Webjet Limited

| ASX code: WEB | www.webjetlimited.com | |

| ||

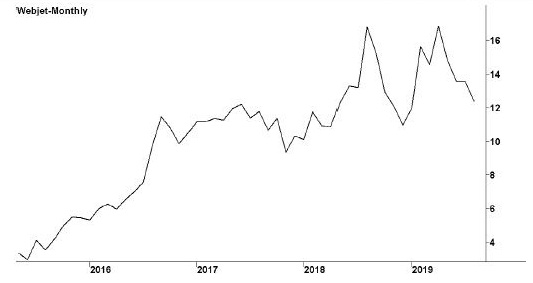

| Share price ($) | 12.42 | |

| 12-month high ($) | 17.33 | |

| 12-month low ($) | 10.18 | |

| Market capitalisation ($mn) | 1683.8 | |

| Price-to-NTA-per-share ratio | ~ | |

| 5-year share price return (% p.a.) | 35.9 | |

| Dividend reinvestment plan | No | |

| Sector: Consumer discretionary | Company | Sector |

| Price/earnings ratio (times) | 26.4 | 13.7 |

| Dividend yield (%) | 1.8 | 3.9 |

Melbourne-based Webjet, established in 1998, is a leading travel business. It divides its operations into two broad segments. The B2B Travel segment (business to business), also known as WebBeds, provides the travel industry with hotel inventory. It operates under various regional brands, including Lots of Hotels, Sunhotels, Fit Ruums, JacTravel and — its new acquisition — Dubai-based Destinations of the World. The B2C Travel segment (business to consumer) operates the webjet.com.au business, the largest online travel agency in Australia and New Zealand, specialising in airline bookings, hotel reservations, travel insurance and rental cars. This segment also includes Online Republic, a cruise, rental car and rental motorhome booking agency.

Latest business results (June 2019, full year)

Webjet reported another excellent result, with profits rising strongly for the second straight year. The key was a sharp increase in the WebBeds business, with revenues up 62 per cent and profits more than doubling. In large part this reflected the US$173 million acquisition, completed in November 2018, of Destinations of the World. However, even excluding the acquisition, profits rose 30 per cent at the EBITDA level, with scale efficiencies coming through in each region as the company expanded. Hotel bookings of 3.4 million were up 51 per cent from the previous year, with a total transaction value of $2.15 billion, up 59 per cent. The B2C Travel segment saw just modest gains, with profits up 4 per cent for the webjet.com.au online travel booking business, but falling for the second straight year for the small Online Republic operation.

Outlook

Webjet has been transformed by a series of acquisitions, and now claims to be the second-largest participant in the global hotel bed intermediary sector, with a market share approaching 4 per cent. This industry is highly fragmented, with the majority of companies having specialised, local offerings and very small market shares. Webjet sees the opportunity to become a major global force, and is now able to offer rooms at some 250 000 hotels, including approximately 30 000 with which it has direct contracts. As it grows it achieves significant economies of scale that boost profit margins. It also continues to invest in new technology platforms, including its innovative Rezchain blockchain initiative, that enable it to lower operating costs. It has launched a new business, Umrah Holidays International, which it says is the first truly online B2B provider of travel services for religious pilgrims to Mecca. At June 2019 Webjet had no net debt, and it continues to seek out new acquisitions.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 291.0 | 366.4 |

| B2B travel (%) | 39 | 50 |

| B2C travel (%) | 61 | 50 |

| EBIT ($mn) | 64.3 | 87.1 |

| EBIT margin (%) | 22.1 | 23.8 |

| Profit before tax ($mn) | 58.6 | 74.7 |

| Profit after tax ($mn) | 43.2 | 60.3 |

| Earnings per share (c) | 37.53 | 47.00 |

| Cash flow per share (c) | 56.65 | 75.06 |

| Dividend (c) | 20 | 22 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | ~ | ~ |

| Interest cover (times) | 11.3 | 7.0 |

| Return on equity (%) | 13.1 | 11.1 |

| Debt-to-equity ratio (%) | ~ | ~ |

| Current ratio | 0.9 | 0.9 |