Codan Limited

| ASX code: CDA | www.codan.com.au | |

| ||

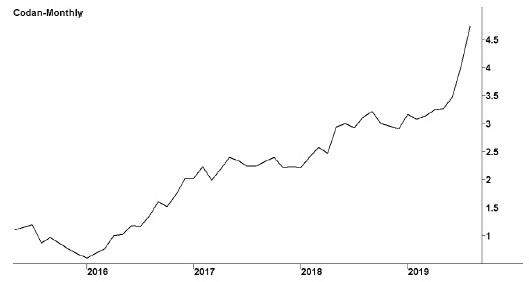

| Share price ($) | 4.66 | |

| 12-month high ($) | 4.97 | |

| 12-month low ($) | 2.78 | |

| Market capitalisation ($mn) | 835.2 | |

| Price-to-NTA-per-share ratio | 6.8 | |

| 5-year share price return (% p.a.) | 48.8 | |

| Dividend reinvestment plan | No | |

| Sector: Information technology | Company | Sector |

| Price/earnings ratio (times) | 18.3 | 29.4 |

| Dividend yield (%) | 1.9 | 1.6 |

Adelaide electronics company Codan was founded in 1959. It is a leading world manufacturer of metal-detecting products, including metal detectors for hobbyists, gold detectors for small-scale miners and landmine detectors for humanitarian applications. A second division produces high-frequency communication radios for military and humanitarian use. A smaller business, the company's Perth-based Minetec subsidiary, provides electronic productivity and safety devices and services for the mining industry. Codan sells to more than 150 countries, and overseas sales represent more than 85 per cent of company revenues.

Latest business results (June 2019, full year)

Profits rebounded, after falling in the previous year, with revenues also up, as all three of the company's businesses achieved growth. The core Metal Detection division saw sales up 11 per cent, with profits rising by 5 per cent. There was strong demand from new gold markets in the Middle East, as well as the first full year's contribution from the innovative Equinox coin and treasure detector. However, the best result came from the Communications division, with sales up 37 per cent and profits more than doubling. The company attributed this to its strategy of forming strategic partnerships with key suppliers and expanding into the global military market. It has also been targeting larger projects. The small Tracking Solutions division, incorporating the Minetec business, saw some delays in securing orders, but nevertheless boosted sales by 19 per cent, though it recorded a loss for the year.

Outlook

Codan is a significant force in three niche high-tech product areas. When demand is high, and the company can get the product mix right, there is the potential for strong profit growth. Its metal detectors dominate the African artisanal gold mining market, with the Middle East a growing market. The company has opened a new office in Brazil to boost Latin American sales. In the coin and treasure market it believes its new Vanquish model will boost its market share. Its Communications division has a strong order book and expects continued growth. The new Sentry Military Manpack radio system will strengthen its position in the land mobile radio sector. The company is targeting militaries in the Middle East, Africa, Asia, Eastern Europe and Latin America, and in July 2019 announced a $15 million contract with the government of Kenya to supply a tactical communications network system. The Minetec business has concluded a global licensing, technology development and marketing agreement with US construction equipment giant Caterpillar, and expects this to generate strong growth for its mine productivity and safety devices.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 229.9 | 270.8 |

| Metal detection (%) | 71 | 67 |

| Communications (%) | 25 | 28 |

| EBIT ($mn) | 53.7 | 63.4 |

| EBIT margin (%) | 23.4 | 23.4 |

| Gross margin (%) | 57.3 | 56.6 |

| Profit before tax ($mn) | 53.2 | 63.3 |

| Profit after tax ($mn) | 41.6 | 45.7 |

| Earnings per share (c) | 23.36 | 25.51 |

| Cash flow per share (c) | 32.73 | 34.03 |

| Dividend (c) | 8.5 | 9 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 0.57 | 0.69 |

| Interest cover (times) | 105.7 | 918.4 |

| Return on equity (%) | 23.5 | 22.9 |

| Debt-to-equity ratio (%) | ~ | ~ |

| Current ratio | 1.6 | 1.9 |