Orora Limited

| ASX code: ORA | www.ororagroup.com | |

|

||

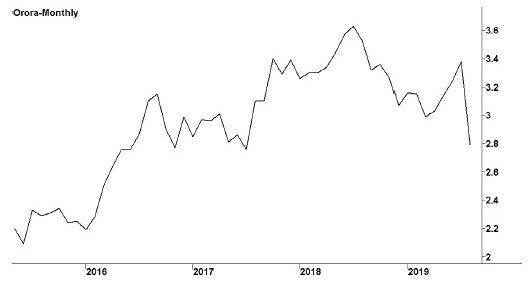

| Share price ($) | 2.77 | |

| 12-month high ($) | 3.56 | |

| 12-month low ($) | 2.60 | |

| Market capitalisation ($mn) | 3342.5 | |

| Price-to-NTA-per-share ratio | 3.2 | |

| 5-year share price return (% p.a.) | 14.2 | |

| Dividend reinvestment plan | Yes | |

| Sector: Materials | Company | Sector |

| Price/earnings ratio (times) | 15.4 | 13.2 |

| Dividend yield (%) | 4.7 | 4.4 |

Melbourne-based Orora was originally the Australasian and packaging distribution businesses of packaging giant Amcor. It was demerged from Amcor in 2013 and listed on the ASX. Today it is a prominent manufacturer of glass bottles, aluminium cans, closures and caps, boxes and cartons, fibre packaging, point of purchase displays, and packaging materials and supplies. It also provides a wide array of package-related services and has a particular specialty in cardboard recycling and the manufacture of recycled packaging paper. It has manufacturing facilities in Australia, New Zealand and the US.

Latest business results (June 2019, full year)

Strength in Australia and New Zealand offset weakness in North America, and profits edged up. Orora Australasia achieved a 6.2 per cent increase in EBIT on a sales rise of 2.1 per cent, thanks especially to strong sales of packaging products, growing demand for beverage cans and the company's cost-cutting initiatives. By contrast, Orora North America saw EBIT down 3.6 per cent, despite sales rising by 21.9 per cent, although this largely reflected the addition of two recent acquisitions. The company benefited from the dollar's weakness, and in local currency terms the North American EBIT was actually down by 11.1 per cent. Though Orora North America was responsible for more than half of total income, it contributed only about a third of company profit.

Outlook

Orora occupies a strong position for many of its products, with high market shares in Australia. Nevertheless, demand is greatly dependent on economic trends, and the company is vulnerable to any economic slowdown. It has been undertaking a series of measures to reduce costs and stimulate growth, including upgrades for many of its manufacturing facilities. A substantial capital investment at its Botany mill in New South Wales has greatly boosted profit margins. It is introducing a new can production line in New Zealand and is building a major warehouse at its Gawler glass plant in South Australia. In North America it has initiated a big corporate restructuring program designed to drive growth and lower costs. A particular strategy has been a series of bolt-on acquisitions in an effort to build scale in its activities and improve operational efficiency. The latest of these are two Texas-based companies, acquired for $143 million. The first is Pollock, a leading provider of packaging and facility supplies, and the other is Bronco, a packaging distributor. Nevertheless, Orora has some large and well-established rivals in the North American market, and it faces many challenges as it works to boost profitability there.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 4 248.0 | 4 761.5 |

| EBIT ($mn) | 323.4 | 335.2 |

| EBIT margin (%) | 7.6 | 7.0 |

| Gross margin (%) | 19.0 | 18.3 |

| Profit before tax ($mn) | 288.9 | 295.8 |

| Profit after tax ($mn) | 214.1 | 217.0 |

| Earnings per share (c) | 17.84 | 18.02 |

| Cash flow per share (c) | 28.00 | 29.05 |

| Dividend (c) | 12.5 | 13 |

| Percentage franked | 30 | 40 |

| Net tangible assets per share ($) | 0.94 | 0.85 |

| Interest cover (times) | 9.4 | 8.5 |

| Return on equity (%) | 13.5 | 13.3 |

| Debt-to-equity ratio (%) | 40.9 | 54.1 |

| Current ratio | 1.2 | 1.2 |