The Citadel Group Limited

| ASX code: CGL | www.citadelgroup.com.au | |

| ||

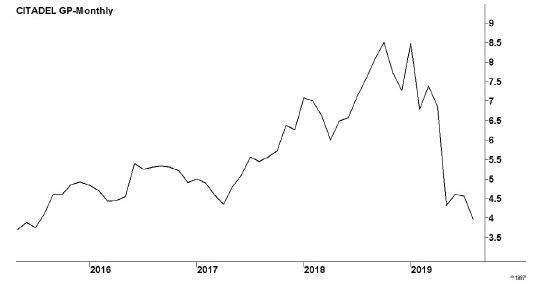

| Share price ($) | 3.91 | |

| 12-month high ($) | 9.30 | |

| 12-month low ($) | 3.63 | |

| Market capitalisation ($mn) | 192.6 | |

| Price-to-NTA-per-share ratio | ~ | |

| 5-year share price return (% p.a.) | 14.6 | |

| Dividend reinvestment plan | No | |

| Sector: Information technology | Company | Sector |

| Price/earnings ratio (times) | 17.7 | 29.4 |

| Dividend yield (%) | 2.8 | 1.6 |

Founded in 2007, Canberra-based Citadel is a software and technology company with a specialty in the provision of secure information management. Its main clients are in the health, national security and defence spheres. It operates Australia's largest laboratory information system, supporting over 60 laboratories nationwide, and also manages an extensive range of digital health systems. It operates from offices in Canberra, Sydney, Melbourne, Brisbane and Adelaide. In June 2019 it acquired the systems integration and engineering specialist Noventus.

Latest business results (June 2019, full year)

Sales and profits fell in a disappointing result for the company. Timing issues were to blame for much of the bad news. Some project extensions, expected to begin during the year, were instead delayed until early in the June 2020 year, as government departments postponed spending initiatives until after the general election. Payments on a major project were also delayed. In addition, the company has begun the transition from high-margin consulting and managed services to software-as-a-service (SaaS) operations. The latter provide reduced margins in the short term, though higher margins over the medium term. In response to shareholder concerns about the need for improved transparency in its financial reporting, the company provided a breakdown of its revenues and profits into three segments — knowledge, technology and health. It was the first category, knowledge, that suffered a sharp decline in sales and profits, hit by government spending delays. By contrast, the health category, which provides software products for diagnostic laboratories and clinical applications, saw sales up and profits steady. The low-margin technology business, which specialises in data, video and voice technology management, actually enjoyed a solid increase in sales, but with profits down.

Outlook

Citadel believes that it is set to return to growth, and it forecasts that its revenues and profits will rise by low double-digit amounts in the June 2020 year. The $5.7 million acquisition of Noventus has boosted its exposure to the defence, government, telecommunications and transportation sectors, and is expected to contribute around $18 million in revenues and $2 million in EBITDA in June 2020. The company is developing new SaaS products that it believes will broaden its revenues base, and is experiencing strong growth for SaaS business. It believes that it can use its intellectual property to expand into overseas markets. It has been enjoying particular success with its CHARM oncology information management system, acquired in 2017, which now has a 28 per cent share of the medical oncology e-health market.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 105.4 | 98.2 |

| Knowledge (%) | 55 | 44 |

| Technology (%) | 27 | 35 |

| Health (%) | 18 | 21 |

| EBIT ($mn) | 26.6 | 15.2 |

| EBIT margin (%) | 25.2 | 15.5 |

| Gross margin (%) | 51.5 | 44.6 |

| Profit before tax ($mn) | 25.3 | 14.3 |

| Profit after tax ($mn) | 14.3 | 10.9 |

| Earnings per share (c) | 29.42 | 22.08 |

| Cash flow per share (c) | 44.53 | 38.30 |

| Dividend (c) | 13.8 | 10.8 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 0.06 | ~ |

| Interest cover (times) | 21.2 | 16.8 |

| Return on equity (%) | 18.7 | 13.1 |

| Debt-to-equity ratio (%) | ~ | ~ |

| Current ratio | 1.6 | 1.4 |