McMillan Shakespeare Limited

| ASX code: MMS | www.mcms.com.au | |

| ||

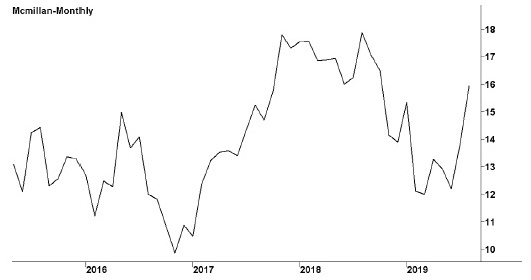

| Share price ($) | 15.73 | |

| 12-month high ($) | 18.65 | |

| 12-month low ($) | 11.77 | |

| Market capitalisation ($mn) | 1308.8 | |

| Price-to-NTA-per-share ratio | 7.3 | |

| 5-year share price return (% p.a.) | 10.6 | |

| Dividend reinvestment plan | No | |

| Sector: Industrials | Company | Sector |

| Price/earnings ratio (times) | 14.7 | 18.3 |

| Dividend yield (%) | 4.7 | 4.1 |

Melbourne-based McMillan Shakespeare, founded in 1988, is a specialist provider of salary packaging, and vehicle leasing and finance services. It operates under three broad categories. The Group Remuneration Services division provides administrative services for salary packaging. It also arranges motor vehicle novated leases — three-way agreements between an employer, employee and financier to lease a vehicle — as well as providing related ancillary services such as insurance. The Asset Management division arranges financing and provides related management services for motor vehicles, commercial vehicles and equipment. The third division, Retail Financial Services, manages financial services for motor vehicles. McMillan Shakespeare has operations in New Zealand and the United Kingdom.

Latest business results (June 2019, full year)

Sales edged up but underlying profits weakened in a mixed year for the company. The Group Remuneration Services division performed well, with revenues and profits higher, thanks to a 2.5 per cent increase in salary packages and a 7.4 per cent

rise in novated leasing volumes. This division is responsible for 40 per cent of company revenues but contributes nearly three-quarters of company profit. The Asset Management division also saw revenues up, but profits fell in both the Australia/New Zealand and the UK segments, with particular weakness in the second half of the year. In the previous year the UK business had recorded a 43 per cent jump in profits. The Retail Financial Services division was hit by falling sales of new cars and by regulatory uncertainty, and profits were down by more than 25 per cent, having fallen by more than 30 per cent in the previous year. The new Plan Partners business delivered an initial profit.

Outlook

The Group Remuneration Services division is responsible for taking advantage of complex laws to help employees, especially in the public and non-profit sectors, gain tax benefits. It occupies a strong position in Australia, with high profit margins and continuing growth from a strong pipeline of prospective business. The company's three-year Beyond 2020 transformational program has begun to reduce its cost base. It has initiated a strategic review of its UK operations, following a weak performance from that business. It is optimistic about the potential for its new initiative Plan Partners, which is designed to provide participants in the government's National Disability Insurance Scheme with greater choice, less complexity and more control over their management plans. An attempt to acquire rival fleet vehicle leasing company Eclipx Group was abandoned in April 2019. However, McMillan Shakespeare continues to seek out further acquisition opportunities.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 543.8 | 547.9 |

| Asset management (%) | 45 | 45 |

| Group remuneration services (%) | 38 | 40 |

| Retail financial services (%) | 17 | 15 |

| EBIT ($mn) | 140.7 | 135.5 |

| EBIT margin (%) | 25.9 | 24.7 |

| Profit before tax ($mn) | 132.6 | 126.8 |

| Profit after tax ($mn) | 93.5 | 88.7 |

| Earnings per share (c) | 113.20 | 107.29 |

| Cash flow per share (c) | 217.34 | 205.41 |

| Dividend (c) | 73 | 74 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 2.00 | 2.16 |

| Interest cover (times) | 17.5 | 15.5 |

| Return on equity (%) | 25.2 | 23.9 |

| Debt-to-equity ratio (%) | 64.1 | 51.3 |

| Current ratio | 2.1 | 2.5 |