SeaLink Travel Group Limited

| ASX code: SLK | www.sealinktravelgroup.com.au | |

| ||

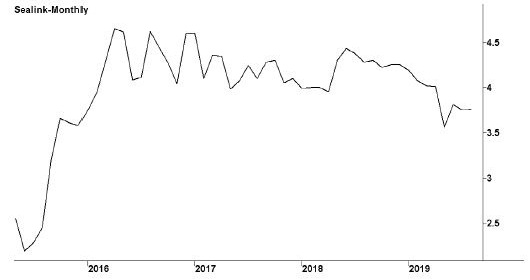

| Share price ($) | 3.65 | |

| 12-month high ($) | 4.34 | |

| 12-month low ($) | 3.44 | |

| Market capitalisation ($mn) | 371.2 | |

| Price-to-NTA-per-share ratio | 3.6 | |

| 5-year share price return (% p.a.) | 18.5 | |

| Dividend reinvestment plan | No | |

| Sector: Consumer discretionary | Company | Sector |

| Price/earnings ratio (times) | 15.8 | 13.7 |

| Dividend yield (%) | 4.1 | 3.9 |

Adelaide tourism and transport company SeaLink has its roots in the launch of a Kangaroo Island ferry service, Philanderer Ferries, in the 1970s. It has since expanded considerably through organic growth and acquisition, and today provides a wide range of ferry, resort and tourism services under more than 20 brands. It divides its operations into four key segments. SeaLink Queensland provides ferry and barging operations, as well as packaged holidays, throughout Queensland and the Northern Territory. SeaLink South Australia manages a wide range of travel services throughout South Australia and on the Murray River. Captain Cook Cruises offers water-based services in Sydney and Perth. In 2018 SeaLink acquired the Kingfisher Bay Resort Group on Fraser Island in Queensland, and this business has become a fourth division.

Latest business results (June 2019, full year)

A full year's contribution from Fraser Island operations boosted revenues. But higher costs hurt profits, although a substantially reduced tax rate meant a rise in the after-tax profit. The best result came from the new Fraser Island business, which contributed sales of $54 million, ahead of expectations, and moved from loss to profit. But the two core divisions, SeaLink Queensland and SeaLink South Australia, both saw profits down. In Queensland the company was affected by the ending of leases on some vessels at its Gladstone operations. South Australian business was hurt by a decline in bookings for the company's Murray Princess paddle steamer, which sails on the Murray River. The Captain Cook Cruises business was also weak, affected by a softening in international tourism demand, and it recorded a loss for the year.

Outlook

SeaLink Travel benefits from a firm economy and a buoyant tourism industry. Its strategy is to leverage its many assets into generating multiple streams of revenue, and it also expects to continue to grow by acquisition. It has experienced a decline in Chinese tourist numbers for its services, but believes that the dollar's weakness may help revive business. A strategic review of its Sydney Harbour operations will mean the termination of the loss-making Manly-to-Barangaroo ferry service, and the company expects a recovery in its Captain Cook Cruises division. It is working to upgrade facilities at its new $43 million Fraser Island acquisition, and is seeing growing numbers of bookings from the wedding market. The company regards the Fraser Island operation as one of the drivers of its future growth, and it has benefited from publicity surrounding the October 2018 visit by the Duke and Duchess of Sussex.

| Year to 30 June | 2018 | 2019 |

| Revenues ($mn) | 208.2 | 248.8 |

| SeaLink Queensland (%) | 37 | 31 |

| SeaLink South Australia (%) | 31 | 26 |

| Fraser Island (%) | 6 | 22 |

| Captain Cook Cruises (%) | 26 | 21 |

| EBIT ($mn) | 33.5 | 31.4 |

| EBIT margin (%) | 16.1 | 12.6 |

| Profit before tax ($mn) | 30.5 | 26.9 |

| Profit after tax ($mn) | 22.1 | 23.4 |

| Earnings per share (c) | 21.85 | 23.07 |

| Cash flow per share (c) | 34.60 | 39.25 |

| Dividend (c) | 14.5 | 15 |

| Percentage franked | 100 | 100 |

| Net tangible assets per share ($) | 0.96 | 1.03 |

| Interest cover (times) | 11.0 | 6.9 |

| Return on equity (%) | 14.7 | 15.1 |

| Debt-to-equity ratio (%) | 69.2 | 53.1 |

| Current ratio | 1.0 | 1.1 |