Rio Tinto Limited

| ASX code: RIO | www.riotinto.com | |

|

||

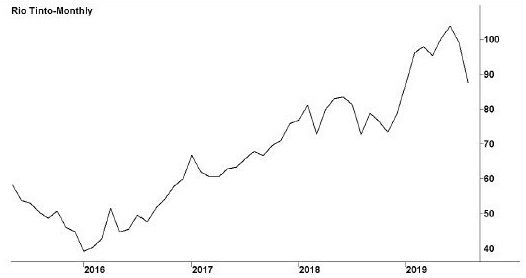

| Share price ($) | 87.76 | |

| 12-month high ($) | 107.99 | |

| 12-month low ($) | 69.41 | |

| Market capitalisation ($mn) | 143540.3 | |

| Price-to-NTA-per-share ratio | 2.8 | |

| 5-year share price return (% p.a.) | 11.5 | |

| Dividend reinvestment plan | Yes | |

| Sector: Materials | Company | Sector |

| Price/earnings ratio (times) | 12.8 | 13.2 |

| Dividend yield (%) | 4.8 | 4.4 |

British-based Rio Tinto, one of the world's largest mining companies, was founded by European investors in 1873 in order to reopen some ancient copper mines at the Tinto River in Spain. It now maintains an ASX presence in a dual-listing structure and continues to pay franked dividends to Australian shareholders. Its products include iron ore, copper, gold, industrial minerals, diamonds and aluminium. Subsidiaries include uranium miner Energy Resources of Australia.

Latest business results (June 2019, half year)

A recovery in iron ore prices helped generate a rise in revenues and underlying earnings, more than offsetting declines in most other areas of business. The iron ore production and sales volume actually fell by 8 per cent, constrained by adverse weather, a fire at one of the company's ports and disruptions at some Western Australian mining operations. However, a 36 per cent jump in the average sales price boosted revenues and profits. Iron ore generates about half the company's revenues, but in June 2019 was responsible for more than 75 per cent of profit. Price declines hit the Aluminium division, which represents nearly a quarter of company turnover. The sales volume was little changed from the June 2018 half, but revenues and profits fell. The Copper and Diamonds division also suffered from lower prices. The Energy and Minerals division enjoyed a good period, with increased volumes and higher prices, although profits were down, reflecting the contribution in the June 2018 half from coking coal assets that have since been sold. Note that Rio Tinto reports its results in US dollars. The tables in this book are based on Australian dollar figures and exchange rates supplied by the company.

Outlook

Rio Tinto maintains a substantial portfolio of well-run assets across many countries, and with generally low operating costs. However, having disposed of most of its coal operations, the company's fortunes are markedly dependent on trends in the global iron ore market, which in turn is strongly influenced by Chinese economic developments. It maintains a high level of capital spending, with US$6 billion expected in 2019, rising to around US$6.5 billion in 2020 and 2021. Its major growth project is the Oyu Tolgoi copper mine development in Mongolia, which is destined eventually to become the world's largest copper mine, though has been hit by delays and cost blow-outs. Other significant projects include the Zulti South industrial minerals mine in South Africa, the Amrun bauxite project in Queensland and the Koodaideri iron ore mine in Western Australia.

| Year to 31 December | 2017 | 2018 |

| Revenues ($mn) | 51 987.0 | 54 029.0 |

| EBIT ($mn) | 17 562.2 | 17 108.0 |

| EBIT margin (%) | 33.8 | 31.7 |

| Profit before tax ($mn) | 16 644.0 | 16 704.0 |

| Profit after tax ($mn) | 11 204.0 | 11 744.0 |

| Earnings per share (c) | 627.08 | 683.07 |

| Cash flow per share (c) | 945.08 | 992.03 |

| Dividend (c) | 366.25 | 421.73 |

| Percentage franked | 100 | 100 |

| Interest cover (times) | 19.1 | 42.3 |

| Return on equity (%) | 20.0 | 19.6 |

| Half year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 25 805.0 | 29 341.0 |

| Profit before tax ($mn) | 8 724.0 | 7 343.0 |

| Profit after tax ($mn) | 5 722.0 | 6 983.0 |

| Earnings per share (c) | 328.70 | 427.00 |

| Dividend (c) | 170.84 | 219.08 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 29.79 | 31.44 |

| Debt-to-equity ratio (%) | 15.9 | 19.1 |

| Current ratio | 1.8 | 1.5 |