Vita Group Limited

| ASX code: VTG | www.vitagroup.com.au | |

| ||

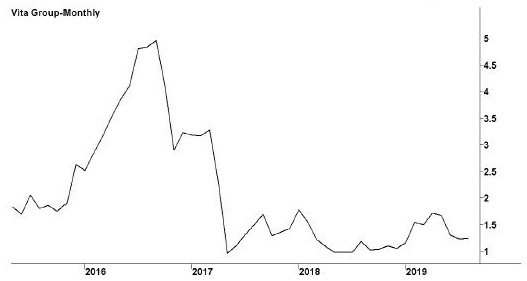

| Share price ($) | 1.22 | |

| 12-month high ($) | 1.77 | |

| 12-month low ($) | 0.85 | |

| Market capitalisation ($mn) | 197.8 | |

| Price-to-NTA-per-share ratio | 77.7 | |

| 5-year share price return (% p.a.) | 11.8 | |

| Dividend reinvestment plan | Yes | |

| Sector: Consumer discretionary | Company | Sector |

| Price/earnings ratio (times) | 8.1 | 13.7 |

| Dividend yield (%) | 7.5 | 3.9 |

Brisbane-based Vita, founded in 1995 as a single store, is a specialist retailer of technology and communication products and services, such as mobile phones and related products and services, along with third-party voice and data services. It also manages service and rental contracts, as well as selling voice and data services. In the business field it operates under the Telstra Business Centre and Vita Enterprise Solutions brands. It sells mobile accessories under its own Sprout brand. Since 2016 it has been moving into the health and wellness sector, with the Artisan Aesthetics chain of skincare clinics and the SQDAthletica brand of men's lifestyle products.

Latest business results (June 2019, full year)

Profits bounced back, after falling in the previous year when the company was hit by reduced payments from Telstra. Telecommunications-related sales provide the bulk of the company's business, and revenues rose 9 per cent to $739 million, with EBITDA up 13 per cent. Retail sales make up around 80 per cent of this business, with some excellent growth. By contrast, commercial sales fell sharply, in part from the transition of small business customers into the retail segment. Vita's own Sprout brand of mobile accessories continued to grow, especially in premium categories. The company's new Skin Health and Wellness division saw revenues more than double to nearly $14 million, although it reported a higher loss as Vita invested heavily for future growth. At June 2019 Vita Group operated 102 Telstra stores, four Telstra Business Centres, one Fone Zone store, 13 Artisan Aesthetics skincare clinics (under various brand names) and three SQDAthletica stores.

Outlook

Vita Group has grown to occupy a prominent position in the sale of telecommunications products to retail consumers and is a significant beneficiary of the continuing strong demand in Australia for the latest devices. However, it is highly dependent on Telstra, at a time when Telstra is working to cut costs. Under a planned new remuneration structure, Vita expects to receive higher payments for sales of devices, but lower payments from sales of connections to the Telstra network. The company has said it is too early to determine the financial impact of this on its business. Meanwhile, it is working to reduce its dependence on Telstra with moves into health and wellness. It has acquired a training organisation and specialist software for this business, and plans to add at least 12 more stores to the Artisan Aesthetics network during the June 2020 year, with an eventual target of 70 to 90 stores nationwide.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 684.5 | 753.7 |

| EBIT ($mn) | 30.9 | 34.7 |

| EBIT margin (%) | 4.5 | 4.6 |

| Profit before tax ($mn) | 29.9 | 34.1 |

| Profit after tax ($mn) | 22.0 | 24.3 |

| Earnings per share (c) | 14.13 | 15.04 |

| Cash flow per share (c) | 20.60 | 21.86 |

| Dividend (c) | 9.1 | 9.2 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | ~ | 0.02 |

| Interest cover (times) | 31.2 | 52.7 |

| Return on equity (%) | 24.1 | 23.5 |

| Debt-to-equity ratio (%) | ~ | ~ |

| Current ratio | 0.9 | 0.8 |