Accent Group Limited

| ASX code: AX1 | www.accentgr.com.au | |

| ||

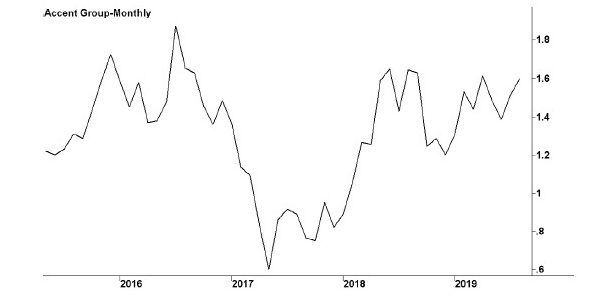

| Share price ($) | 1.63 | |

| 12-month high ($) | 1.71 | |

| 12-month low ($) | 1.05 | |

| Market capitalisation ($mn) | 877.7 | |

| Price-to-NTA-per-share ratio | 17.4 | |

| 5-year share price return (% p.a.) | 49.0 | |

| Dividend reinvestment plan | No | |

| Sector: Consumer discretionary | Company | Sector |

| Price/earnings ratio (times) | 16.3 | 13.7 |

| Dividend yield (%) | 5.1 | 3.9 |

Sydney company Accent Group is a nationwide footwear wholesaler and retailer that has grown rapidly through a series of mergers and acquisitions. Its brands now include The Athlete's Foot — established in 1976 — Hype DC, Platypus, Podium Sports, Skechers, Merrell, CAT, Vans, Dr. Martens, Saucony, Timberland, Sperry Top-Sider, Palladium and Stance. The company's wholesale division distributes footwear and apparel. Accent also operates in New Zealand.

Latest business results (June 2019, full year)

Accent overcame a weak retail environment to post a strong result, with double-digit gains in sales and profit. With profit growing at a faster pace than sales, the company was successful in boosting margins. The good result came despite the weakening dollar, which forced up costs for its imported products. Retail sales at company-owned stores rose 16 per cent to $656 million. This included a 2.3 per cent increase in like-for-like sales and a 93 per cent surge in digital sales. Skechers, Platypus, Vans, Dr. Martens, Timberland and Merrell all traded especially well. Wholesale revenues of $116 million were 7 per cent higher than in the previous year, with strong performances from Vans, Dr. Martens, Merrell, CAT and Stance more than offsetting continued weakness from Skechers. Total company sales for the year, including for franchise stores, rose 9 per cent to $935 million. During the year Accent opened 54 new stores and closed 21, resulting in a total of 479 stores and online sites.

Outlook

Accent maintains its ambitious growth strategy and expects profits to continue rising. It plans to open more than 40 new stores during the June 2020 year, with a further 30 to 40 in the ensuing two to three years. In the current weak retail environment it finds that it is able to arrange beneficial deals with landlords that make new stores cashflow-positive from the first month. It is enjoying success with its new The Trybe children and youth brand, launched in October 2018, with the initial stores performing well ahead of expectations. Also performing well ahead of expectations is its new range of socks and shoe accessories, launched in November 2018 under the Hype, Platypus and The Athlete's Foot brands. In September 2018 it acquired Subtype, a boutique retailer of limited-edition premium sneakers, and it expects to expand this business. In 2020 it plans the launch of a new store brand, PIVOT, selling budget-priced footwear. It has also opened some large new CBD Platypus stores in response to the expansion in Australia of British sportswear retailer JD Sports.

| Year to 30 June* | 2018 | 2019 |

| Revenues ($mn) | 702.4 | 796.3 |

| EBIT ($mn) | 64.7 | 80.6 |

| EBIT margin (%) | 9.2 | 10.1 |

| Profit before tax ($mn) | 60.9 | 77.0 |

| Profit after tax ($mn) | 44.0 | 53.9 |

| Earnings per share (c) | 8.23 | 10.02 |

| Cash flow per share (c) | 12.75 | 15.28 |

| Dividend (c) | 6.75 | 8.25 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 0.08 | 0.09 |

| Interest cover (times) | 17.1 | 22.6 |

| Return on equity (%) | 11.6 | 13.6 |

| Debt-to-equity ratio (%) | 8.9 | 12.3 |

| Current ratio | 1.3 | 1.2 |

* 1 July 2018