Commonwealth Bank of Australia

| ASX code: CBA | www.commbank.com.au | |

| ||

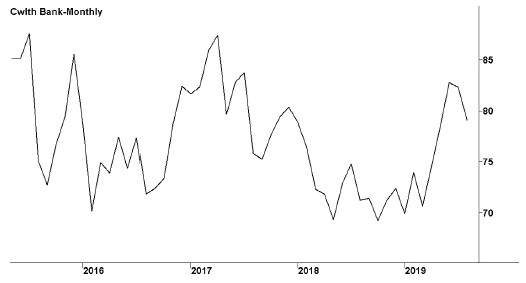

| Share price ($) | 79.08 | |

| 12-month high ($) | 83.99 | |

| 12-month low ($) | 65.23 | |

| Market capitalisation ($mn) | 139792.2 | |

| Price-to-NTA-per-share ratio | 2.3 | |

| 5-year share price return (% p.a.) | 4.4 | |

| Dividend reinvestment plan | Yes | |

| Sector: Financials | Company | Sector |

| Price/earnings ratio (times) | 16.4 | 15.0 |

| Dividend yield (%) | 5.5 | 5.9 |

The Commonwealth Bank, based in Sydney, was founded in 1911. It is today one of Australia's largest banks, and one of the country's top providers of home loans, personal loans and credit cards, as well as the largest holder of deposits. Commonwealth Securities is Australia's largest online stockbroker. It has significant interests in New Zealand, through ASB Bank, and a network of businesses in Asia. It owns Bankwest in Western Australia. It has sold its Colonial First State wealth management business.

Latest business results (June 2019, full year)

Revenues were down and the cash profit slipped for the second consecutive year, as the bank was hit by falling interest rates, a slowing economy and higher customer compensation fees. The decline in official interest rates led to a contraction in the net interest margin — although it steadied in the second half — forcing revenues down. During the year the bank spent $2.2 billion in customer remediation payments or provisions, following revelations of wrongful conduct at the recent Banking Royal Commission. This amount was up from $1.2 billion in the previous year. In addition, operating expenses rose, with the addition of some 600 risk and compliance staff, in response to concerns from bank regulators. The weakness was spread across all of the bank's domestic operations. The core Retail Banking Services division — which includes the home loans and retail deposit businesses, and generates around half of the bank's earnings — saw profits down 12 per cent, despite a 4 per cent increase in home lending. Profits for the Business and Private Banking division were down 7 per cent, although business lending rose by 4 per cent. The Institutional Banking and Markets division saw profits down 8 per cent. By contrast, New Zealand operations were once again strong.

Outlook

Commonwealth Bank occupies a powerful position in the domestic economy as well as in the local banking industry. Thanks to a large branch network, offering many cross-selling opportunities, it has pricing power that has generally enabled it to maintain a cost advantage over some of its rivals. It is working to streamline its operations. It has sold Colonial First State Global Asset Management for $4.2 billion and is divesting itself of most of its insurance and financial planning businesses. It has spent heavily on new technology, which sometimes now gives it an edge over its main domestic rivals. It has announced a US$100 million investment in the Swedish bank Klarna, and will introduce Klarna's credit payment products to Australia.

| Year to 30 June | 2018 | 2019 |

| Operating income ($mn) | 24 914.0 | 24 407.0 |

| Net interest income ($mn) | 18 342.0 | 18 120.0 |

| Operating expenses ($mn) | 10 995.0 | 11 269.0 |

| Profit before tax ($mn) | 12 848.0 | 11 941.0 |

| Profit after tax ($mn) | 8 915.0 | 8 492.0 |

| Earnings per share (c) | 510.60 | 481.13 |

| Dividend (c) | 431 | 431 |

| Percentage franked | 100 | 100 |

| Non-interest income to total income (%) | 26.4 | 25.8 |

| Net tangible assets per share ($) | 33.14 | 34.86 |

| Cost-to-income ratio (%) | 44.1 | 46.2 |

| Return on equity (%) | 13.7 | 12.4 |

| Return on assets (%) | 0.9 | 0.9 |