NIB Holdings Limited

| ASX code: NHF | www.nib.com.au | |

| ||

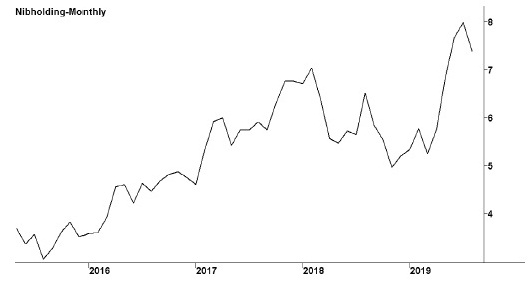

| Share price ($) | 7.04 | |

| 12-month high ($) | 8.20 | |

| 12-month low ($) | 4.64 | |

| Market capitalisation ($mn) | 3207.1 | |

| Price-to-NTA-per-share ratio | 12.0 | |

| 5-year share price return (% p.a.) | 17.8 | |

| Dividend reinvestment plan | Yes | |

| Sector: Financials | Company | Sector |

| Price/earnings ratio (times) | 21.4 | 15.0 |

| Dividend yield (%) | 3.3 | 5.9 |

Newcastle private health insurer NIB Holdings was established as the Newcastle Industrial Benefits Hospital Fund in 1952 by workers at the BHP steelworks. It subsequently demutualised and became the first private health insurer to list on the ASX. It is also active in New Zealand. Other businesses are travel insurance and the provision of specialist insurance services to international students and workers in Australia. In May 2019 it acquired QBE's travel insurance business.

Latest business results (June 2019, full year)

NIB enjoyed another good year, with a further increase in its revenues and profits. The company's flagship Australian Residents Health Insurance (ARHI) was again the key, with the policyholder base growing by 2.1 per cent for the year — down from 3 per cent in the previous year — compared with virtually no growth at all for the industry as a whole. With a 3.4 per cent premium increase during the year the company saw premium revenues for this business rise 7.6 per cent, with profits up by more than 14 per cent. ARHI represents about 85 per cent of company revenues and 75 per cent of company profit. New Zealand activities contribute 9 per cent of total turnover, and while premium revenues rose, thanks to 7.2 per cent growth in policyholder numbers, profits fell for the second successive year, as claims increased. Profits were also down for the company's travel insurance business, despite a 7.5 per cent increase in premium revenues. However, the company's high-margin health insurance program for international students and workers in Australia continued its impressive growth rate, with premium revenues and profits rising by around 19 per cent.

Outlook

NIB is adopting a variety of strategies for expansion. It benefits from an ageing population that needs more medical care and it is working to build a national profile for its domestic health insurance business. However, medical insurance is a highly regulated industry, and claim rates in recent years have been below long-term averages, which the company does not expect to continue. In addition, the growth in its policyholder base has been above the industry average, and this too may not endure. Its new partnership with Chinese pharmaceuticals company Tasly Holding to enter the Chinese health insurance market is awaiting Chinese government approval. It has launched nib International Student Services to provide health insurance services for international students on a global basis. The $24 million acquisition of QBE Travel is expected to bolster its travel insurance business.

| Year to 30 June | 2018 | 2019 |

| Premium revenues ($mn) | 2 186.9 | 2 372.6 |

| EBIT ($mn) | 190.9 | 211.5 |

| EBIT margin (%) | 8.7 | 8.9 |

| Profit before tax ($mn) | 192.3 | 213.0 |

| Profit after tax ($mn) | 132.4 | 149.8 |

| Earnings per share (c) | 29.38 | 32.89 |

| Cash flow per share (c) | 34.80 | 38.34 |

| Dividend (c) | 20 | 23 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 0.53 | 0.59 |

| Interest cover (times) | ~ | ~ |

| Return on equity (%) | 26.8 | 25.6 |

| Debt-to-equity ratio (%) | 6.9 | 15.7 |

| Current ratio | 1.8 | 1.9 |