Syntax. TBILLEQ(Settlement,Maturity,Discount)

Definition. This function calculates the equivalent annual interest rate in arrears based on 365 days for a given anticipative annual interest rate based on 360 days. The latter is usually formulated as the discount rate of the par value (disagio). It is used for U.S. treasury bills.

Arguments

Settlement (required) The date when the ownership of the security changes

Maturity (required) The date of the repayment of the certified par value

Discount (required) The percent disagio of the par value

There are the following requirements:

Settlement and Maturity require a date specification without a time; decimal places are truncated. Invalid date specifications return the

#VALUE!error.If the start date is not positive, TBILLEQ() returns the

#NUMBER!error.The same error is generated if the settlement date lies past the maturity date or if the maturity has more than a year of time difference from the settlement.

Important

Excel Help contains the following note:

“Dates should be entered with the DATE() function or as results of other formulas or functions. Problems might occur if dates are entered as text.”

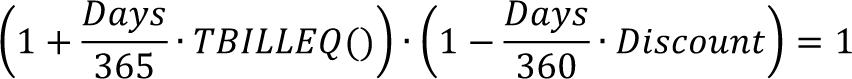

Background. The equivalence between anticipative interest payment and interest payment in arrears is created by the following equation:

Days is the exact day difference between Maturity and Settlement.

Example. In the sample files for this function, you can find some number experiments that manually recreate this formula and compare the results with those of YIELDDISC() and INTRATE(). They convert anticipative interest rates to interest rates in arrears.