APPENDIX 7C

CREDIT RATING AGENCIES AND DOE RATIOS

Education organizations have a number of specialized financial ratios by which they are evaluated. Bond rating agencies and the U.S. Department of Education (DOE) use these specialized ratios in order to assess creditworthiness. Many of these were developed originally by accounting firm Peat Marwick, now part of KPMG LLP. Bank lenders may also use some of these ratios in evaluating your loan requests. We include here a summary done by Fischer, Gordon, Greenlee, and Keating, as well as website information for your further study.

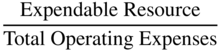

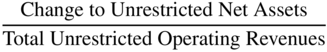

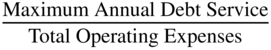

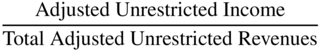

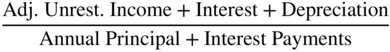

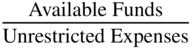

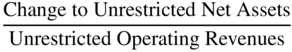

In Exhibit 7C.1, note the key ratios that the DOE, KPMG, and the three largest ratings agencies (S&P, Moody's, and Fitch) use in their analysis of private colleges and universities. Exhibit 7C.2 gives the definitions of the items in the ratio numerators and denominators. We begin our presentation by providing the web addresses for the three nationally recognized statistical ratings organizations (NRSROs) rating nonprofits' debt issues in the United States.

| Liquidity Ratios | Operating Performance Ratios | Debt and Leverage Ratio | |

| US Department of Education |  |

|

|

| KPMG et al. (1999) |  |

|

|

|

|||

| Standard&Poor's (2002a) |  |

|

|

| |||

| Moody's (2002) |  |

|

|

| |||

| |||

| Fitch (2001) |  |

|

|

Source: Mary Fischer, Teresa P. Gordon, Janet Greenlee, and Elizabeth K. Keating, “Measuring Operations: An Analysis of U.S. Private Colleges and Universities' Financial Statements,” Financial Accountability & Management 20 (May 2004): 129–151 (Table 1). Used by permission.

Exhibit 7C.1 Key Ratios for Evaluating Private Colleges and Universities

Definitions

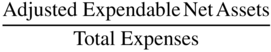

Adjusted expendable net assets = (unrestricted net assets) + (temporarily restricted net assets) − (annuities, term endowments, and life income funds that are temporarily restricted) − (intangible assets) − (net property, plant and equipment) + (post-employment and retirement liabilities) + (all debt obtained for long-term purposes).

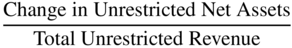

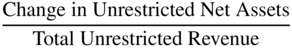

Adjusted unrestricted income = Adjusted unrestricted revenues − Adjusted unrestricted expenses. Adjustments to revenues include removing sponsored and unsponsored scholarships, including 1.5% of beginning cash and investments instead of investment income and gains, and removing net assets released from restrictions if related to gifts for capital projects. Expenses are adjusted by removing scholarships and fellowships.

Available funds = unrestricted and temporarily restricted cash and investments. Fitch says it does not use net assets because of the uncertainty related to the liquidity and value of some assets.

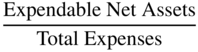

Expendable net assets = expendable resources = expendable financial resources = (total net assets) − (permanently restricted net assets) − (net investment in plant).

Net investment in plant = (net property, plant, and equipment) − (long-term debt).

Modified net assets = (unrestricted net assets) + (temporarily restricted net assets) + (permanently restricted net assets) − (intangible assets) − (unsecured related party receivables).

Modified assets = (total assets) − (intangible assets) − (unsecured related-party receivables).

Total unrestricted operating revenue includes only investment income to the extent of the school's endowment spending policy. If there is no policy, investment gains and losses are excluded.

Unrestricted operating revenues (Fitch) = Total unrestricted revenues less investment gains (if investment income is a significant source of revenue).

Source: Mary Fischer, Teresa P. Gordon, Janet Greenlee, and Elizabeth K. Keating, “Measuring Operations: An Analysis of U.S. Private Colleges and Universities' Financial Statements,” Financial Accountability & Management 20 (May 2004): 129–151 (Table 1, Continued). Used by permission.

Exhibit 7C.2 Definitions for Key Ratios for Evaluating Private Colleges and Universities

WEBSITES FOR CREDIT RATING AGENCIES

Educational institution and healthcare bond ratings are based largely on financial ratios, and credit ratings agencies have specialized ratios on which they rely. Each credit rating agency has a website with information about its ratings criteria and definitions or ratings guidelines. Several of these require a free registration, and each may limit advanced research materials to paid subscribers. The following three credit ratings organizations have been rating public sector (or “public finance”) organizations for a number of years:

- Moody's (www.moodys.com)

Public Finance page:

https://www.moodys.com/researchandratings/market-segment/u.s.-public-finance/005003/005003/-/-1/0/-/0/-/-/en/global/rr Public Finance Rating Methodologies (requires registration):

- Standard & Poor's (S&P) (www.standardandpoors.com)

Public Finance Rating Criteria:

- Recent Public Finance Ratings Actions: https://www.standardandpoors.com/en_US/web/guest/ratings/ratings-actions (set menus to Public Finance / United States / All Actions)

- Fitch Ratings (www.fitchratings.com)

Public Finance Outlooks and New Developments:

https://www.fitchratings.com/site/uspf

Public Finance Rating Criteria:

https://www.fitchratings.com/site/search?content=research&filter=1237+1215+363+4294288214+1198

Exhibit 7C.1 provides key ratios that might be used by a credit rating agency to evaluate private colleges and universities. That lens is valuable to you as a manager or board member as you get to see how creditworthy your organization is, whether or not you are thinking about issuing bonds or taking out other long-term debt.

Exhibit 7C.2 defines several of the key financial ratios that a credit rating agency might calculate and use to assess a 501(c)(3) college's financial strength.

Finally, we note that financial analysis is not limited to financial ratios. For example, let's say that your organization is not in the healthcare or education industries. Moody's (see reference above) considers a nonprofit's market position as a very important rating factor. To assess market position, Moody's scrutinizes your operating revenue performance. To score highly, your organization would have large as well as diverse activities (such as programs) that have favorable outlooks relative to its ability to generate revenue and support, a brand that is well-known and viewed positively, and diverse revenue sources.