Blackmores Limited

| ASX code: BKL | www.blackmores.com.au | |

| ||

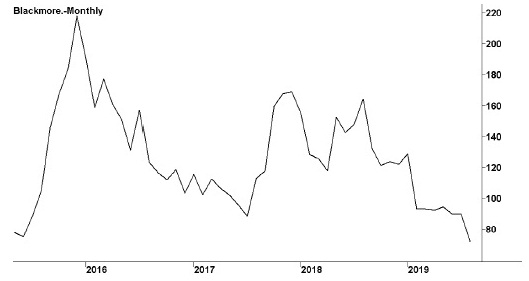

| Share price ($) | 71.13 | |

| 12-month high ($) | 165.10 | |

| 12-month low ($) | 63.64 | |

| Market capitalisation ($mn) | 1234.9 | |

| Price-to-NTA-per-share ratio | 9.7 | |

| 5-year share price return (% p.a.) | 23.2 | |

| Dividend reinvestment plan | Yes | |

| Sector: Consumer staples | Company | Sector |

| Price/earnings ratio (times) | 23.0 | 22.1 |

| Dividend yield (%) | 3.1 | 2.4 |

Founded in Queensland in the 1930s, and now based in Sydney, Blackmores is a leading manufacturer and distributor of a wide range of natural healthcare products, nutritional supplements and cosmetics, with high market shares. It has a buoyant export business, especially to China. Its BioCeuticals operation manufactures nutritional supplements for healthcare practitioners and its Pure Animal Wellbeing (PAW) business specialises in natural dietary supplements for dogs and cats. It also owns the Chinese herbal medicines manufacturer Global Therapeutics, which markets its products under the Fusion Health and Oriental Botanicals brands. It entered the weight loss sector in 2018 with the acquisition of the Impromy weight management portfolio of products.

Latest business results (June 2019, full year)

Revenues edged up but profits fell, as the company took a hit from its Chinese operations. Sales to China of $122 million were down 15 per cent from the previous year, with EBIT crashing 40 per cent. Sales in Australia and New Zealand were steady, though rising costs, including higher raw material prices, sent EBIT down. A bright note came from the rest of Asia, with sales of $107 million up 30 per cent, and EBIT soaring 218 per cent, although from a low base, and profitability for this business remains low. The BioCeuticals division saw sales rise 4 per cent to $113 million, with EBIT up 10 per cent.

Outlook

Blackmores has been hurt by new Chinese regulations making it onerous for small entrepreneurs in Australia to buy up its products in Australia and ship them for resale in China. From around 2015 this business had been generating some strong sales for many of Blackmores' products. The company believes that difficulties with the Chinese market will continue until early in 2020. However, its other Asia businesses continue to grow, with Vietnamese sales up 157 per cent in the June 2019 year and South Korean sales up 28 per cent. The company has placed a particular emphasis on its joint venture company in the Indonesian market, and this moved into profit during the second half of the June 2019 year. It is now evaluating the prospects for an entry into the Indian market. Following some encouraging trials, the BioCeuticals division may begin marketing a medical cannabis product. In February 2019 Blackmores announced a major streamlining of its operations, with a target of $60 million in cost savings over three years. The move to a new Melbourne manufacturing facility in October 2019 is also expected to reduce costs.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 601.1 | 609.5 |

| EBIT ($mn) | 101.6 | 80.5 |

| EBIT margin (%) | 16.9 | 13.2 |

| Profit before tax ($mn) | 97.7 | 75.5 |

| Profit after tax ($mn) | 70.0 | 53.5 |

| Earnings per share (c) | 406.38 | 309.15 |

| Cash flow per share (c) | 458.27 | 372.03 |

| Dividend (c) | 305 | 220 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 7.35 | 7.30 |

| Interest cover (times) | 25.9 | 16.1 |

| Return on equity (%) | 37.8 | 26.7 |

| Debt-to-equity ratio (%) | 25.6 | 45.5 |

| Current ratio | 1.7 | 2.0 |