Cochlear Limited

| ASX code: COH | www.cochlear.com | |

|

||

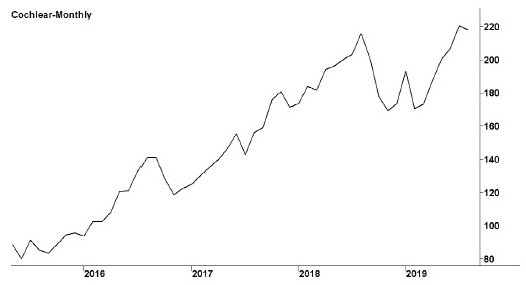

| Share price ($) | 216.76 | |

| 12-month high ($) | 226.71 | |

| 12-month low ($) | 155.22 | |

| Market capitalisation ($mn) | 12510.5 | |

| Price-to-NTA-per-share ratio | 41.5 | |

| 5-year share price return (% p.a.) | 25.8 | |

| Dividend reinvestment plan | No | |

| Sector: Health care | Company | Sector |

| Price/earnings ratio (times) | 45.1 | 37.1 |

| Dividend yield (%) | 1.5 | 1.4 |

Sydney-based Cochlear, founded in 1981, has around 65 per cent of the world market for cochlear bionic-ear implants, which are intended to assist the communication ability of people suffering from severe hearing impediments. It also sells the Baha bone-anchored hearing implant, as well as a range of acoustic products. With manufacturing facilities and technology centres in Australia, Sweden, Belgium and the US, it has sales in over 100 countries, and overseas business accounts for more than 90 per cent of revenues and profits.

Latest business results (June 2019, full year)

The company notched up another solid result, despite a small decline in implant demand. Cochlear implant revenues rose 2 per cent, though were down 3 per cent on a constant currency basis, with unit sales also down 3 per cent, to 34 083. Both the US and Germany lost market share, although the company reported a sales recovery towards the end of the financial year with the launch of the new Nucleus Profile Plus Series implant. Services revenues rose by 20 per cent, or 14 per cent on a constant currency basis, thanks mainly to existing customers upgrading their sound processors. The small Acoustics division saw revenues up by 5 per cent, although they edged down on a constant currency basis, with a decline in upgrade sales.

Outlook

Cochlear continues to launch new products at an impressive rate, with research and development spending up 10 per cent in the June 2019 year to $184 million, and this is helping it maintain its leadership position. It is already seeing a rise in sales following the launch of its Nucleus Profile Plus Series implants. These are the world's thinnest implants with the benefit that they enable the implant recipient to undergo a magnetic resonance imaging scan without the need to remove the internal magnet. The company is also working to expand its markets. It views hearing-impaired adults in developed countries as offering great potential, thanks to a current penetration rate of only around 3 per cent. In recent years this has become the fastest-growing market segment for the company. Cochlear is building a $50 million implant production facility in China, aimed especially at servicing fast-growing emerging markets. This will be its first implant manufacturing facility outside Australia, and will boost total company production capacity by 50 per cent when it is completed in 2020. The company's early forecast is for a June 2020 after-tax profit of $290 million to $300 million, though much will depend on currency movements.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 1363.7 | 1426.7 |

| Cochlear implants (%) | 62 | 58 |

| Services (%) | 26 | 30 |

| Acoustics (%) | 12 | 12 |

| EBIT ($mn) | 348.4 | 370.1 |

| EBIT margin (%) | 25.5 | 25.9 |

| Gross margin (%) | 73.0 | 74.8 |

| Profit before tax ($mn) | 340.5 | 365.6 |

| Profit after tax ($mn) | 245.8 | 276.7 |

| Earnings per share (c) | 427.27 | 480.82 |

| Cash flow per share (c) | 486.72 | 547.72 |

| Dividend (c) | 300 | 330 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 4.61 | 5.22 |

| Interest cover (times) | 44.1 | 82.2 |

| Return on equity (%) | 42.6 | 41.4 |

| Debt-to-equity ratio (%) | 14.1 | 14.2 |

| Current ratio | 2.0 | 1.8 |