Magellan Financial Group Limited

| ASX code: MFG | www.magellangroup.com.au | |

|

||

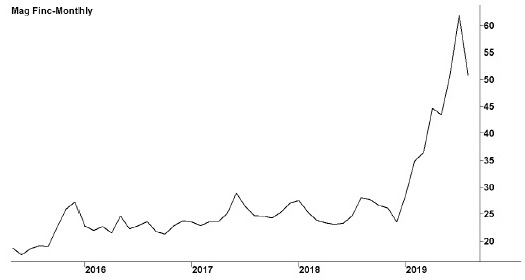

| Share price ($) | 50.91 | |

| 12-month high ($) | 62.60 | |

| 12-month low ($) | 22.55 | |

| Market capitalisation ($mn) | 9015.5 | |

| Price-to-NTA-per-share ratio | 14.8 | |

| 5-year share price return (% p.a.) | 33.7 | |

| Dividend reinvestment plan | No | |

| Sector: Financials | Company | Sector |

| Price/earnings ratio (times) | 24.7 | 15.0 |

| Dividend yield (%) | 3.0 | 5.9 |

Sydney-based Magellan is a specialist investment management company that evolved in 2006 from the ASX-listed Pengana Hedgefunds Limited. Its main business is Magellan Asset Management, which offers managed funds to retail and institutional investors, with particular specialties in global equities and infrastructure. In 2018 it acquired Airlie Funds Management.

Latest business results (June 2019, full year)

In volatile market conditions, Magellan posted an excellent result, with a big increase in revenues and profits. Management and services fees rose 22 per cent to $473 million. Performance fees more than doubled to $83.6 million, having soared 83 per cent in the previous year. The company achieved great success in containing costs, which increased by only 3 per cent, with staff costs up, as the average number of employees during the year rose from 116 to 125, but with marketing expenses down. At June 2019 Magellan had funds under management of $86.7 billion, up from

$69.5 billion a year earlier, thanks to the strong investment performance and net inflows of $4.4 billion.

Outlook

Magellan continues to expand impressively, and funds under management exceed those of two rivals, Platinum Asset Management and Perpetual. It has a record of strong, long-term performance in global — and particularly, American — equities, and has become a significant beneficiary of moves by Australian investors to diversify into overseas markets. It also benefits from the reputation and stock-picking prowess of its Chairman and Chief Investment Officer, Hamish Douglass. Nevertheless, it remains heavily dependent on the state of financial markets, and it would suffer from any big sell-off in equities, or from a prolonged bear market. In addition, as its funds swell in size it becomes increasingly difficult for their fund managers to find the new investments needed to continue outperforming their benchmarks. The acquisition of Airlie Funds Management has provided Magellan with a new platform for growth. Airlie is a specialist Australian equities fund manager with over $6 billion of funds under management, mainly for institutional and high-net-worth clients. In August 2019 Magellan launched its new Magellan High Conviction Trust, which aims at investing in a concentrated portfolio of around 8 to 12 global stocks weighted towards Magellan's best ideas. In addition, the company is developing a major new fund aimed at retirees seeking income from their assets and is also actively planning other new funds. Magellan's stated target is that it should generate annual shareholder returns — profit growth plus dividends — in the low to mid teens annually over the medium term. At August 2019 funds under management had risen to $92.1 billion.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 426.8 | 559.1 |

| EBIT ($mn) | 349.2 | 510.9 |

| EBIT margin (%) | 81.8 | 91.4 |

| Profit before tax ($mn) | 351.6 | 513.4 |

| Profit after tax ($mn) | 268.9 | 364.2 |

| Earnings per share (c) | 154.94 | 205.93 |

| Cash flow per share (c) | 156.03 | 208.72 |

| Dividend (c) | 119.6 | 151.8 |

| Percentage franked | 100 | 75 |

| Net tangible assets per share ($) | 2.92 | 3.44 |

| Interest cover (times) | ~ | ~ |

| Return on equity (%) | 50.4 | 53.8 |

| Debt-to-equity ratio (%) | ~ | ~ |

| Current ratio | 5.5 | 6.2 |