Ruralco Holdings Limited

| ASX code: RHL | www.ruralco.com.au | |

|

||

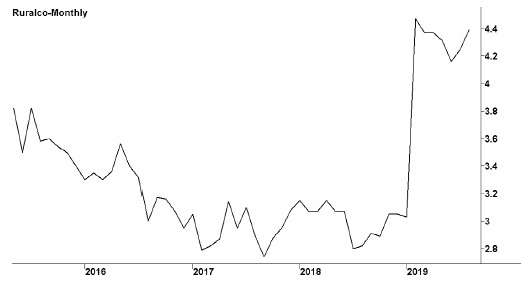

| Share price ($) | 4.39 | |

| 12-month high ($) | 4.51 | |

| 12-month low ($) | 2.80 | |

| Market capitalisation ($mn) | 461.2 | |

| Price-to-NTA-per-share ratio | 10.0 | |

| 5-year share price return (% p.a.) | 8.5 | |

| Dividend reinvestment plan | No | |

| Sector: Consumer discretionary | Company | Sector |

| Price/earnings ratio (times) | 16.0 | 13.7 |

| Dividend yield (%) | 3.4 | 3.9 |

Sydney-based farm supplies company Ruralco has grown out of a long series of mergers and acquisitions, most notably the 2006 merger with Tasmanian company Roberts, which itself was established in 1865. Today it operates through dozens of brands with businesses that include rural merchandise, wool and livestock agency, real estate agency, fertiliser manufacture, stock feed and grain storage, handling and distribution, water products and financial services. In February 2019 the Canadian fertiliser company Nutrien made a $469 million takeover bid for Ruralco.

Latest business results (March 2019, half year)

Revenues edged up and profits marked time. The core Rural Services division, responsible for more than 60 per cent of company turnover, saw profits flat, with good rains in northern Queensland and a strong season in Tasmania offset by inconsistent rainfall in South Australia and Victoria and reduced cotton and rice plantings. Profits declined slightly for the Water Services division, following a slowdown in water project activity along the Murray Darling basin and northern New South Wales. The Live Export division moved from loss to profit, thanks to an increase in volumes, especially to Indonesia. The very small Financial Services division enjoyed a big jump in profits.

Outlook

Nutrien has offered to acquire Ruralco for a price of $4.40 per share, and Ruralco directors have recommended that shareholders accept this offer. A vote on the matter was due for September 2019, and it is possible that Ruralco will have ceased to exist as an independent company by the time this book is published. However, the Australian Competition and Consumer Commission has expressed some concerns over the proposal and may delay matters. Nutrien is already the largest participant in the Australian farm services sector, through its subsidiary Landmark, with Ruralco also prominent in the industry. The Commission is concerned that the proposed takeover would lead to market dominance for some products and services. In response, Nutrien has said that the combination of Landmark and Ruralco would allow it to offer a much improved service to farmers across Australia. Meanwhile Ruralco is proceeding with plans to expand its range of private label products aimed at farmers. It is also working to boost its water business and its financial services operations. It sees scope for growth in Vietnam for its live export business, although this business is being hurt by higher feed costs. Overall, the company's activities remain heavily affected by the weather and other factors that influence the rural economy.

| Year to 30 September | 2017 | 2018 |

| Revenues ($mn) | 1826.1 | 1913.5 |

| EBIT ($mn) | 49.5 | 53.0 |

| EBIT margin (%) | 2.7 | 2.8 |

| Gross margin (%) | 18.3 | 17.9 |

| Profit before tax ($mn) | 49.4 | 51.5 |

| Profit after tax ($mn) | 26.2 | 28.8 |

| Earnings per share (c) | 27.47 | 27.49 |

| Cash flow per share (c) | 38.47 | 39.63 |

| Dividend (c) | 15 | 15 |

| Percentage franked | 100 | 100 |

| Interest cover (times) | 454.2 | 34.7 |

| Return on equity (%) | 10.9 | 10.2 |

| Half year to 31 March | 2018 | 2019 |

| Revenues ($mn) | 667.3 | 685.2 |

| Profit before tax ($mn) | 28.2 | 27.7 |

| Profit after tax ($mn) | 16.7 | 16.6 |

| Earnings per share (c) | 15.96 | 15.77 |

| Dividend (c) | 9 | 10 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 0.60 | 0.44 |

| Debt-to-equity ratio (%) | 46.8 | 52.9 |

| Current ratio | 1.3 | 1.3 |