, the country has tremendous technology assets, especially in “human capital” (an educated workforce), and a great deal of experience in the nuclear field. India may find its own way to put together its unique capabilities to create a climate-friendly development path.