Harvey Norman Holdings Limited

| ASX code: HVN | www.harveynormanholdings.com.au | |

| ||

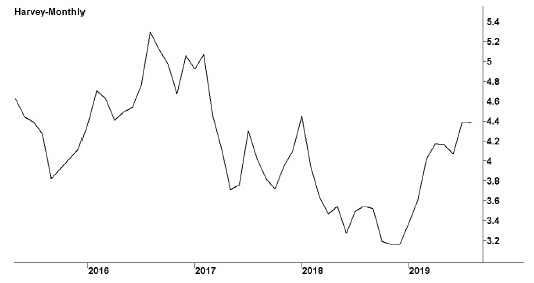

| Share price ($) | 4.43 | |

| 12-month high ($) | 4.77 | |

| 12-month low ($) | 2.99 | |

| Market capitalisation ($mn) | 5226.2 | |

| Price-to-NTA-per-share ratio | 1.7 | |

| 5-year share price return (% p.a.) | 10.3 | |

| Dividend reinvestment plan | No | |

| Sector: Consumer discretionary | Company | Sector |

| Price/earnings ratio (times) | 12.8 | 13.7 |

| Dividend yield (%) | 7.4 | 3.9 |

Sydney-based Harvey Norman, established in 1982, operates a chain of 285 retail stores specialising in electrical and electronic goods, home appliances, furniture, flooring, carpets and manchester, throughout Australia, New Zealand, Ireland, Northern Ireland, Singapore, Malaysia, Slovenia and Croatia, under the Harvey Norman, Domayne and Joyce Mayne banners. The Australian stores are independently held as part of a franchise operation, from which Harvey Norman receives income for advisory and advertising services. It also receives a considerable amount of income from its own stores, from its $2.99 billion property portfolio and from the provision of finance to franchisees and customers.

Latest business results (June 2019, full year)

Buoyant business at many of the company's 90 overseas stores, bolstered by the weak dollar, offset soft conditions at home, and Harvey Norman reported a positive result. All overseas regions recorded higher sales. The Singapore and Malaysia segment was especially strong, with sales up 16 per cent to $568 million and the pre-tax profit jumping 48 per cent. The Ireland and Northern Ireland segment was also strong, with sales rising 18 per cent to $378 million and profits surging more than five-fold, though from a low base. New Zealand, the largest overseas contributor, recorded higher sales, but profits were down. By contrast, total sales by Harvey Norman's Australian franchisees of $5.7 billion were down 2 per cent. Franchise income received by Harvey Norman fell 2 per cent to $839 million, with franchise profits falling 12 per cent. Property profits rose 8.5 per cent.

Outlook

For the second straight year, Harvey Norman's overseas operations have recorded robust growth, at a time when domestic sales are weak. The company attributes this in part to its policy of establishing a premium flagship store in each of its countries of operation, raising brand awareness among local consumers and contributing to stronger business. Consequently, Harvey Norman plans further offshore expansion, and expects to open 21 new overseas stores by June 2021. Singapore and Malaysia have become particularly buoyant markets, and 17 of the stores will be in those countries. The company has also reported that its Australian stores have made a positive start to the new financial year, and that with interest rates low and the economy firm, and with indications of a housing recovery, the signs were positive for a good year domestically. Its stores operate with high levels of fixed costs, so a modest rise in sales can deliver a much bigger rise in profits, although the reverse is also true.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 3 156.1 | 3 404.9 |

| Retail (%) | 62 | 65 |

| Franchising operations (%) | 28 | 24 |

| Property (%) | 9 | 10 |

| EBIT ($mn) | 549.3 | 598.1 |

| EBIT margin (%) | 17.4 | 17.6 |

| Gross margin (%) | 33.5 | 32.4 |

| Profit before tax ($mn) | 530.2 | 574.6 |

| Profit after tax ($mn) | 375.4 | 402.3 |

| Earnings per share (c) | 33.21 | 34.70 |

| Cash flow per share (c) | 40.72 | 42.05 |

| Dividend (c) | 30 | 33 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 2.55 | 2.63 |

| Interest cover (times) | 28.6 | 25.4 |

| Return on equity (%) | 13.2 | 13.2 |

| Debt-to-equity ratio (%) | 25.7 | 19.6 |

| Current ratio | 1.6 | 1.6 |