Perpetual Limited

| ASX code: PPT | www.perpetual.com.au | |

| ||

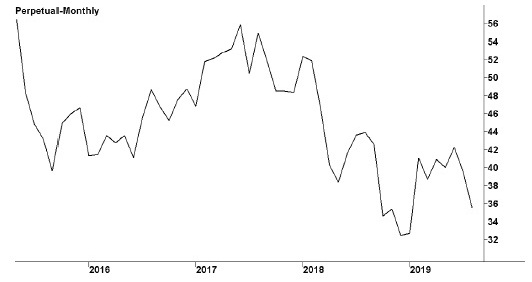

| Share price ($) | 36.22 | |

| 12-month high ($) | 44.99 | |

| 12-month low ($) | 29.70 | |

| Market capitalisation ($mn) | 1666.6 | |

| Price-to-NTA-per-share ratio | 5.3 | |

| 5-year share price return (% p.a.) | −0.6 | |

| Dividend reinvestment plan | Yes | |

| Sector: Financials | Company | Sector |

| Price/earnings ratio (times) | 14.4 | 15.0 |

| Dividend yield (%) | 6.9 | 5.9 |

Sydney-based financial services company Perpetual was established in 1886 as Perpetual Trustees. It divides its operations into three broad areas. Perpetual Investments is a funds management business offering a range of managed investment products to the retail, wholesale and institutional markets. Perpetual Private is a specialist boutique financial services business aimed at high-net-worth individuals, and providing its clients with access to tailored financial, tax, legal and estate planning advice. The Perpetual Corporate Trust division is a leading provider of corporate trustee and transaction support services to the financial services industry.

Latest business results (June 2019, full year)

Another poor performance from the Perpetual Investments division sent revenues and profits lower. This business saw revenues down 11 per cent and pre-tax profit tumbling 29 per cent, largely the result of some significant net outflows from its funds by institutional clients. At June 2019 the division had $27.1 billion in funds under management, down from $30.8 billion a year earlier, and $31.4 billion in the year before that. It was the fourth consecutive year of lower profits for this division. The Perpetual Private business reported revenues in line with the previous year, but profits fell 11 per cent as the company boosted investments in strategic initiatives aimed at future growth. Funds under advice for this division rose 5 per cent to $14.8 billion. The Perpetual Corporate Trust division saw revenues and profits up, thanks to strong performances from the debt market services and the managed fund services operations.

Outlook

Perpetual has built a strong long-term reputation for its equities funds, and they continue to generate solid profit margins. During the year it raised $440 million for its new Perpetual Credit Income Trust and an additional $101 million for its Perpetual Equity Investment Company. Nevertheless, poor performances in recent years have caused some institutional investors to withdraw money. Perpetual blames its underperformance on its style of investing, which favours value stocks, at a time when it is largely growth stocks that are leading markets higher. In addition, the company's fortunes remain heavily dependent on financial market movements, and it could be hit by any substantial market downturn. It is actively seeking acquisitions to bolster this business. It believes that its Perpetual Private division will benefit from disruption in the financial advisory business sparked by the Banking Royal Commission. Perpetual Corporate Trust continues to perform well, and the December 2018 acquisition of RFi Analytics has boosted its debt market services capabilities. This division has been undertaking a major technology modernisation program.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 526.7 | 508.9 |

| Perpetual investments (%) | 45 | 41 |

| Perpetual private (%) | 35 | 37 |

| Perpetual corporate trust (%) | 20 | 22 |

| EBIT ($mn) | 193.5 | 164.5 |

| EBIT margin (%) | 36.7 | 32.3 |

| Profit before tax ($mn) | 191.3 | 162.2 |

| Profit after tax ($mn) | 139.0 | 115.9 |

| Earnings per share (c) | 302.32 | 250.89 |

| Cash flow per share (c) | 341.34 | 293.81 |

| Dividend (c) | 275 | 250 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 7.28 | 6.88 |

| Interest cover (times) | 88.3 | 70.3 |

| Return on equity (%) | 21.5 | 17.5 |

| Debt-to-equity ratio (%) | 7.5 | 6.0 |

| Current ratio | 1.7 | 1.9 |