APN Property Group Limited

| ASX code: APD | www.apngroup.com.au | |

| ||

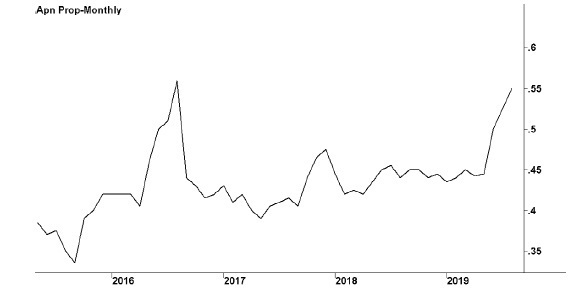

| Share price ($) | 0.55 | |

| 12-month high ($) | 0.55 | |

| 12-month low ($) | 0.41 | |

| Market capitalisation ($mn) | 172.6 | |

| Price-to-NTA-per-share ratio | 1.4 | |

| 5-year share price return (% p.a.) | 19.4 | |

| Dividend reinvestment plan | No | |

| Sector: Financials | Company | Sector |

| Price/earnings ratio (times) | 11.1 | 15.0 |

| Dividend yield (%) | 5.0 | 5.9 |

Melbourne company APN Property was established in 1996 as a funds management group specialising in real estate. Its funds are targeted at both institutional and retail investors. It established its flagship APN Property for Income Fund in 1998 and its first direct property fund, APN Retirement Properties Fund, in 1999. Today the company manages 12 funds, including domestic and international property securities, direct property and listed funds. It derives income from investing in its own funds, and profits are also affected by changes in the valuation of its properties.

Latest business results (June 2019, full year)

APN delivered its sixth straight year of higher recurring revenues, with profits also strong. Fund management fees of $15 million were up 6 per cent from the previous year, and co-investment income — from the company's own investments — grew 18 per cent to $8 million. The company classifies its operations into four broad categories, and all reported higher revenues and profits. The largest category, Real Estate Securities Funds, comprises five funds, with growth in value thanks to a positive investment performance, though partially offset by net fund outflows by investors. Two ASX-listed funds, the APN Industria REIT and the APN Convenience Retail REIT, comprise two further categories, and both these grew during the year. The fourth category, Direct Funds, comprises fixed-term unlisted direct property syndicates. During the year this division successfully launched the $24 million APN Nowra Property Fund. At June 2019 the company's total funds under management of $2.9 billion were up 5 per cent from a year earlier.

Outlook

APN's particular goal is to invest in properties that provide annuity-style income. It also hopes to gain from capital appreciation. With Australian interest rates low, and equity markets volatile, it sees great potential for its funds. The Real Estate Securities Funds division — the bulk of its business — has an income focus, with funds that are targeted at investors seeking stable superannuation, retirement and investment income, with some capital growth and lower-than-market volatility. This division has seen especially impressive growth in demand for its strongly performing APN Asian REIT. The company is seeking new distribution channels for these funds, particularly with independent financial advisers, and it is also planning new funds. Its Direct Funds division has a team that is an active participant in the commercial property market, and is seeking to buy additional packages of properties suitable for new syndicates. The company is also actively seeking out and acquiring appropriate new properties for its two ASX-listed funds.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 25.9 | 26.7 |

| EBIT ($mn) | 19.3 | 20.2 |

| EBIT margin (%) | 74.7 | 75.5 |

| Profit before tax ($mn) | 18.9 | 20.1 |

| Profit after tax ($mn) | 13.6 | 14.5 |

| Earnings per share (c) | 4.61 | 4.94 |

| Cash flow per share (c) | 4.68 | 4.99 |

| Dividend (c) | 2.25 | 2.75 |

| Percentage franked | 100 | 70 |

| Net tangible assets per share ($) | 0.38 | 0.40 |

| Interest cover (times) | 41.6 | 229.4 |

| Return on equity (%) | 11.7 | 11.7 |

| Debt-to-equity ratio (%) | 1.3 | ~ |

| Current ratio | 2.7 | 2.5 |