Figure 1, which covers the two decades from 1914 to 1933, shows the magnitude of the contraction in the perspective of a longer period. Money income declined by 15 per cent from 1929 to 1930, 20 per cent the next year, and 27 per cent in the next, and then by a further 5 per cent from 1932 to 1933, even though the cyclical trough is dated in March 1933. The rapid decline in prices made the declines in real income considerably smaller but, even so, real income fell by 11 per cent, 9 per cent, 18 per cent, and 3 per cent in the four successive years. These are extraordinary declines for individual years, let alone for four years in succession. All told, money income fell 53 per cent and real income 36 per cent, or at continuous annual rates of 19 per cent and 11 per cent, respectively, over the four-year period.

Already by 1931, money income was lower than it had been in any year since 1917 and, by 1933, real income was a trifle below the level it had reached in 1916, though in the interim population had grown by 23 per cent. Per capita real income in 1933 was almost the same as in the depression year of 1908, a quarter of a century earlier. Four years of contraction had temporarily erased the gains of two decades, not, of course, by erasing the advances of technology, but by idling men and machines. At the trough of the depression one person was unemployed for every three employed.

In terms of annual averages—to render the figures comparable with the annual income estimates—the money stock fell at a decidedly lower rate than money income—by 2 per cent, 7 per cent, 17 per cent, and 12 per cent in the four years from 1929 to 1933, a total of 33 per cent, or at a continuous annual rate of 10 per cent. As a result, velocity fell by nearly one-third. As we have seen, this is the usual qualitative relation: velocity tends to rise during the expansion phase of a cycle and to fall during the contraction phase. In general, the magnitude of the movement in velocity varies directly with the magnitude of the corresponding movement in income and in money. For example, the sharp decline in velocity from 1929 to 1933 was roughly matched in the opposite direction by the sharp rise during World War I, which accompanied the rapid rise in the stock of money and in money income; and, in the same direction, by the sharp fall thereafter accompanying the decline in money income and in the stock of money after 1920. On the other hand, in mild cycles, the movement of velocity is also mild.3 In 1929–33, the decline in velocity, though decidedly larger than in most mild cycles, was not as much larger as might have been expected from the severity of the decline in income. The reason was that the accompanying bank failures greatly reduced the attractiveness of deposits as a form of holding wealth and so induced the public to hold less money relative to income than it otherwise would have held (see section 3, below). Even so, had a decline in the stock of money been avoided, velocity also would probably have declined less and thus would have reinforced money in moderating the decline in income.

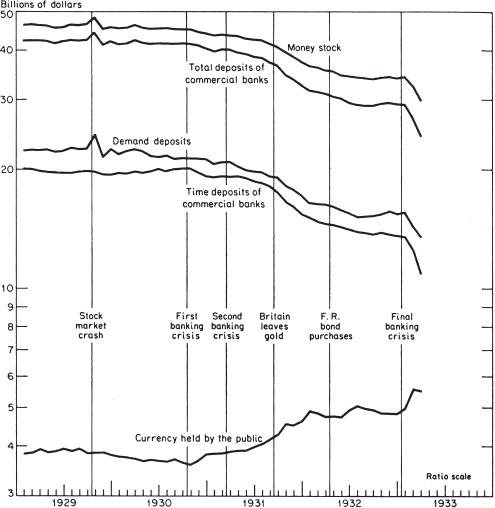

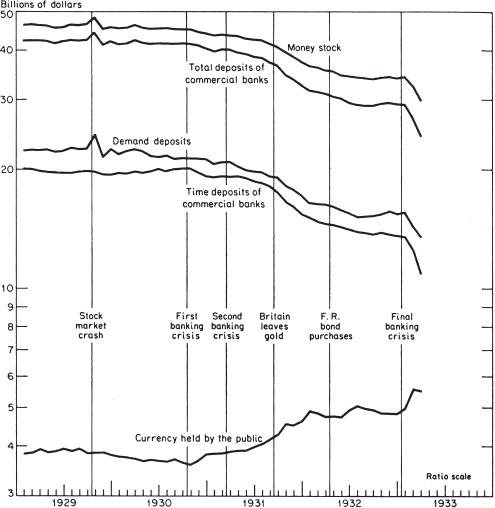

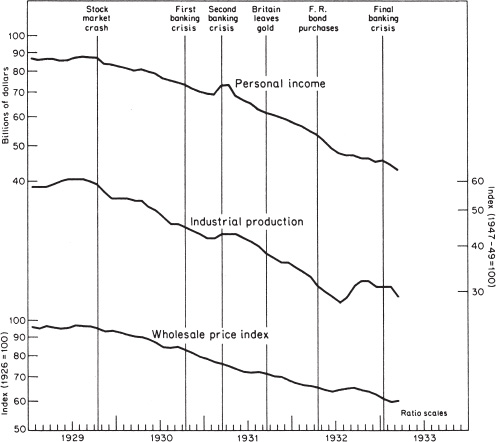

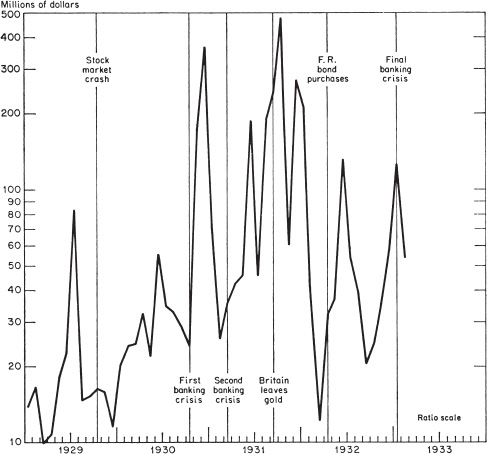

For a closer look at the course of events during these traumatic years, we shift from annual to monthly figures. Figure 2 reproduces on an expanded time scale for 1929 through March 1933 the stock of money, as plotted on Figure 1, and adds series on deposits and currency. Figure 3 reproduces the series on industrial production and wholesale prices, and adds a series on personal income. Figure 4 plots a number of interest rates—of special importance because of the crucial role played during the contraction by changes in financial markets—and also Standard and Poor’s index of common stock prices and the discount rates of the Federal Reserve Bank of New York.

FIGURE 2

Money Stock, Currency, and Commercial Bank Deposits, Monthly, 1929–March 1933

SOURCE: Table A-1.

FIGURE 3

Prices, Personal Income, and Industrial Production, Monthly, 1929–March 1933

SOURCE: Industrial production, same as for Figure 1. Wholesale price index, same as for Chart 62. Personal income, Business Cycle Indicators (Princeton for NBER, G. H. Moore, ed., 1961), Vol. II, p. 139.

It is clear that the course of the contraction was far from uniform. The vertical lines mark off segments into which we have divided the period for further discussion. Although the dividing lines chosen designate monetary events—the focus of our special interest—Figures 3 and 4 demonstrate that the resulting chronology serves about equally well to demarcate distinctive behavior of the other economic magnitudes.

FIGURE 4

Common Stock Prices, Interest Yields, and Discount Rates of Federal Reserve Bank of New York, Monthly, 1929–March 1933

SOURCE: Common stock price index, Standard and Poor’s, as published in Common-Stock Indexes, 1871–1937 (Cowles Commission for Research in Economics, Bloomington, Ind., Principia Press, 1938), p. 67. Discount rates, Banking and Monetary Statistics, p. 441. Other data, same as for Chart 35.

The first date marked is October 1929, the month in which the bull market crashed. Though stock prices had reached their peak on September 7, when Standard and Poor’s composite price index of 90 common stocks stood at 254, the decline in the following four weeks was orderly and produced no panic. In fact, after falling to 228 on October 4, the index rose to 245 on October 10. The decline thereafter degenerated into a panic on October 23. The next day, blocks of securities were dumped on the market and nearly 13 million shares were traded. On October 29, when the index fell to 162, nearly 16½ million shares were traded, compared to the daily average during September of little more than 4 million shares.4 The stock market crash is reflected in the sharp wiggle in the money series, entirely a result of a corresponding wiggle in demand deposits, which, in turn, reflects primarily an increase in loans to brokers and dealers in securities by New York City banks in response to a drastic reduction of those loans by others.5 The adjustment was orderly, thanks largely to prompt and effective action by the New York Federal Reserve Bank in providing additional reserves to the New York banks through open market purchases (see section 2, below). In particular, the crash left no mark on currency held by the public. Its direct financial effect was confined to the stock market and did not arouse any distrust of banks by their depositors.

The stock market crash coincided with a stepping up of the rate of economic decline. During the two months from the cyclical peak in August 1929 to the crash, production, wholesale prices, and personal income fell at annual rates of 20 per cent, 7 ½ per cent, and 5 per cent, respectively. In the next twelve months, all three series fell at appreciably higher rates: 27 per cent, 13 ½ per cent, and 17 per cent, respectively. All told, by October 1930, production had fallen 26 per cent, prices, 14 per cent, and personal income, 16 per cent. The trend of the money stock changed from horizontal to mildly downward. Interest rates, generally rising until October 1929, began to fall. Even if the contraction had come to an end in late 1930 or early 1931, as it might have done in the absence of the monetary collapse that was to ensue, it would have ranked as one of the more severe contractions on record.

Partly, no doubt, the stock market crash was a symptom of the underlying forces making for a severe contraction in economic activity. But partly also, its occurrence must have helped to deepen the contraction. It changed the atmosphere within which businessmen and others were making their plans, and spread uncertainty where dazzling hopes of a new era had prevailed. It is commonly believed that it reduced the willingness of both consumers and business enterprises to spend;6 or, more precisely, that it decreased the amount they desired to spend on goods and services at any given levels of interest rates, prices, and income, which has, as its counterpart, that it increased the amount they wanted to add to their money balances. Such effects on desired flows were presumably accompanied by a corresponding effect on desired balance sheets, namely, a shift away from stocks and toward bonds, away from securities of all kinds and toward money holdings.

The sharp decline in velocity—by 13 per cent from 1929 to 1930—and the turnaround in interest rates are consistent with this interpretation though by no means conclusive, since both declines represent fairly typical cyclical reactions. We have seen that velocity usually declines during contraction, and the more so, the sharper the contraction. For example, velocity declined by 10 per cent from 1907 to 1908, by 13 per cent from 1913 to 1914, and by 15 per cent from 1920 to 1921—though it should be noted that the banking panic in 1907, the outbreak of war in 1914, and the commodity price collapse in 1920 may well have had the same kind of effect on the demand for money as the stock market crash in 1929 had. In contraction years that were both milder and unmarked by such events—1910–11, 1923–24, and 1926–27—velocity declined by only 4 to 5 per cent. It seems likely that at least part of the much sharper declines in velocity in the other years was a consequence of the special events listed, rather than simply a reflection of unusually sharp declines in money income produced by other forces. If so, the stock market crash made the decline in income sharper than it otherwise would have been. Certainly, the coincidence in timing of the stock market crash and of the change in the severity of the contraction supports that view.

Whatever its magnitude, the downward pressure on income produced by the effects of the stock market crash on expectations and willingness to spend—effects that can all be summarized in an independent decline in velocity—was strongly reinforced by the behavior of the stock of money. Compared to the collapse in the next two years, the decline in the stock of money up to October 1930 seems mild. Viewed in a longer perspective, it was sizable indeed. From the cyclical peak in August 1929—to avoid the sharp wiggle in the stock of money produced by the immediate effects of the stock market crash—the money stock declined 2.6 per cent to October 1930, a larger decline than during the whole of all but four preceding reference cycle contractions—1873–79, 1893–94,7 1907–08, and 1920–21—and all the exceptions are contractions that were extraordinarily severe by other indications as well. The decline was also larger than in all succeeding reference cycle contractions, though only slightly larger than in 1937–38, the only later contraction comparable in severity to the earlier ones listed.

The decline in the stock of money is especially notable because it took place in a monetary and banking environment that was in other respects free of marked difficulties. There was no sign of any distrust of banks on the part of depositors, or of fear of such distrust on the part of banks. As Figure 2 shows, currency held by the public declined by a larger percentage than deposits—8 per cent compared with 2 per cent—though the reverse relation had been an invariable accompaniment of earlier banking crises. Similarly, the banks made no special effort to strengthen their own liquidity position. Excess reserves—for which no estimates are available before 1929—remained negligible. As we shall see in more detail in the next section, the decline in the stock of money up to October 1930 reflected entirely a decline in Federal Reserve credit outstanding which more than offset a rise in the gold stock and a slight shift by the public from currency to deposits.

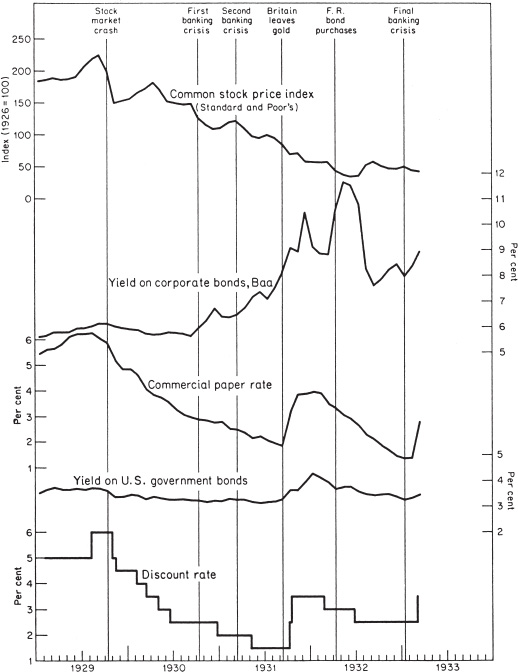

In October 1930, the monetary character of the contraction changed dramatically—a change reflected in Figure 5 by the extraordinary rise in the deposits of suspended banks. Before October 1930, deposits of suspended banks had been somewhat higher than during most of 1929 but not out of line with experience during the preceding decade. In November 1930, they were more than double the highest value recorded since the start of monthly data in 1921. A crop of bank failures, particularly in Missouri, Indiana, Illinois, Iowa, Arkansas, and North Carolina, led to widespread attempts to convert demand and time deposits into currency, and also, to a much lesser extent, into postal savings deposits.8 A contagion of fear spread among depositors, starting from the agricultural areas, which had experienced the heaviest impact of bank failures in the twenties. But such contagion knows no geographical limits. The failure of 256 banks with $180 million of deposits in November 1930 was followed by the failure of 352 with over $370 million of deposits in December (all figures seasonally unadjusted), the most dramatic being the failure on December 11 of the Bank of United States with over $200 million of deposits.9 That failure was of especial importance. The Bank of United States was the largest commercial bank, as measured by volume of deposits, ever to have failed up to that time in U.S. history. Moreover, though an ordinary commercial bank, its name had led many at home and abroad to regard it somehow as an official bank, hence its failure constituted more of a blow to confidence than would have been administered by the fall of a bank with a less distinctive name. In addition, it was a member of the Federal Reserve System. The withdrawal of support by the Clearing House banks from the concerted measures sponsored by the Federal Reserve Bank of New York to save the bank—measures of a kind the banking community had often taken in similar circumstances in the past—was a serious blow to the System’s prestige (see section 3, below).

The change in the character of the contraction is reflected clearly in Figure 2. Currency held by the public stopped declining and started to rise, so that deposits and currency began to move in opposite directions, as in earlier banking crises. Banks reacted as they always had under such circumstances, each seeking to strengthen its own liquidity position. Despite the withdrawal of deposits, which worked to deplete reserves, there was a small increase in seasonally adjusted reserves, so the ratio of deposits to bank reserves declined sharply from October 1930 to January 1931.

We have already expressed the view (pp. 167–168) that under the pre–Federal Reserve banking system, the final months of 1930 would probably have seen a restriction, of the kind that occurred in 1907, of convertibility of deposits into currency. By cutting the vicious circle set in train by the search for liquidity, restriction would almost certainly have prevented the subsequent waves of bank failures that were destined to come in 1931, 1932, and 1933, just as restriction in 1893 and 1907 had quickly ended bank suspensions arising primarily from lack of liquidity. Indeed, under such circumstances, the Bank of United States itself might have been able to reopen, as the Knickerbocker Trust Company did in 1908. After all, the Bank of United States ultimately paid off 83.5 per cent of its adjusted liabilities at its closing on December 11, 1930, despite its having to liquidate so large a fraction of its assets during the extraordinarily difficult financial conditions that prevailed during the next two years.10

FIGURE 5 Deposits of Suspended Commercial Banks, Monthly, 1929–February 1933

SOURCE: Data from Federal Reserve Bulletin, Sept. 1937, p. 909, were adjusted for seasonal variations by the monthly mean method, applied 1921–33.

As it was, the existence of the Reserve System prevented concerted restriction, both directly and indirectly: directly, by reducing the concern of stronger banks, which had in the past typically taken the lead in such a concerted move, since the System provided them with an escape mechanism in the form of discounting; and indirectly, by supporting the general assumption that such a move was made unnecessary by the establishment of the System. The private moves taken to shore up the banking system were therefore extremely limited.11 The result was that the episode, instead of being the climactic phase of the banking difficulties, was only the first of a series of liquidity crises that was to characterize the rest of the contraction and was not to terminate until the banking holiday of March 1933.

The initial crisis did not last long. Bank failures declined sharply in early 1931, and the banks’ scramble for liquidity came to a halt. There was a marked rise in the ratio of deposits to reserves from January 1931 to March 1931, the terminal month of the segment we have been discussing and the month of the onset of the second banking crisis. In January and February, the public slackened its demand for additional currency; demand and time deposits, after declining in January, rose a trifle in February and held nearly constant in March.

Interest rates show clearly the effects of the banking crisis. Until September 1930, the month before the first banking crisis, both long- and short-term interest rates had been declining, and so had the yields on corporate Baa bonds. Synchronous with the first crisis, a widening differential began to emerge between yields on lower-grade corporate bonds and on government bonds. The yields on corporate bonds rose sharply, the yields on government bonds continued to fall. The reason is clear. In their search for liquidity, banks and others were inclined first to dispose of their lower-grade bonds; the very desire for liquidity made government bonds ever more desirable as secondary reserves; hence the yield on lower-grade securities rose, which is to say, their prices fell, while the yields on government bonds fell. The decline in bond prices itself contributed, as we shall see in more detail later, to the subsequent banking crises. It made banks more fearful of holding bonds and so fostered declines in prices. By reducing the market value of the bond portfolios of banks, declines in bond prices in turn reduced the margin of capital as evaluated by bank examiners, and in this way contributed to subsequent bank failures.12 The end of the first banking crisis was registered in a sharp improvement in the bond market after the turn of the year; the onset of the next crisis, in renewed deterioration.

The onset of the first liquidity crisis left no clear imprint on the broad economic series shown in Figure 3. However, after the turn of the year, there were signs of improvement in those indicators of economic activity—no doubt partly cause and partly effect of the contemporaneous minor improvement in the monetary area. Industrial production rose from January to April. Factory employment, seasonally adjusted, which had fallen uninterruptedly since August 1929, continued to fall but at a much reduced rate: in all but one month from August 1929 to February 1931, the decline was equal to or greater than the total decline in the three months from February to May 1931. Other indicators of physical activity tell a similar story. Personal income rose sharply, by 6 per cent from February to April 1931, but this is a misleading index since the rise was produced largely by government distributions to veterans.13 All in all, the figures for the first four or five months of 1931, if examined without reference to what actually followed, have many of the earmarks of the bottom of a cycle and the beginning of revival.

Perhaps if those tentative stirrings of revival had been reinforced by a vigorous expansion in the stock of money, they could have been converted into sustained recovery. But that was not to be. The effects of returning confidence on the part of the public and the banks, which made for monetary expansion by raising the ratios of deposits to currency and to reserves, were largely offset by a reduction in Federal Reserve credit outstanding (see section 5, below). Consequently, the total stock of money was less than 1 per cent higher in March than in January 1931, and lower in March than it had been in December 1930. In March, a second banking crisis started a renewed decline in the stock of money and at an accelerated rate. A month or two later, a renewed decline started in economic activity in general, and the hope of revival that season was ended.

As Figure 5 shows, deposits of suspended banks began to rise in March, reaching a high point in June. From March on, the public resumed converting deposits into currency, and from April on, banks started strengthening their reserve position, liquidating available assets in order to meet both the public’s demand for currency and their own desire for liquidity. Excess reserves, which in January 1931 had for the first time since 1929, when data become available, reached the $100 million level and had then declined as confidence was restored, again rose, reaching a level of $125–$130 million in June and July.14 Once bitten, twice shy, both depositors and bankers were bound to react more vigorously to any new eruption of bank failures or banking difficulties than they did in the final months of 1930.

Events abroad still further intensified the financial weakness—a feedback effect, since the events were themselves largely a response to the prior severe economic and monetary decline in the United States which reduced markets for both goods and services and for foreign securities. The failure in May 1931 of the Kreditanstalt, Austria’s largest private bank, had repercussions that spread throughout the continent. It was followed by the closing of banks in Germany on July 14 and 15, as well as in other countries, and the freezing of British short-term assets in Germany. A one-year intergovernmental debt moratorium, and a “standstill agreement” among commercial banks not to press for repayment of short-term international credits, both proposed by President Hoover and agreed to in July,15 gave the countries involved only temporary relief, as did strict control of foreign exchanges by Germany and borrowing by Britain in France and the United States.

These events had mixed effects on the monetary situation in the United States. On the one hand, they stimulated a flight of capital to the United States, which added to the already swollen gold stock. On the other hand, U.S. commercial banks held a large amount of short-term obligations of foreign banks which were now frozen. Furthermore, financial panic is no respecter of national frontiers. The failure of world-famous financial institutions and the widespread closing of banks in a great country could not but render depositors throughout the world uneasy and enhance the desire of bankers everywhere to strengthen their positions.

The downward pressure on the money stock arising from attempts by depositors to convert deposits into currency and by banks to add to their reserves relative to their liabilities was offset to some extent by the gold inflow from abroad. But this was the only offset. Federal Reserve credit outstanding showed only its usual seasonal movements, though minor open market purchases were undertaken, June–August, to ease the market (see section 5, below). In all, from February to mid-August, there was no net change in Federal Reserve credit outstanding, despite an unprecedented liquidation of the commercial banking system.

The result was that the second banking crisis had far more severe effects on the stock of money than the first. In the six months from February to August 1931, commercial bank deposits fell by $2.7 billion or nearly 7 per cent, more than in the whole eighteen-month period from the cyclical peak in August 1929 to February 1931. In the seven months from February to September 1931, commercial bank deposits fell by 9 per cent, one percentage point more than the maximum decline in deposits during the whole of the 1920–21 contraction. Currency in the hands of the public increased, absorbing the increase in gold and the decline in reserves, so that the total stock of money fell by a smaller percentage than deposits did. Even so, it fell by nearly 5 ½ per cent from February to August 1931, or at a rate of 11 per cent per year.

The effects of the banking crisis on interest rates show up clearly in the renewed and far more drastic rise in yields on lower-grade corporate bonds, as banks sought to realize on their portfolios and in the process forced bond prices ever lower. By that time, too, the economic contraction had seriously impaired the earning power of many concerns and sharply raised the chances of default. Yields on long-term government bonds continued to fall and reached extraordinarily low levels in mid-1931; so the yield differential rose as a result of a movement in both low- and high-grade securities. One reason, already cited, was that the very desire for liquidity served to enhance the value of government securities. Another was that those securities could be used as collateral for loans from Federal Reserve Banks, hence the decline in Federal Reserve discount rates served to make them more attractive as a secondary reserve. Yields on commercial paper also fell, keeping nearly a stable relation to discount rates.

The climax of the foreign difficulties came on September 21, when, after runs on sterling precipitated by France and the Netherlands, Britain abandoned the gold standard.16 Anticipating similar action on the part of the United States, central banks and private holders in a number of countries—notably France, Belgium, Switzerland, Sweden, and the Netherlands—converted substantial amounts of their dollar assets in the New York money market to gold between September 16 and October 28. Because of the low level of money-market interest rates in the United States, foreign central banks had for some time been selling dollar bankers’ acceptances previously purchased for their accounts by the New York Reserve Bank, the proceeds of which were credited to their dollar bank deposits. From the week of September 16, the unloading of the bills onto the Federal Reserve assumed panic proportions. Foreign central banks drew down their deposits to increase earmarkings of gold, much of which was exported during the following six weeks. From September 16 to September 30, the gold stock declined by $275 million, from then to the end of October by an additional $450 million. Those losses about offset the net influx during the preceding two years and brought the gold stock back roughly to its average level during 1929.

The onset of the external drain was preceded and accompanied by an intensification of the internal drain on the banking system. In August, deposits of suspended banks rose to a level that had been exceeded only in the month of December 1930, and in September rose higher yet. In those two months alone, banks with deposits of $414 million, or more than 1 per cent of the by-then shrunken total of commercial bank deposits, closed their doors. The outflow of gold in September added to the pressure on bank reserves. Currency was being withdrawn internally by depositors justifiably fearful for the safety of banks, and gold was being withdrawn externally by foreigners fearful for the maintenance of the gold standard. The combination of an external drain and an internal drain, and particularly their joint occurrence in the autumn when the demand for currency was in any event at its seasonal peak, was precisely the set of circumstances that in pre–Federal Reserve days would have produced restriction of convertibility of deposits into currency. If the pre–Federal Reserve banking system had been in effect, all other events had been as they were, and restriction of payments by banks had not taken place in December 1930, restriction almost certainly would have occurred in September 1931 and very likely would have prevented at least the subsequent bank failures.17

The Federal Reserve System reacted vigorously and promptly to the external drain, as it had not to the previous internal drain. On October 9, the Reserve Bank of New York raised its rediscount rate to 2½ per cent and on October 16, to 3½ per cent—the sharpest rise within so brief a period in the whole history of the System, before or since. The move was followed by a cessation of the external drain in the next two weeks. The gold stock reached its trough at the end of October, and thereafter rose until a renewed gold drain began at the end of December. But the move also intensified internal financial difficulties and was accompanied by a spectacular increase in bank failures and in runs on banks. In October alone, 522 commercial banks with $471 million of deposits closed their doors, and in the next three months, 875 additional banks with $564 million of deposits. All told, in the six months from August 1931 through January 1932, 1,860 banks with deposits of $1,449 million suspended operations,18 and the deposits of those banks that managed to keep afloat fell by a much larger sum. Total deposits fell over the six-month period by nearly five times the deposits in suspended banks or by no less than 17 per cent of the initial level of deposits in operating banks.

The rise in currency offset some of the effect on the money stock of the decline in deposits. But the offset was minor. The money stock fell by 12 per cent from August 1931 to January 1932, or at the annual rate of 31 per cent—a rate of decline larger by far than for any other comparable span in the 53 years for which we have monthly data,19 and in the whole 93-year period for which we have a continuous series on the money stock.

Why should the gold drain and the subsequent rise in discount rates have intensified the domestic financial difficulties so greatly? They would not have done so, if they had been accompanied by extensive open market purchases designed to offset the effect of the external gold drain on high-powered money, and of the internal currency drain on bank reserves. Unfortunately, purchases were not made. The Reserve System’s holdings of government securities were actually reduced by $15 million in the six-week period from mid-September to the end of October, and then kept unchanged until mid-December. Though the System raised bill buying rates along with discount rates, it did buy some $500 million additional bills in the crucial six-week period. However, that amount was inadequate to offset even the outflow of gold, let alone the internal drain. The result was that the banks found their reserves being drained from two directions—by export of gold and by internal demands for currency. They had only two recourses: to borrow from the Reserve System and to dump their assets on the market. They did both, though neither was a satisfactory solution.

Discounts rose to a level not reached since 1929, despite the rise in discount rates. The situation and its effects are well described in a memorandum prepared for a meeting of the Open Market Policy Conference in February 1932. The conditions it described were still much the same as those that had prevailed in October 1931.

… The weight of these discounts is falling most heavily on banks outside the principal centers. In fact, the discounts of these groups of banks are considerably larger than they were in 1929 when the reserve system was exerting the maximum of pressure for deflation. The present amount of member bank borrowing has always proved deflationary, except perhaps during the war, and with the present sensitive psychology, an interruption to deflation seems unlikely as long as the weight of discounts is as heavy as at present.20

The aversion to borrowing by banks, which the Reserve System had tried to strengthen during the twenties, was still greater at a time when depositors were fearful for the safety of every bank and were scrutinizing balance sheets with great care to see which banks were likely to be the next to go. This is the context of the “sensitive psychology” to which the quotation refers.

The effect of the attempt to realize on assets is vividly displayed in Figure 4. For the first time, yields on long-term government bonds and on commercial paper rose sharply along with the yields on lower-grade corporate securities. Those rises in yields clearly did not reflect the effect of the depression on corporate earnings; they reflected the liquidity crisis and the unwillingness or inability of banks to borrow even more heavily from the Reserve System. There was some discussion at the time, and even more later, attributing the decline in the price of government bonds to the federal deficit (under $0.5 billion in fiscal 1931; $2.5 billion in fiscal 1932), and to the fear of “irresponsible” legislation, but it is hard to believe that those factors had much effect in comparison with the extremely heavy pressure on banks to liquidate their assets. Certainly, the rise in the commercial-paper rate reflected both in timing and amount primarily the movements in the discount rate.

Again, we may draw on a preliminary memorandum for an Open Market Policy Conference, this time in January 1932.

Within a period of a few months United States Government bonds have declined 10 per cent; high grade corporation bonds have declined 20 per cent; and lower grade bonds have shown even larger price declines. Declines of such proportions inevitably have increased greatly the difficulties of many banks, and it has now become apparent that the efforts of individual institutions to strengthen their position have seriously weakened the banking position in general.21

Some measures were attempted or proposed for the relief of banking difficulties, for example, measures sponsored by the New York Reserve Bank to encourage a more liberal evaluation of bank assets, to reduce the pressure on railroad bond prices, and to accelerate the liquidation of deposits in closed banks.22 These were palliatives that would have had little effect, even if they had been fully carried out. More far-reaching proposals came from outside the Reserve System. At the urging of President Hoover, and with only the reluctant cooperation of the banking community, a private National Credit Corporation was created in October 1931 to extend loans to individual banks, associated together in cooperatives in each Federal Reserve district, against security collateral not ordinarily acceptable and against the joint guarantee of the members of the cooperative. The Corporation’s loans were, however, limited. In Hoover’s words, “After a few weeks of enterprising courage … [it] became ultraconservative, then fearful, and finally died. It had not exerted anything like its full possible strength. Its members—and the business world—threw up their hands and asked for governmental action.”23 These arrangements were explicitly patterned after those in the temporary Aldrich-Vreeland Act, which had worked so well in 1914, the one occasion when they were used. On Hoover’s recommendation, the Reconstruction Finance Corporation was established in January 1932, with authority to make loans to banks and other financial institutions, as well as to railroads, many of which were in danger of default on their bonded indebtedness.24 The epidemic of bank failures ended at about the same time as the establishment of the RFC, though the two developments may have been unrelated. In any event, during the rest of 1932, RFC loans to banks totaled $0.9 billion, and deposits of banks that suspended fluctuated about the level of mid-1930.

The Glass-Steagall Act, passed on February 27, 1932, which had its origins in the Treasury and the White House, was mainly designed to broaden the collateral the Reserve System could hold against Federal Reserve notes, by permitting government bonds as well as eligible paper to serve as collateral.25 But it also included provisions designed to help individual banks by widening the circumstances under which they could borrow from the System.26

In May 1932, a bill to provide federal insurance of deposits in banks was passed by the House of Representatives. It was referred to a subcommittee of the Senate Banking and Currency Committee, of which Carter Glass was chairman, but was never reported out.27 He had opposed a similar provision at the time of the passage of the original Federal Reserve Act.28 Glass believed that the solution was reform of the practices of commercial banks and introduced several bills to that end.29 None received the support of the administration or of the Reserve System, and none was passed.30

In July 1932, the Federal Home Loan Bank Act was passed in another attempt to cope with the problem of frozen assets—specifically of home financing institutions (i.e., savings and loan associations, savings banks, insurance companies). The act provided for the organization of federal home loan banks to make advances to those institutions on the security of first mortgages they held.

The broader economic indicators in Figure 3 show little effect of the financial developments that followed Britain’s departure from gold. Rather, they show a continuous decline from the onset of the second banking crisis in March 1931 right on through mid-1932. If anything, there is some stepping up of the rate of decline, but any acceleration is less notable than the high rate of decline throughout: an annual rate of 31 per cent for personal income, of 14 per cent for wholesale prices, and of 32 per cent for production.

The severity of the depression stimulated many remedial efforts, governmental and nongovernmental, outside the monetary area. A nationwide drive to aid private relief agencies was organized in the fall of 1931 by a committee of seventy, appointed by Hoover and named the President’s Unemployment Relief Organization. The unemployed in many states formed self-help and barter organizations, with their own systems of scrip. Hoover expanded federal expenditures on public works, but was concerned about incurring deficits for such a purpose. A committee of twelve, representing the public, industry, and labor, appointed by him in September 1931, opposed a construction program financed by public funds. In Congress, however, there was growing support for increased government expenditures and for monetary expansion, proposals widely castigated by the business and financial community as “greenbackism” and “inflationary.” On its part, the business and financial community, and many outside it, regarded federal deficits as a major source of difficulty. Pressure to balance the budget finally resulted in the enactment of a substantial tax rise in June 1932. The strength of that sentiment, which, in light of present-day views, seems hard to credit, is demonstrated by the fact that in the Presidential campaign of 1932, both candidates ran on platforms of financial orthodoxy, promising to balance the federal budget.

In April 1932, under heavy Congressional pressure (see section 5, below), the System embarked on large-scale open market purchases which raised its security holdings by roughly $1 billion by early August. Ninety-five per cent of the purchases were made before the end of June, and no net purchases were made after August 10. The System’s holdings then remained almost exactly constant until after the turn of the year when they were reduced in the usual seasonal pattern. Initially, the purchases served mostly to offset a renewed gold outflow but, after June, they were reinforced by a mild gold inflow. From the time the purchases ended until the end of the year, a continued and stronger gold inflow served in their stead to keep high-powered money rising.

The provision of additional reserves reinforced the effect of the tapering off of bank failures in January and February 1932, referred to above, which was accompanied by a return of currency from circulation from February to May. In the absence of the bond purchases, it is possible that the renewed flurry of bank failures in mid-1932, consisting partly of a wave of over 40 failures in Chicago in June, before the RFC granted a loan to a leading Chicago bank, would have degenerated into a major crisis. As it was, bank failures again subsided, so that the rise in the public’s currency holdings from May to July was again followed by a decline.

The combination of the more favorable banking situation and of the bond-purchase program is clearly reflected in the behavior of the stock of money. As Figure 2 shows, the decline in both bank deposits and the stock of money moderated. Demand deposits reached a trough in July, total deposits and the money stock, in September; the following rise was mild. In absolute terms, the changes in the stock of money were small; by comparison with the prior sharp declines, the shift was major.

The effect of the purchase program is even clearer in Figure 4, which shows interest rates. In the first quarter of 1932 the rates had fallen from the peaks reached in December 1931 or January 1932. In the second quarter, however, the corporate Baa bond yield soared to a peak (11.63 per cent in May)—unmatched in the monthly record since 1919—and the yield on long-term government bonds rose slightly. Commercial paper rates continued to decline in the second quarter, the reduction in the discount rate in New York on February 26 having led the commercial paper rate. After the purchase program began, a sharp fall occurred in all the rates. The reduction in the discount rate in New York on June 24 again led the commercial paper rate and, in August, the commercial paper rate fell below the discount rate and remained there, a relation without parallel since the beginning of the Reserve System.

The reversal in the relation between the commercial paper rate and the discount rate marked a major change in the role of discounting, about which we shall have more to say in Chapter 9. Except for a spurt in connection with the 1933 banking panic, discounting was not again to be of major importance until long after the end of World War II. Banks were henceforth to seek safety through “excess” reserves, and later, through government securities whose prices were pegged, not through recourse to borrowing. That change was, of course, a major factor in keeping rates from going even lower. Throughout 1932, for example, yields on long-term government bonds were notably higher than at any time between May 1930 and September 1931.

The tapering off of the decline in the stock of money and the beginning of the purchase program were shortly followed by an equally notable change in the general economic indicators shown in Figure 3. Wholesale prices started rising in July, production in August. Personal income continued to fall but at a much reduced rate. Factory employment, railroad ton-miles, and numerous other indicators of physical activity tell a similar story. All in all, as in early 1931, the data again have many of the earmarks of a cyclical revival. Indeed, some students date the cyclical trough in 1932. Burns and Mitchell, although dating the trough in March 1933, refer to the period as an example of a “double bottom.”31

There is, of course, no way of knowing that the economic improvement reflected the monetary improvement. But it is entirely clear that the reverse was not the case. Aside from the precedence in time of the monetary improvement, the program of large-scale open market purchases was a deliberative action undertaken by the Reserve System. And it was the major factor accounting for the monetary improvement.

The timing relations, previous experience, and general considerations all make it highly plausible that the economic improvement reflected the influence of the monetary improvement, rather than the only other alternative—that it occurred shortly thereafter entirely by coincidence. We have observed that, in the past, an increase in the rate of monetary growth—in the present case, from rapid decline to mild decline and then mild rise—has invariably preceded a trough in general business. After three years of economic contraction, there must have been many forces in the economy making for revival, and it is reasonable that they could more readily come to fruition in a favorable monetary setting than in the midst of continued financial uncertainty.

As it happened, the recovery proved only temporary and was followed by a relapse. Once again, banking difficulties were a notable feature of the relapse. A renewed series of bank failures began in the last quarter of 1932, mostly in the Midwest and Far West, and there was a sharp spurt in January involving a wider area. The deposit-currency ratio fell; the stock of money ceased growing and began to fall precipitously after January 1933. Statewide bank holidays spread, increasing the demand for currency. Substitutes for currency were introduced as in earlier panics, offsetting to some extent the decline in the money stock shown in our estimates.32 The monetary difficulties were accompanied by a reversal in the movement of interest rates and by a relapse on the economic front. Physical indexes ceased rising and began to fall once again and so did prices and other indicators of business activity.

This time the availability of RFC loans did not stem the rising tide of bank failures, partly because a provision of an act passed in July 1932 was interpreted as requiring publication of the names of banks to which the RFC had made loans in the preceding month, and such publication began in August. The inclusion of a bank’s name on the list was correctly interpreted as a sign of weakness, and hence frequently led to runs on the bank. In consequence, banks were fearful of borrowing from the RFC. The damage was further increased in January 1933 when, pursuant to a House resolution, the RFC made public all loans extended before August 1932.33 When runs on individual banks in Nevada threatened to involve banks throughout the state, a state banking holiday relieving them of the necessity of meeting their obligations to creditors was declared on October 31, 1932. Iowa followed suit under similar circumstances on January 20, 1933; Louisiana declared a holiday on February 3 to aid the banks of the city of New Orleans; and Michigan, on February 14. Congress freed national banks in February from penalties for restricting or deferring withdrawals according to the terms of holidays in the states where they were located. By March 3, holidays had been declared in about half the states.34 While the holiday halted withdrawals in a given state, it increased pressure elsewhere, because the banks that had been given temporary relief withdrew funds from their correspondents in other states in order to strengthen their position. In addition, substitutes for bank money became essential, as in past restrictions of convertibility of deposits, and internal exchanges were disrupted. Currency holdings of the public rose $760 million, or about 16 per cent, in the two months from the end of 1932 to February 1933.

The main burden of the internal drain fell on New York City banks. Between February 1 and March 1, interior banks withdrew $760 million in balances they held with those banks. New York City banks reduced their holdings of government securities by $260 million during February—a measure that tightened the money market—and turned to the Reserve Bank for borrowing funds. The situation produced nervousness among the New York banks with their much intensified aversion to borrowing. At the beginning of March they still held $900 million in interbank balances.

Fear of a renewed foreign drain added to the anxiety of both the commercial banks and the Federal Reserve System. Rumors that the incoming administration would devalue—rumors that were later confirmed by the event—led to a speculative accumulation of foreign currencies by private banks and other holders of dollars and to increased earmarkings of gold. For the first time, also, the internal drain partly took the form of a specific demand for gold coin and gold certificates in place of Federal Reserve notes or other currency. Mounting panic at New York City banks on these accounts was reinforced in the first few days of March by heavy withdrawals from savings banks and demands for currency by interior banks.

The Federal Reserve System reacted to these events very much as it had in September 1931. It raised discount rates in February 1933 in reaction to the external drain, and it did not seek to counter either the external or internal drain by any extensive open market purchases. Though it increased its government security holdings in February 1933, after permitting them to decline by nearly $100 million in January, they were only $30 million higher at the time of the banking holiday than they were at the end of December 1932. Again it raised the buying rates on acceptances along with the discount rate, and again bills bought increased but by far less than the concurrent drain on bank reserves. Again, as in September and October 1931, banks were driven to discount at the higher rates and to dump securities on the market, so that interest rates on all categories of securities rose sharply (see Figure 4).

This time the situation was even more serious than in September 1931 because of all that had gone before. In addition, the panic was far more widespread. In the first few days of March, heavy drains of gold, both internal and external, reduced the New York Bank’s reserve percentage below its legal limit. On March 3, Governor Harrison informed Governor Meyer of the Federal Reserve Board that “he would not take the responsibility of running this bank with deficient reserves in the absence of legal sanction provided by the Federal Reserve Act.” With some reluctance, the Board suspended reserve requirements for thirty days.35

The System itself shared in the panic that prevailed in New York. Harrison was eager for a bank holiday, regarding suspension of reserve requirements as an inadequate solution and, on the morning of March 3, recommended a nationwide holiday to Secretary of the Treasury Mills and Governor Meyer. Despite much discussion between New York and Washington, by evening the declaration of a national holiday was ruled out. Harrison then joined the New York Clearing House banks and the State Superintendent of Banks in requesting New York’s Governor Lehman to declare a state banking holiday.36 Lehman did so, effective March 4. Similar action was taken by the governors of Illinois, Massachusetts, New Jersey, and Pennsylvania. On March 4, the Federal Reserve Banks remained closed as did all the leading exchanges. The central banking system, set up primarily to render impossible the restriction of payments by commercial banks, itself joined the commercial banks in a more widespread, complete, and economically disturbing restriction of payments than had ever been experienced in the history of the country. One can certainly sympathize with Hoover’s comment about that episode: “I concluded [the Reserve Board] was indeed a weak reed for a nation to lean on in time of trouble.”37

A nationwide banking holiday, which was finally proclaimed after midnight on March 6 by President Roosevelt, closed all banks until March 9 and suspended gold redemption and gold shipments abroad. On March 9, Congress at a special session enacted an Emergency Banking Act confirming the powers assumed by the President in declaring the holiday, provided for a way of dealing with unlicensed banks and authorized emergency issues of Federal Reserve Bank notes to fill currency needs. The President thereupon extended the holiday; it was not terminated until March 13, 14, and 15, depending on the location of the banks, which were authorized to open only if licensed to do so by federal or state banking authorities (for a fuller discussion, see Chapter 8, section 1).

As noted in Chapter 4, section 3, the banking holiday, while of the same species as earlier restrictions of payments in 1814, 1818, 1837, 1839, 1857, 1873, 1893, and 1907, was of a far more virulent genus. To the best of our knowledge, in these earlier restrictions, no substantial number of banks closed down entirely even for a day, let alone for a minimum of six business days.38 In the earlier restrictions, banks had continued to make loans, transfer deposits by check, and conduct all their usual business except the unlimited conversion of deposits into currency on demand. Indeed, the restriction enabled them to continue such activities and, in some instances, to expand their loans by relieving them from the immediate pressure to acquire currency to meet the demands of their depositors—a pressure that was doomed to be self-defeating for the banking system as a whole except through drastic reduction in the stock of money. True, to prepare themselves for resumption, banks generally tended to reduce the ratio of their deposits to reserves, following restriction. But the fall in the deposit-reserve ratio and the resulting downward pressure on the money stock were moderate and gradual and could be largely or wholly offset by expansion in high-powered money through specie inflows.39 As a result, contraction of the stock of money, when it occurred at all, was relatively mild and usually lasted perhaps a year, not several years as in 1929–33. Restriction was, as we remarked earlier, a therapeutic measure to prevent a cumulation of bank failures arising solely out of liquidity needs that the system as a whole could not possibly satisfy. And restriction succeeded in this respect. In none of the earlier episodes, with the possible exception of the restriction that began in 1839 and continued until 1842,40 was there any extensive series of bank failures after restriction occurred. Banks failed because they were “unsound,” not because they were for the moment illiquid.

Restriction of payments was not, of course, a satisfactory solution to the problem of panics. If the preceding description makes it sound so, it is only by comparison with the vastly less satisfactory resolution of 1930–33. Indeed, the pre–World War I restrictions were regarded as anything but a satisfactory solution by those who experienced them, which is why they produced such strong pressure for monetary and banking reform. Those earlier restrictions were accompanied by a premium on currency, which in effect created two separate media of payments; and by charges imposed by banks in one locality on the remission of funds to other banks at a distance, since local substitutes for money would not serve as means of payment elsewhere in the country and banks were reluctant to part with reserve funds that were generally acceptable. To O. M. W. Sprague, “the dislocation of the domestic exchanges” as a result of restriction was a serious disturbance to the trade of the country.41

The term suspension of payments, widely applied to those earlier episodes, is a misnomer. Only one class of payments was suspended, the conversion of deposits into currency, and this class was suspended in order to permit the maintenance of other classes of payments. The term suspension of payments is apt solely for the 1933 episode, which did indeed involve the suspension of all payments and all usual activities by the banking system. Deposits of every kind in banks became unavailable to depositors. Suspension occurred after, rather than before, liquidity pressures had produced a wave of bank failures without precedent. And far from preventing further bank failures, it brought additional bank failures in its train. More than 5,000 banks still in operation when the holiday was declared did not reopen their doors when it ended, and of these, over 2,000 never did thereafter (see Chapter 8, section 1). The “cure” came close to being worse than the disease.

One would be hard put to it indeed to find a more dramatic example of how far the result of legislation can deviate from intention than this contrast between the earlier restrictions of payments and the banking holiday under the Federal Reserve System, set up largely to prevent their repetition.

The facts of the banking panic are straightforward. The immediate reasons for its occurrence are not. Why was tentative recovery followed by relapse? Why after some months of quiet was there renewed pressure on the banking system? The answer is by no means clear.

One important factor was the drastically weakened capital position of the commercial banks, which made them extremely vulnerable to even minor drains. The recorded capital figures were widely recognized as overstating the available capital, because assets were being carried on the books at a value higher than their market value.42 Federal Reserve open market purchases would have improved the capital position by raising market values, but those purchases ended in August 1932. Alternatively, Reconstruction Finance Corporation funds could have improved the capital position if they had been made available in the form of capital.43 They were not, however, until the Emergency Banking Act of March 9, 1933, authorized the RFC to invest in the preferred stock or capital notes of commercial banks.

The election campaign may well have been another factor. It was the occasion for a summing up by the Republicans of all the perils to which the financial system had been exposed and which they claimed to have successfully surmounted, while the Democrats predicted worse perils to come if the Republicans were continued in office. Fears concerning the safety of the banking system were heightened not only by the campaign talk, but also by the January 1933 disclosure, as noted above, of names of banks to which the RFC had made loans before August 1932, and by consideration in the Senate that same month of the Glass bill which proposed reform of questionable practices of the banks.

Uncertainty about the economic and, particularly, the monetary policies to be followed by the new administration also contributed to the relapse.44 In the course of the election campaign Roosevelt had made ambivalent statements which were interpreted—certainly by Senator Glass, among others—as committing himself to the retention of the gold standard at the then existing gold parity.45 After the election, rumors spread that the new administration planned to devalue, that Roosevelt had been persuaded by George Warren to follow a policy of altering the gold content of the dollar as a means of “reflating” prices. The rumors became particularly widespread in early 1933 and gained credence when Roosevelt refused to deny them. The effect of the rumors and the failure to deny them was that, for the first time in the course of the contraction, the internal drain in part took the form of a demand for gold coin and certificates thereby reinforcing the external drain arising from speculative accumulation of foreign exchange.

The rumors about gold were only one part of the general uncertainty during the interregnum about future financial and economic policy. Under ordinary circumstances, it would have been doubtful that such rumors and such uncertainty could be a major factor accounting for so dramatic and widespread a financial panic. But these were not ordinary circumstances. The uncertainty came after more than three years of severe economic contraction and after more than two years of banking difficulties in which one wave of bank failures had followed another and had left the banking system in a peculiarly vulnerable position. The Federal Reserve itself participated in the general atmosphere of panic. Once the panic started, it fed on itself.

3 See Milton Friedman, The Demand for Money: Some Theoretical and Empirical Results, New York, National Bureau of Economic Research, Occasional Paper 68, 1959, p. 16.

4 As in pre–Federal Reserve times, J. P. Morgan and Company assumed leadership of an effort to restore an orderly market by organizing a pool of funds for lending on the call market and for purchase of securities. But the bankers’ pool did not stem the tide of selling. By the second week after the crash the phase of organized support of the market was over.

5 During the two weeks before the panic on Oct. 23, loans to brokers for the account of others by reporting member banks in New York City declined by $120 million, largely as a result of withdrawals of funds by foreigners. From then to the end of the year, those loans declined by $2,300 million, or by no less than 60 per cent. Loans on account of out-of-town banks fell an additional $1 billion. More comprehensive figures show a decline of roughly $4.5 billion in brokers’ loans by outof-town banks and others from Oct. 4 to Dec. 31, and a more than halving of total brokers’ loans.

For the data on New York City weekly reporting member bank loans to brokers and dealers in securities, see Banking and Monetary Statistics, Board of Governors of the Federal Reserve System, 1943, Table 141, p. 499, and, for quarterly estimates of the total of such loans by all lenders, see ibid., Table 139, p. 494. Although both tables show similar captions for the principal groups of lenders—most of whose funds were placed for them by the New York banks—except for loans by New York City banks for their own accounts, the breakdowns are not comparable. In the weekly series, “out-of-town domestic banks” include member and nonmember banks outside New York City and, to an unknown amount, customers of those banks, whereas in the comprehensive series that category is restricted to member banks outside New York City. Similarly, “others” in the weekly series cover mainly corporations and foreign banking agencies, but in the comprehensive series include also other brokers, individuals, and nonmember banks.

For loans except to brokers and dealers by New York City weekly reporting member banks, which also increased in the week after the crash, see ibid., p. 174. Also see the discussion of that episode in sect. 2, below.

6 See A. H. Hansen, Economic Stabilization in an Unbalanced World, Harcourt, Brace, 1932, pp. 111–112; J. A. Schumpeter, Business Cycles, McGraw-Hill, 1939, Vol. II, pp. 679–680; R. A. Gordon, Business Fluctuations, Harper, 1952, pp. 377–379, 388; J. K. Galbraith, The Great Crash, 1929, Boston, Houghton Mifflin, 1955, pp. 191–192. See also Federal Reserve Board, Annual Report for 1929, p. 12.

7 Since only June estimates of the money stock are available for those years, the decline was measured from June 1892 to June 1894 rather than from Jan. 1893 to June 1894, the monthly reference dates.

In view of the 5.4 per cent decline in the money stock from Jan. 1867 to Jan. 1868—the earliest dates for which we have estimates—another possible exception is the reference contraction from Apr. 1865 to Dec. 1867.

8 The growth of postal savings deposits from 1929 to 1933 is one measure of the spread of distrust of banks. In Nov. 1914 postal savings deposits were $57 million. By Aug. 1929 they had grown by only $100 million. By Oct. 1930 they were $190 million; from then to Mar. 1933 they increased to $1.1 billion.

9 Annual Report of Superintendent of Banks, State of New York, Part I, Dec. 31, 1930, p. 46.

For two and a half months before its closing, Joseph A. Broderick, New York State Superintendent of Banks, had sponsored various merger plans—some virtually to the point of consummation—which would have saved the bank. Governor Harrison devised the final reorganization plan, the success of which seemed so sure that, two days before the bank closed, the Federal Reserve Bank had issued a statement naming proposed directors for the merger. The plan would have become operative had not the Clearing House banks at the last moment withdrawn from the arrangement whereby they would have subscribed $30 million in new capital funds to the reorganized institution. Under Harrison’s plan, the Bank of United States would have merged with Manufacturers Trust, Public National, and International Trust—a group of banks that had a majority of stockholders and directors of the same ethnic origin and social and financial background as most of the stockholders and directors of the Bank of United States—with J. Herber Case, chairman of the board and Federal Reserve agent of the New York Bank, as head. The decision of the Clearing House banks not to save the Bank of United States was reached at a meeting held at the New York Bank and was not changed despite personal appeals by Broderick and New York State Lieutenant Governor Herbert H. Lehman. Broderick, after waiting in an anteroom for hours despite repeated requests to be allowed to join the bankers in their conference room, was finally admitted through the intercession of Thomas W. Lamont, of J. P. Morgan and Company, and Owen D. Young, a director of the New York Federal Reserve Bank. Broderick’s account of his statement of the bankers follows in part:

I said it [the Bank of United States] had thousands of borrowers, that it financed small merchants, especially Jewish merchants, and that its closing might and probably would result in widespread bankruptcy among those it served. I warned that its closing would result in the closing of at least 10 other banks in the city and that it might even affect the savings banks. The influence of the closing might even extend outside the city, I told them.

I reminded them that only two or three weeks before they had rescued two of the largest private bankers of the city and had willingly put up the money needed. I recalled that only seven or eight years before that they had come to the aid of one of the biggest trust companies in New York, putting up many times the sum needed to save the Bank of United States but only after some of their heads had been knocked together.

I asked them if their decision to drop the plan was still final. They told me it was. Then I warned them that they were making the most colossal mistake in the banking history of New York.

Broderick’s warning failed to impress Jackson Reynolds, president of the First National Bank and of the Clearing House Association, who informed Broderick that the effect of the closing would be only “local.”

It was not the actual collapse of the reorganization plan but runs on several of the bank’s branches, which had started on Dec. 9 and which he believed would become increasingly serious, that led Broderick to order the closing of the bank to conserve its assets. At a meeting with the directors after leaving the conference with the bankers, Broderick recalled that he said: “I considered the bank solvent as a going concern and … I was at a loss to understand the attitude of askance which the Clearing House banks had adopted toward the real estate holdings of the Bank of United States. I told them I thought it was because none of the other banks had ever been interested in this field and therefore knew nothing of it.” Until that time, he said he never had proper reason to close the bank.

Broderick did succeed in persuading the conference of bankers to approve immediately the pending applications for membership in the Clearing House of two of the banks in the proposed merger, so that they would have the full resources of the Clearing House when the next day he announced the closing of the Bank of United States. As a result, the two banks, which like the Bank of United States had been affected by runs, did not succumb.

The details of the effort to save the bank were revealed in the second of two trials of Broderick upon his indictment by a New York County grand jury for alleged neglect of duty in failing to close the bank before he did. The first proceedings ended in a mistrial in Feb. 1932. Broderick was acquitted on May 28. See Commercial and Financial Chronicle, May 21, 1932, pp. 3744–3745 for the quotations; also June 4, 1932, p. 4087, for Harrison’s testimony.

10 Annual Report of Superintendent of Banks, State of New York, Part 1, 1931–45, Schedule E in each report. Four-fifths of the total recovered by depositors and other creditors was paid out within two years of the bank’s closing.

11 In some communities financial reconstruction was attempted by arrangements for a strong bank to merge with a weakened bank or, if several weakened banks were involved, by establishing a new institution with additional capital to take over the liabilities of the failing banks, the stockholders of which took a loss (F. Cyril James, The Growth of Chicago Banks, New York, Harper, 1938, Vol. II, pp. 994–995).

12 According to a memorandum, dated Dec. 19, 1930, prepared for the executive committee of the Open Market Policy Conference, banks “dumped securities to make their positions more liquid,” thus increasing the pressure on the bond market. Weak bond prices in turn produced “a substantial depreciation in the investment portfolios of many banks, in some cases causing an impairment of capital.” In addition, the bond market was almost completely closed to new issues (George L. Harrison Papers on the Federal Reserve System, Columbia University Library, Harrison, Open Market, Vol. I, Dec. 19, 1930; for a full description of the Papers, see Chap. 5, footnote 41 and the accompanying text).

13 U.S. advances to veterans of World War I of up to 50 per cent of the face value of their adjusted service certificates were made possible by legislation of Feb. 27, 1931. These loans totaled $796 million in the first four months after the enactment.

14 Banking and Monetary Statistics, p. 371.

15 Herbert Hoover, Memoirs, The Great Depression, 1929–1941, Macmillan, 1952, pp. 61–80.

16 Some 25 other countries followed Britain’s lead within the following year. The currencies of about a dozen—the sterling area within which British financial and economic influence remained dominant—moved in general conformity with sterling.

Because of the weakness in sterling immediately after the departure from gold, there was no internal relaxation of orthodox financial standards for several months: Britain balanced her budget and repaid foreign credits; Bank rate went up to 6 per cent on the date of suspension and was not reduced until February 1932, when it was changed to 5 per cent. From that point on, defense of sterling was in general no longer considered necessary; instead, control was substituted to prevent a rise in sterling exchange that, it was feared, would eliminate the stimulus a low rate was expected to give to British exports. Imports were restricted by a new protective tariff passed in February. Accompanying the protective tariff policy was a cheap money policy, adopted originally to facilitate refunding wartime issues at lower rates. An expansion in bank credit began in the second quarter of 1932; the trough of the British business contraction was reached in August 1932, according to NBER reference cycle chronology.

17 Men who had experienced the 1907 panic were not unmindful of lessons to be learned from it. Samuel Reyburn (president of Lord and Taylor, a New York City department store, and a director of the New York Federal Reserve Bank) suggested at a board meeting in Dec. 1931 “that if the banking difficulties extended much further, it would be possible for the banks to suspend cash payments as they did in 1907, but still continue in business.” He believed there would be a difficulty, “which had not been present in 1907, that the Federal reserve banks cannot suspend cash payments.” In Mar. 1933, this turned out not to be a problem; the Reserve Banks joined the other banks in restricting payments. One Bank officer commented that “there is the further difference between 1907 and the present time, that the difficulty of the banks in 1907 was not one of solvency, but inability to continue to pay out currency, whereas at the present time the banks are able to pay out currency in large amounts, if necessary, but there is the danger that they may become insolvent in so doing” (Harrison, Notes, Vol. II, Dec. 7, 1931).

That answer was hardly to the point, confusing the problem of the individual bank with the problem of the banking system. The threat of insolvency arose from the inability of the banking system as a whole to pay out currency without a reduction in total deposits, given the failure of the Federal Reserve System to create sufficient additional high-powered money. The attempted liquidation of assets to acquire the high-powered money drove down their prices and rendered insolvent banks that would otherwise have been entirely solvent. By cutting short this process, the early restriction of payments prevented the transformation of a temporary liquidity problem into a problem of insolvency.

18 Rumors about the condition of some of the largest and best-known New York City banks spread alarm in Europe (Harrison, Conversations, Vol. I, Oct. 2, 1931). However, Harrison considered their position in October 1931 “stronger and more liquid than for a long time.” The 23 New York Clearing House banks were not included in a memorandum, dated Dec. 8, 1931, listing the shrinkage in capital funds of the member banks in the second Federal Reserve District, which Harrison sent to Governor Meyer (Miscellaneous, Vol. I, Dec. 8, 1931). The shrinkage ranged from 56 per cent for the highest quality group of banks to more than double the capital funds for the lowest quality group. One of the reasons New York City banks were said to be reluctant to borrow from the Reserve Bank was the fear that Europeans would interpret borrowings as an indication of weakness.

19 Excluding only the five 5-month intervals spanning the holiday, Oct. 1932–Mar. 1933—Feb.–July 1933, when the recorded data show a decline of the same order of magnitude as the annual rate of decline, Aug. 1931–Jan. 1932. As we shall see in Chap. 8, sect. 1, the banking holiday produced a discontinuity in the money figures, and the recorded decline may be a statistical artifact.

20 Harrison, Open Market, Vol. II, memorandum, dated Feb. 23, 1932.

21 Ibid., memorandum, dated Jan. 8, 1932.

22 (1) The Bank sponsored an attempt to develop a uniform method of valuing bank assets, involving a more liberal procedure to be followed by examiners in estimating depreciation. The Comptroller ruled that national banks would be required to charge off no depreciation on bonds of the four highest ratings, and only 25 per cent of the depreciation on all other bonds, except defaulted issues on which the full depreciation was to be charged off. The rule, however, was applied only to banks whose capital funds would not be wiped out if the entire depreciation of all the investments, together with any losses on other assets, were to be written off. Hence banks most in need of liberal treatment were not helped (Harrison, Notes, Vol. II, Aug. 6, 13, and Dec. 7, 1931). (2) It tried to obtain a revision of the rules governing the list of investments legal for savings banks, insurance companies, and trust funds in New York State. The prospect of the elimination of railroad bonds from the legal list threatened a further decline in their price, as holders bound by the list sold the bonds. As a result, commercial bank holdings of railroad bonds suffered losses (ibid., Aug. 13, 1931). (3) It promoted the formation of a railroad bond pool, to restore bond values, conditional on prior adjustment of railroad costs and income (ibid., Oct. 5, and Dec. 7, 1931; also, Conversations, Vol. I, Dec. 5, 1931). (4) It sought the assistance of a group of member banks to accelerate the liquidation of deposits in closed banks. The going banks were asked to buy the assets of the closed banks, and to make an immediate advance against the assets, so that an agreed percentage of deposits could be paid out promptly to depositors (Harrison, Office, Vol. II, Sept. 11, 1931).

23 Hoover, Memoirs, p. 97. See the copy of the prepared statement—requesting formation of the Corporation—read to a meeting of nineteen New York bankers held at Secretary Mellon’s apartment, Sunday, Oct. 4, 1931; Hoover’s letter, dated Oct. 5, 1931, to Harrison; and Harrison’s answer of Oct. 7 (all in Miscellaneous, Vol. I). Harrison stressed the need for a railroad bond pool, to raise the prices of those bonds in bank assets, as an indispensable measure to help the banks in addition to the formation of the Corporation. Also see Notes, Vol. II, Oct. 5, 12, 15, 1931, for the tepid reception of the Corporation by most of the Bank’s directors.

24 The Emergency Relief and Construction Act of July 21, 1932, which increased the borrowing power of the RFC from $1.5 billion to $3.3 billion in addition to its subscribed capital of $500 million, authorized it to advance up to $300 million at 3 per cent interest to states and territories for unemployment relief; to make loans for self-liquidating public works (little was actually advanced either for relief or public works up to the end of the year); to finance marketing of agricultural products in foreign markets and in the U.S.; and to create a regional credit corporation with capital subscribed by the RFC in any land-bank district. These measures did not prevent the continued fall in farm income and farm land values, the rise in farm foreclosures, and continued forced sales due to tax delinquency.

25 The provision was to expire on Mar. 3, 1933, but was extended another year on Feb. 3, 1933, and thereafter periodically until made permanent by the act of June 12, 1945.

26 The Glass-Steagall Act permitted member banks to borrow from the Reserve Banks (at penalty rates) on ineligible assets under specified conditions. With the consent of at least five members of the Federal Reserve Board, notes of groups of five or more member banks with insufficient eligible assets could be discounted. A unit bank with a capital under $5 million was also authorized, in exceptional circumstances, to borrow on ineligible assets with the consent of at least five members of the Federal Reserve Board. The release of funds by these terms was slight. The Emergency Relief and Construction Act of July 21, 1932, therefore permitted the Reserve Banks to discount for individuals, partnerships, and corporations, with no other sources of funds, notes, drafts, and bills of exchange eligible for discount for member banks. Those powers were used to a very limited extent. Discounts for individuals, partnerships, and corporations reached a maximum of $1.4 million in Mar. 1933. Authorization to make those discounts expired July 31, 1936.

27 House bill 11362 was referred to the Senate Banking and Currency Committee on May 28, 1932 (Congressional Record, 72d Cong., 1st sess., p. 11515).

28 Glass had been chairman of the House Banking and Currency Committee in 1913. The bill passed that year by the Senate included deposit guaranty; the bill passed by the House did not. In the conference, the House conferees succeeded in eliminating that provision (Paul M. Warburg, The Federal Reserve System, New York, Macmillan, 1930, Vol. I, p. 128).

29 In 71st Cong., 2d sess., June 17, 1930, S. 4723, on national banking associations (Congressional Record, p. 10973); in 72d Cong., 1st sess., Jan. 21 and Mar. 17, 1932, S. 3215 and S. 4115, on Federal Reserve Banks (ibid., pp. 2403, 6329), also Apr. 18, 1932, S. 4412, on Federal Reserve Banks and national banking associations.

30 See also footnote 134, below.