1300SMILES Limited

| ASX code: ONT | www.1300smiles.com.au | |

|

||

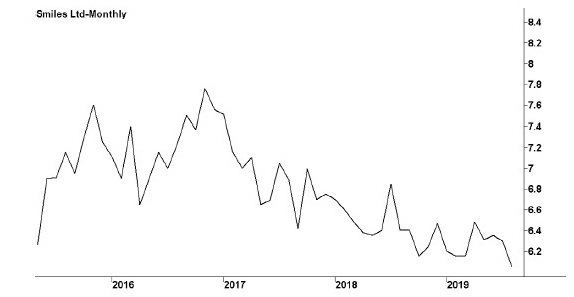

| Share price ($) | 6.10 | |

| 12-month high ($) | 6.60 | |

| 12-month low ($) | 5.98 | |

| Market capitalisation ($mn) | 144.4 | |

| Price-to-NTA-per-share ratio | 21.9 | |

| 5-year share price return (% p.a.) | 3.6 | |

| Dividend reinvestment plan | No | |

| Sector: Health care | Company | Sector |

| Price/earnings ratio (times) | 18.6 | 37.1 |

| Dividend yield (%) | 4.1 | 1.4 |

Townsville-based 1300SMILES, founded in 2000, runs a chain of more than 35 dental practices in 10 major population centres of Queensland, and has also expanded to South Australia and New South Wales. Its main role is the provision of dental surgeries and practice management services to self-employed dentists, allowing them to focus on dental services. It also manages its own small dental business. The founder and managing director, Dr Daryl Holmes, owns around 60 per cent of the company equity.

Latest business results (June 2019, full year)

Revenues and profits rose modestly as the company continued to expand. The company also reports what it calls over-the-counter revenues, which represent the amount actually received by its dentistry businesses before the deduction of patient fees by self-employed dentists. On this basis — which the company believes gives a fairer measure of the scale of its operations than its reported statutory sales figure — total company revenues rose to $58.9 million in June 2019, from $55.8 million in the previous year. During the year the company acquired new practices in Noosa, Springfield Lakes, Maroochydore and Strathpine, all in Queensland.

Outlook

The dental business in Australia is fragmented, with around 70 per cent of dentists working in their own private practices or in small partnerships. However, as stricter regulatory and compliance requirements drive up costs, a gradual consolidation is taking place, which has led to the rise of what has become known as the Dental Service Organisations sector, and 1300SMILES is one of the leaders in this trend. The company buys dental practices, then retains the dentists, who pay a fee to 1300SMILES for services received, including marketing, administration, billing and collection, facilities certification and licensing. The company also provides support staff, equipment and facilities and sources all consumable goods. It continues to seek out new practices to buy, though it has strict benchmarks concerning the price it will pay. Company management have suggested that a big new wave of consolidation is due to take place, and they believe that 1300SMILES, with its relatively low levels of debt and its strong reputation, will be able to take advantage of this. In particular, the company believes that it may even be able to buy out some of its rival consolidators. In addition, it expects to continue establishing new practices in existing and new regions. It will also build up existing practices through benchmarking, training and mentoring, as well as by expanding those facilities that are at full capacity.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 39.1 | 40.3 |

| EBIT ($mn) | 10.4 | 10.7 |

| EBIT margin (%) | 26.6 | 26.4 |

| Profit before tax ($mn) | 10.7 | 10.8 |

| Profit after tax ($mn) | 7.6 | 7.8 |

| Earnings per share (c) | 32.24 | 32.82 |

| Cash flow per share (c) | 41.98 | 42.40 |

| Dividend (c) | 24 | 25 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 0.42 | 0.28 |

| Interest cover (times) | ~ | ~ |

| Return on equity (%) | 20.6 | 19.9 |

| Debt-to-equity ratio (%) | ~ | 21.4 |

| Current ratio | 0.9 | 1.0 |