Ansell Limited

| ASX code: AMA | www.ansell.com | |

|

||

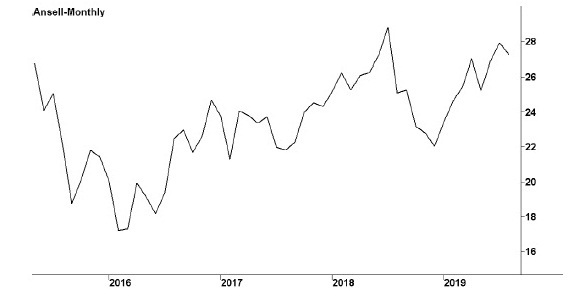

| Share price ($) | 27.39 | |

| 12-month high ($) | 28.14 | |

| 12-month low ($) | 21.07 | |

| Market capitalisation ($mn) | 3623.8 | |

| Price-to-NTA-per-share ratio | 8.0 | |

| 5-year share price return (% p.a.) | 9.0 | |

| Dividend reinvestment plan | Yes | |

| Sector: Health care | Company | Sector |

| Price/earnings ratio (times) | 17.7 | 37.1 |

| Dividend yield (%) | 2.4 | 1.4 |

Melbourne-based Ansell has roots that stretch back to the manufacture of pneumatic bicycle tyres in the 19th century. It is today a global leader in a variety of safety and healthcare products. It makes a wide range of examination and surgical gloves for the medical profession. It also makes gloves and other hand and arm protective products for industrial applications, including for single use, along with household gloves. It has offices and production facilities in 55 countries, and more than 90 per cent of company revenues derive from abroad. Though still based in Australia, the company has its operational headquarters in the US.

Latest business results (June 2019, full year)

Ansell reports its results in US dollars, and sales and profits edged up, though the gains were magnified when converted to Australian dollars, as used in this book. The Healthcare division enjoyed a 4.8 per cent rise in sales, with especially solid demand in the life science and synthetic surgical categories. However, rising raw material costs, especially in the first half, forced profits down. The Industrial division saw revenues rise 1.5 per cent, which partially reflected a new corporate acquisition. European demand was weak, especially in the automobile sector, though largely offset by strength in emerging markets. Nevertheless, thanks to lower costs and some price rises the division reported a solid rise in profits. The results in this book do not include the one-off costs for the company's transformation program, and on a statutory basis profits actually fell. Note that the figures in this book have been converted to Australian dollars using prevailing currency rates.

Outlook

Ansell has a strong portfolio of products, which gives it a degree of pricing power. It has achieved success in its research and development efforts, with a continuing stream of innovative and high-margin products. Thanks to a major company transformation program, which still continues, it has been able to lower its manufacturing costs. The acquisition in 2019 of US specialty gloves manufacturer Ringer Gloves has boosted the Industrial division, and the company is actively seeking further acquisitions. Its high exposure to the health sector gives it a degree of protection against volatile economic cycles that can hurt demand for its industrial products. Nevertheless, Ansell remains quite exposed to global economic trends, as well as to raw material prices and currency movements. The company's early forecast is for earnings per share in the June 2020 year of US$1.12 to US$1.22, compared with US$1.115 in June 2019.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 1960.3 | 2 081.9 |

| Healthcare (%) | 52 | 53 |

| Industrial (%) | 48 | 47 |

| EBIT ($mn) | 248.7 | 278.2 |

| EBIT margin (%) | 12.7 | 13.4 |

| Gross margin (%) | 39.1 | 39.0 |

| Profit before tax ($mn) | 237.6 | 262.8 |

| Profit after tax ($mn) | 193.0 | 209.6 |

| Earnings per share (c) | 134.23 | 154.90 |

| Cash flow per share (c) | 170.65 | 194.12 |

| Dividend (c) | 60.02 | 64.93 |

| Percentage franked | 24 | 0 |

| Net tangible assets per share ($) | 4.81 | 3.41 |

| Interest cover (times) | 22.5 | 18.0 |

| Return on equity (%) | 10.6 | 10.3 |

| Debt-to-equity ratio (%) | ~ | 10.5 |

| Current ratio | 3.9 | 3.1 |